Bright spots of Chinese public automakers’ first half 2020 financial results

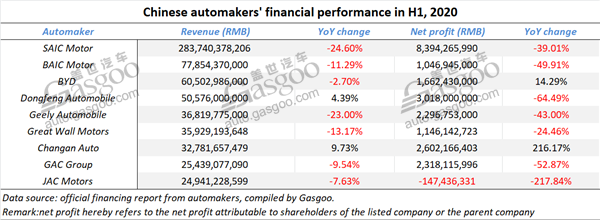

Shanghai (Gasgoo)- China's automobile industry was mired in a deep downturn in the first half of 2020, pressured by the coronavirus-induced weak demands. Under the stagnant market climate, many automakers faced evident decrease in their first-half revenue and net profit, but some bright spots are still worth mentioning.

Among the Chinese public automakers hereby listed by Gasgoo, SAIC Motor was still the most profitable one, even though it posted two-digit decrease in both revenue and net profit. BYD saw its first-half net profit jump 14.29% year on year. Thanks to the strong impetus from CV business, Dongfeng Motor recorded a 4.39% increase in revenue. Changan Auto was the one only that chalked up growth in both revenue and net profit.

Let's review what other highlights for those companies' semi-annual financial performance.

SAIC Motor boasts robust growth in second-quarter net profit

For the first half of 2020, SAIC Motor's gross revenue fall 24.6% over a year ago to 283.74 billion yuan ($41.453 billion), and its net profit attributable to shareholders tumbled 39.01% to 8.394 billion yuan ($1.226 billion).

Based on both the first-half and first-quarter financial reports, we can learn that the China's largest automaker gained roughly 177.794 billion yuan ($25.975 billion) and 7.273 billion yuan ($1.063 billion) in the second-quarter gross revenue and net profit, achieving robust surge of 67.81% and 548.92% over a quarter ago respectively.

(Roewe RX5 PLUS, photo source: Roewe)

For the Jan.-Jun. period, the net cash flows from operating activities stood at 29.358 billion yuan ($4.289 billion), a marvelous hike from 129.092 million yuan ($18.86 million) recorded in the year-ago period. SAIC Motor said the cash flow provided great supports for the company’s handling over such uncertainties as the continuous market adjustments and the COVID-19 pandemic.

SAIC Motor's R&D expenses for the first six months amounted to 5.843 billion yuan ($853.591 million), accounting for 2.13% of the semi-annual revenue and sliding 2.6% over the prior-year period.

Disturbed by the COVID-19 pandemic, SAIC Motor is piling on pressure in the sale and other operations. Its first-half complete vehicle sales volume slumped 30.2% from a year earlier to 2.049 million units.

BAIC Motor's first-half net profit halved over a year ago

BAIC Motor Corporation Limited (“BAIC Motor”) said its first-half revenue reached roughly 77.854 billion yuan ($11.374 billion), sliding 11.29% from the previous year.

During the same period, the company saw its profit attributable to shareholders was nearly halved over a year ago to 1.047 billion yuan ($152.961 million). Besides, the profit belonging to the non-controlling interests amounted to 4.764 billion yuan ($695.993 million).

The company said the revenue and profit downturn was mainly due to the impact of the COVID-19, which resulted in a significant decrease in sales volume of whole vehicles, especially in the first quarter.

(BEIJING X7, photo source: BAIC Motor)

For the first six months, the sales volume of Beijing Brand reached 35,000 units. The brand has fully resumed work and production despite the outbreak of COVID-19 and launched two key vehicle models (i.e. Beijing-X7 and Beijing-X7PHEV) as planned, said BAIC Motor.

In the first half of 2020, Beijing Benz achieved sales of 27,000 units, representing a year-on-year decrease of 4.2%. In terms of specific products, the brand saw the average monthly sales volumes of three major models, namely, E-Class sedan, C-Class sedan and GLC SUV, all exceed 10,000 units.

Beijing Hyundai reported the retail sales volume of 235,000 units for the Jan.-Jun. period, which largely mitigates the operation pressure of dealers and lays a good foundation for greater achievement in subsequent. Besides, the vehicle sales volume of Fujian Benz climbed 6.9% to 14,000 units.

BYD logs 14.29% year-on-year jump in first-half net profit

BYD Company Limited (BYD) announced that its 2020's first-half revenue slid 2.7% from a year ago to 60.503 billion yuan ($8.839 billion), while the net profit attributable to shareholders jumped 14.29% year on year to roughly 1.662 billion yuan ($242.871 million).

Compared to the first quarter (Q1), BYD's second-quarter (Q2) revenue and net profit skyrocketed 107.46% and 1275.93% respectively to 40.824 billion yuan ($5.964 billion) and 1.55 billion yuan ($226.446 million), according to both Q1 and H1 financial results.

