The global map of the power-battery industry is being quietly — and profoundly — redrawn. While the sector remains fixated on a numbers race in installed capacity, a more complex, multi-dimensional battle is already underway.

CATL, the power-battery maker that has led the world for eight straight years, is at a turning point: it must not only defend a slipping market share but also lay the technical foundation and global footprint for the next decade.

Since the start of 2025, CATL has signed decade-long strategic pacts with GAC, Great Wall Motor, JAC Group and BAIC Foton, spanning R&D, supply-chain assurance and market expansion. At its Dec. 28 supplier conference, the company announced it will deploy sodium-ion batteries at scale in 2026.

This is CATL's structural response to twin pressures — fierce competition at home and expansion abroad: not merely fighting over products and markets, but steering the industry's tempo and direction. Through action, CATL aims to redefine the landscape.

Winning back lost share

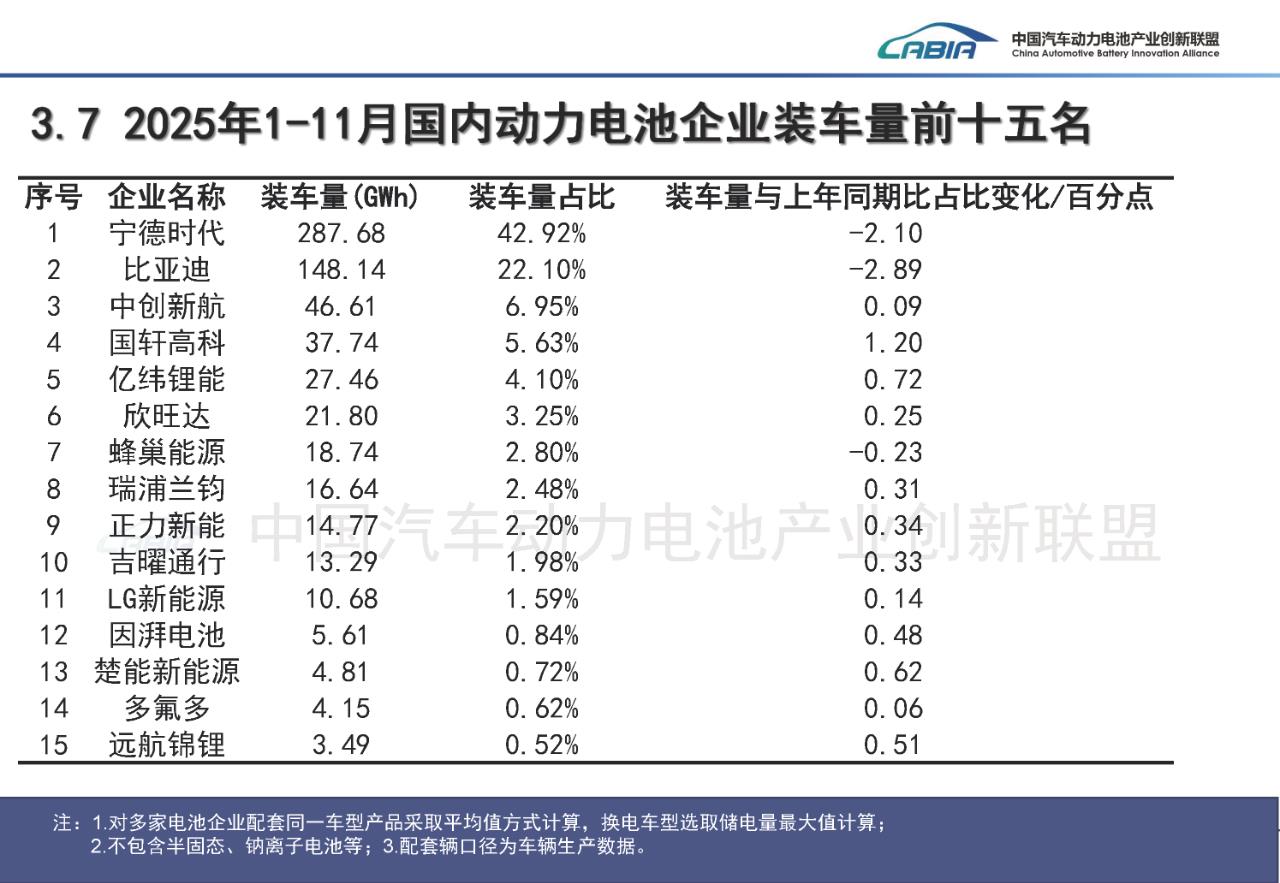

According to the China Automotive Power Battery Industry Innovation Alliance, CATL's domestic battery installations reached 287.68 GWh in January–November 2025, for a 42.97% share. In past years, its share at home at times topped 50%.

