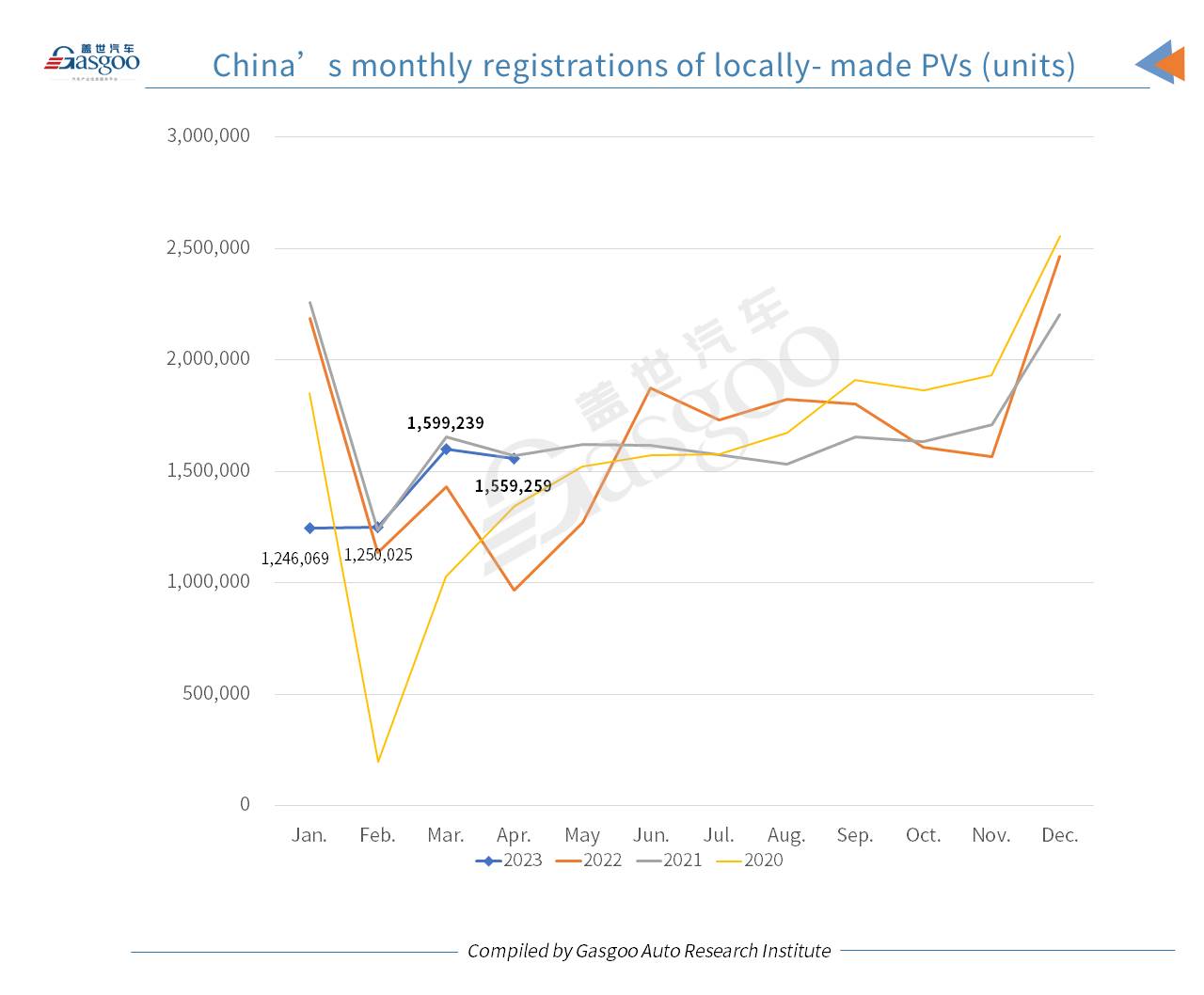

China's monthly registrations of locally-made passenger vehicles (PVs) reached 1,559,259 units in Apr. 2023, surging 60.9% from the previous year, but edging down 2.5% from the previous month, according to the data compiled by Gasgoo Auto Research Institute (“GARI”).

The year-on-year spike in the Apr. registrations was mainly due to the low base for the year-ago period where the epidemic led to disruption across the automotive supply chain.

The growing demands for travel during the May Day holiday boosted car purchases in April, continuing the stable trend from the end of Mar. Besides, the Auto Shanghai 2023 held in Apr. also served as a powerful platform and booster for promoting domestic car consumption.

For the first four months of this year, there were 5,654,592 homemade PVs registered across the Chinese mainland, representing a tiny drop of 1.16% year-over-year.

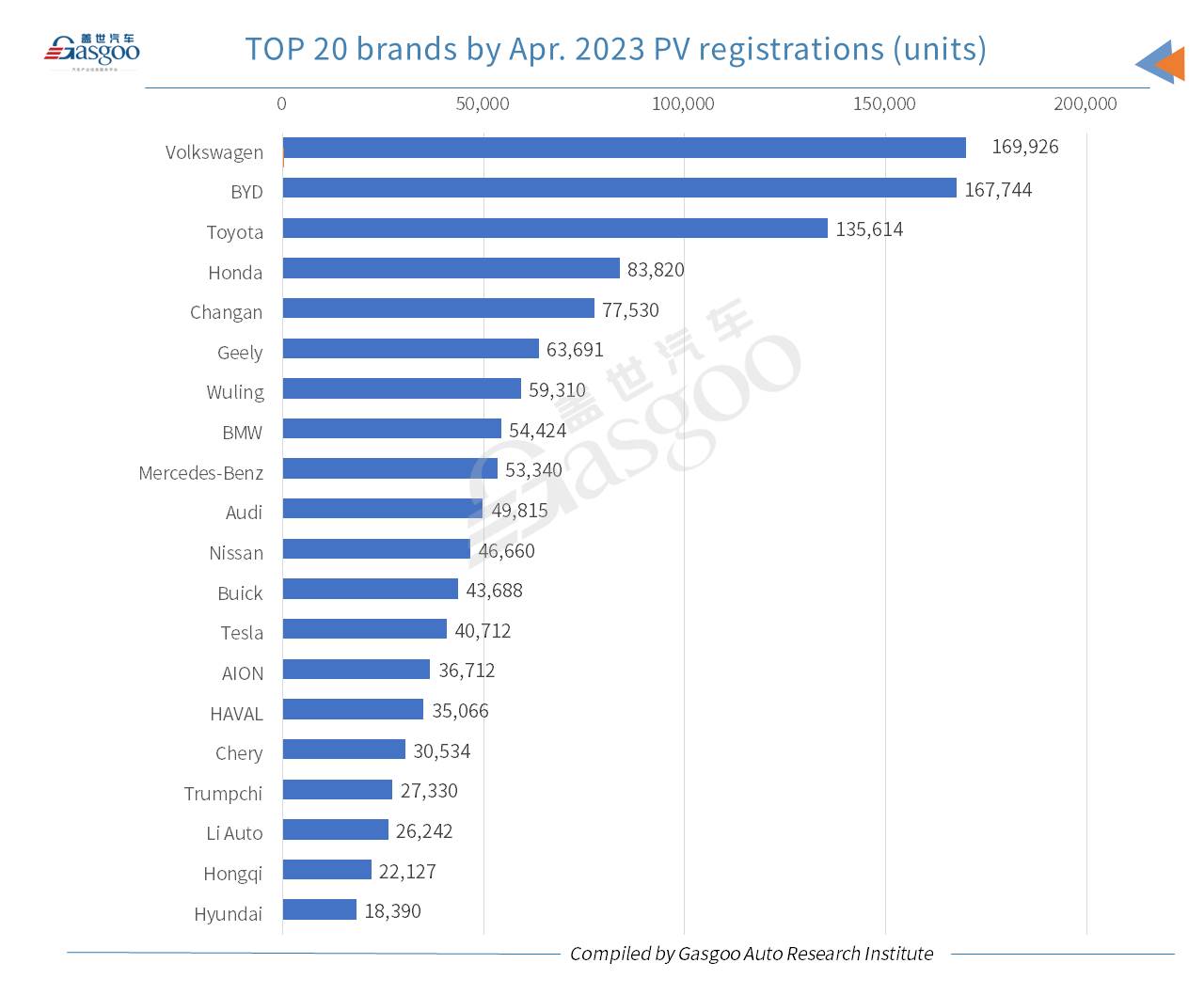

In Apr. 2023, three brands saw their monthly PV registrations in China exceed 100,000 units, namely, Volkswagen, BYD, and Toyota. The two China’s indigenous brands—Changan and Geely, ranked 5th and 6th among all brands by Apr. PV registrations, following Honda, who got 83,820 vehicles registered.

