China's automotive industry delivered another record-setting year in 2025, with vehicle production reaching 34.531 million units and sales totaling 34.4 million units, up 10.4% and 9.4% year on year respectively, according to data from the China Association of Automobile Manufacturers ("CAAM").

The performance marked the country's 17th consecutive year as the world's largest auto market, while annual output and sales have now remained above 30 million units for three straight years.

Market momentum was underpinned by the expanded implementation of the "two new" policy framework (China's stimulus package, including incentives for large-scale equipment renewals and consumer goods trade-ins), which ensured policy continuity while stimulating replacement demand. Automakers also accelerated new model launches, helping sustain consumer appetite and pushing full-year results beyond expectations.

In December last year, auto production and sales moderated to 3.296 million and 3.272 million units respectively, reflecting seasonal adjustments, with both figures easing from the previous month and posting mild year-on-year declines.

Industry concentration remained high. The top 15 automobile groups together sold 31.741 million vehicles in 2025, accounting for 92.3% of total market sales, though their combined share edged slightly lower than the previous year.

China's domestic auto market continued to expand in 2025, with total vehicle sales reaching 27.302 million units, a 6.7% increase from a year earlier. Growth, however, was increasingly uneven, as sales of conventional fuel-powered vehicles slipped 4% to 13.427 million units, underscoring the structural shift toward electrification.

Momentum weakened in December, when domestic auto sales fell to 2.519 million units, down both month on month (-6.7%) and year on year (-15.6%). The pullback was most pronounced in internal combustion engine models, whose sales dropped sharply compared with the same period last year.

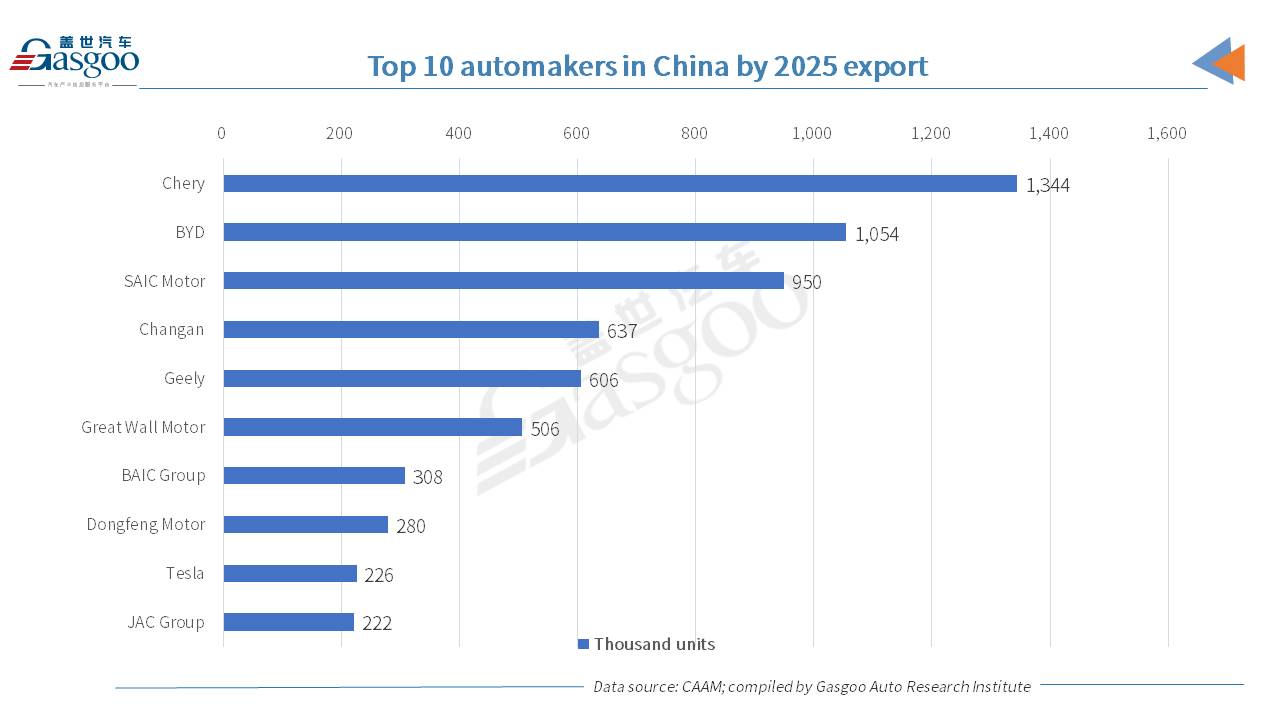

Exports emerged as a key engine of growth in 2025 as automakers accelerated their overseas expansion. Chinese brands strengthened their global competitiveness, joint ventures also posted solid export results, and rapid growth in new energy vehicle (NEV) shipments pushed total vehicle exports to a record 7.098 million units, up 21.1% year on year.