Market share shifts are never just a numbers game; they reflect a rebalancing of power across the value chain.

Second-tier battery makers are rising in unison. Alliance data show that in January–November, CALB posted 46.61 GWh of installations for a 6.95% share, ranking third; Gotion High-tech had 37.74 GWh and 5.63% in fourth; EVE Energy recorded 27.46 GWh and 4.10% in fifth.

Three deeper forces sit behind this structural change: automakers' anxiety over supply-chain security, technology diffusion driving more homogeneous competition, and continued capital-market support for second-tier players.

After the NEV industry's "chip-and-battery" crunch, OEMs broadly adopted de-risking strategies, cultivating second and third suppliers to spread risk. As battery technology has matured and standardized, the gap with CATL has narrowed — with local advantages emerging in certain niches.

Previously tight clients began "leaving" CATL: XPENG and NIO shifted to CALB; GAC AION changed its primary supplier; Li Auto has grown closer to Sunwoda. The hushed refrain — "long weary of the CATL king" — is turning into tangible diversification across the supply chain.

That "de-CATL" phase, however, flipped in 2025. On Dec. 17, CATL signed a 10-year deep strategic agreement with VOYAH, covering new technology adoption, product supply, brand co-building and global market coordination.

Nor was that a one-off — since 2025, CATL has established similar long-term relationships with mainstream automakers including GAC, Great Wall Motor, JAC Group and BAIC Foton.

What's the essence of a "10-year pact"? For CATL, it’s about locking in share where certainty is scarce.

NEV penetration keeps climbing, and policy signals are long-term. The "Energy-Efficient and New-Energy Vehicle Technology Roadmap 3.0," released this October, specifies that by 2035, ICE passenger cars will be fully hybridized; by 2040, NEV penetration among passenger vehicles is expected to top 85%.

At a China EV100 media briefing, chairman Zhang Yongwei projected domestic auto sales could exceed 28 million in 2026, with NEV sales next year likely to surpass 20 million. He expects China's NEV penetration to reach 60% in 2026.

Yet as battery capacity moves beyond shortage into intense competition, OEM–core supplier ties are shifting from one-way dependence and bargaining to pragmatic, deep co-dependence. For automakers, CATL's "10-year pact" offers three kinds of certainty:

Technology: over the next decade, mainstream paths will be incremental advances in lithium systems (CTP/CTC, the Qilin battery, etc.), rather than wholesale replacement by disruptive routes such as all-solid-state; Cost: long-term contracts can lock capacity and pricing mechanisms, sharing scale and manufacturing innovation to bank cost-down gains — a buffer for future price wars; Supply security: as high-quality capacity grows scarce, long-term deals serve as tickets to priority supply, safeguarding one's own capacity while implicitly constraining rivals' access to cells.

The tech moat takes shape

At its Dec. 28 supplier conference, CATL said it will begin large-scale application of sodium-ion batteries from 2026 in swapping, passenger cars, commercial vehicles and energy storage — easing dependence on lithium.

The move coincides with a sustained rise in lithium carbonate prices, sharpening sodium-ion's cost advantage as its raw materials are cheaper than lithium-based chemistries.

One inner engine of the new-energy vehicle boom is relentless battery innovation. Beyond the mainstream lithium-ion route, solid-state and sodium-ion technologies are emerging — with potential to reshape the industry. In the glare of rapid iteration, sodium-ion, a grounded pragmatist, has quietly moved from lab to industrial deployment.

Sodium-ion batteries cost about 18% less than LFP, and excel in the cold — retaining over 90% of capacity at −20°C.

Image source: CATL

Since unveiling its first-generation sodium-ion battery in July 2021, CATL has pushed to unlock the technology’s potential and bring it into the spotlight. Its sodium packs have been validated at scale in commercial vehicles, and are in commercial use for storage and two-wheelers.

While energy density still trails lithium-ion, sodium-ion is showing strong substitution potential in cost-sensitive, cold-weather applications.

With policy support and market demand, the sodium-ion value chain is accelerating. Hundreds of companies have moved into core materials, with thousand-ton orders delivered and capacity coming online.

In power batteries, the core edge ultimately comes from breakthroughs in materials science. CATL's annual R&D spend tops CNY 18 billion, much of it into new chemistries — sodium-ion among them.

On all-solid-state progress, CATL's lab cells have surpassed 400 Wh/kg — well above current liquid lithium-ion limits. The company expects mass production around 2027.

That timeline broadly matches plans by Toyota and Volkswagen, showing Chinese firms are running neck-and-neck with global leaders in next-generation battery technology.

