Gasgoo Munich- The 2026 Chinese auto market opened without smoke, yet the war drums are already thundering.

In early January, Tesla kicked off a new round of market battles with an official announcement. It unveiled an ultra-low interest loan scheme of up to seven years for its core Model 3 and Model Y lines, with annualized rates dipping as low as 0.98%. Almost overnight, the slogan "Drive away a Tesla for 1,918 yuan a month" flooded the internet.

Within just half a month, mainstream automakers including Xiaomi, Li Auto, XPENG, and Geely quickly followed suit, rolling out their own "seven-year ultra-low interest" products. With regulators having called a halt to disorderly price wars, the focus of competition in the auto market has shifted from price cuts to a more covert and complex "financial war."

Seven-Year Low Interest: What Are You Staking Beyond the Monthly Payment?

Among the automakers, Tesla is undoubtedly the architect of this "financial war." Its "seven-year low interest" scheme is straightforward, no different from standard car loans: partner banks provide financing, extending the traditional three-to-five-year loan cycle to seven years. Take a Model 3 priced at 235,500 yuan: after a down payment of 79,900 yuan, the remaining 155,600 yuan is repaid over 84 installments. The monthly payment is just 1,918 yuan, with total interest over seven years amounting to roughly 5,512 yuan. That rate is far below the prevailing market level for consumer loans.

A week later, on January 16, Xiaomi Chairman Lei Jun announced a seven-year low interest plan for the YU7, with an annual fee rate of 1%, alongside a three-year zero-interest option. By January 20, Li Auto followed with a "seven-year ultra-low monthly payment" scheme covering its entire lineup; additionally, the Li Auto MEGA and i8 enjoy interest-free terms for the first three years. XPENG also touted a "seven-year low interest for all models" slogan, while brands like Geely and Dongfeng Yi Pai joined the fray. A "seven-year installment" race, led by Tesla and drawing in major players, fully unfolded in January 2026.

Yet, beneath the uniform "seven-year low interest" slogans, significant differences exist in financing structures, real costs, and consumer rights.