The German trio BMW, Mercedes-Benz, and Audi ranked 8th, 9th, and 10th, respectively, by Apr. China-made PV registrations. In the same period, Tesla had 40,712 Shanghai-made vehicles registered in China. The 14th to 19th places were all occupied by Chinese indigenous brands, namely, AION, HAVAL, Chery, Trumpchi, Li Auto, and Hongqi.

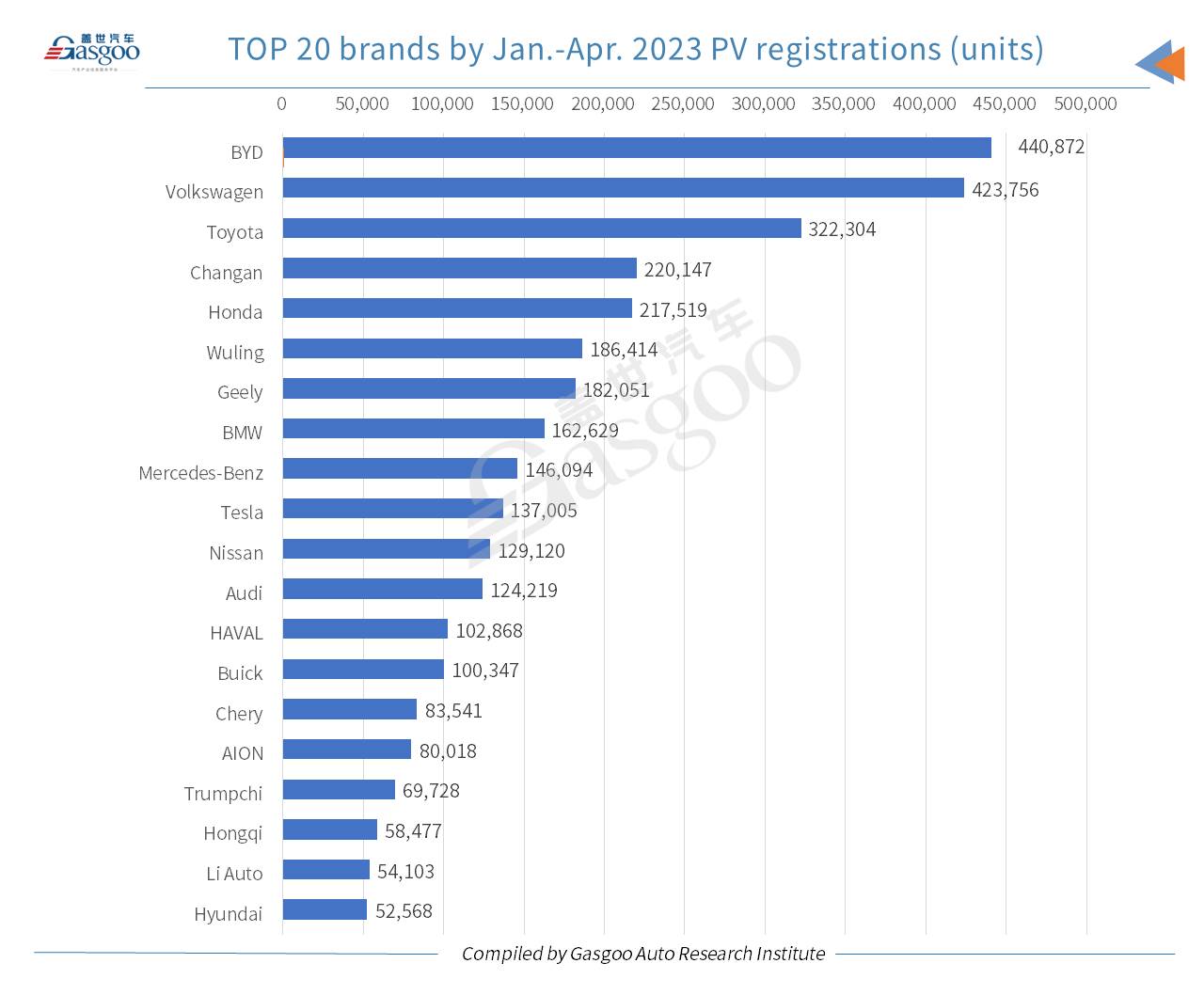

As for the Jan.-Apr. registrations, BYD outshone other brands in China, outselling the runner-up Volkswagen by 17,116 vehicles. The three major Japanese brands—Toyota, Honda, and Nissan—stood at the 3rd, 5th, and 11th places, respectively.

