Gasgoo Munich - China's new energy passenger vehicle wholesale sales are estimated at 900,000 units in January, up 1% from a year earlier, according to the latest data from the China Passenger Car Association (CPCA).

That gain is notable against a backdrop of shifting purchase tax policies. Starting January 1, 2026, the exemption for new energy vehicle purchase taxes will be halved, with the maximum tax break cut from 30,000 yuan to 15,000 yuan.

The policy shift triggered a rush of purchases in December 2025, cannibalizing some of January's demand. Yet, unlike the 54% plunge seen in January 2020 when subsidies ended, or the 8% drop in January 2023 following the subsidy phase-out, this year managed to stay in positive territory.

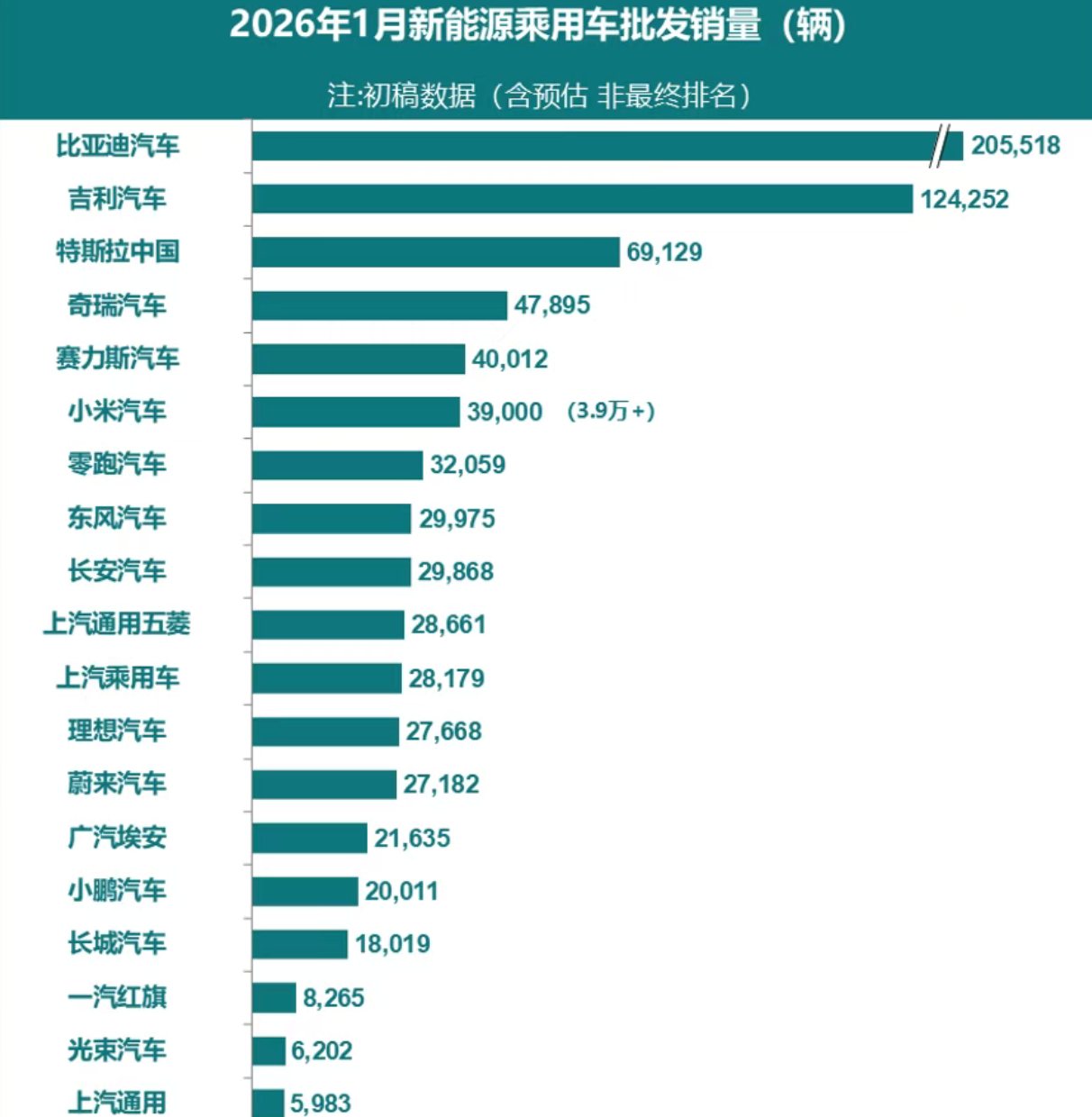

Image source: CPCA

BYD Holds the Top Spot

A closer look at individual manufacturers reveals a stark divergence in performance.