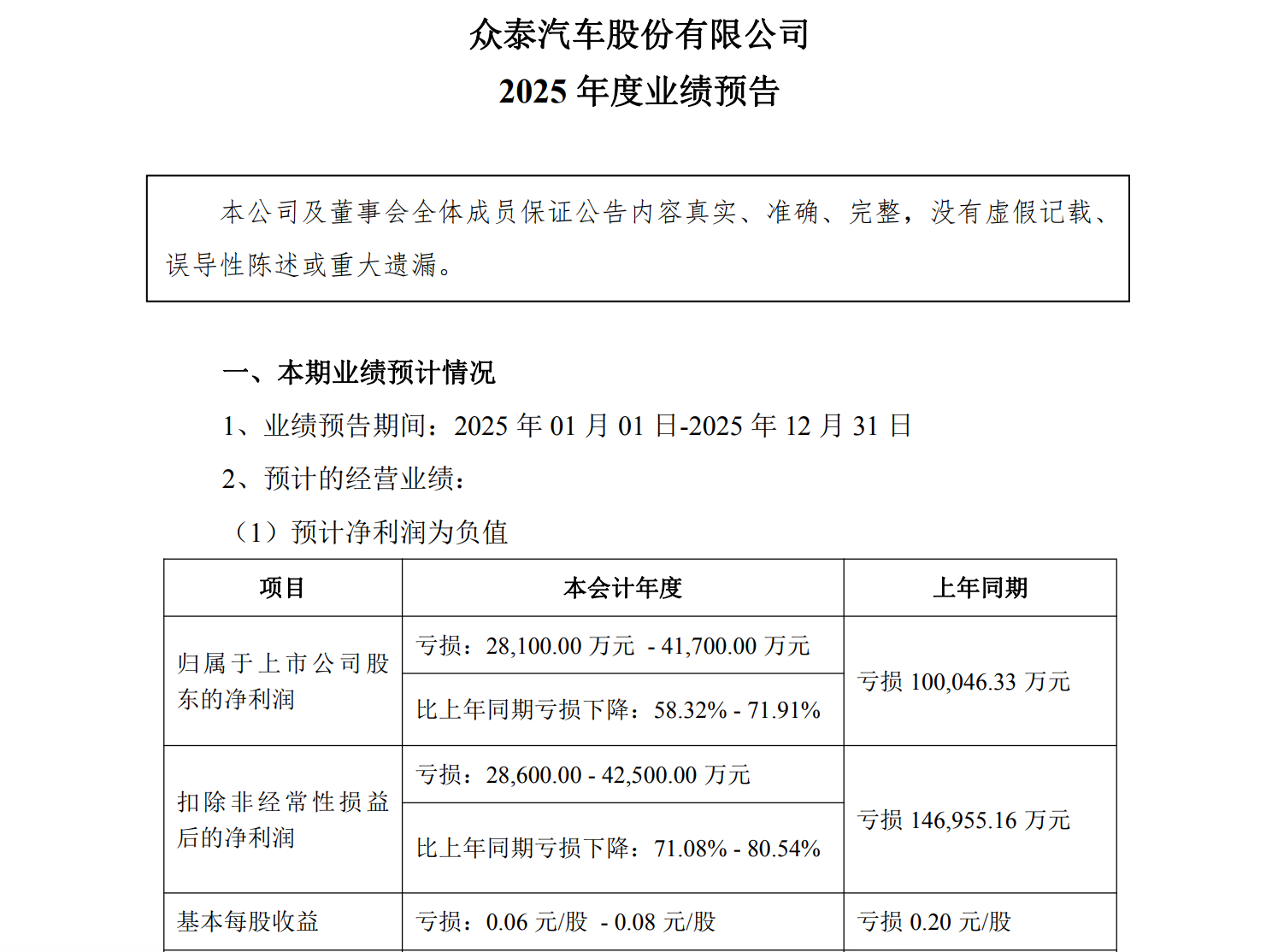

Image Source: Li Auto, XPENG

Tesla's "seven-year low interest" scheme operates like a standard loan, though compared to its five-year zero-interest option, the seven-year plan has limited partner banks—primarily SPDB and China CITIC Bank. Under standard loans, consumers sign contracts directly with banks; the vehicle serves as collateral, but ownership is registered in the consumer's name from the outset. Most other brands, such as Li Auto, XPENG, and Xiaomi, utilize a "financial leasing" model for their seven-year low interest offers. For instance, XPENG and Li Auto explicitly state on posters that the "plan is provided by XPENG/Li Auto Financial Leasing," while Xiaomi’s app notes that the "low interest plan is provided by Shanghai Xiaomi Financial Leasing and Shanghai Changtu Financial Leasing." In this structure, the low-interest financing is provided by the automaker's financial arm or a third-party leasing platform.

According to the definition from the National Financial Regulatory Administration, financial leasing is a transaction where a lessor (a leasing company) purchases a vehicle based on the lessee's selection and provides it for use; the lessee pays rent, and the lessor retains ownership of the leased asset.

Gasgoo consulted legal professionals, who confirmed: "Buying a car via financial leasing differs from a bank loan. During the leasing period, ownership belongs to the leasing company and is only transferred to the consumer upon full repayment."

This means that over the 84-month repayment period, the consumer is legally merely the "lessee"; ownership resides with the leasing company and only transfers to the consumer after all payments are settled and transfer procedures completed. This approach carries hidden risks: if the partnering financial company encounters operational issues, consumers could face complex disputes over property rights.

Regarding these issues, Gasgoo contacted sales representatives from the aforementioned brands. Some sales representatives insisted: "XX Finance is just the brand's own financial company; it just means holding the vehicle title with XX Finance," further claiming that "it is no different from a bank loan."

