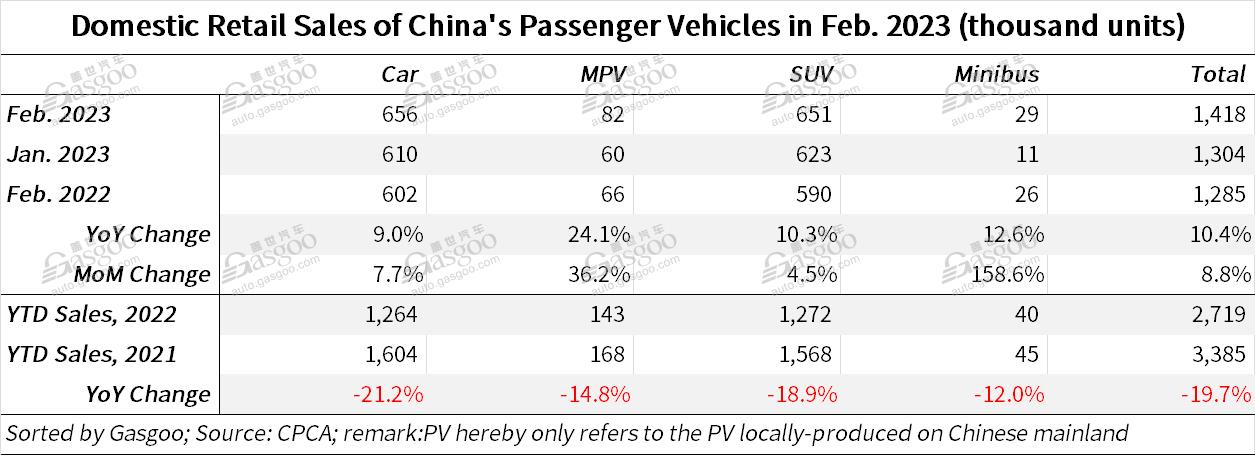

Shanghai (Gasgoo)- China's passenger vehicle (PV) retail sales amounted to 1.418 million units in Feb. 2023, growing 10.4% from the previous year, while also rising 8.8% from the previous month, according to the China Passenger Car Association (CPCA).

For clarity, the passenger vehicles hereby refer to the cars, SUVs, MPVs, and minibuses locally produced on the Chinese mainland.

The CPCA explained that the MoM growth in Feb. PV retail sales is a reasonable trend in line with the industry expectations, as a result of the combined influence of some factors like the withdrawal of the Spring Festival holiday.

For the first two months of 2023, China’s passenger vehicle market posted a 19.7% year-over-year decrease in its cumulative retail sales, which came in at 2.719 million units.

There were around 200,000 luxury PVs retailed across China last month, representing a 23% year-on-year jump and an 8% month-on-month growth. The luxury car market has gradually strengthened as the shortage of high-end cars caused by the chip supply constraints last year has waned.

Chinese indigenous PV brands recorded a combined retail sales volume of roughly 710,000 units in Feb., which was 29% and 12% more than that of the year-ago and month-ago periods, respectively.

The CPCA's data show that China's local brands accounted for 51.1% of the country's total PV retail volume last month, 7 percentage points higher than the prior-year level.

With about 480,000 PVs delivered in Feb., mainstream joint ventures in China faced a 12% decline from a year earlier, but posted a 2% growth from the previous month.

