Gasgoo Munich- China's new energy vehicle penetration rate continues to climb. By 2025, sales of new cars accounted for nearly half of the market. The total fleet surpassed 40 million units.

Shenzhen Shanxin Power Technology Co., Ltd. recently unveiled its chain brand. It also launched the "power battery CTP automatic repair production line" in Shanghai. The move targets growing repair challenges in the new energy vehicle aftermarket.

Gasgoo reports that Shanxin Power aims to drive maintenance toward intelligence and standardization. It uses a "technology + service" approach. This allows millions of car owners to enjoy safer and more convenient mobility.

Supply-Demand Imbalance in Power Battery Repair Peaks

The rapid pace of the new energy vehicle market creates a significant aftermarket challenge. Data from the China Association of Automobile Manufacturers shows that in 2025, production and sales exceeded 16 million units. Market penetration approached 50%.

However, compared to front-end manufacturing and sales, aftermarket services lag significantly behind. This is particularly true for the power battery, the vehicle's core component.

The first wave of mass-market new energy vehicles launched between 2018 and 2020 is exceeding factory warranties. Demand for battery repair and replacement is now growing rapidly.

CTP (Cell to Pack) technology is a mainstream choice. It significantly improves volume utilization and energy density. Statistics show new cars with module-less structures like CTP or CTC account for 40% of the market. This corresponds to nearly 20 million vehicles on the road. It is estimated that between 2025 and 2026, newly assembled CTP battery vehicles will reach approximately 7 million annually.

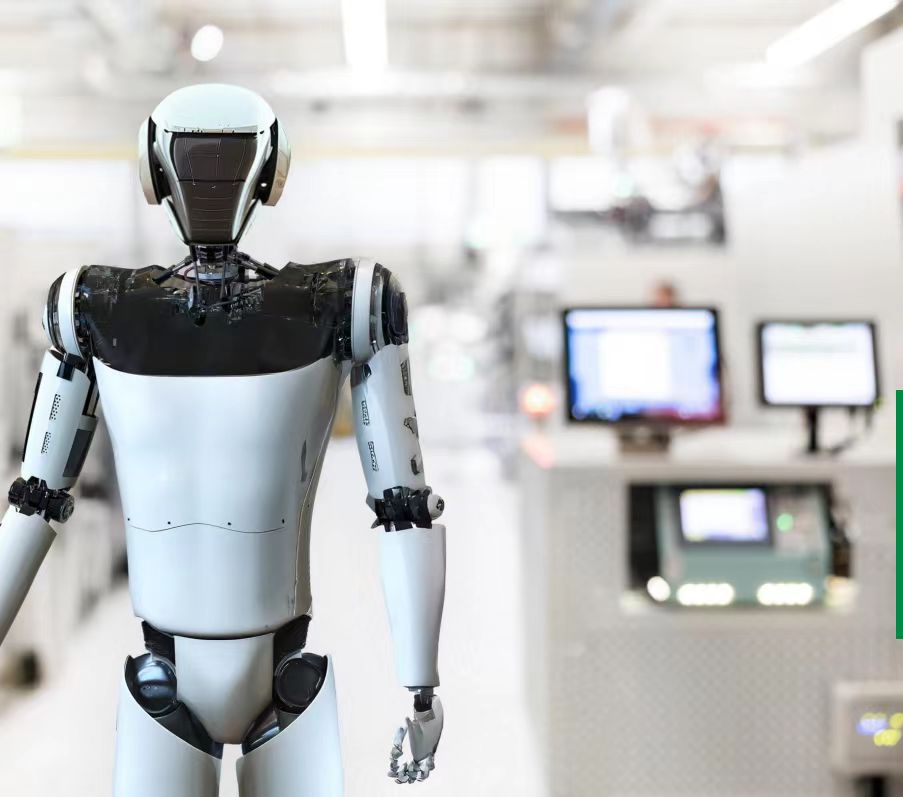

Image Source: ZEEKR

This market potential contrasts with the industry's service shortcomings. "Easy to buy, hard to repair" is a concern for many new energy vehicle owners. Unlike engines in traditional vehicles, a power battery is a highly integrated electrochemical system. Its repair involves complex technologies. These include high-voltage safety, cell chemistry, structural bonding, and BMS software. Currently, few third-party service providers exist outside OEM-authorized channels. They are rarely capable of professionally handling core battery faults. These include cell failure or cooling plate leaks.

