China's auto industry is quietly completing a profound coming-of-age.

In recent years, China's car market used electrification as a spear to pierce legacy giants’ technical moats, with intelligence as its wings, it vaulted the user experience into a new dimension, and, with striking market efficiency, pushed new-energy penetration from single digits past half the market — cementing China's status as the main arena for global automotive transformation.

As the first half of this industrial revolution — defined by surging scale and penetration — nears its end, the second half’s whistle has quietly sounded. Through 2025, much of the domestic industry has faced a familiar bind: rising revenue without rising profits. That, like a mirror, reflects how growth driven by policy support and sheer market expansion is bumping up against its ceiling.

2026 may well be the year that "coming-of-age" is put to the test, as China's auto sector shifts from the miracle of volume to the resilience of quality. This is not a mere downshift in growth. It is a deep reframe of development logic, competitive structure and global role. Against that backdrop, the industry’s focus will move from how to grab share faster to how to create value more durably — and define the future.

Looking ahead to 2026, Gasgoo has mapped out fresh directions for the market. Drawing on survey results and the Gasgoo Research Institute’s outlook, we explore three dimensions — macro headwinds, technological divergence and global coopetition — to gauge where China's car market goes next.

Market adjustment accelerates

For China's passenger-vehicle market, the first task in 2026 is learning how to survive and grow in a post-stimulus era.

Gasgoo Research Institute expects the domestic passenger-vehicle market to contract about 3.3% year on year in 2026, slipping into mild negative growth. That is not a step backward; it signals a shift from an abnormally high, policy-propelled expansion (purchase-tax cuts, trade-in and scrappage programs) back to a normal cadence driven by intrinsic demand, the economic cycle and industry-led innovation.

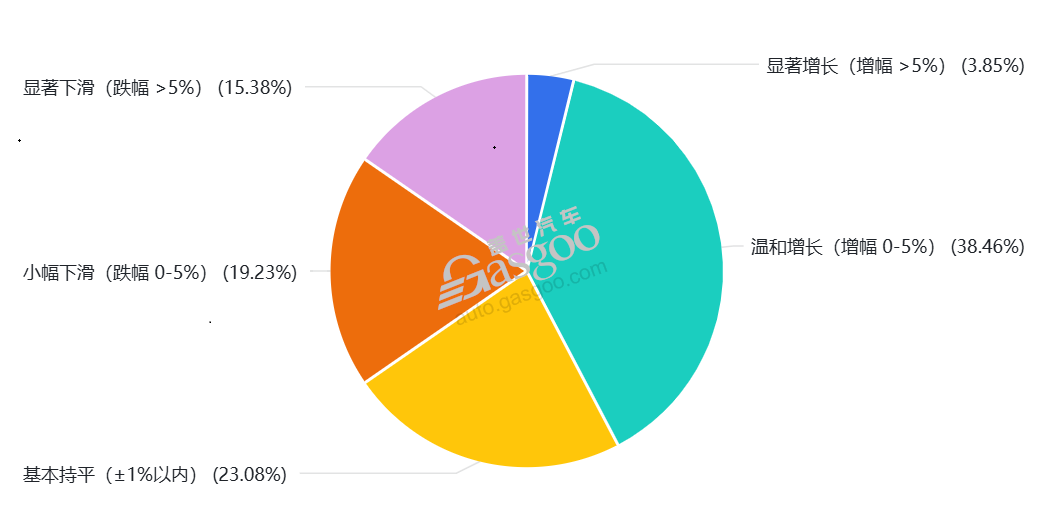

Survey results on the overall trend of China's auto market in 2026. Image source: Gasgoo

Our industry survey echoes that trajectory. Asked about the overall outlook for 2026, moderate growth (0–5%) remains the mainstream expectation at 38.46%, yet respondents who see the market as flat or declining together account for more than 57% — a sober recognition that breakneck growth is unsustainable.

At the root of this cyclical retreat are a change in growth engines and the visible hangover from demand pulled forward.

First, on the demand side for new-energy vehicles — the key driver of expansion — there has been a clear shift in momentum, as early adopters motivated by incentives and novelty have largely completed purchases. Growth now hinges on mainstream family buyers — a larger pool, but more rational and more demanding.