(BYD Han EV, photo source: BYD)

For the first half of 2020, BYD's automobile sales totaled 158,628 units, plunging 30.45% from the previous year. Nevertheless, the company's auto arm gained gradual sales rebound after March as the COVID-19 pandemic was abating in China. According to BYD's sales report, its Q2 sales reached 97,355 units, 59% more than that of the quarter ago period.

The contracted proceed from the automobile business should be blamed for BYD's H1 revenue decrease. The company's auto business earned around 32.072 billion yuan ($4.686 billion) worth of revenue from January to June, falling 5.62% over the year-ago period. Nonetheless, the downturn in automobile arm was somewhat offset by the 0.24% and 7.59% increase in the revenues of the handset components and assembly arm and the rechargeable battery and photovoltaic business.

Dongfeng Motor's Jan.-Jun. revenue climbs 4.39% year on year

Dongfeng Motor Group Company Limited (Dongfeng Motor) said its revenue for the first half of 2020 reached 50.576 billion yuan ($7.382 billion), up by 4.39% from a year ago. Nevertheless, the first-half net profit attributable to the company’s equity holders tumbled 64.49% year on year to 3.018 billion yuan ($440.5 million).

For the Jan.-Jun. period, the basic and diluted earnings per share stood at 35.03 cents, dropping from 98.64 cents for the year-ago period. The Board of Directors declared an interim dividend of RMB0.10 per share, amounting to 862 million yuan ($125.933 million). The dividend will be distributed on October 28, 2020.

(Civic, photo source: Dongfeng Honda)

According to Dongfeng Motor's semi-annual results, the sales revenue of passenger vehicles (PVs) for the reporting period decreased by 43.9% from a year earlier to roughly 7.606 billion yuan ($1.111 billion). The decline in the revenue was mainly from the PV business of Dongfeng Peugeot Citroen Automobile Sales Co.,Ltd. and Dongfeng Liuzhou Motor Co.,Ltd..

Besides, the group's first-half commercial vehicle (CV) sales revenue jumped 21.5% year over year to 39.314 billion yuan ($5.744 billion). The growth primarily stemmed from the sales growth of Dongfeng Commercial Vehicles Co.,Ltd. and the CV business of Dongfeng Liuzhou Motor Co.,Ltd.

Dongfeng Motor sold roughly 1,144,500 new vehicles in the first half of the year, representing a year-on-year decline of 16.7%, which was better than the industry by 0.2 percentage points. According to the statistics published by the China Association of Automobile Manufacturers (CAAM), Dongfeng Motor had a market share of around 11.2% in terms of sales volume of the domestically-produced PVs and CVs in the first half of 2020.

Geely Auto posts 43% year-on-year slump in first-half net profit

Geely Automobile Holdings Limited ("Geely Auto" or “the Company”) announced that it gained 36,819,775,000 yuan ($5.386 billion) in revenue for the first-half of 2020, posting a year-on-year decrease of 23% mainly due to the lower sales volume and the production disruption caused by the partial lockdown in most areas of China in early 2020.

During the same period, the profit attributable to the equity holders slumped 43% from a year ago to 2,296,753,000 yuan ($335.984 million).

The basic earnings per share for the first six months stood at 0.2473 yuan, versus 0.4439 yuan for the year-ago period. Diluted earnings per share (EPS) were down 44% to 0.247 yuan.

(Geometry C, photo source: Geometry)

Geely Auto and its subsidiaries (called “the Group” collectively) sold a total of 530,446 new vehicles (including the sales volume of Lynk & Co vehicles) in the first six months, representing a 19% year-on-year decline. Of those, 510,873 units (-17%) were sold in domestic market and 19,573 units (-49%) were exported to overseas markets.

Because the sales recovery has so far been slower than expected and near-term uncertainties remain in the global macro environment, the Group therefore decided to trim down its 2020 full-year sales target by around 6% from 1.41 million units to 1.32 million units.

Great Wall Motor's Jan.-Jun. net profit falls 24.46% over a year earlier

For the first half of 2020, Great Wall Motor Company Limited (GWM) saw its gross revenue dip 13.17% from a year ago to roughly 35.929 billion yuan ($5.256 billion), according to its semi-annual financial results.

During the first two quarters, its net profit attributable to shareholders dwindled 24.46% year on year to 1.146 billion yuan ($167.665 million). Excluding the impact of certain non-recurring gains and losses, like the subsidies received from the government, GWM's first-half net profit slumped 35.34% to 802.452 million yuan ($117.388 million). The company said the governmental subsidies included into the Jan.-Jun. profits and losses were worth 331.064 million yuan ($48.43 million).

(Haval F5, photo source: Haval)

The profit downturn mainly stemmed from the impact of the COVID-19 pandemic, the sales decrease and the rise in R&D investment, the automaker said.

