As domestic EV startups fight for survival in a life-or-death race, one brand with just 15,000 annual sales and a faint voice at home is driving its boxy vehicle badged "ROX" onto the streets of Dubai and Abu Dhabi. Priced at $80,000, it is taking on the Land Rover Defender as a direct competitor.

It is called ROX.

For years, its name has been shadowed by rumors of an impending exit. Yet, it consistently manages to deliver an unexpected growth curve on the sales charts.

In 2025, ROX delivered 15,318 vehicles — a near-300% surge from the previous year — marking 11 straight months of month-on-month growth.

In a white-hot EV market, ROX's survival has piqued the curiosity of industry observers: why is it not just alive, but steadily advancing?

So, flying under the radar of industry giants, how has ROX managed to carve out a survival niche of its own?

Delivering a "Small but Steady" Report Card

In 2025, the polarization of China's NEV market became starkly clear. On one side, brands like Leapmotor, XPENG, and Xiaomi smashed annual targets and set delivery records, fueled by hit products or ecosystem momentum. On the other, some players saw growth stall, struggling to survive the price war and industry shakeout.

Sales and financial health are the most direct yardsticks for judging whether a brand is "alive" and vital. Recently, major EV startups released their 2025 scorecards.

Specifically, Leapmotor delivered 597,000 units in 2025, achieving 119.3% of its target and setting a new annual record for EV startups. XPENG sold 429,000 vehicles, up 125.9% year-on-year, hitting 113% of its goal. Li Auto moved 406,000 units, reaching 63.5% of its target, while Xiaomi EV surpassed 400,000 sales, fulfilling 114.3% of its objective.