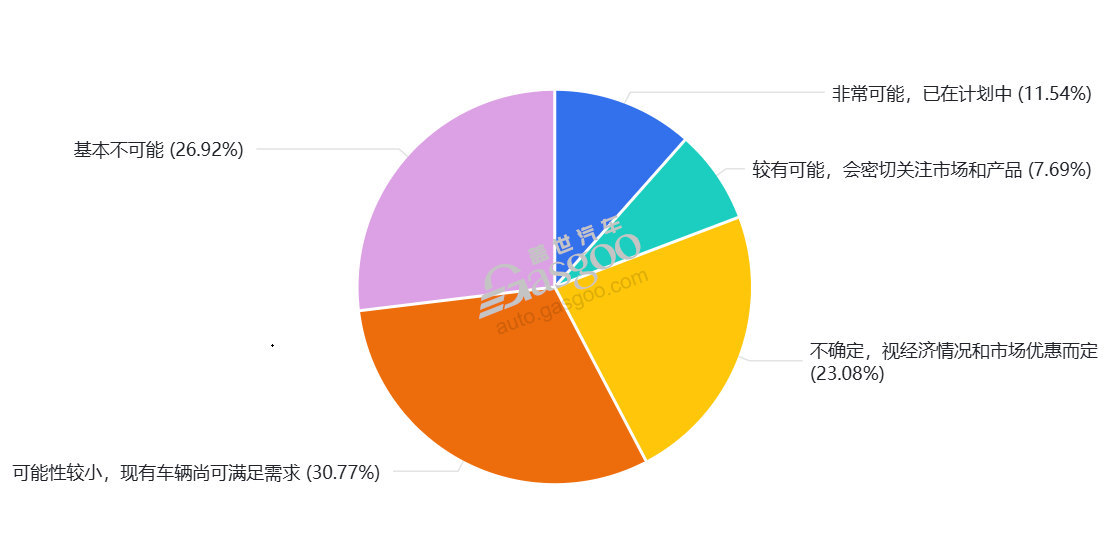

In our survey, a majority of participants (57.69%) intend to delay purchases. Their decisions rely more on confidence in the economic outlook, real product value and total ownership costs than on one-off policy windfalls.

Survey on the likelihood of individuals or families buying or replacing a car in 2026. Image source: Gasgoo

Second, 2025 marks the expiry of several incentive programs; the resulting pull-forward will leave 2026 with a demand "valley", in other words, demand has not suddenly disappeared — the cadence of consumption has been disrupted.

The macro backdrop in 2026 will amount to a stress test. It will probe not only automakers' operating resilience as sales growth slows, but also whether the wider supply chain can build healthy, market-based profitability after bidding farewell to subsidies.

Pricing is likely to evolve from disorderly “race-to-the-bottom” discounting toward an orderly return to value.

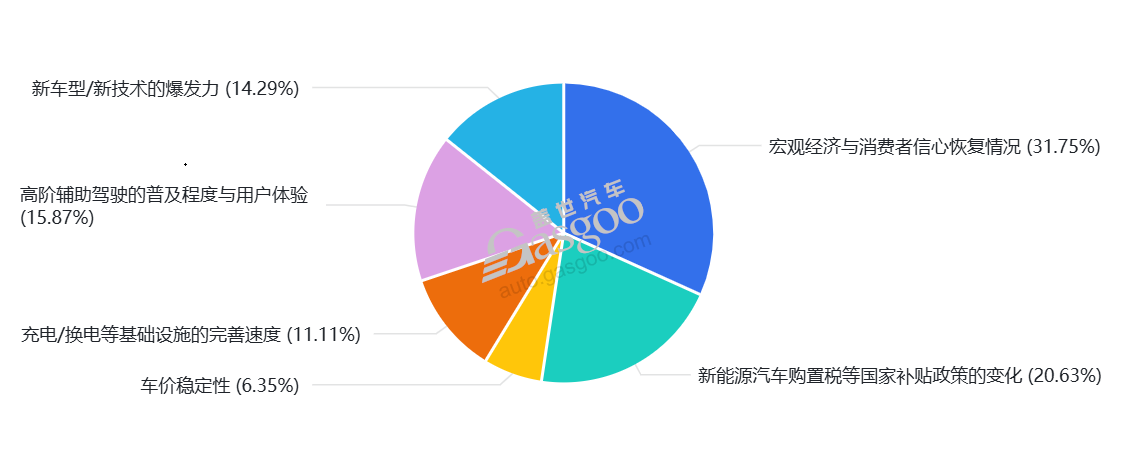

Relentless price wars may juice volume in the short run, but over time they erode brand equity and trust in price stability. Only 6.35% of respondents in our survey see “price stability” as a key variable for 2026 — a worrying signal. When buyers broadly expect prices to keep swinging or drifting lower, waiting becomes rational. That creates a self-reinforcing loop: expectations for lower prices delay purchases, carmakers cut further to move metal, those cuts in turn harden expectations of further declines.