Furthermore, significant disparities exist in the real cost of purchasing. The "annual fee rate" frequently touted in automaker marketing sounds enticing—Tesla’s is 0.5%, for instance—but it does not reflect the true cost of borrowing. The gold standard for measuring borrowing costs is the "annual interest rate" (APR), which accounts for the monthly reduction of principal and is typically 1.8 to 2 times the fee rate figure. For example, Tesla’s 0.5% fee rate converts to an APR of roughly 0.98%, while a 2.5% fee rate from some brands translates to an actual APR of around 4.7%. On a 100,000 yuan loan over seven years, the former generates only about 3,500 yuan in total interest, while the latter could exceed 14,000 yuan—a marked difference. Additionally, the "financial leasing" model may carry hidden costs such as GPS installation fees, account management charges, and mandatory designated insurance.

Differences in financing structures and actual costs naturally reflect in marketing focus. Leveraging its extremely low cost of capital, Tesla highlights "ultra-low interest" itself, emphasizing rate advantages. Some other brands, however, focus on "ultra-low monthly payments" and "ultra-low down payments," shifting consumer attention—whether intentionally or not.

This marketing strategy makes it easy for consumers to be drawn in by low initial monthly payments, potentially overlooking higher total expenditures, restricted vehicle ownership, and various usage limitations inherent in the "lease-to-own" model.

Finally, these seemingly attractive ultra-long-term loans often face the awkward reality of being "more praised than purchased" in practice. Numerous frontline sales staff report that due to the long duration and high risk, financial institutions enforce exceptionally strict approval for such seven-year loans. Requirements for credit history, bank statements, and debt-to-income ratios far exceed those for short-term loans. Many in-store consumers, after understanding the details, still tend to opt for traditional three-to-five-year interest-free plans.

Regarding this financial promotion sweeping the industry, veteran analyst Zhang Xiang offered a clear business logic: "Currently, these financial promotions appear compliant and not disorderly. Automakers want to sell cars with lower thresholds to boost volume. Given the overcapacity and sluggish market, this is a way to drive demand."

Behind the Financial Promotion Frenzy

As financial tools become the main melody of competition, beneath the veneer of prosperity, a cognitive dissonance and undercurrents within the industry are beginning to surge.

The greatest temptation of ultra-long installments lies in diluting purchase pressure into monthly figures, creating an illusion of "effortless ownership." However, the cost of low monthly payments is a longer repayment cycle and relatively higher total interest. Consumers can easily fixate on the monthly payment figure while overlooking potential financial handling fees, higher mandatory insurance requirements, and various management fees under the financial leasing model.

As mentioned, signing a financial leasing contract means you are merely the vehicle's "long-term tenant" until all debts are cleared. This can lead to a series of usage inconveniences: restrictions on vehicle modifications, mandatory GPS installation, and the need for leasing company approval to dispose of the vehicle (e.g., selling it), significantly eroding autonomy.

Furthermore, new energy vehicle owners may face certain long-term financial traps. Industry data indicates that the seven-year residual value for most NEV models is currently only around 20%. Consequently, these long-term financing schemes could lead to "negative equity"—where the vehicle's market residual value is lower than the outstanding loan balance. For example, one used car dealer calculated the math: a new car priced at 379,800 yuan might be worth only 190,000 yuan after three years. If a seven-year loan was used, the remaining balance could be as high as 217,000 yuan, resulting in an upside-down gap of 27,000 yuan. In such cases, selling the car would require paying the difference out of pocket.

By launching long-term low-interest policies, automakers effectively concede profits to consumers at the point of sale, persuading potential customers who are sensitive to price and monthly payments to finally commit. Through financial tools, automakers precisely "subsidize" specific groups without resorting to overt deep price cuts that would damage brand value or alienate high-value customers, thereby boosting sales while maintaining the pricing structure.

The impact of this financial frenzy on the industry itself may be even more severe than the confusion facing consumers.

Image Source: Tesla

The reality behind low interest is that automakers pay massive "interest subsidies" to financial institutions. Take Tesla’s 0.98% rate: the difference between this and the normal market rate is largely borne by the automaker. Industry estimates suggest this subsidy policy can cost thousands or even tens of thousands of yuan per vehicle. For an automaker selling hundreds of thousands of cars annually, this amounts to billions in extra expenditures, directly eroding already thin profit margins and potentially squeezing crucial R&D investment.

