Gasgoo Munich - From January to December, China's passenger car exports globally were defined by a clear pattern: new energy vehicles leading the charge, top-tier players setting the pace, diverging growth rates, and a tug-of-war between established and emerging forces. In Europe, SAIC Motor Passenger Vehicle held onto the top spot, while Leapmotor emerged as a new benchmark with a staggering 1,000.3% surge. In Southeast Asia, BYD dominated the pack; its 216.8% annual jump highlighted the technological edge and localization strengths of its new energy lineup, as Chery, Changan, and Great Wall Motor also expanded rapidly.

North America saw the new energy camp take the lead, with BYD posting a 176.0% surge to achieve a dual breakthrough in both volume and growth rate. In Central and South America, BYD and Chery continued to lead, while Great Wall Motor, JMC, and DFSK all delivered growth exceeding 60%, becoming core engines of expansion. The Middle East market featured top-tier leaders but polarized growth: Chery held the top spot but slipped 25.7% year-on-year due to a high base and intense competition, while BYD, Great Wall Motor, and Soueast Motor doubled their sales through new energy deployments. The steady rise in overseas penetration for Chinese brands masks a contest of comprehensive strength—product power, supply chain resilience, and localized operations—as competition across regions shifts toward a more refined and differentiated phase.

Top 10 Chinese Passenger Car Exporters to Europe

NO.1 SAIC Motor Passenger Vehicle. Jan-Dec, exported 297,649 units to Europe, up 12.0% year-on-year.

NO.2 BYD. Jan-Dec, exported 280,712 units to Europe, up 205.7% year-on-year.

NO.3 Chery. Jan-Dec, exported 174,391 units to Europe, up 167.8% year-on-year.

NO.4 Tesla. Jan-Dec, exported 103,302 units to Europe, down 31.9% year-on-year.

NO.5 Geely. Jan-Dec, exported 63,852 units to Europe, down 40.9% year-on-year.

NO.6 Spotlight Automotive. Jan-Dec, exported 45,667 units to Europe, up 6.7% year-on-year.

NO.7 Leapmotor. Jan-Dec, exported 39,257 units to Europe, up 1,000.3% year-on-year.

NO.8 Volkswagen Anhui. Jan-Dec, exported 32,484 units to Europe, up 33.2% year-on-year.

NO.9 Geely Volvo. Jan-Dec, exported 25,295 units to Europe, up 4.0% year-on-year.

NO.10 eGT. Jan-Dec, exported 21,323 units to Europe, down 28.2% year-on-year.

From January to December, the European market was characterized by high concentration among the leaders. SAIC Motor Passenger Vehicle, BYD, and Chery formed an absolute first tier, taking the top three spots with exports of 297,649, 280,712, and 174,391 units respectively—totaling over 750,000 units. While SAIC Motor Passenger Vehicle remains firmly in first place, BYD is closing the gap; the difference is now just 16,900 units, putting the challenger within striking distance of the champion.

Emerging players delivered particularly standout performances. Leapmotor exported 39,000 units with a 1,000.3% surge, establishing itself as a benchmark for new independent automakers breaking into Europe. Volkswagen Anhui (up 33.2%) and Spotlight Automotive (up 6.7%) achieved steady growth through established market layouts, while Geely Volvo posted a modest climb of 4.0%.

At the same time, market divergence intensified. Tesla's European exports slipped 31.9% to 103,000 units, while Geely saw a steeper 40.9% decline to 64,000 units. eGT also fell, dropping 28.2%. These fluctuations likely stem from a combination of factors: intensifying competition as Chinese brands crowd the market, faster electric pivots by European incumbents, and internal adjustments to product cycles.

Throughout the year, the market penetration of Chinese automakers in Europe steadily climbed. A pattern of established brands holding firm while emerging forces break through helped drive overall export volumes higher. Yet the disparity in growth rates suggests that competition in Europe is set to heat up further. Moving forward, product strength, supply chain resilience, and the ability to operate locally will be the decisive factors for success in the European market.

Top 10 Chinese Passenger Car Exporters to Southeast Asia

NO.1 BYD. Jan-Dec, exported 176,132 units to Southeast Asia, up 216.8% year-on-year.

NO.2 Chery. Jan-Dec, exported 88,356 units to Southeast Asia, up 131.5% year-on-year.

NO.3 Geely. Jan-Dec, exported 76,565 units to Southeast Asia, up 38.0% year-on-year.

NO.4 Changan. Jan-Dec, exported 35,163 units to Southeast Asia, up 77.3% year-on-year.

NO.5 Great Wall Motor. Jan-Dec, exported 24,313 units to Southeast Asia, up 68.0% year-on-year.

NO.6 Tesla. Jan-Dec, exported 19,405 units to Southeast Asia, up 42.0% year-on-year.

NO.7 Jiangsu Yueda-Kia. Jan-Dec, exported 17,699 units to Southeast Asia, down 7.0% year-on-year.