Survey on key variables shaping the auto market in 2026. Image source: Gasgoo

Breaking that loop requires shifting from price wars to a true value war — a contest built on scale advantages, technology-driven cost reductions and overall operational strength.

What will define competitiveness next? With room for pure price cuts narrowing, the edge lies in delivering a markedly better product experience and full life-cycle value at the same — or even lower — price. There may be growing pains, but this is the path from scale to profit and quality.

A brutal reshuffle will follow. Players lacking cost control and technological pricing power will exit faster.

The fight for technological primacy

As the market shifts from rapid expansion to steadier growth, structural stories will carry more weight.

Forecasts from the Gasgoo Research Institute indicate China’s new-energy passenger-vehicle market could reach 16.90 million units in 2026, up 8% year on year, lifting penetration to 56%.

As the NEV market keeps expanding, competition among technology routes will only intensify. The essence is no longer a doctrinal debate over which powertrain is superior, but a contest over how well different solutions fit China’s complex use cases.

Our survey adds a clear read on sentiment for that contest.

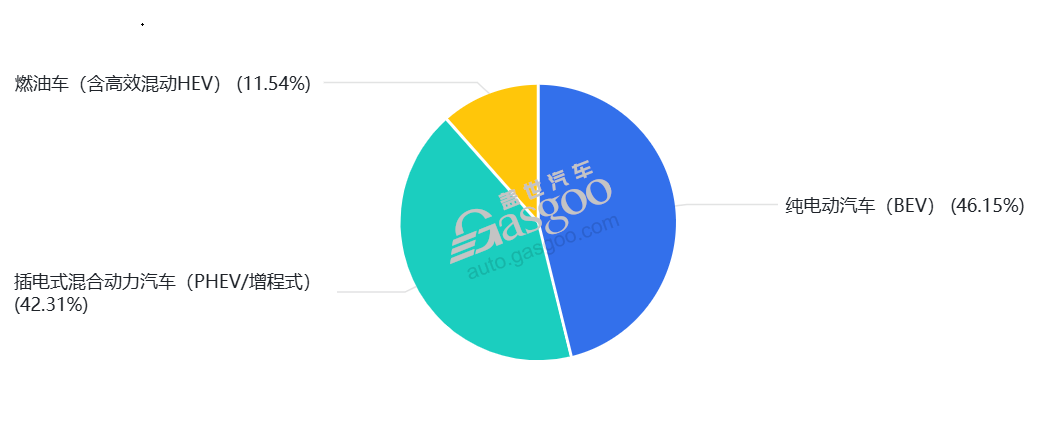

Which segment is most anticipated in 2026. Image source: Gasgoo

Battery-electric vehicles (BEVs), with 46.15% of the vote, are seen as the strongest growth segment in 2026. Plug-in hybrids (including PHEVs and EREVs) follow closely at 42.31%. Together they account for nearly nine-tenths of expectations. The takeaway is clear: electrification — whether pure electric, plug-in hybrid or range-extended — is the mainstream consensus. Traditional combustion models (including HEVs) drew just 11.54%, confirming a steady marginalization.

It is evident that China will continue to feature a diversified powertrain mix — BEVs leading with hybrids alongside — and no single route will dominate all use cases. This diversity is not a transitional phase, given China’s vast geography, varied driving scenarios, uneven infrastructure and layered consumer needs, it may be a long-term equilibrium.

The BEV market will enter a new phase of high-level consolidation and structural deepening.

Analysts at the Gasgoo Research Institute note that in the first 11 months of 2025, BEVs contributed 88% of the passenger-car market’s incremental growth. In 2026, off a high base, overall BEV growth is likely to ease, yet the potential to expand scale remains. Drivers will include deeper penetration and share gains in mainstream price bands, better user experience as charging infrastructure — especially ultra-fast networks — fills out, and lower battery-material costs that improve vehicle economics and create pricing headroom.

In 2026, China’s BEV market will likely shift from broad-based gains to leaner, more targeted growth anchored in specific niches (premium smart EVs, refined urban runabouts) and clearer total-cost-of-ownership advantages. Success will hinge on turning charging anxiety into a perception of charging convenience.