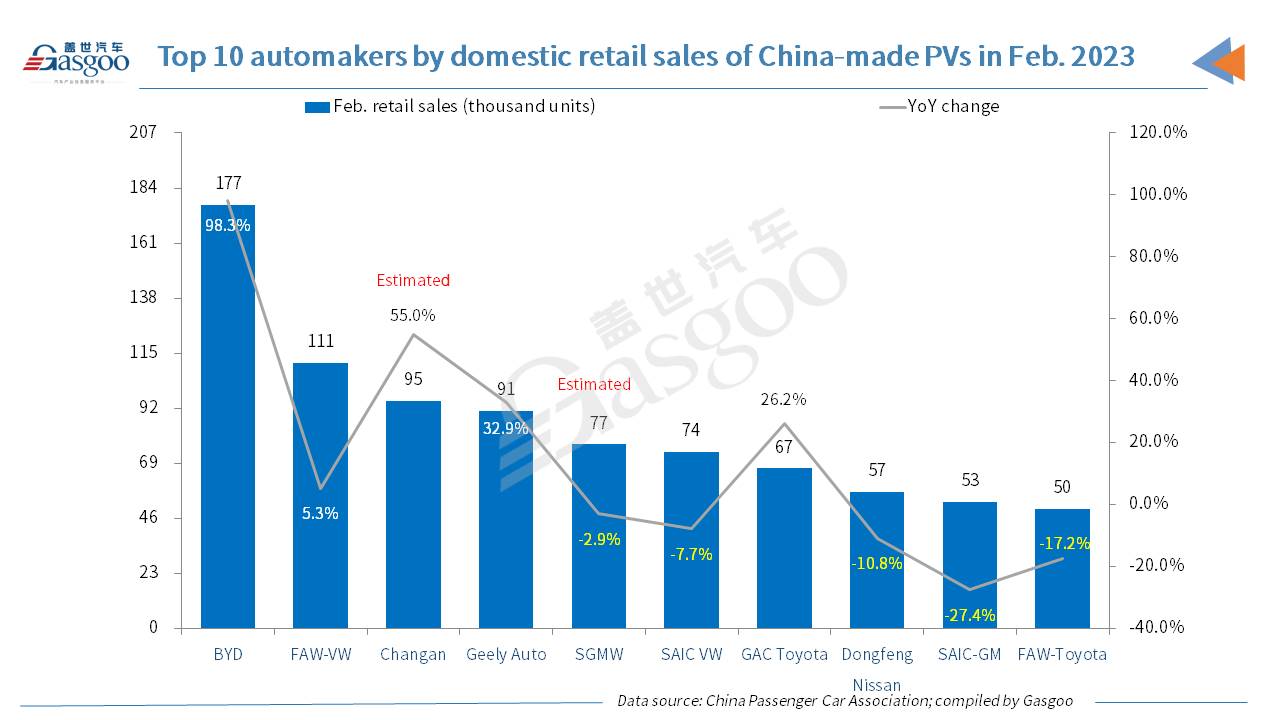

Among the top 10 automakers by Feb. PV retail sales in China, BYD ranked highest in terms of both the sales volume and the year-on-year growth. Besides, Changan Auto’s wholly-owned PV brands, Geely Auto, and GAC Toyota all scored a two-digit year-on-year growth as well.

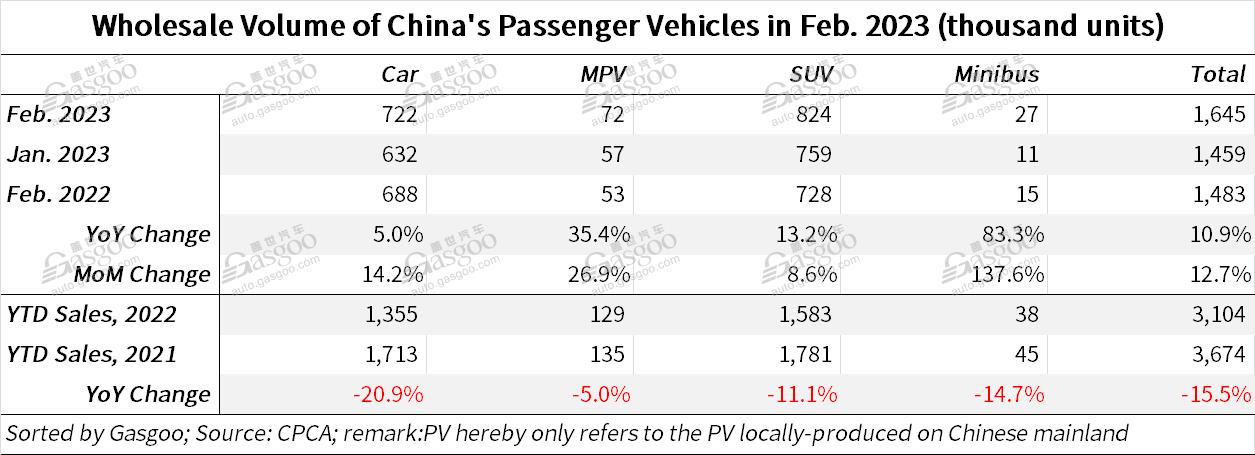

China's monthly PV wholesale volume reached 1.645 million units last month, rising at a double-digit rate compared to both the year-ago and month-ago periods.