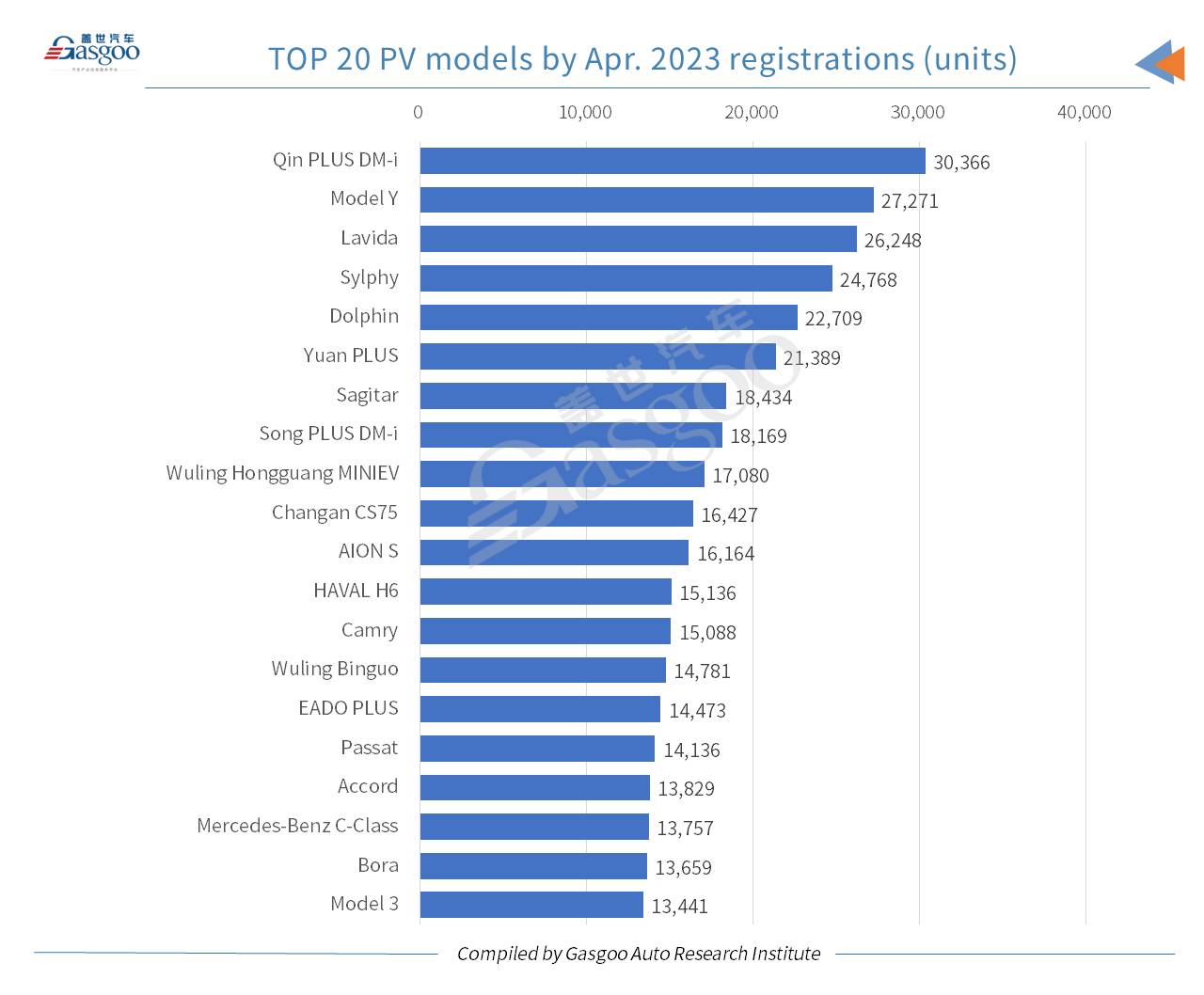

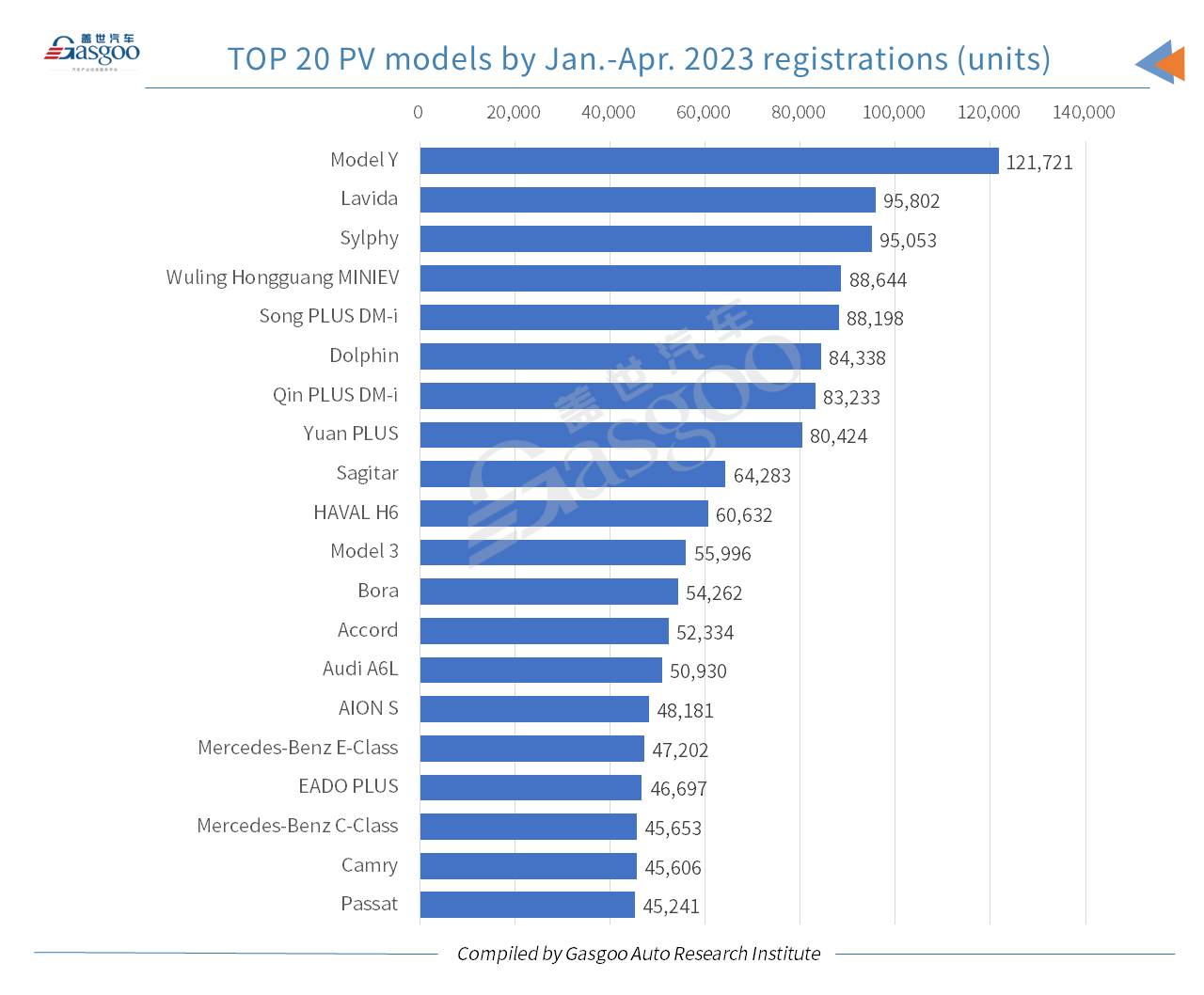

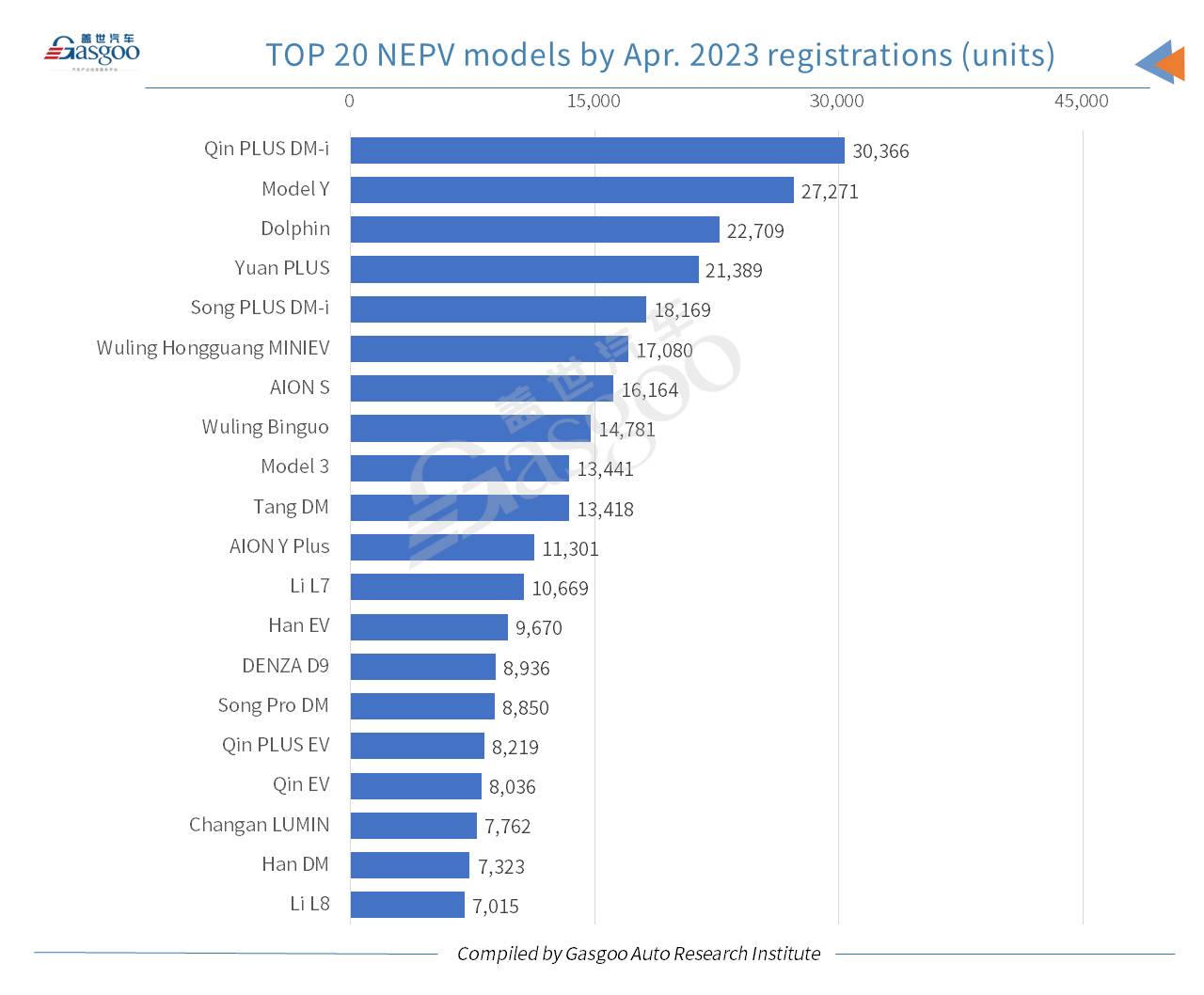

Among all China-made PV models, the Qin PLUS DM-i ranked highest by Apr. registrations. Tesla’s Model Y dropped one spot from a month earlier to the 2nd place in Apr., and it was also honored the best-selling SUV model. Notably, on the top 10 PV models list by Apr. registrations, BYD’s Dolphin, Yuan PLUS, and Song PLUS DM-i all took a place, demonstrating their popularity in respective segments.