BYD's wholesale sales climbed to 205,500 units, securing its position at the top. Exports accounted for roughly 48% of the total, making overseas markets a critical pillar for its overall volume.

Geely Auto recorded 124,300 wholesale new energy sales in January — a record high for the month. Its Galaxy series and ZEEKR brand continue to gain traction, with significant volume growth in Southeast Asia and Europe.

Tesla China delivered 69,100 wholesale units, maintaining its lead among foreign brands. Chery Auto reached 47,900 units, with exports making up about 60% of its total. It has now shipped over 100,000 units monthly for nine consecutive months.

Image source: BYD

The startup camp is seeing a clear split. Seres Auto posted 40,000 wholesale units, driven largely by its AITO brand. The M9 and new M7 models remain fiercely competitive in the 300,000 yuan-plus segment, marking a milestone of 1 million vehicles rolling off the production line in January.

Xiaomi Auto hit 39,000 wholesale units, a monthly delivery record. With the launch of its all-electric SUV YU7, the company has formed a two-model matrix alongside the SU7, signaling the start of its product cycle momentum. Leapmotor logged 32,100 wholesale sales, while Dongfeng Motor and others hovered around the 30,000 mark.

Among joint ventures, SAIC-GM reported 5,983 units and Dongfeng Nissan 4,211, achieving a phased breakthrough in their transition to new energy vehicles.

Concentration at the Top Intensifies

In terms of sales structure, manufacturers selling over 30,000 units accounted for roughly 550,000 vehicles — about 60% of January's total wholesale volume. This concentration at the top reflects both the objective laws of industry development and the current market environment, where corporate competitiveness is key.

China's new energy vehicle market has moved past the introduction phase into the late stages of growth, now transitioning toward maturity. During this shift, market competition is moving from fighting for new buyers to fighting for market share, and consumer decisions are becoming increasingly rational.

With the purchase tax adjustment, the influence of policy incentives on purchasing decisions is fading, making product strength the core determinant of market share. Leading automakers, armed with years of technical accumulation, brand influence, and economies of scale, hold a distinct advantage in this round of competition.

R&D capability is the linchpin for staying ahead. BYD, for instance, has mastered the core technologies of batteries, motors, and electronic controls, building technical barriers with its Blade Battery and DM-i hybrid systems. This vertically integrated supply chain not only lowers production costs but also allows for rapid responses to market demand.

Geely Auto also brings advanced new energy technology and management experience, boasting a full product matrix from A0-segment to C-segment vehicles. Tesla, meanwhile, continues to lead foreign brands by leveraging its expertise in electric powertrains and intelligent driving.

Image source: Geely Auto

Brand building is equally critical. Despite its short time in the auto industry, Xiaomi Auto has quickly built brand awareness and user loyalty through Lei Jun's personal influence and the synergy of its ecosystem chain. Its "Human-Car-Home" ecosystem concept means customers aren't just buying a vehicle — they're buying into an intelligent lifestyle.

AITO has leveraged Huawei's technological edge in intelligent driving and cockpits to carve out a differentiated competitive edge, gaining a firm foothold in the premium market above 300,000 yuan. Similarly, startups like Li Auto and NIO have built strong brand identities by focusing on niche segments and deepening user services.

The ability to expand overseas has emerged as a new dividing line. As the domestic market enters an adjustment phase due to policy shifts, automakers with strong export capabilities show greater resilience. It is no coincidence that the top performers in new energy sales are also the driving force behind China's auto exports. By establishing a presence in Southeast Asia, Europe, and South America, these companies have diversified their market structures, effectively hedging against domestic volatility.

In contrast, smaller automakers lacking core technology, brand power, and scale face mounting survival pressure. Squeezed by fading policy tailwinds and a persistent price war, these players cannot match the product strength of industry leaders nor compete on cost control.

The proliferation of intelligent features is further accelerating market polarization. In January 2026, the penetration rate of advanced driver-assistance systems continued to rise, with falling costs enabling high-end NOA functions to spread to vehicles in the 150,000–200,000 yuan range.

Leading automakers with in-house intelligent driving tech can deliver superior experiences at lower costs, while smaller firms relying on supplier solutions lag in both cost and user experience. Intelligence is replacing purchase tax incentives as the core driver of consumer purchasing decisions.

It is foreseeable that smaller enterprises lacking core competitiveness will face accelerated consolidation, and the polarization of the market landscape is set to intensify.