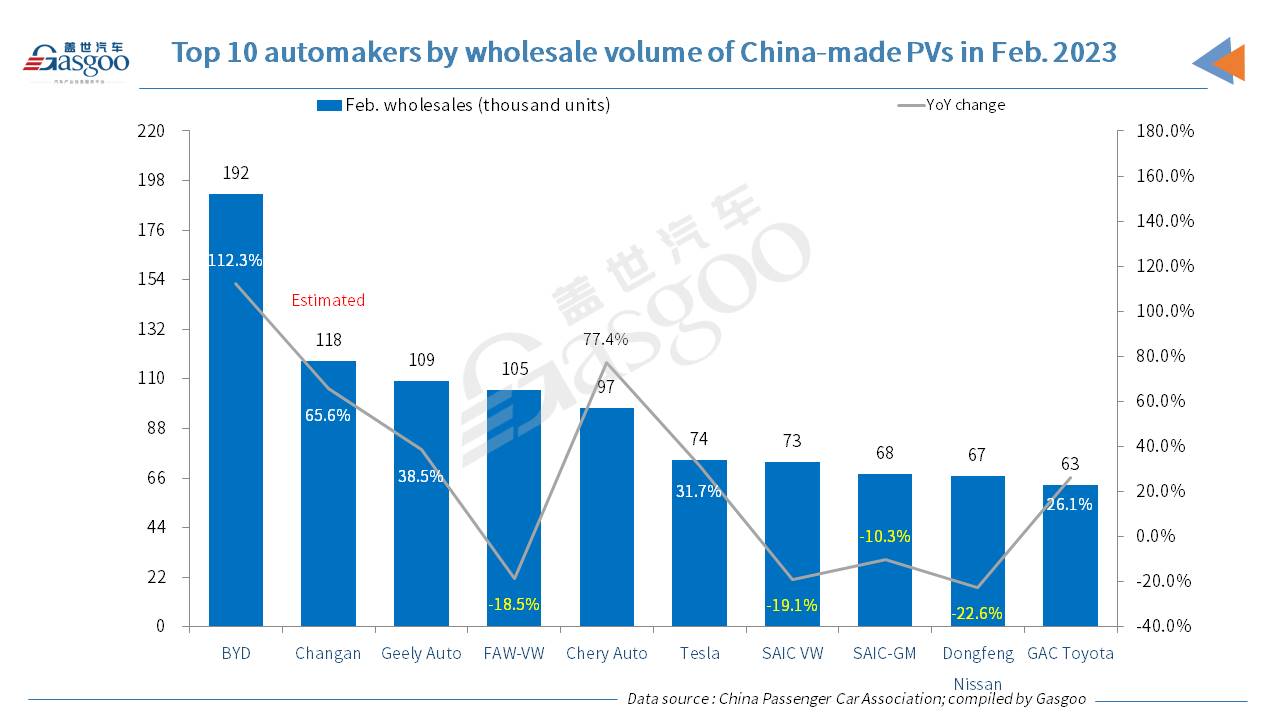

With regard to the PV wholesale volume in Feb., BYD still outshone other automakers with a wholesale volume of around 192,000 units. Among the top 10 automakers, BYD, Changan (self-owned PV brands), Geely Auto, Chery Auto, Tesla, and GAC Toyota all gained a robust year-on-year jump.

Although BMW Brilliance and Beijing Benz failed to enter the top 10 rankings by Feb. wholesale volume, the two Sino-German joint ventures also scored a significant upward movement, the CPCA added.

As for production performance, China’s locally-produced PV output amounted to 1.692 million units last month, growing 11.1% and 23.6% from a year earlier and a month earlier, respectively.

According to the data compiled by the CPCA, China's passenger vehicle export volume (including complete vehicles and CKDs) reached 250,000 units in Feb., zooming up 89% from the prior-year period, while also climbing 8% from the previous month.

In the Jan.-Feb. period, China exported a total of 488,000 passenger vehicles (+61% YoY), 31% of which were contributed by new energy vehicles.