In the rankings of the top 20 homemade PV models by Apr. registrations, there were 9 new energy vehicle (NEV) models, 7 of which were battery electric vehicle (BEV) models.

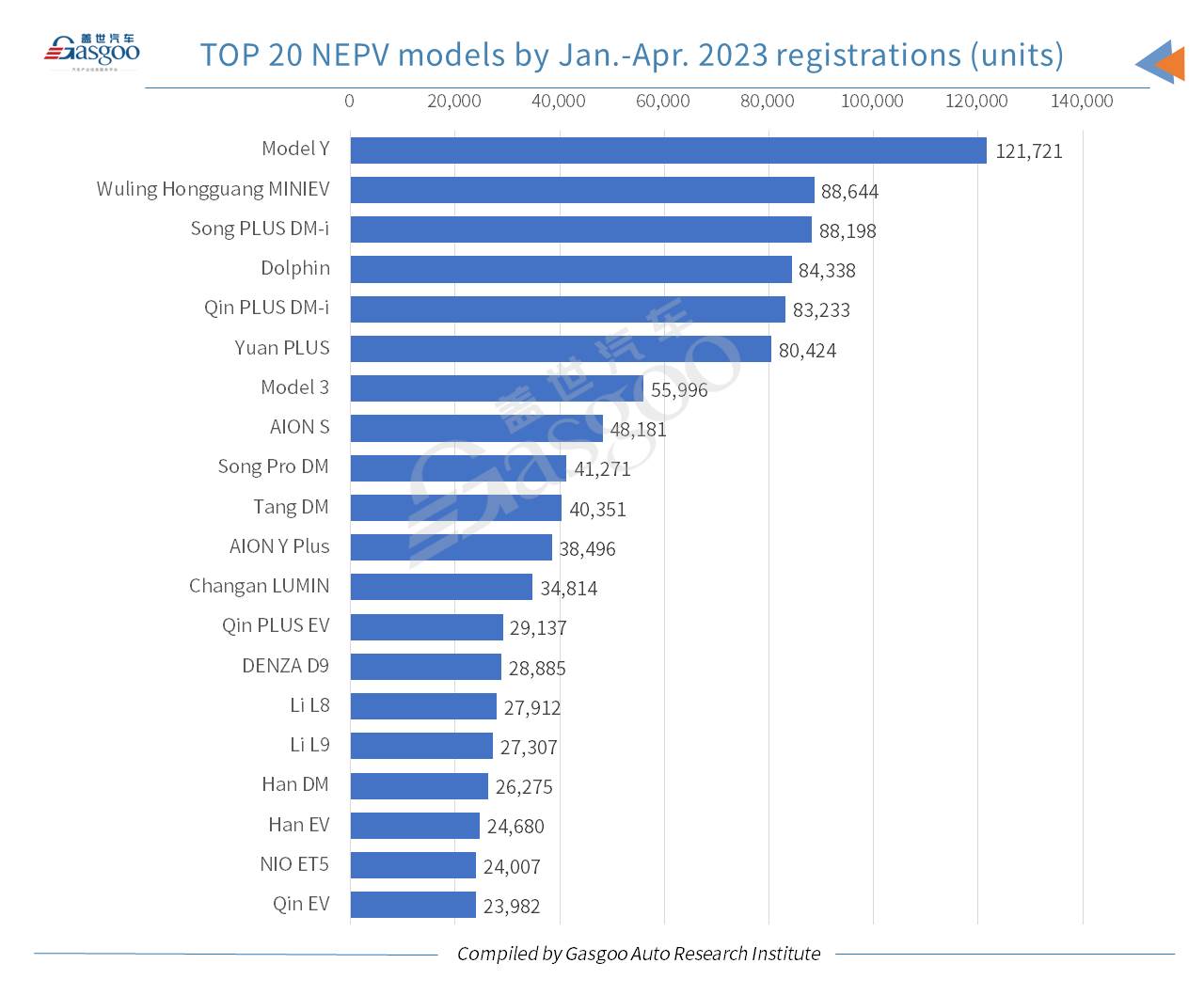

As for the year-to-date performance, the Model Y was crowned the highest-ranking PV model in China, and it was also the only model that got over 1000,000 vehicles registered through the first four months.