NO.8 JMC. Jan-Dec, exported 17,482 units to Southeast Asia, up 20.3% year-on-year.

NO.9 SAIC Motor Passenger Vehicle. Jan-Dec, exported 15,425 units to Southeast Asia, down 43.7% year-on-year.

NO.10 SGMW. Jan-Dec, exported 12,999 units to Southeast Asia, down 43.5% year-on-year.

From January to December, the Southeast Asian market displayed high concentration among leaders alongside diverging growth rates. In the top camp, BYD solidified its lead with 176,132 exports, its 216.8% surge underscoring the technological advantage and deep localization of its new energy offerings. Chery followed with 88,356 units; its 131.5% growth reflects strong competitiveness from products tailored to local needs. Geely held steady with 76,565 units and a 38.0% rise, demonstrating a solid market foundation.

Meanwhile, Changan, Great Wall Motor, Tesla, and JMC all posted positive growth, with rates ranging from 20.3% to 77.3%. Changan's 77.3% jump and Great Wall Motor's 68.0% rise were particularly notable, highlighting aggressive expansion. However, the market split is widening: Jiangsu Yueda-Kia dipped 7.0%, while SAIC Motor Passenger Vehicle and SGMW suffered sharper declines of 43.7% and 43.5%, respectively.

Overall, Chinese brands continue to gain ground in Southeast Asia, with new energy models remaining the core driver of export growth. Leading companies are leveraging technical barriers and mature networks to consolidate their lead, while the export declines of others signal a shift from "scale expansion" to "refined operations" in the region. Looking ahead, the ability to precisely match products to market needs and execute deep localization will be critical for winning in Southeast Asia.

Top 10 Chinese Passenger Car Exporters to North America

NO.1 BYD. Jan-Dec, exported 130,452 units to North America, up 176.0% year-on-year.

NO.2 SGMW. Jan-Dec, exported 105,864 units to North America, up 15.4% year-on-year.

NO.3 SAIC Motor Passenger Vehicle. Jan-Dec, exported 45,982 units to North America, down 14.5% year-on-year.

NO.4 Geely. Jan-Dec, exported 44,280 units to North America, up 76.6% year-on-year.

NO.5 Shanghai GM. Jan-Dec, exported 39,860 units to North America, down 43.8% year-on-year.

NO.6 Changan Ford. Jan-Dec, exported 37,158 units to North America, down 19.9% year-on-year.

NO.7 Chery. Jan-Dec, exported 36,989 units to North America, up 26.3% year-on-year.

NO.8 Jiangsu Yueda-Kia. Jan-Dec, exported 31,121 units to North America, up 5.9% year-on-year.

NO.9 Changan. Jan-Dec, exported 19,544 units to North America, up 137.9% year-on-year.

NO.10 GAC Trumpchi. Jan-Dec, exported 15,640 units to North America, up 30.2% year-on-year.

From January to December, the North American market was defined by a new energy surge and adjustment among traditional players. BYD dominated with 130,452 exports and a 176.0% surge, achieving a dual breakthrough in volume and speed that highlights the hard-core competitiveness of its new energy lineup. SGMW held second place with 105,864 units and a steady 15.4% increase. Geely ranked fourth with 44,280 units, its 76.6% growth signaling strong expansion momentum. Changan broke through with a 137.9% surge, while Chery, Jiangsu Yueda-Kia, and GAC Trumpchi also posted positive growth, reflecting diverse market vitality.

Meanwhile, some traditional automakers saw significant volatility and adjustment. SAIC Motor Passenger Vehicle's exports fell 14.5% to 45,982 units, while Shanghai GM dropped 43.8% to 39,860 units. Changan Ford also retreated by 19.9%. These figures suggest there is room to improve how well these companies' product structures align with current consumer trends in North America.

Overall, Chinese automakers' exports to North America are in a critical transition phase: the new energy camp is breaking through aggressively, while traditional forces are adjusting their fit. Going forward, the technical competitiveness of new energy products and the precision of regional operations will be the focal points for reshaping the export landscape in North America.

Top 10 Chinese Passenger Car Exporters to Central and South America

NO.1 BYD. Jan-Dec, exported 165,325 units to Central and South America, up 26.4% year-on-year.

NO.2 Chery. Jan-Dec, exported 151,527 units to Central and South America, up 40.6% year-on-year.

NO.3 Great Wall Motor. Jan-Dec, exported 74,588 units to Central and South America, up 87.2% year-on-year.

NO.4 Jiangsu Yueda-Kia. Jan-Dec, exported 50,683 units to Central and South America, up 0.0% year-on-year.

NO.5 JMC. Jan-Dec, exported 40,713 units to Central and South America, up 95.5% year-on-year.

NO.6 Geely. Jan-Dec, exported 31,821 units to Central and South America, up 33.5% year-on-year.