For the first two quarters, GWM saw its sales dip 19.95% over a year ago to 395,097 units. The company also noted that its R&D expense for the same period leapt 32.97% over the previous year to 1.22 billion yuan ($178.478 million) as the company stepped up its investment in R&D businesses during the reporting period.

Changan Auto turns losses into profits during first half of 2020

Chongqing Changan Automobile Company Limited (Changan) procured roughly 32.782 billion yuan ($4.796 billion) in the operating revenue for the first half of 2020, a year-on-year increase of 9.73%, according to the company's semi-annual financial results.

For the same period, Changan's net profit attributable to shareholders amounted to 2.602 billion yuan ($380.662 million), recording an impressive surge from the year-ago loss of 2.24 billion yuan ($327.688 million). However, after deducting non-recurring profit and loss, the company still suffered a net loss of 2.617 billion yuan ($382.815 million), versus the loss of 2.912 billion yuan ($425.952 million) for the prior-year period.

(CS55, photo source: Changan Auto)

Changan said its profit for the first six months was greatly affected by non-recurring gains and losses. Notably, the government subsidies included in the profit and loss of the reporting period amounted to 215.978 million yuan ($31.595 million).

According to the financial preview Changan released in mid-July, three non-recurring items contributed to the net profit worth 5.275 billion yuan ($771.661 million) in total. To be specific, introducing strategic investors for Chongqing Changan New Energy Automobile Co., Ltd., Changan's wholly-owned subsidiary, while Changan waiving its pre-emptive right to subscribe for shares of Changan New Energy, brought 2.1 billion yuan ($307.202 million) worth of net profit.

Besides, the disposal of the shares Changan held in Changan PSA Automobiles Co., Ltd. (CAPSA) and the increase in the price of shares in CATL controlled by Changan respectively produced net profits of 1.4 billion yuan ($204.801 million) and 1.775 billion yuan ($259.659 million).

GAC Group records 52.87% slump in first-half net profit

GAC Group announced that its operating revenue of the first half of 2020 shrank 9.54% from a year ago to 25.439 billion yuan ($3.721 billion) and the semi-annual net profit attributable to shareholders plunged 52.87% year on year to roughly 2.318 billion yuan ($339.109 million). Besides, the basic earnings per share stood at 0.23 yuan, versus 0.48 yuan for the year-ago period.

Given the company's profitability and the demands for future development, GAC Group's board of directors recommended payment of an interim dividend of 0.3 yuan per 10 shares (including tax) to all shareholders.

(Trumpchi GS4, photo source: GAC Motor)

According to GAC Group's sales reports, the automaker sold 824,579 units during the first two quarters, of which 518,482 units were sold in the second quarter, a robust increase of 69.38% compared to the first quarter. Besides, it acquired 10.47% share in China's PV market for the first half of the year, 0.62 percentage points higher than the prior-year level.

Two major Sino-Japanese joint ventures featured rising impetus during the second quarter. As of June, GAC Toyota had gained double-digit growth for the third month in a row, while GAC Honda also attained year-on-year sales growth in April and June.

JAC Motors' first-half revenue drop 7.63% YoY, but profit plunges 217.84%

Anhui Jianghuai Automobile Group Corp.,Ltd. (JAC Motors)'s first-half revenue shrank 7.63% from the previous year to 24.941 yuan ($3.64 billion). During the same period, the Hefei-based automaker suffered a net loss of 147.436 million yuan ($21.519 million), slumping from the net profit of 125.114 million yuan ($18.261 million) for the prior-year period.

Excluding the impact of certain non-recurring gains and losses, JAC Motor was hit by a net loss of 653.397 million yuan ($95.368 million) during the first half of the year, nosediving 1,125.13% from the year-ago profit of 63.738 million yuan ($9.303 million).

(JAC Refine S5, photo source: JAC Motors)

In the first half 2020, the governmental subsidies included into the current profits and losses were 480.562 million yuan ($70.142 million), which largely resulted in the gap between net loss and the non-recurring loss.

According to the company's semi-annual and first-quarter financial results, JAC Motors' second-quarter revenue jumped 27.93% year on year to 15.821 billion yuan ($2.309 billion). Despite the net loss it faced for the first half of the year, the net profit attributable to shareholders shot up 244.77% from a year earlier to 208.514 million yuan ($30.434 million) in the second quarter.

The company said its first-half vehicle sales dwindled 10.97% from a year earlier to 209,400 units. The CV unit outperformed the PV arm in terms of both sales volume and year-on-year change. To be specific, CV sales edged up 1.86% year on year to 142,587 units, including 102,494 light-duty trucks, 5,701 medium-duty trucks and 27,114 heavy-duty trucks, while PV sales tumbled 29.81% to only 66,792 units.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com