Leading automakers, with stronger cash flows, lower financing costs, and larger sales volumes, can more comfortably absorb the pressure of subsidies, even using them as a weapon to cleanse the market. Small and medium-sized automakers with tight cash chains face a dilemma: follow and risk profits, or hold back and lose market share. This competition is accelerating the Matthew effect, potentially pushing brands lacking core technology and financial reserves out of the market faster.

Ultra-long terms and low down payments mean longer risk exposure periods and higher loan-to-value ratios. Should the economy fluctuate in the future and consumer repayment capacity decline, widespread "negative equity" could transform into non-performing loans for financial institutions, triggering a chain reaction.

When the intensity of financial subsidies becomes a key variable influencing sales, it severely impacts the healthy development of the industry. It represents a deep-seated internal friction that, in the long run, hinders the Chinese auto industry from establishing genuine technological leadership globally.

The Other Side of the Combo: Direct Price Cuts and Tax Subsidies Continue

Of course, the "financial war" is not the entirety of year-end promotions. Traditional pricing tactics and policy hedging strategies still play a vital role in the market, forming a "combo punch" alongside financial schemes.

Image Source: BMW China

While new energy startups battle over financial schemes, some traditional brands, particularly luxury marques, have opted for more direct concessions. BMW officially adjusted prices on 31 models in early 2026, with 24 seeing cuts exceeding 10% and five exceeding 20%. The starting price of the BMW iX1 dropped from 299,900 yuan to 228,000 yuan—a 24% reduction. The official guide price for flagship models like the BMW i7 M70L was slashed by up to 301,000 yuan. These "official price cuts" aim to directly lower the barrier to purchase and boost market competitiveness.

This is not an isolated case; the luxury car pricing system is showing signs of "structural loosening." For traditional powerhouses like Mercedes-Benz, Audi, and Volvo, terminal discounts on multiple electric and fuel models generally reach 20% to 30%, with concessions on slow-selling models being even more aggressive. The pressure of this downward price shift quickly transmitted to the mid-to-high-end market, forcing joint-venture mid-to-large SUVs like the Volkswagen Teramont and Ford Explorer to adjust accordingly. Classic B-segment sedans like the Volkswagen Magotan have also used substantial terminal discounts to push the drive-away price of mainstream configurations into the 150,000 yuan range, further lowering price floors.

Beyond market-driven price adjustments, the early 2026 auto market is also feeling the impact of a policy "gear shift," spawning another massive wave of promotional actions: the stacking of purchase tax subsidies with national and local trade-in policies.

According to a joint announcement by the Ministry of Finance, State Taxation Administration, and Ministry of Industry and Information Technology, the exemption from purchase tax for new energy vehicles ended on January 1, 2026, entering a two-year phase of "halved collection." This implies that consumer acquisition costs have increased compared to 2025.

To offset this policy impact and stabilize market confidence, a campaign of "purchase tax subsidies" voluntarily borne by automakers began as early as late 2025. Over 17 mainstream brands, including Li Auto, NIO, Xiaomi, and ZEEKR, pledged to "cover the difference" for users. This became another crucial tool for automakers to stimulate the market, alongside financial schemes.

Beyond voluntary corporate "bottoming out," a more powerful consumption driver comes from the policy level. At the start of 2026, the "Implementation Rules for 2026 Automobile Trade-In Subsidies" officially took effect, providing individual consumers with direct cash subsidies ranging from several thousand to 20,000 yuan for scrapping or trading in old vehicles for new ones. The synergy between national and corporate subsidies formed the strongest promotional "combo punch" in the early-year market.

Conclusion

The early 2026 auto market promotions clearly display two parallel themes: on one hand, financial schemes represented by "seven-year low interest" cleverly lower the entry barrier for specific consumer groups; on the other, traditional means like direct price cuts and policy subsidies use straightforward concessions to stabilize the base.

Regardless of how the forms evolve, the essence remains a refined extraction of consumer purchasing power. For the entire auto industry, promotion is indeed a useful medicine, but beyond that, the nature of the market remains unchanged: truly sustainable advantages do not stem from the most ingenious financial designs or the most aggressive price concessions, but from "hard power" in technology, product, and business models that cannot be easily replicated.