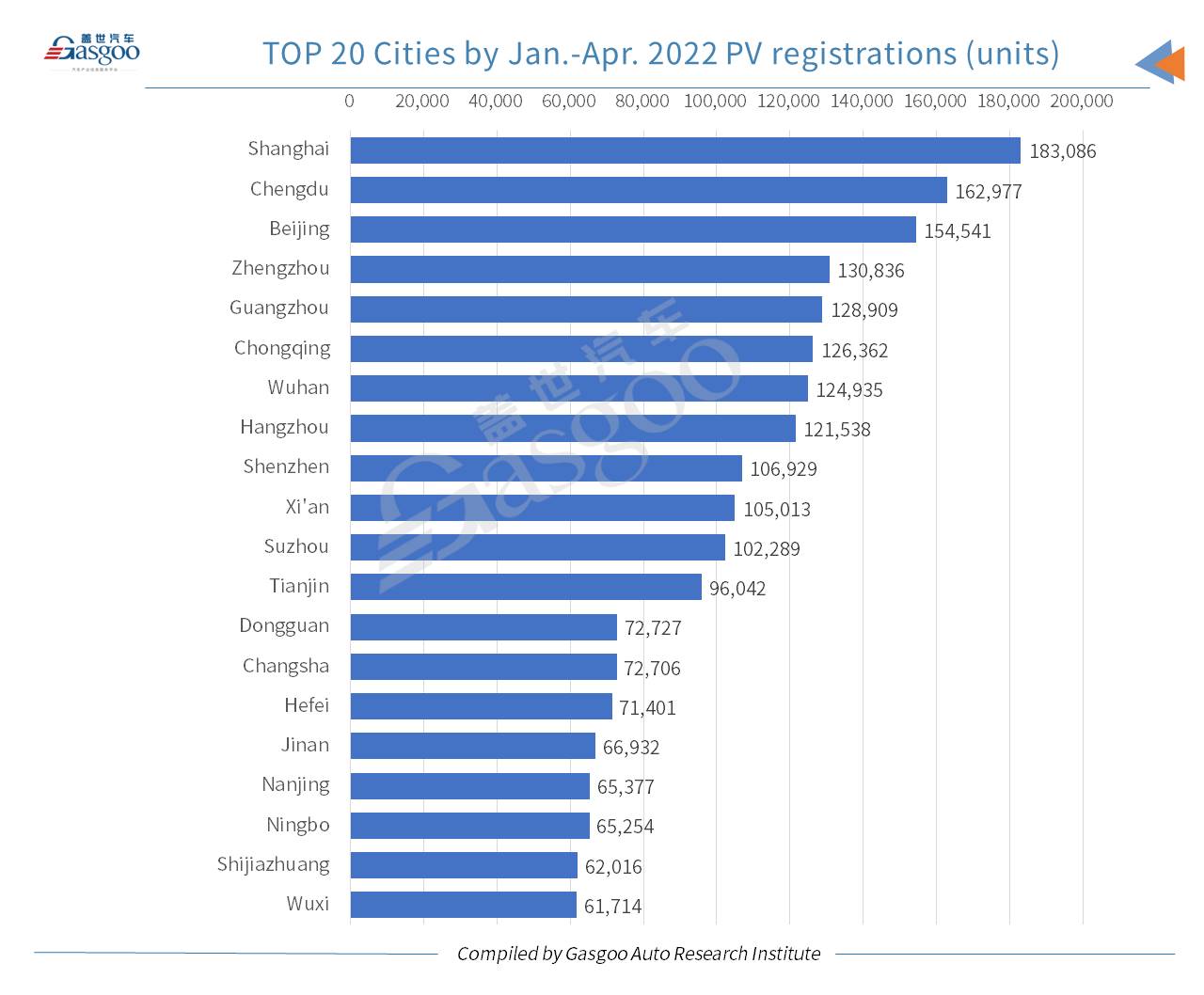

Among cities on the Chinese mainland, Shanghai and Beijing took the two first seats by Apr. registrations, and both of them had over 50,000 domestically-built PVs registered in the month. Chengdu recorded a monthly registration volume of 48,053 units, becoming the second runner-up among all cities.

For the Jan.-Apr. period, a total of eleven cities had over 100,000 locally-made PVs registered each, of which the first three ones’ volumes all surpassed 150,000 units.

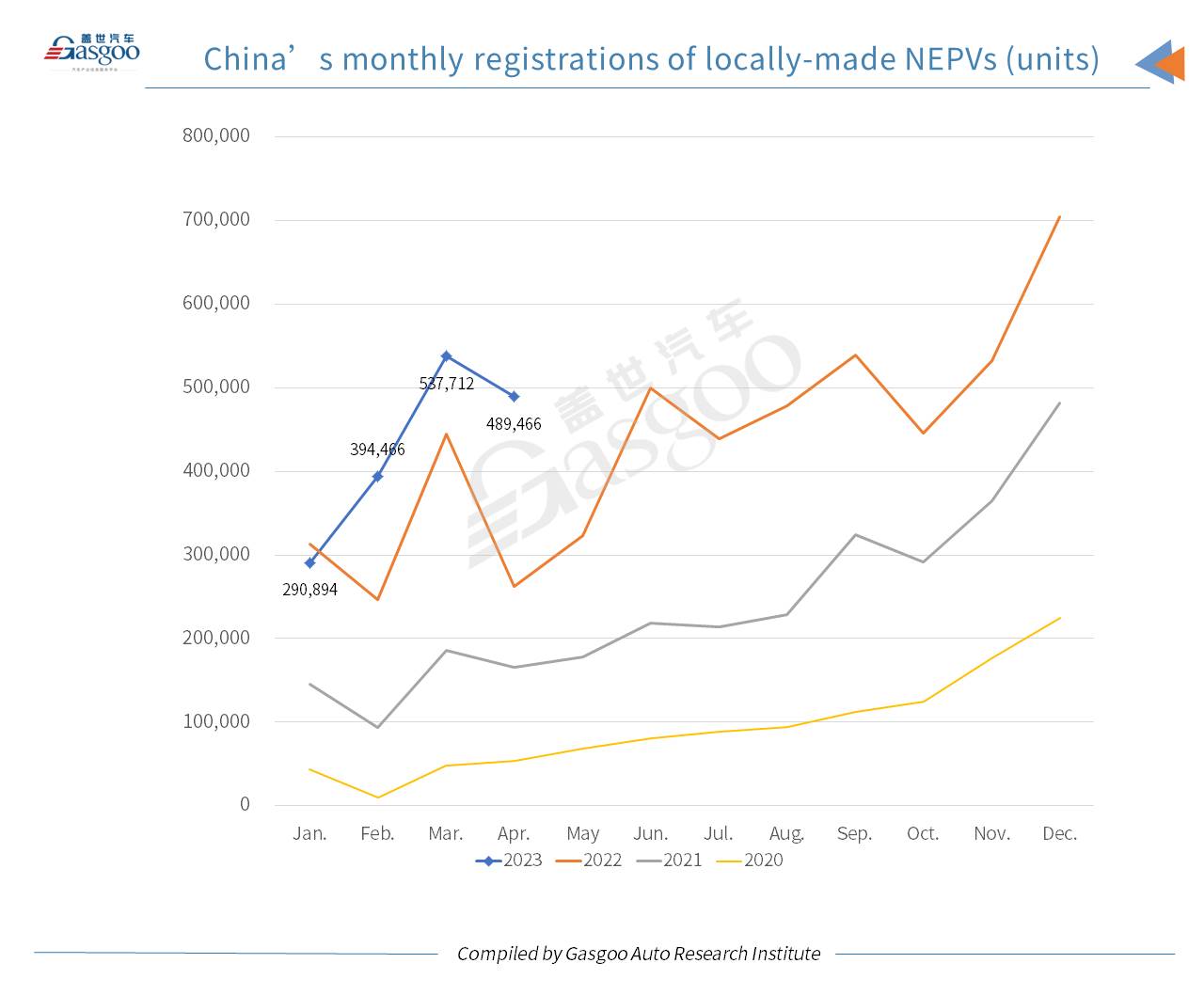

In Apr. 2023, China's monthly locally-made new energy passenger vehicle (NEPV) registrations came in at 489,466 units, soaring 86.74% year on year, but sliding 8.97% month on month.

For the first four months of this year, the cumulative NEPV registrations in China jumped 35.24% over the prior-year period to 1,712,538 units.