NO.7 SGMW. Jan-Dec, exported 28,564 units to Central and South America, down 6.4% year-on-year.

NO.8 DFSK. Jan-Dec, exported 25,693 units to Central and South America, up 60.0% year-on-year.

NO.9 SAIC Motor Passenger Vehicle. Jan-Dec, exported 25,677 units to Central and South America, up 54.0% year-on-year.

NO.10 Changan. Jan-Dec, exported 25,221 units to Central and South America, up 24.4% year-on-year.

From January to December, the Central and South American market saw top players hold their ground while most automakers increased volumes. In the leading tier, BYD solidified its top position with 165,325 exports, its 26.4% growth further cementing the appeal of its new energy matrix. Chery followed closely with 151,527 units; a 40.6% rise, driven by economy models tailored to local demand and deep localized channels, allowed it to steadily narrow the gap with the leader.

Several automakers served as powerful engines for regional export growth. Great Wall Motor, JMC, and DFSK all posted annual gains exceeding 60%. JMC's 95.5% surge was particularly striking, validating the fit of its commercial-passenger models for the region. SAIC Motor Passenger Vehicle also made steady inroads with a 54.0% jump. Geely and Changan maintained resilient growth of 33.5% and 24.4%, respectively. However, pressure remains for some: Jiangsu Yueda-Kia's exports were flat year-on-year, while SGMW slipped 6.4%, suggesting a need to further optimize regional strategies and product structures.

Overall, competition in Central and South America has entered a new stage of "precise layout." Automakers must focus on product differentiation, deep localization, and the pace of technological iteration. Only by aligning with core regional demands—such as energy trends and consumer preferences—can they achieve sustainable growth.

Top 10 Chinese Passenger Car Exporters to the Middle East

NO.1 Chery. Jan-Dec, exported 236,241 units to the Middle East, down 25.7% year-on-year.

NO.2 BYD. Jan-Dec, exported 133,766 units to the Middle East, up 128.4% year-on-year.

NO.3 SAIC Motor Passenger Vehicle. Jan-Dec, exported 104,824 units to the Middle East, down 0.6% year-on-year.

NO.4 Changan. Jan-Dec, exported 91,916 units to the Middle East, up 38.6% year-on-year.

NO.5 Jiangsu Yueda-Kia. Jan-Dec, exported 85,203 units to the Middle East, up 12.4% year-on-year.

NO.6 Geely. Jan-Dec, exported 78,389 units to the Middle East, down 4.4% year-on-year.

NO.7 FAW Toyota. Jan-Dec, exported 68,256 units to the Middle East, up 46.0% year-on-year.

NO.8 Great Wall Motor. Jan-Dec, exported 53,563 units to the Middle East, up 127.0% year-on-year.

NO.9 Soueast Motor. Jan-Dec, exported 48,906 units to the Middle East, up 111.5% year-on-year.

NO.10 Beijing Hyundai. Jan-Dec, exported 42,065 units to the Middle East, up 26.9% year-on-year.

From January to December, the Middle East market featured a stable lead from top players but polarized growth rates. Chery maintained the top spot with 236,241 exports, though it slipped 25.7% year-on-year due to a high base from the previous year and intensified competition. BYD followed with 133,766 units and a 128.4% surge; by aligning its new energy models with local energy transitions and upgrading consumption, it achieved leapfrog growth and steadily narrowed the gap with the leader.

Meanwhile, growth slowed for some. SAIC Motor Passenger Vehicle dipped 0.6%, and Geely fell 4.4%, signaling a need to accelerate product and strategy iterations to adapt to the rapidly shifting environment. In stark contrast, several automakers showed strong momentum: Changan (38.6%), Jiangsu Yueda-Kia (12.4%), FAW Toyota (46.0%), and Beijing Hyundai (26.9%) all expanded steadily. Soueast Motor and Great Wall Motor more than doubled their sales, becoming key engines for regional growth.

Overall, the Middle East has become a key strategic market for Chinese passenger car exports. The pace of new energy deployment and the ability to differentiate products are becoming the levers for growth. Traditional leaders must accelerate their strategic transformation to match regional needs, while high-growth automakers need to strengthen localized channels and product competitiveness to build a foundation for long-term, sustainable expansion.

Data Source: Gasgoo Automotive Research Institute China Passenger Car Export Database (by Country)

——END——

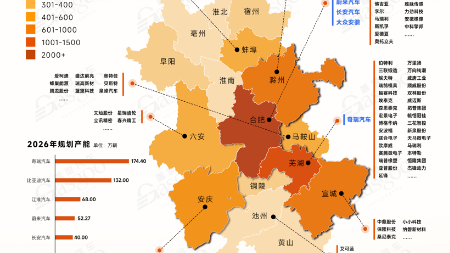

Recommended: "2025 China Major Overseas Automaker Industrial Layout Map", scan to purchase the high-definition version!