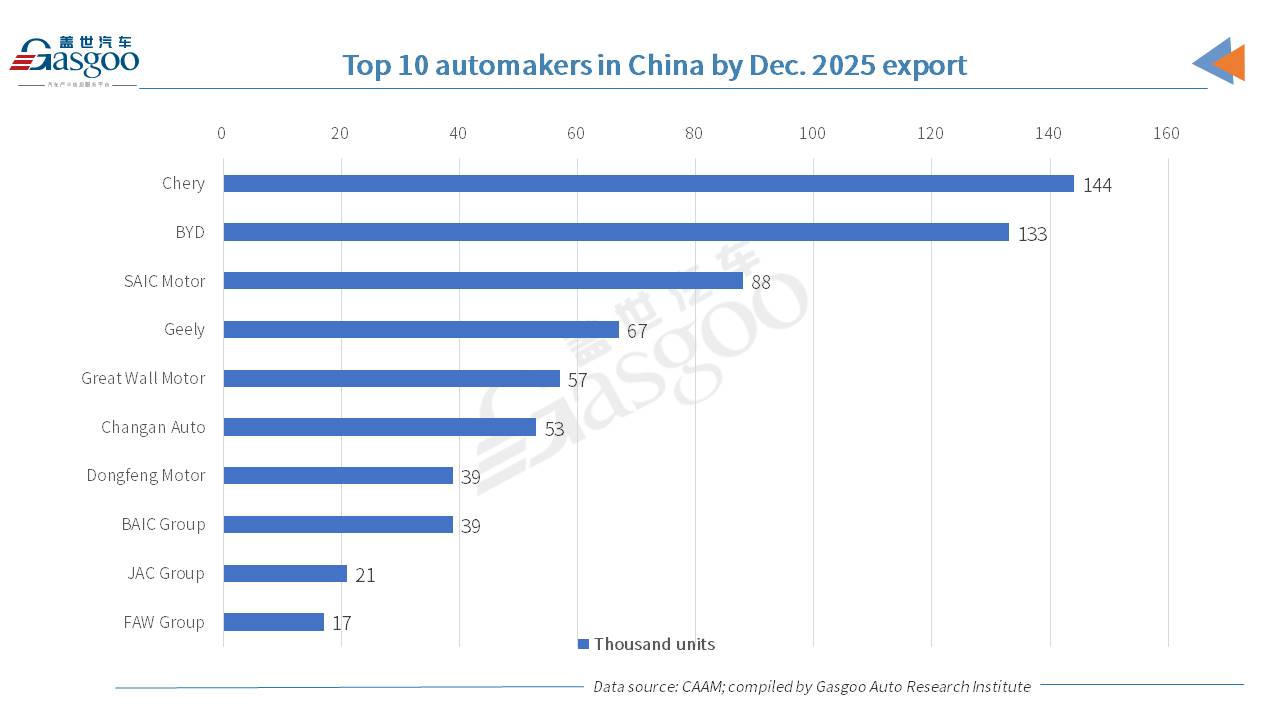

The export momentum carried through to year-end. In December alone, vehicle exports reached 753,000 units, posting strong gains both month on month (3.5%) and from a year earlier (49.2%).

In 2025, among the top ten vehicle exporters, Chery remained the largest contributor, shipping 1.344 million vehicles overseas during the year. Its export volume rose 17.4% from a year earlier and accounted for 18.9% of the country's total vehicle exports. BYD, meanwhile, delivered the most striking expansion among major players, with exports reaching 1.054 million units—soaring 140% year-on-year and underscoring the rapid globalization of its product lineup.

The year-end picture echoed the broader annual trend. In December, Chery once again led the export rankings, sending 144,000 vehicles abroad, a sharp 46.9% increase from the same month a year earlier and equivalent to 18.9% of total exports. BYD continued to outpace its peers in growth momentum, exporting 133,000 vehicles in the month—up 120% year-on-year—highlighting its accelerating push into overseas markets.