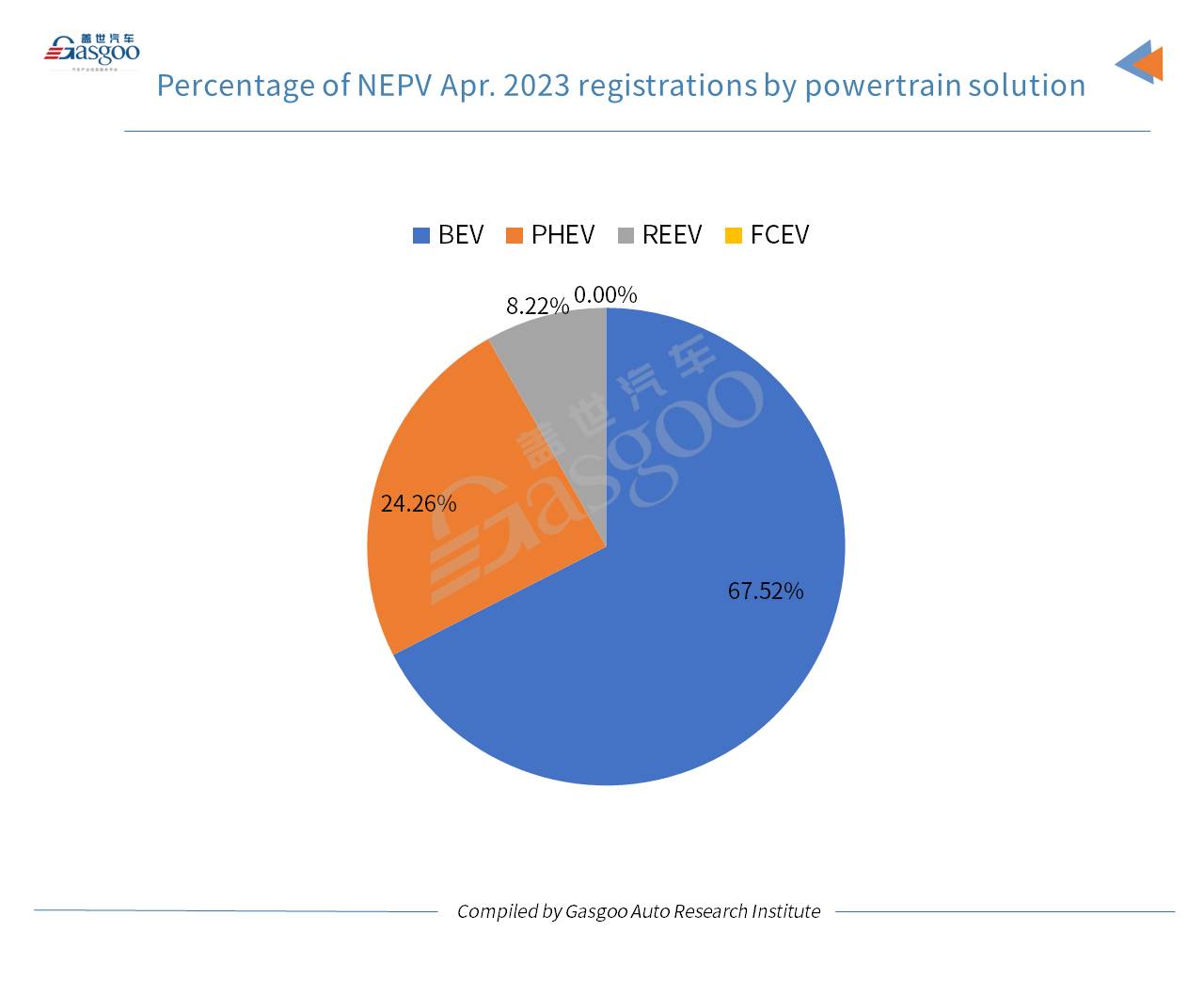

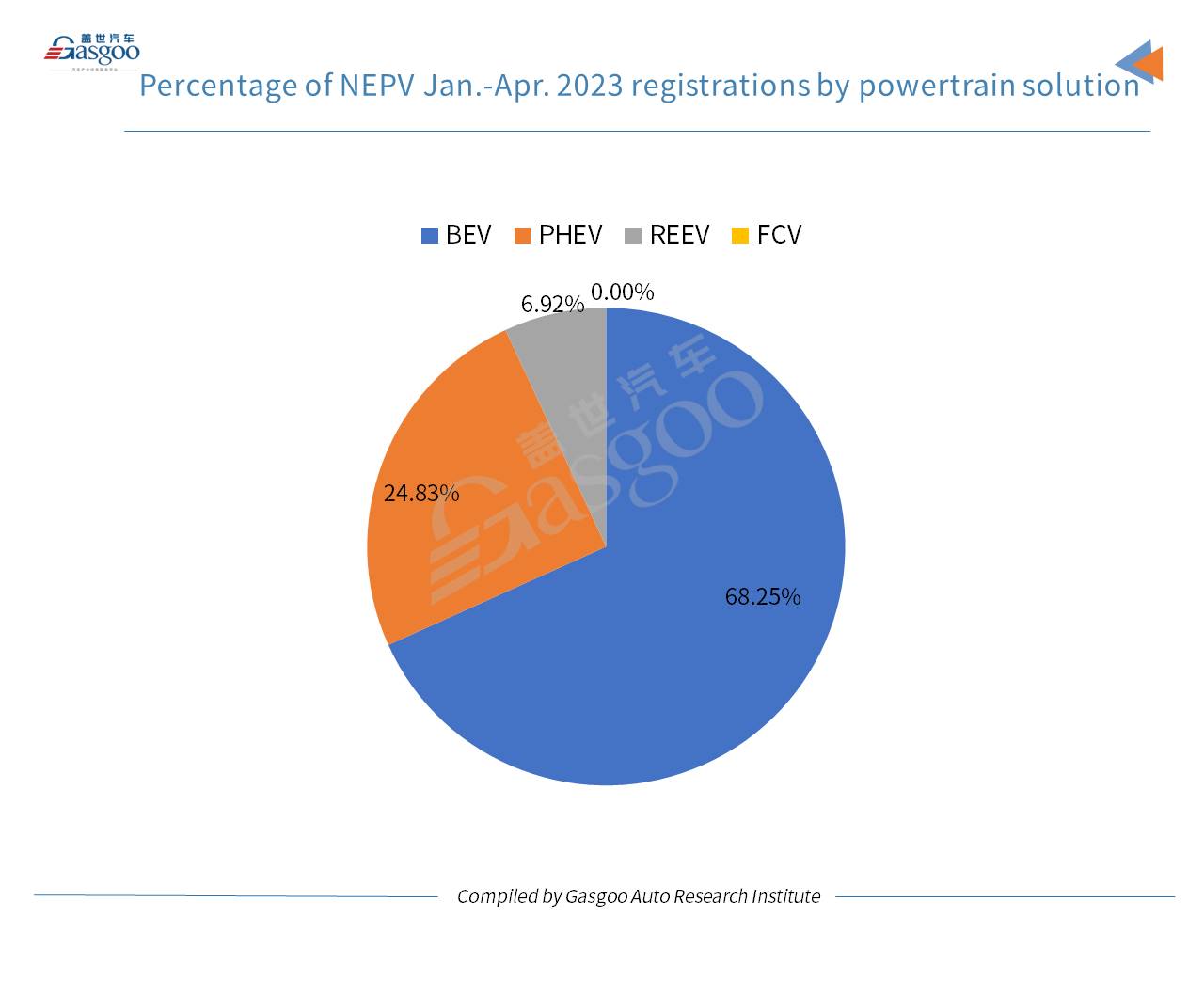

By specific powertrain solutions, the battery-electric vehicle (BEV) sector logged a registration volume of 330,466 units in Apr., accounting for 67.52% of the country's total NEPV registrations. The plug-in hybrid electric vehicle (PHEV) registrations reached 158,985 units, which included 40,220 range-extended electric vehicles (REEVs).

There were 15 fuel cell electric vehicles (FCEVs) registered on the Chinese mainland in Apr. Nevertheless, its market share was hereby omitted due to its tiny quantity.

Of the NEPVs registered in the first four months of this year, 68.25% were contributed by BEVs.