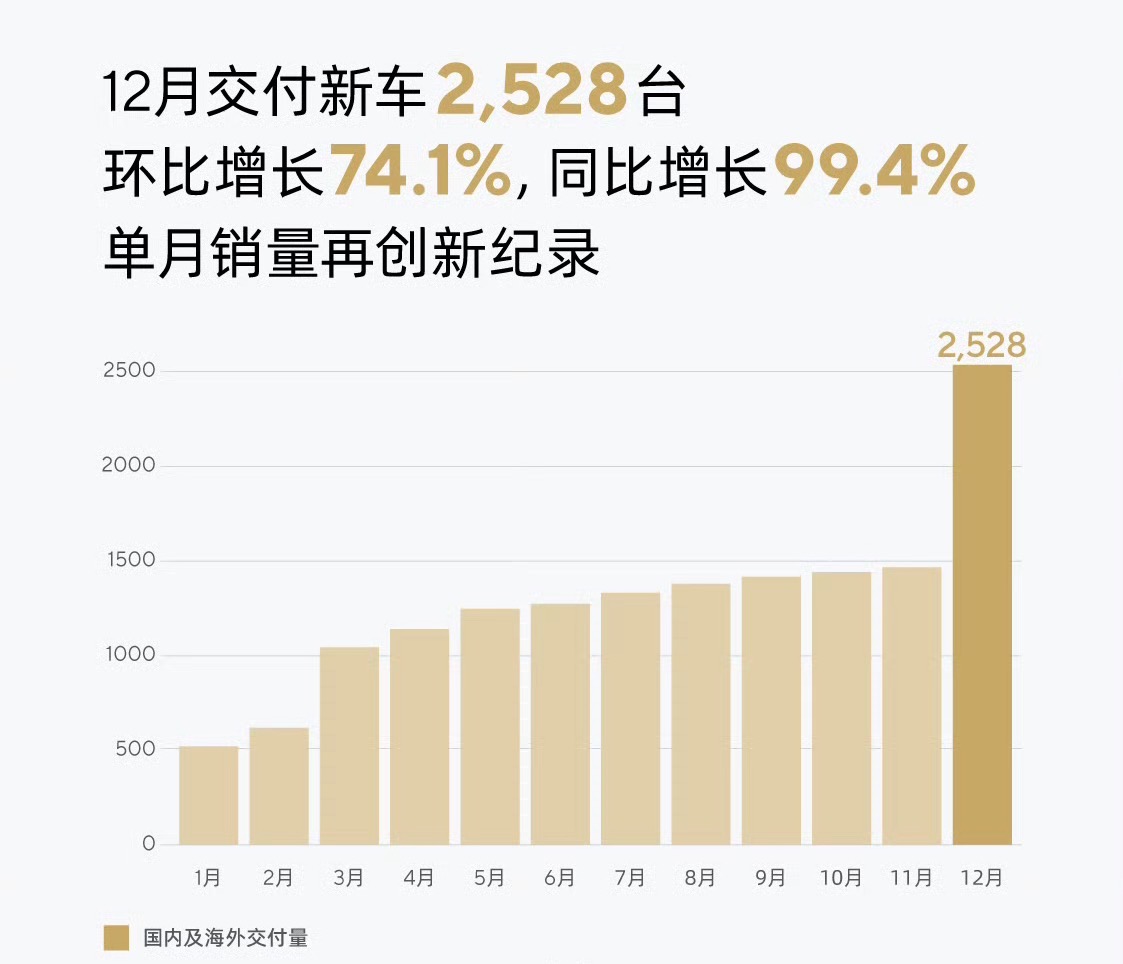

Against this "tale of two markets," ROX's 15,000 annual sales seem out of place. Yet remarkably, the company achieved month-on-month growth for 11 consecutive months in 2025. December alone saw 2,528 deliveries, an all-time high.

Image Source: ROX

Shift the focus from absolute figures to ROX's growth trajectory and market structure, however, and a completely different narrative emerges.

Unlike other startups fighting tooth and nail in the domestic market, ROX chose a flanking maneuver: going global. To date, its business spans over 40 countries and regions, with more than 80 showrooms established.

ROX's performance in the Middle East is particularly dazzling. In the UAE, the ROX 01 has captured over 10% of the luxury all-terrain SUV market priced above $80,000, even breaking into the top three for sales of luxury SUVs costing over 500,000 yuan. Local media have dubbed it a "Defender Killer." Even more surprisingly, the Dubai police force has added it to its fleet, parking it alongside Land Rover Defenders in the station garage.

"The UAE is the third-largest market for Land Rover and Land Cruiser, after China and the U.S. Making the top three there shows locals understand what a luxury SUV is," said Yan Feng, founder and CEO of ROX. "That is ROX's market and opportunity."

This statement reveals the core logic behind ROX's premium strategy: rather than getting trapped in the cutthroat "red ocean" of the mainstream market, go to the most discerning mature markets. Win over the most demanding users with product strength to build a high-potency brand image.

Li Nan, a senior industry insider speaking under a pseudonym, told Gasgoo that ROX's brand awareness and market presence in China still need a breakthrough. Its short-term survival and development will continue to rely on overseas markets as a pillar.

This view aligns with broad industry consensus. At the end of 2025, ROX held a brand launch to officially unveil its new flagship — the ROX ADAMAS China edition, an all-terrain luxury SUV — marking a phase where its globalization strategy advances both domestic and foreign markets in tandem.

The ROX ADAMAS China edition carries official guide prices of 349,900 yuan and 359,900 yuan, with promotional launch prices of 334,900 yuan and 344,900 yuan. It offers six- and seven-seat layouts. The six-seater features second-row Nappa leather zero-gravity seats with a maximum recline angle of 150°, while the seven-seater boasts a central aisle width of 183mm to facilitate third-row entry and exit.

Yan Feng also set a clear target: global sales of 30,000 units in 2026. The longer-term vision is to become the preferred NEV brand for global outdoor enthusiasts by 2030.

ROX's marketing style is unique and its voice relatively quiet; its sales volume has never cracked the top tier. Yet it hasn't just survived — it's operating with stability. There is no denying that among the ranks of EV startups, ROX is a fascinating case study.

