Gasgoo Munich- Data from Gasgoo Auto Institute reveals a clear "dual-track" dynamic shaping the 2025 passenger vehicle market. On one front, new energy vehicles (NEVs) are accelerating their penetration, serving as the core engine for sales growth; whether in sedans or SUVs, NEVs now dominate the mainstream. On the other, domestic brands are leveraging comprehensive product matrices, tiered pricing, and channel advantages to push deeper into every segment, further squeezing the space available to joint-venture brands.

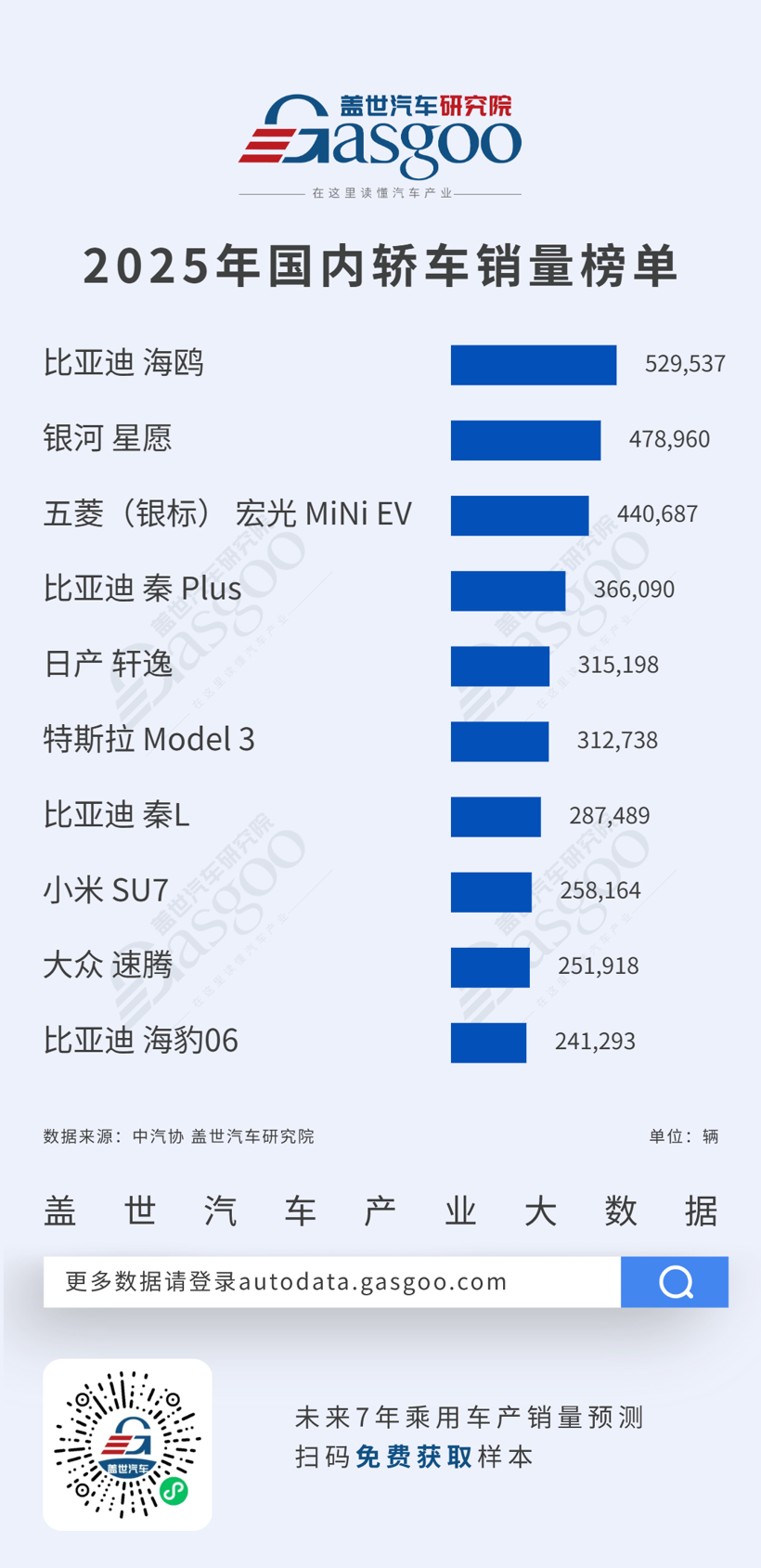

Top 10 Sedan Sales: January–December 2025

NO.1 BYD Seagull, with full-year sales of 529,537 units

NO.2 Galaxy Xingyuan, with full-year sales of 478,960 units

NO.3 Wuling Hongguang Mini EV (Silver Badge), with full-year sales of 440,687 units