In 2025, China's passenger vehicle market cleared the 30-million-unit threshold for both production and sales, underscoring steady underlying growth. Full-year output reached 30.27 million units, while sales totaled 30.103 million units, representing year-on-year increases of 10.2% and 9.2%, respectively.

Momentum softened toward the end of the year. In December, passenger vehicle production fell to 2.879 million units and sales to 2.847 million units, both easing from November levels and posting moderate year-on-year declines, reflecting seasonal factors and a high base of comparison.

Indigenous brands continued to consolidate their leadership. Chinese-brand passenger vehicle sales climbed to 20.936 million units in 2025, up 16.5% year on year, lifting market share to 69.5%. Even as December volumes slipped, local marques expanded their share further, highlighting their growing competitiveness despite short-term demand fluctuations.

Across the domestic market, passenger vehicle sales rose 6.4% year on year to 24.065 million units last year. However, sales of conventional fuel-powered models continued to contract, falling 4.3% to 11.06 million units, as electrification steadily reshaped the demand structure.

The structural shift was particularly evident in December, when domestic passenger vehicle sales dropped sharply on both a month-on-month (-8.6%) and year-on-year (-18.1%) basis, with internal combustion engine vehicles seeing a 29.6% year-on-year decline.

Exports emerged as a major growth pillar for passenger vehicles in 2025. Overseas shipments reached 6.038 million units for the year, up 21.9% from a year earlier, reflecting stronger international demand and the expanding global footprint of Chinese automakers.

In December alone, passenger vehicle exports climbed to 641,000 units, rising both month on month (+2.8%) and sharply year on year (+50.5%), reinforcing the sector's export-driven momentum.

Beyond passenger vehicles, the commercial vehicle segment staged a clear recovery in 2025. Supported by policy stimulus under the expanded "two new" framework, rising penetration of new energy vehicle models, and improving exports, the market delivered both cyclical recovery and structural upgrading.

Full-year commercial vehicle production and sales reached 4.261 million and 4.296 million units, both posting double-digit year-on-year growth. Sales of natural gas-powered commercial vehicles also expanded, reflecting diversified energy adoption within the segment.

In December 2025, commercial vehicle output and sales amounted to 416,000 units and 425,000 units, both month on month and year on year, although natural gas models experienced a temporary month-on-month pullback, highlighting uneven short-term dynamics amid an otherwise strengthening market.