The Founder's Precise "Bet"

In the NEV industry, a founder's background often dictates a company's initial DNA and breakout path. For instance, the founders of "Nio-Xpeng-Li Auto" — William Li, He Xiaopeng, and Li Xiang — bear distinct internet imprints. They used internet thinking to reshape user service and product definition, challenging the traditional automotive value chain.

"ROX's development trajectory is also deeply stamped with its founder's style," Li Nan told Gasgoo. "Looking at the status quo, they chose to enter a high-ticket, 'small but beautiful' high-net-worth niche. While this track is niche, the demand is real and clear."

ROX is jointly built by Roxintel and the Fortune 500 company Shandong Weiqiao Pioneering Group Co., Ltd., and it too carries a distinct founder style.

Roxintel was co-founded by Chang Jing and Yan Feng. Chang Jing previously founded RoboROXk, a Xiaomi ecosystem company known as the "first stock of sweeping robots on the STAR Market." An avid off-road enthusiast and fan of self-driving tours, Chang Jing entered the auto industry driven by passion and the desire for a challenge.

Yan Feng, meanwhile, is an "auto industry veteran" deeply rooted in traditional manufacturing yet fluent in the languages of intelligence and globalization. He formerly served at SAIC Motor and was one of the founders of Banma Network — the smart system behind China's first internet car, the Roewe RX5. Later, he joined WM Motor as CTO, experiencing firsthand the meteoric rise and turbulence of the EV startup era.

As a startup, ROX champions frugality internally; its founders often fly economy class. Yet when it comes to brand building and product validation, they spare no expense.

In October 2025, ROX held a new car launch in the banquet hall of the Emirates Palace in Abu Dhabi — dubbed the "eight-star hotel." Described by local media as "unprecedented," the event unveiled the global flagship SUV ROX ADAMAS, attended by multiple members of the royal family and high-ranking government officials.

Image Source: ROX

Previously, ROX launched a "Silk Road" expedition spanning 81 days, 13 countries across Asia, Europe, and Africa, and covering 25,000 kilometers. It used unmodified, factory-stock vehicles for extreme long-distance validation. "No other brand can do this again," the ROX team remarked, highlighting the unique value of such an investment.

"The industry changes fast; some come with confidence, others leave with regret. I often think about where ROX's road should lead. The answer was written five years ago. We determined then that the next opportunity in cars isn't in crowded cities, but in the vastness of nature," Yan Feng said at the 2025 brand event, sharing his long-held vision. "More and more people crave exploration. They need a vehicle that can conquer the wild while bringing comfort and safety to the whole family. This is a real, continuously growing, yet long-overlooked global demand."

For new brands, capital and R&D are indispensable. Previously, Shandong Weiqiao Pioneering Group Co., Ltd. made a strategic investment of $1 billion in Roxintel, primarily for all-aluminum body R&D, integrated die-casting technology, and short-pROXess smart manufacturing projects. Weiqiao is Shandong's largest private enterprise, known as a "textile giant" and the "King of Aluminum."

ROX also co-founded the "Weiqiao-ROX Lightweight Joint Laboratory" with Weiqiao, kicking off deep collaborative innovation from materials science to vehicle engineering. The recently launched ROX ADAMAS already incorporates about 150kg of lightweight aluminum materials built to Weiqiao's high standards, providing a reliable quality endorsement for its entire all-aluminum chassis.

However, Li Nan noted to Gasgoo: "ROX's model relies on contract manufacturing and exports, placing extreme demands on cash flow management. This is the critical test for whether it can sustain operations."

Finding a Blue Ocean in a Red Sea

It's not hard to see why ROX has survived to this day, even becoming a "survival sample" among EV startups: it chose the right track.

In the Chinese market, while every player bleeds over "family cars," "smart tech," and "extreme value," ROX has blazed a different trail. It created a new category: the new energy all-terrain luxury SUV, precisely targeting the "city-and-wilderness" scenario.

In terms of product, it doesn't sacrifice on-road comfort like traditional hard-core off-roaders, nor does it lack the confidence for the wild like city SUVs. From 3D transparent chassis to smart camping mode, its features revolve around genuine outdoor needs.