NO.4 BYD Qin PLUS, with full-year sales of 366,090 units

NO.5 Nissan Sylphy, with full-year sales of 315,190 units

NO.6 Tesla Model 3, with full-year sales of 312,738 units

NO.7 BYD Qin L, with full-year sales of 287,489 units

NO.8 Xiaomi SU7, with full-year sales of 258,164 units

NO.9 Volkswagen Sagitar, with full-year sales of 251,918 units

NO.10 BYD Seal 06, with full-year sales of 241,293 units

Overall, NEVs claimed seven of the top 10 spots in the 2025 sedan rankings. With both battery-electric and plug-in hybrid models advancing in parallel, the displacement of traditional combustion engines in the mainstream sedan market is all but confirmed. Among conventional internal combustion engine sedans, only the Nissan Sylphy and Volkswagen Sagitar retain a significant scale advantage.

Meanwhile, BYD has tightened its grip on the sedan market. Four of its models—the Seagull, Qin PLUS, Qin L, and Seal 06—landed in the top 10, spanning multiple segments to form a distinct product matrix and pricing ladder. Notably, the Qin series alone moved over 650,000 units for the year, solidifying its foundation in the family sedan segment. This performance highlights BYD’s systemic strengths in channel coverage, cost control, and rapid product iteration.

Joint-venture brands showed some resilience, with the Nissan Sylphy and Volkswagen Sagitar cracking the top 10—a testament to their lingering advantages in brand awareness, existing ownership base, and dealer networks. Yet, under the sustained assault of surging NEV sales, the overall rankings of JV combustion sedans have slipped significantly, their market position trending from "stable" to "fragile." At the same time, the inclusion of both the Tesla Model 3 and Xiaomi SU7 in the top 10 signals that demand for mid-to-high-end electric sedans is establishing a firm footing. Intelligent features and brand momentum are gradually rewriting the competitive logic of the sedan market.

Top 10 SUV Sales: January–December 2025

NO.1 Tesla Model Y, with full-year sales of 494,949 units

NO.2 BYD Song PLUS, with full-year sales of 400,920 units

NO.3 Geely Xingyue L, with full-year sales of 269,307 units

NO.4 BYD Yuan, with full-year sales of 267,179 units

NO.5 Chery Tiggo 8/8 Plus/Pro, with full-year sales of 243,062 units

NO.6 Chery Tiggo 5x, with full-year sales of 239,539 units

NO.7 Chery Tiggo 7/7 Plus, with full-year sales of 238,279 units

NO.8 Geely Binyue/Binyue Pro, with full-year sales of 237,593 units

NO.9 BYD Song Pro, with full-year sales of 232,548 units

NO.10 Volkswagen Tiguan L, with full-year sales of 208,949 units

Figures show a "dual-track" drive in the 2025 SUV market, fueled by both new energy vehicles and domestic brands, with sales concentrating heavily among top models. The Tesla Model Y held the top spot with nearly 500,000 units sold, cementing its status as the benchmark for mid-to-high-end electric SUVs. Meanwhile, three BYD models—the Song PLUS, Yuan, and Song Pro—simultaneously cracked the top 10. Covering both compact and small SUV segments, this trio underscores BYD’s systematic layout and scale advantages in the NEV SUV space.

At the same time, a cluster of models from Geely (Xingyue L and Binyue series) and Chery (Tiggo 8, Tiggo 5x, and Tiggo 7) dominated the rankings, forming the market’s "middle ground." Relying on practical space, competitive value-for-money specifications, and mature distribution networks, these models maintained steady volume in market tiers where NEV penetration is not yet complete. Notably, the sales performance of the Tiggo series was also bolstered by sustained support from export markets, serving as a key pillar underpinning the scale of the SUV market.

In contrast, the presence of joint-venture brands in the SUV market has contracted. Only the Volkswagen Tiguan L made the top 10, reflecting its residual advantages in brand recognition and product reputation. However, the segment has largely shifted from "dominance" to "defense." As NEV penetration accelerates and domestic brands continue to elevate product quality, the competitive landscape of the SUV market is rapidly evolving toward "electrification led by Chinese automakers."