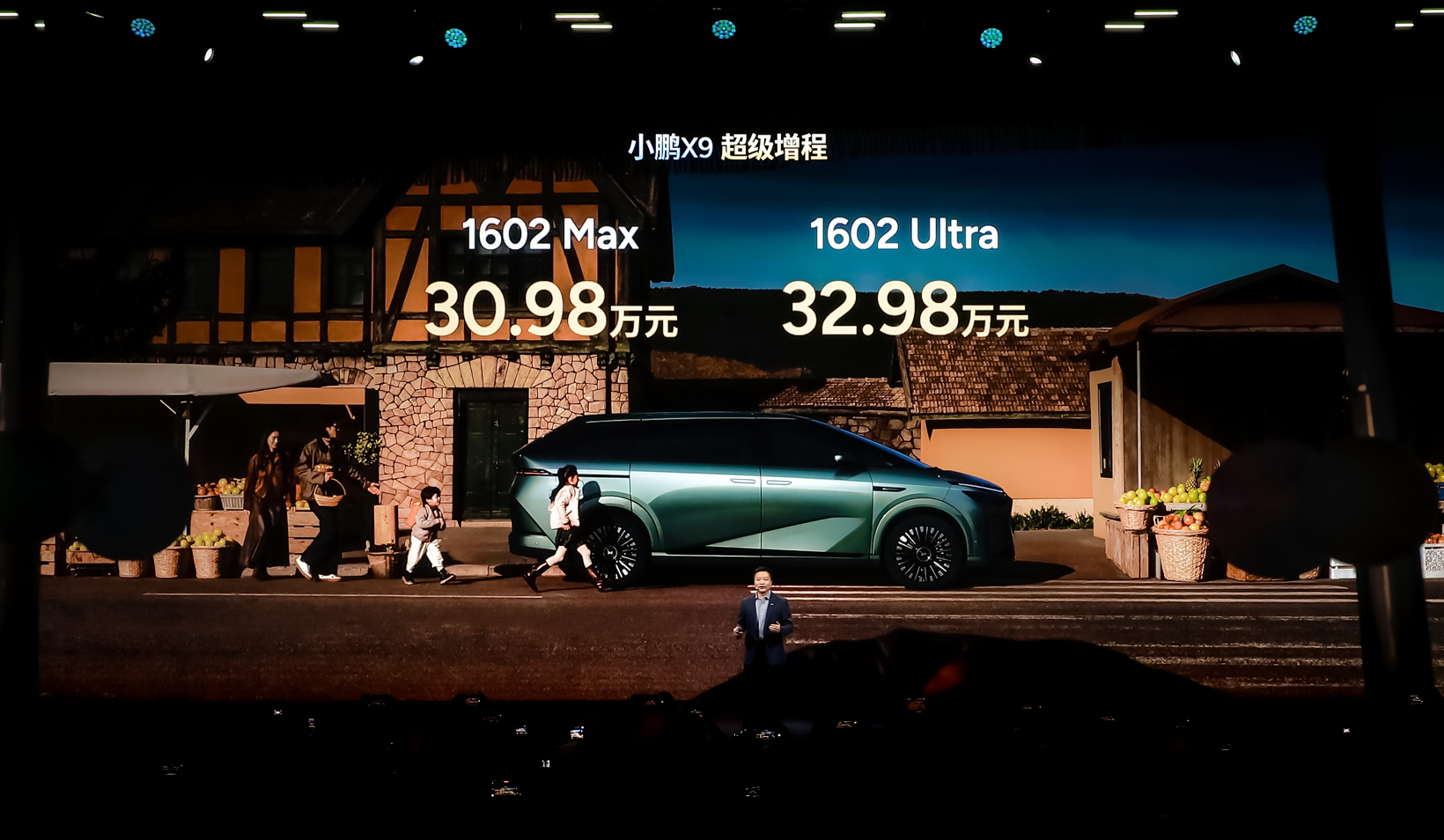

Indeed, it was amid lingering charging anxiety that the PHEV/EREV segment had its moment. In our survey, 42.31% of respondents are upbeat about PHEV/EREV prospects — and with reason. In 2026, the domestic plug-in market, especially range-extenders, will see an unprecedented product year. Harmony Intelligent Mobility, Xiaomi, XPENG, Leapmotor and other tech-led and new-energy brands have lined up dense launch schedules for range-extenders. The influx will broaden consumer choice and, through fierce competition, speed up tech iteration, lower costs and upgrade experiences.

Image source: XPENG

The surge of range-extender technology is a textbook case of supply-side innovation precisely matching demand-side pain points.