On the market front, it voluntarily abandoned the massive mainstream crowd to serve a "niche" group that loves nature and pursues high-quality outdoor living. These users have low price sensitivity and value functional fit and emotional worth, allowing ROX to escape the price war and chase healthy gross margins.

Image Source: ROX

Globally, it adopted a unique "top-down" path. First, it conquered the Middle East's premium market — the most demanding in terms of quality and brand stature — establishing an image of luxury and reliability. Now, it is bringing that "overseas halo" and proven product strength back to China.

This differentiated track choice allowed ROX to avoid a head-on collision with giants, establishing its initial foothold in a relatively calm blue ocean.

Against this backdrop, ROX's survival appears distinctly "atypical." It chose not to battle giants for scale and price in the mainstream market, but instead anchored itself in a unique global niche from the outset, employing a differentiated competitive strategy. Its very existence challenges the singular success standard of "scale is justice."

The overseas strategy provided ROX with an "escape route," but for the company, that overseas accumulation is more about validating how to successfully build a premium brand.

ROX has successfully entered 40 countries and built a luxury high-end brand overseas, yet it maintains that success in the Chinese market is the true measure of a brand's success.

"Everyone knows China is the world's largest market, and we are a company born here. We really want to bring good products back to the Chinese market and tell consumers there is actually a very good brand called ROX," Yan Feng said, his heart set on the domestic market.

After Breaking Through, Where Next?

Having carved out a path to survival, ROX's future is far from "smooth sailing." Its unique survival model comes with obvious challenges.

First is the ceiling on scale. "Premium outdoor NEV" is inherently a niche market with limited capacity. Once sales grow to 30,000 or 50,000 units, where will the incremental growth come from? This is a question ROX must answer. Being too niche may struggle to support long-term R&D and channel construction; yet compromising for the sake of scale risks diluting the brand positioning and erasing its uniqueness.

Second is the tough battle to "return" to China. The ROX ADAMAS sells for $80,000 overseas (about 580,000 yuan), but the launch price in China starts at 334,900 yuan. This massive price gap is a double-edged sword. While it lowers the entry barrier for domestic consumers, it poses a narrative challenge to the brand's premium image. Furthermore, rebuilding domestic channels and service systems will be another resource-intensive project.

Image Source: ROX

The greatest long-term risk may come from a crushing blow by industry giants. The current quiet in this niche is largely because mainstream giants haven't fully committed. Once BYD's Fangchengbao, Great Wall Motor's Tank, or even Li Auto launch competitive models in earnest, leveraging their massive scale, cost control, and distribution networks, ROX's advantages in product uniqueness and cost will face a severe test.

Yan Feng remarked, "The Chinese market is in a confused phase. I hope ROX can be a clear stream, offering some spiritual comfort. What is that spirit? It is exploring a unique, distinct path in the vast darkness."

In 2026, ROX will launch an agency cooperation model to accelerate the construction of its domestic sales and service system.

Corporate registry data on Tianyancha shows that Shanghai Luoke Auto Parts Co., Ltd. was recently established with Wu Yue as legal representative and a registered capital of 10 million yuan. Its business scope includes retail and wholesale of auto parts, parts manufacturing, and battery production. Shareholder information indicates the company is wholly owned by Shanghai Roxintel Co., Ltd., an affiliate of ROX.

It is clear that ROX is launching the second act of its globalization story: leveraging the luxury brand certification and high-end user reputation gained in the Middle East, it is attempting to convert that scarce "overseas momentum" into brand capital and a foundation of trust in the domestic market, embarking on a unique "homecoming" journey.

Conclusion:

The auto industry remains full of opportunity; the value chain reconstruction driven by electrification and intelligence is far from over. Any new player must respect the cycle and honor the industry. The essence of entrepreneurship is the constant search for small blue oceans within a red sea. In a brutal industry that worships scale, capital, and traffic, ROX offers a "counter-intuitive" survival sample: one that doesn't chase absolute numerical myths, but relies on extreme differentiation and a precise globalization strategy.