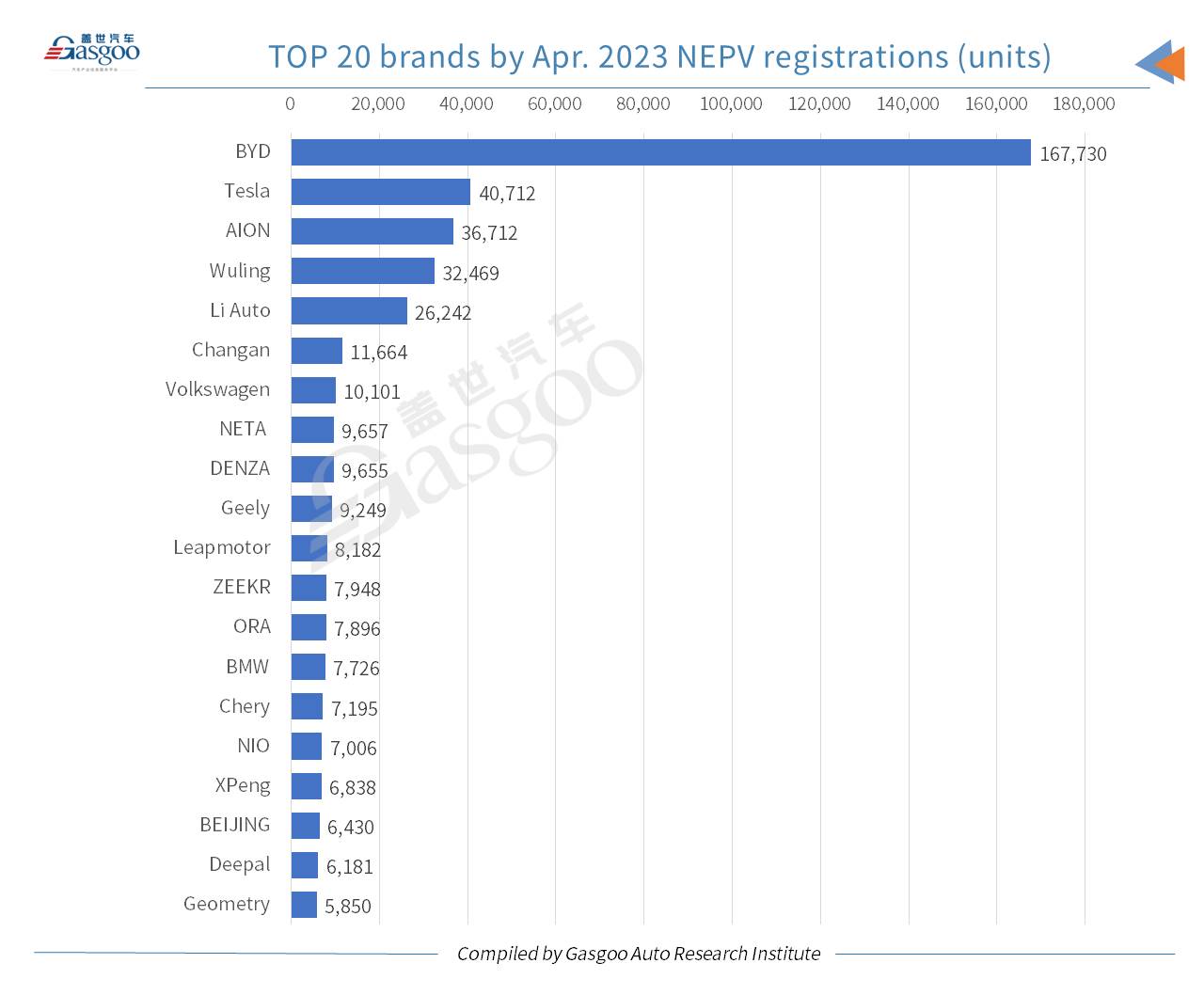

With respect to the NEPV registrations in Apr., BYD still took a remarkable lead over other brands. It had 167,730 NEPVs registered in the month, which were even more than the sum of the No.2-No.8 occupants. The U.S. EV brand Tesla was credited the runner-up, while AION and Wuling ranked 3rd and 4th, respectively.

Li Auto was the highest-ranking Chinese NEV startup by Apr. registrations. Besides, NETA was another startup-owned brand to crack the top 10 brands list by Apr. NEPV registrations.

DENZA, a premium auto brand majority-owned by BYD, ranked ninth among all brands with a NEPV registration volume of 9,655 units.

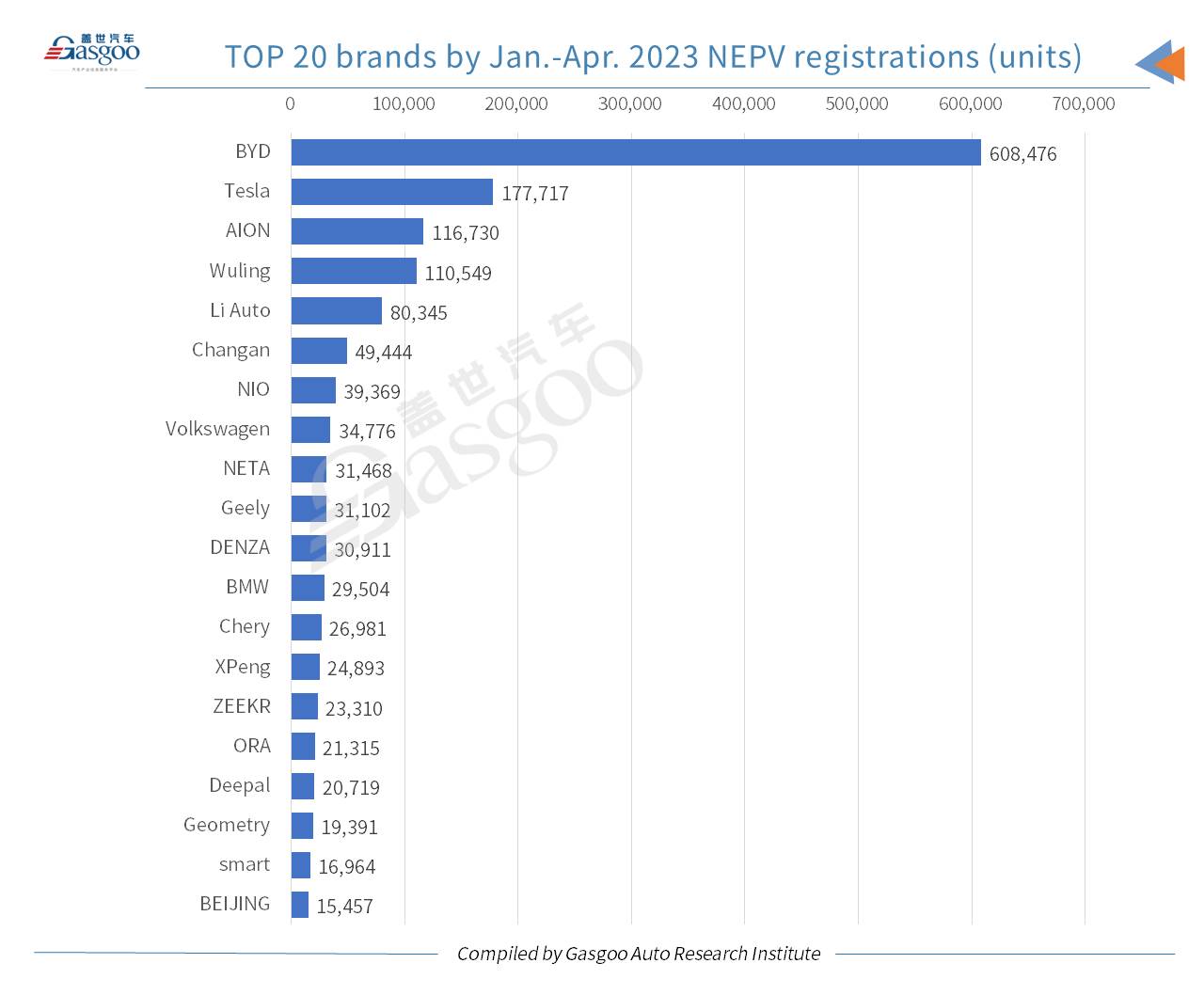

In terms of the year-to-date NEPV registrations, the top four brands—BYD, Tesla, AION, and Wuling—all witnessed their cumulative registration volume surpass 100,000 units.

With regard to Apr. registrations, the Qin PLUS DM-i topped other homemade NEPV models. On the top 20 NEPV models list, there were 10 under BYD brand, 5 of which entered the top 10 rankings. The DENZA D9, which ranked 17th, was from a BYD-backed brand as well.

Notably, the Wuling Binguo, a small-sized all-electric city car hitting the market at the end of March, recorded a registration volume of 14,781 units in Apr., which were even more than that of the Model 3.

Judging from the Jan.-Apr. performance, there were six NEPV models in total whose respective cumulative registrations all exceeded 80,000 units.

