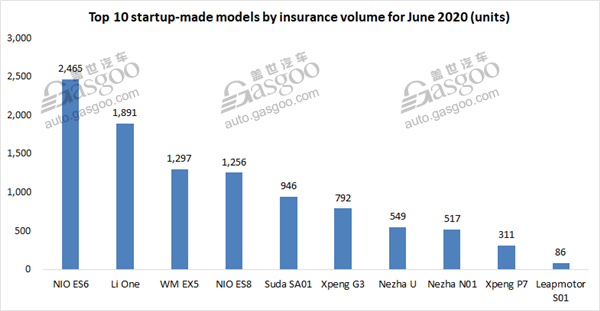

Shanghai (Gasgoo)- The gap among Chinese EV startups is getting increasingly wider. According to the data offered by the China Insurance Regulatory Commission (CIRC), the so-called first-tier startups—NIO, Li Auto, WM Motor, Xpeng Motors and HOZON Auto—accounted for nearly 90% of the June insurance registrations of the Chinese startup-made NEVs and took eight places of the top 10 models by insurance volume.

Except Leading Ideal One, the other four automakers all have two mass-produced models on sale. The NIO ES6 was still honored the best-selling startup-made model, outnumbering the Leading Ideal One by 574 units. The registrations of the NIO ES8 also exceeded 1,000 units in June.

Notably, NIO, Leading Ideal, Xpeng Motors and HOZON Auto all announced remarkable financing progress amid the first half of 2020. By contrast, WM Motor seems to be trailed in acquiring capital supports.

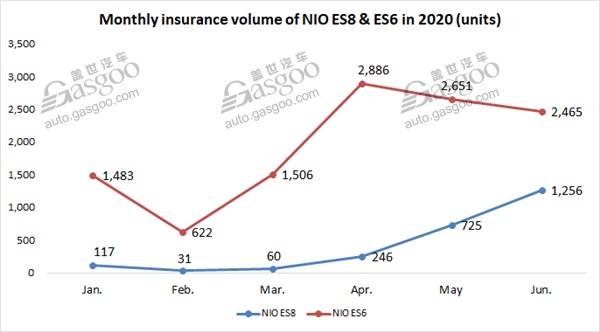

NIO records fourth-month-in-a-row MoM growth

NIO's insurance registrations totaled 3,721 units in June, recording month-over-month increase for the fourth month in a row.

The vehicles registered last month include 2,465 ES6s and 1,256 ES8s. The volume of the ES6 has declined month by month for two straight months, while the number of the ES8 surged to 1,256 units from 246 units in April.

Aside from the consecutive delivery growth, as of July 2, NIO has opened 127 stores nationwide, including 22 NIO Houses and 105 NIO Spaces, with a sales network covering 83 cities countrywide.

The high profile EV startup worked much more smoothly this year in gaining capital support than 2019. NIO China signed a strategic cooperation agreement with six Chinese banks on July 10, pursuant to which the banks will grant NIO China a credit line worth 10.4 billion yuan ($1,482,051,480).

(NIO ES6, photo source: NIO's WeChat)

As of the signing time, NIO has raised over 10 billion yuan ($1,425,049,500) of funds so far this year by selling convertible notes, obtaining strategic investments for NIO China and offering American depositary shares. The newly-approved credit line further indicates that NIO has been solved its potential cash flow issue and regained the market's confidence.

In terms of the roll-out of new products, NIO also moves ahead of its rivals. At the Chengdu Motor Show 2020, NIO put its third mass-produced model, the NIO EC6, onto the market. Deemed as the coupe version of the ES6, the EC6 is expected to take on such vehicles as the Mercedes-Benz GLC Coupe and Tesla's Model Y.

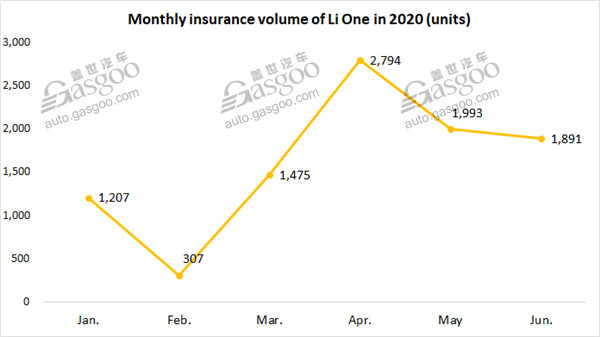

Li Auto ranked No.2 with only one production model

The insurance registrations of the Li One PHEVs reached 1,891 units in June, 574 units fewer than that of the NIO ES6.

Li Auto saw its registrations hit a record high of 2,794 units in April, rising precipitously from only 307 units in Feb. The startup said the 10,000th Li One SUV was handed over on June 16 to a consumer at the startup's Changshu plant, only six and a half months after the delivery kicked off.

The automaker partly owes the outstanding deliveries to its frequent product upgrading and improvements based on a proactive collection of users’ feedback. Since starting the delivery in last December, Leading Ideal has so far completed six over-the-air (OTA) software upgrades and is about to launch a new round in the third quarter, which is set to introduce new applications like QQ Music, WeRead and Tencent News.

(Li One, photo source: Li Auto)

To maintain the upward momentum and better serve users, Li Auto will take stronger steps to sell cars and speed up its service network expansion. According to an official press release, it plans to spread its retailing centers over 30 cities in this year’s third quarter, including Hefei, Kunming, Changzhou, Dongguan, Foshan, Nanchang, Shenyang, Dalian, Nanning, Haikou, Fuzhou, Guiyang and Lanzhou. What’s more, its after-sale service outlets are expected to land up to 100 cities by the end of 2020.