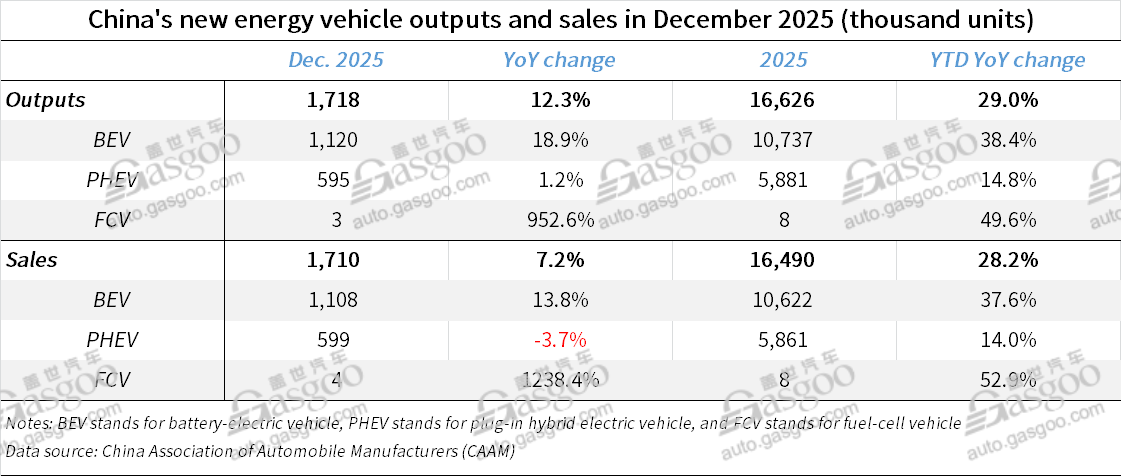

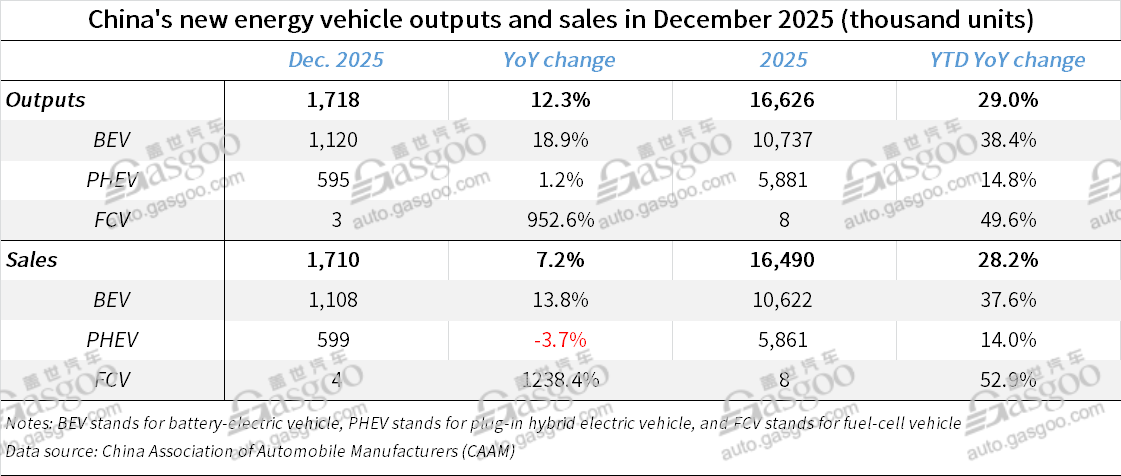

China maintained its position as the world's largest new energy vehicle market for the eleventh consecutive year. Supported by favorable policies, a broadening product lineup, and continued improvements in charging and energy infrastructure, the NEV sector sustained robust growth, with both production and sales surpassing 16 million units.

Full-year NEV production reached 16.626 million units and sales totaled 16.49 million units, rising 29% and 28.2% year on year, respectively. NEVs accounted for 47.9% of all new car sales, marking a year-on-year growth of 7 percentage points in market penetration.

In December, NEV sales reached 1.71 million units, crossing the halfway mark (52.3%) of total new vehicle sales, highlighting how NEV models have become the dominant growth driver even amid a broader market slowdown.

Industry concentration intensified in 2025, with the top 15 automobile groups by annual NEV sales selling a combined 15.669 million NEVs, up 29.2% year-on-year. Together, these players accounted for 95% of total NEV sales, a 0.7 percentage-point increase from the previous year, signaling that scale and consolidation are becoming increasingly decisive in China's fast-maturing NEV market.

Domestically, NEV sales climbed 19.8% over the year-ago period to 13.875 million units in 2025. Passenger NEVs continued to expand steadily (13.005 million units, +17.7% YoY), while new energy commercial vehicles posted particularly strong growth (871,000 units, +63.7% YoY), reflecting faster adoption in logistics and commercial transport.

China's domestic NEV market softened in December, with sales totaling 1.41 million units, down 7.4% from the previous month and 3.6% year-on-year. Passenger NEVs accounted for 1.29 million units, posting sharper declines both month-on-month (-9.4%) and year-on-year (-7.4%), while commercial NEVs bucked the trend, rising strongly to 120,000 units on robust fleet demand.

Over the full year of 2025, NEVs represented 50.8% of total vehicle sales in China's domestic auto market. Penetration was even higher in the passenger vehicle segment, where NEVs accounted for 54% of sales, while commercial NEVs reached a penetration rate of 26.9%.

In December alone, NEV penetration climbed further, with NEV models making up 56% of all domestic vehicle sales. Passenger NEVs captured 58.5% of the passenger vehicle market, while the share of new energy commercial vehicles rose to 38.3%, underscoring faster electrification toward the end of the year despite softer absolute volumes.

Exports emerged as a major growth engine in 2025, with China shipping 2.615 million NEVs overseas, doubling from a year earlier. Passenger NEVs dominated outbound volumes at 2.532 million units, also up 100%, while exports of new-energy commercial vehicles reached 83,000 units, reflecting strong but comparatively slower growth.

In December, NEV exports stood at 300,000 units, edging down 0.1% from November but surging 120% year-on-year. Passenger NEV exports continued to expand modestly on a monthly basis and more than doubled from a year earlier, while commercial NEV exports slipped both month-on-month and year-on-year, highlighting divergent demand dynamics across segments.