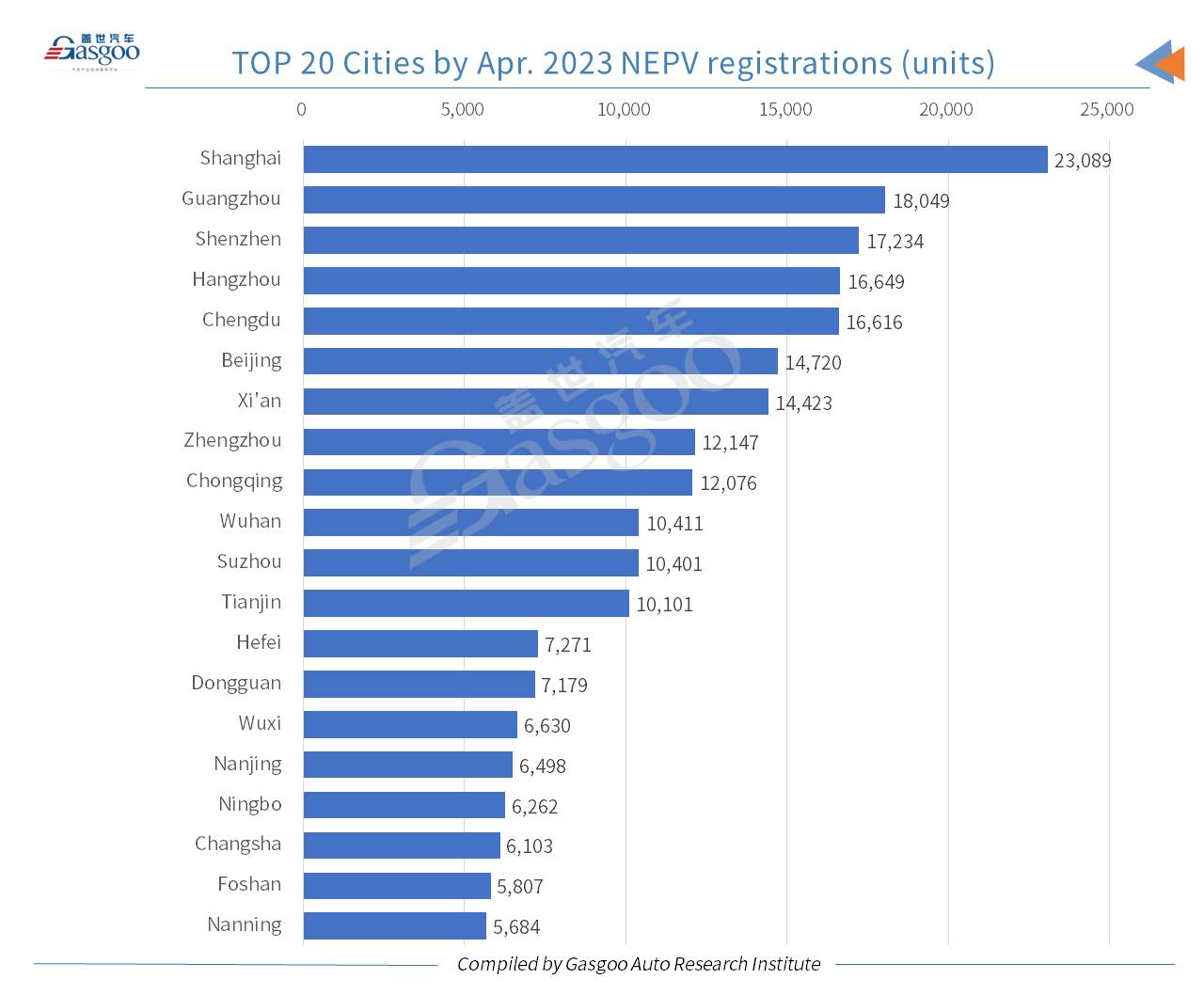

In Apr. 2023, Shanghai outdid other cities with 23,089 homemade NEPVs registered, which accounted for 42.41% of the city's overall PV registrations. It was closely followed by Guangzhou and Shenzhen.

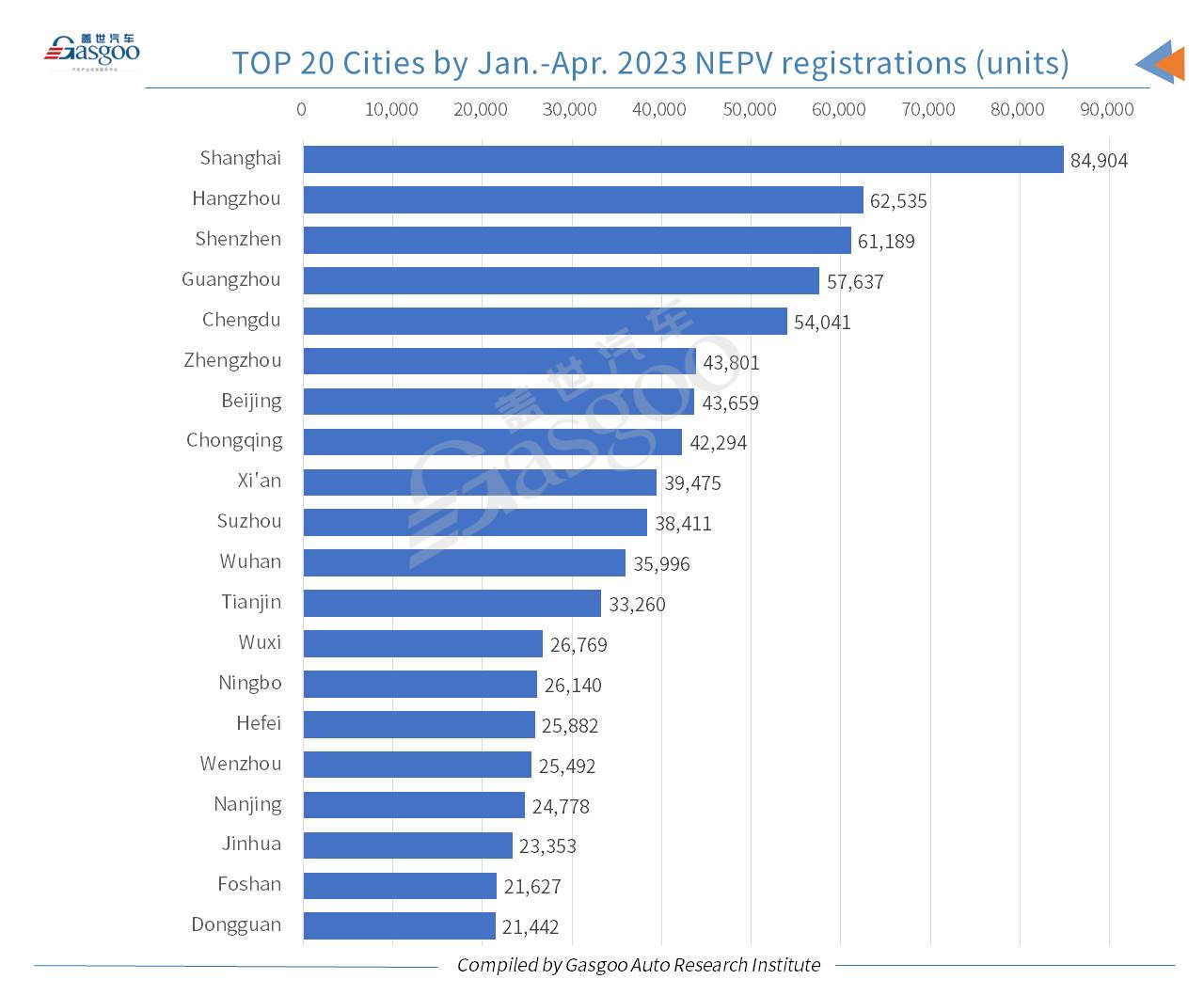

During this year’s first four months, there were 12 cities on the Chinese mainland with over 30,000 domestically built NEPVs registered each.