Owners face a difficult choice. OEM service outlets often mean high costs and long waits. Unauthorized repairs entail significant safety and quality risks.

The consequences of this imbalance are far-reaching. For consumers, high costs and opaque processes impact ownership experience. For insurers, difficulty in controlling claims drives up premiums. For the industry chain, assessing battery health restricts vehicle value in the used car market. This creates a bottleneck from production to recycling.

Consequently, the power battery aftermarket requires a profound transformation. This spans concepts, technology, standards, and networks. It is necessary to handle the large-scale service demand.

How Should New Repair Standards Be Defined?

Shanxin Power's entry addresses this industry bottleneck. Its strategy is not just a technological breakthrough. It is a "core technology product + national service network" model. This model systematically solves industry pain points.

The highlight is the "power battery CTP automatic repair production line." It is an industrial-grade solution setting the next generation standard. It is a complete system integrating mechanical engineering, automated control, and digital management. It uses OEM-level testing standards.

The line's breakthrough solves the "non-destructive disassembly" problem of CTP packs. It integrates specialized freezers, high-precision milling machines, and cell extrusion presses. This achieves safe, non-destructive separation and replacement of cells. It can also repair components like water-cooling plates.

The line covers the entire workflow. This includes incoming diagnosis, baking, and dehumidification. It also covers cell capacity matching, automated disassembly, and welding. Finally, it handles gluing, sealing, and EOL testing. Critical steps are automated to ensure consistency.

Automation delivers a qualitative leap in efficiency. The line supports parallel processing of multiple packs. It has a monthly capacity of 130 packs and an annual capacity of 1,300 packs. This provides a foundation for large-scale demand.

Crucially, it establishes a digital quality control system. The line integrates a full-pack test system and automated EOL test bench. These align with OEM factory standards. Test data is automatically collected and evaluated. It is generated into a tamper-proof file linked to the battery's "digital ID." This ensures every repaired pack meets safety standards. It also provides a data foundation for warranty services and valuations.

Image Source: Shanxin Power

Shanxin Power simultaneously launched the national chain service brand. It aims to build a service ecosystem with hierarchical coverage and unified standards. The brand adopts a dual-line development strategy known as the "Thousand Enterprise Alliance" and "County Access."

The "Thousand Enterprise Alliance" focuses on core cities like first-tier and provincial capitals. It aims to establish high-standard flagship service centers. These primarily serve OEMs, large fleets, and insurance companies. They also act as regional support centers. "County Access" penetrates deep into county-level markets. It exports equipment and standards to empower local repairers. This solves the "last mile" problem of new energy services. It serves private car owners and local fleets.

According to the plan, the national chain service brand aims to achieve "Hundred Cities, Thousand Stores" by 2026. It plans to build 1,000 stores domestically and launch 11 overseas stores. Its service network will be divided into multiple tiers. These include S-class, A/B-class, and C-class stations. Different tiers will have differentiated capabilities. These range from deep repairs to basic testing, forming a synergistic relationship.

Shanxin Power attempts to transform repair from a "workshop-style" industry to a modern one. It aims to replace opaque, skill-dependent processes with standardization, digitization, and scale.

If this model succeeds, it will benefit car owners by reducing usage costs. It will improve insurers' willingness to underwrite and stabilize used car residual values. This activates the new energy vehicle circulation chain.

As the industry transitions from "incremental competition" to "stock operation," aftermarket services are critical. Their maturity will determine the industry's healthy and sustainable development.

Shanxin Power CEO Peng Chen stated at the launch: "We are a technology service provider driving aftermarket upgrades. We aspire to become an enabling platform. We promote the industrial chain toward efficiency and sustainability through innovation."

Now, Shanxin Power has entered the race with an innovative combination of "technology + network." Whether it can lead the industry into a new era of transparency remains to be seen. However, the battle to upgrade after-sales services for the "heart" of new energy vehicles has begun.