Li Auto is also one of the few startups that are successfully financed this year. Local media outlets revealed in late June that the PHEV manufacturer was going to obtain $550 million from its Series D round financing which was led by Chinese on-demand food delivery firm Meituan.

Furthermore, the five-year-old automaker expects to sell 95 million American depositary shares (ADDS) in its initial public offering at an indicative range of $8 to $10 per share, according to its updated prospectus filed with the U.S. Securities and Exchange Commission on July 24.

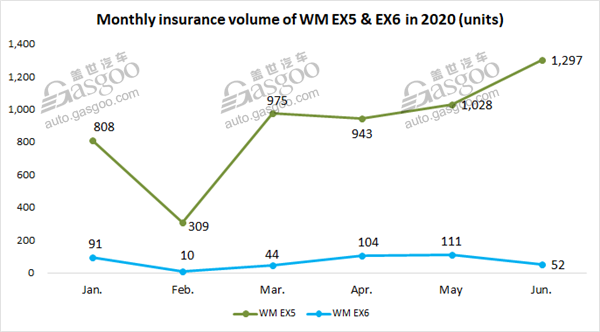

WM Motor posts stable sale growth, while falls behind in financing progress

The CIRC's data show that 1,349 consumers in China bought insurance for WM Motor's vehicles, consecutively rising month by month from 319 units in the virus-hit February.

The vehicles registered last month include 1,297 EX5s (+26.17% MoM) and 52 EX6s (-53.15% MoM).

With 5,772 vehicles registered in total, WM Motor held the second runner-up place among Chinese EV startups by the Jan.-Jun. insurance volume.

The company said it delivered the 30,000th EX5 on July 6. In reaching this milestone, WM Motor became the first Chinese BEV startup that surpassed the 30,000-units sales of a single vehicle model.

(WM EX5 Plus, photo source: WM Motor)

The share of younger drivers among WM Motor's customer base has continued to grow. The startup revealed that the Jan.-Jun. number of users born after 1995 surged 43.4% compared to the year-ago period. Additionally, the drivers who are parents of young children now accounted for 69% of the company's customer base.

However, WM Motor might lag behind the other four startups in raising funds. Freeman Shen, WM Motor's Founder and CEO, noted that the company is moving ahead with its fundraising process, while doesn’t work with all its might.

Bloomberg reported last week that WM Motor Technology Co. is weighing an initial public offering in Shanghai as rival electric vehicle manufacturers battle for a domestic market increasingly dominated by Tesla Inc.

Xpeng P7 needs time to prove strength as China's Model 3 rival

Xpeng Motors saw its insurance registrations of the Xpeng G3 edge down 4.46% over a month earlier to 792 units in June, making the first-half volume total 5,186 units.

The Guangzhou-based startup put its second mass-produced model, the Xpeng P7, onto the market on April 27, while the scale delivery kicked off two months later. The new model is ambitious to compete head-on the Tesla Model 3. By the end of June, there were 477 consumers in total buying insurances for the P7 electric coupes.

(Xpeng P7, photo source: Xpeng Motors)

Xpeng Motors has secured the production license for its self-built fully-owned manufacturing plant in Zhaoqing, Guangdong province, the EV manufacturer announced on May 19.

Moreover, the company announced on July 20 the signing of its Series C+ financing of around $500 million with a group of investors including Aspex, Coatue, Hillhouse and Sequoia Capital China. As of today, the company has completed 10 financing rounds with around 20.3 billion yuan ($2.9 billion) raised in total, according to the public information.

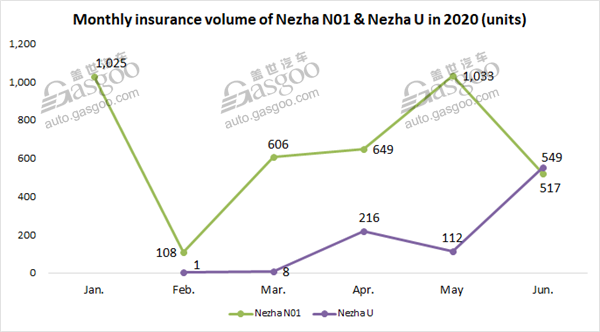

Low-key HOZON Auto bets on rising demands for affordable EVs

HOZON Auto, the startup operating a brand named after the teen hero of Chinese mythology “Nezha”, witnessed its first-half insurance registrations reach 4,824 units, 81.63% of which were the Nezha N01. However, in June, the latecomer Nezha U outsold the N01.

Unlike NIO who targets the premium vehicle market from the beginning, HOZON Auto decides to take entry-level EV segment as gateway. For instance, guiding prices of the Nezha N01 start at only 66,800 yuan ($9,540).

HOZON Auto claimed last week it has initiated its Series C funding round with the aim of raising 3 billion yuan ($428,491,830), and plans to go public on China's Nasdaq-style sci-tech innovation board (the STAR Market) in 2021.

(Nezha U, photo source: Nezha's WeChat account)

As of April 2020, the startup has completed its angel, Series A and Series B financing rounds with over 7 billion yuan ($999,814,270) garnered in total.

HOZON Auto has to-day put two mass-produced models—the Nezha N01 and the Nezha U, onto the market. The delivery of the latter just kicked off last month.

Dubbed “Nezha V”, the third production model will hit the market in 2020's third quarter, said the company. Positioned as a small-sized all-electric SUV, the forthcoming new model will be powered by the batteries offered by CATL, which enables a NEDC-rated range of 401km.