With a relatively simple architecture, it sidesteps BEVs’ current weaknesses in charging and long-haul scenarios. Electricity for the city, fuel for the highway — plus low-cost electric drive — directly targets mainstream families’ core needs: all-scenario usability, zero anxiety and low costs. The rise of range-extenders is, under specific historical and technical conditions, the "best-fit" solution for the market. It also signals that future competition among technology routes will depend more on deep insight into segment users and precise product definition than on doctrinal allegiance to any single path.

Divergent technology routes will reshape product value and pricing. Whether BEV or hybrid, the center of competition is shifting from powertrain debates to a value war built on smart cabins, advanced driver assistance and overall vehicle quality. Power systems will become increasingly modular and platform-based, while intelligent experiences and services rooted in the E/E architecture will drive pricing power and brand differentiation — concentrating resources in companies with real depth in core technologies.

A new journey for Chinese autos

Market and technology shifts will ultimately crystallize into a wholesale reshaping of competition. In 2026, a new "Warring States" pattern will take shape: Chinese brands in firm command, startups and tech firms as the innovation vanguard, and joint ventures splitting sharply as they transform. Gasgoo Research Institute projects Chinese brands’ market share to climb to 72% or more, making them the undisputed locomotive of the market.

72% signifies more than a shift in share. It marks a fundamental reallocation of market leadership, technological voice and value-chain returns.

This transformation springs from several intertwined paths.

Start with the systemic victories of traditional domestic champions. Flagships such as BYD, Geely and Chery now compete on more than products or single technologies. Their edge rests on vertically integrated supply chains, rigorous cost discipline, and a multi-route strategy that advances BEVs, PHEVs and EREVs in parallel.

Innovation upgrades from startups and tech firms are just as vital. Harmony Intelligent Mobility, Xiaomi, XPENG and Leapmotor are pushing the contest into automated driving, smart cabins, ecosystem connectivity and user experience. In 2025, several newcomers crossed the 300,000-unit sales mark, and many are steadily improving profitability. By defining cars in software, iterating with data and building sticky ecosystems, they keep raising the bar for the smart-vehicle experience — forcing the industry to accelerate its shift to intelligence.

Meanwhile, legacy joint ventures and luxury brands are struggling yet persisting in their push to change — an indispensable part of the market. Overall, JV share will likely remain hard to stabilize in 2026, but divergence within the camp offers new angles. In 2025, many leading JVs sought to save themselves by devolving technology authority, rebuilding local decision-making and bringing the same intelligence to both ICE and EV lineups to slow share losses. Gasgoo Research Institute's view: in 2026, their room to operate will depend on whether they can deliver step-change advances in EV platforms, intelligent experience and cost control.

While the fight at home rages, the battle overseas is just as sweeping. 2025 exports of around 5.90 million vehicles set a very high starting point for 2026. Yet as the global environment shifts and protectionist barriers keep rising, Chinese automakers’ export businesses face real challenges. Simple trade-led market entry will struggle to deliver major breakthroughs.

China’s auto globalization must move from the 1.0 era of product exports to a 2.0 model of local production, local supply chains and local operations. That raises unprecedented demands on capital strength, cross-cultural management, global supply-chain layout and mastery of local regulations. This is no longer a mere trade race, but an export of industrial systems underpinned by national capabilities. Difficult, yes — but essential for China to progress from an export powerhouse to an automotive power with a global industrial footprint and brand influence.

Summary:

In 2026, China’s auto market will be a mirror. It will reflect less the frenzy of volume and more how each link in the chain repositions its value and builds sustainable competitiveness as growth downshifts. This is a year to squeeze out froth, sharpen core capabilities and set the competitive order — a deep transition from high speed to high quality.

Behind the pressure on totals is a healthier rotation in growth drivers. The contest among technology routes reflects rational preference for diversified solutions. The broad dominance of Chinese brands is the inevitable result of decades of accumulation and a decade of breakthroughs. And the new hurdles to globalization are, in fact, catalysts pushing Chinese automakers from exporting products to exporting capabilities.

For every participant, 2026 is about adaptation and reconstruction — adapting to a slower-growth normal, and rebuilding a growth logic centered on technological innovation and user value.

2026 is both a comedown from a cyclical peak and a crucial period of accumulation before the next climb. The deep adjustment and reshaping in the world’s largest car market will ripple across the globe — and could reshape the industry's balance of power and the trajectory of automotive technology.