CATL's most imaginative bet may be its expansion from a single battery business into a diversified ecosystem — not diversification for its own sake, but strategic extensions built around core battery capabilities.

Times Intelligent's skateboard chassis is the emblematic test. Proposed in 2002, the concept stalled in the ICE era. EVs changed the game — with the battery, motor and power electronics at the core and a much simpler underbody, commercialization became viable.

In December 2024, CATL launched the CIIC integrated intelligent chassis (Panshi chassis), tightly integrating the battery, motor, power electronics, suspension, braking and steering. The pitch: OEMs can build atop this standardized base, focus on the upper body and intelligent cockpit, and cut new-model development cycles from 3–4 years to 12–18 months.

The vision is compelling, but the challenges are significant. As the vehicle's "skeleton," the chassis dictates handling, safety and ride quality; legacy automakers see it as core IP and are loath to outsource. For now, Times Intelligent's customers are mainly NETA, AVATR and others with relatively weaker EV R&D — or firms with equity links to CATL.

Even so, the skateboard chassis hints at a new division of labor. As the industry shifts toward electrification and intelligence, the traditional whole-vehicle model is being deconstructed. CATL is bidding to take a more central role — not only as a components supplier, but as a platform definer.

Energy storage is another example. CATL's Tianheng energy storage system holds a 36.5% global share, and storage gross margin reached 26.84% in 2024 — a key profit driver. Storage shares technology with traction batteries, yet use-cases and business models differ. The unit smooths cyclic swings in EV batteries and plugs CATL into the trillion-yuan global energy market.

Image source: CATL

CATL's swapping business now covers both passenger and commercial vehicles, with a 10-minute swap network taking shape in Chongqing.

These seemingly scattered bets follow a clear logic: anchor in battery technology, extend upstream into materials and mining, and downstream into storage systems, swap networks and skateboard chassis — building a complete energy ecosystem.

Within that ecosystem, CATL's role shifts from "selling batteries" to "providing energy solutions," expanding both its value chain and profit space.

Globalization 2.0: from "going out" to "fitting in"

Chairman Robin Zeng told the supplier conference that real growth will still come globally. The new-energy industry must earn worldwide trust to go out from China — not just a macro ambition, but a practical choice.

CATL’s international strategy has entered a new stage. As of end-Q3 2025, construction-in-progress carried on the books stood at 37.366 billion yuan, with most investment flowing to overseas plants.

Europe is the focal point. The Thuringia, Germany plant started production in 2022 and is consistently profitable, supplying BMW and Volkswagen; phase one of Debrecen, Hungary is commissioning equipment and slated for completion by end-2025 to serve Central and Eastern Europe; the JV plant with Stellantis in Spain has approvals and will soon break ground. The three sites form a West–Central–South Europe triangle with more than 100 GWh of planned capacity.

Image source: CATL

In Southeast Asia, CATL is building a USD 5 billion integrated battery supply chain in Indonesia, with 15 GWh of planned capacity and start-up expected in the first half of 2026. The project is about more than market access: Indonesia holds the world’s largest nickel reserves, and nickel is a key raw material for NMC batteries. By building there, CATL secures both feedstock and market entry.

A global capacity network doesn’t just bring factories closer to customers and cut transport costs; it erects twin barriers of capital and time. A cutting-edge gigafactory takes investment in the tens of billions of yuan and 2–3 years to build — hurdles second-tier players with weaker finances and thinner tech stacks struggle to clear. By moving first, CATL has effectively raised the global entry bar.

In 2025, CATL listed on the Hong Kong exchange, marking the largest H-share fundraising in nearly four years. Some 90% of the IPO proceeds will go to phases I and II of the Hungary project, further boosting localized battery supply in Europe.

CATL's campaign reflects the broader mix of anxiety and drive across China's NEV supply chain in transition. With rapid iteration and a reshaped competitive order, even the industry leader can't rest on past gains; it must push beyond its comfort zone and fight on multiple fronts.

The outcome of this multi-front war will shape the global NEV landscape. If CATL completes its shift from battery manufacturer to energy technology company — building an ecosystem spanning materials, batteries, chassis, storage and swapping — it can keep the lead over the next decade, perhaps even define the technical standards and business models for the next generation of EVs.

Conclusion: a giant pivots, and an industry's future

The "king of Ningde" offers a clear lesson: in technology-driven industries, no moat is permanent; only relentless innovation and self-disruption sustain leadership. In a global contest, Chinese companies must not only go out — they must fit in, earning respect through high-quality growth and responsible competition.

CATL's offense and defense isn't just a corporate story; it's a snapshot of China's manufacturing upgrade. In a competition about the future, fighting hard is not a pose — it's a necessity. As the giant pivots, the industry's seismograph has already recorded the first tremor.