While many automakers remain stuck in fierce competition over price and specifications, Li Auto is pivoting in early 2026 to a far more capital-intensive and prolonged race: humanoid robots.

In a recent all-hands meeting, Li Auto CEO Li Xiang announced that the company's brand positioning would no longer be limited to "creating a mobile home." Instead, it must double down on "embodied intelligence." Li told employees that 2026 is the "final window" to become a top-tier global AI company, insisting the company must "launch and showcase results as soon as possible."

Yet at the end of 2024, Li's stance on robotics was far more conservative.

This decision to double down on frontier investment during a period of industry anxiety reveals a deeper layer of Li Auto's strategic thinking: rather than getting stuck in a saturated market, it is better to act early and secure a ticket to the next era.

But the cost and risk of that ticket could be astronomical.

Li's Obsession: We Must Build Robots

The idea of Li Auto building robots has long been deeply rooted in Li Xiang's mind.

During a deep-dive interview in late 2024, when asked if he would build robots, Li's answer was unequivocal: "In terms of probability, it is definitely 100%."

He immediately added a caveat: "But the timing is not now."

Image source: Li Auto

Li's logic is pragmatic. He views smart cars as "wheeled robots" operating in a standardized road environment. If Level 4 autonomous driving is not yet achievable in relatively simple scenarios, then tackling the far more complex challenge of AI robotics would be implausible.

Even so, Li Auto's mission has always been "to create a mobile home, and a happy home." Breaking it down, Li believes the "mobile home" ultimately equates to L4 autonomy, while the "happy home" requires a "silicon-based family member."

Li divides the evolution of Artificial General Intelligence (AGI) into three stages. First, "enhancing my capabilities," serving as an auxiliary tool for humans. Second, "becoming my assistant," capable of independently completing continuous tasks. The ultimate form is the "silicon-based family member," offering deep cognition and proactive care.

From today's perspective, Li's vision of a "silicon-based family member" aligns closely with the ultimate goal of humanoid robots.

In that sense, Li Auto's foray into robotics is a natural strategic extension. It shifts from AI that serves "cars" to AI that serves "people."

"Li Xiang has long maintained that the ultimate form of the automobile is a robot. This implies restarting the robotics strategy is an upgrade from 'automaker' to 'embodied intelligence enterprise.' Li Auto's expansion into robotics is about staking out an early position," said an analyst at Gasgoo Automotive Research Institute.

So the question arises: why was Li so restrained about robotics just a year ago, only to decide to go all-in now?

The core reason likely lies in the rapidly narrowing window of internal and external conditions.

By 2025, the external market for embodied robots matured rapidly. Core technologies achieved breakthroughs, and policy support continued. Global cumulative shipments of humanoid robots exceeded 15,000 units in 2025.

Li judges that 2026 is the "last window" to become a top AI company. He predicted that fewer than three companies globally will compete across the four core layers. Li Auto must enter this "final circle."

Once the strategic judgment was clear, action followed with unusual speed. Currently, Li Auto has swiftly pushed forward two substantive moves.

First, organizational restructuring. Li Auto overhauled its R&D system. It reorganized into modules like foundation models and software entity. Notably, automobiles and robots were grouped under the same "hardware entity."

Insiders say the purpose is straightforward. It aims to bridge smart car and robot capabilities. Capabilities in autonomous driving can be shared or migrated into robot development.

Image source: Li Auto

Second, team building. Li Auto's website lists R&D job postings for the robotics chain. These cover sensors, joint modules, and motion control algorithms.

Li stated his intention to "recruit back those who left for robotics startups." This shows robotics R&D is now a core strategic pillar.

It is worth noting that the "People-Car-Home" ecosystem offers a natural stage for robots.

The car is a mobile space and the home is fixed. The humanoid robot connects and serves both. This gives Li Auto's entry inherent logical consistency.

"For Li Auto, pivoting to humanoid robotics reuses technology. It expands into a new growth curve. This gains recognition from capital markets," an analyst said.

Reality: Core Business Losses, Talent Drain

As Li Auto turns to robotics, its auto business faces volatility.

Because of this, many are skeptical about Li Auto's expansion.

Image source: Internet

The most obvious challenge lies in market performance. In 2025, Li Auto's annual deliveries were roughly 406,300 units. This is a 19% year-on-year decline. The company missed its targets after revisions.

With the core business under pressure, new projects draw attention. Car manufacturing is capital-intensive. Robot R&D burns cash with uncertainty.

Li Auto's decision to open a new battlefield is risky.

Financial data amplify concerns. In Q3 2025, revenue fell 36.2% year-on-year. The company recorded a net loss of 624 million yuan. Operating cash flow was a net outflow of 7.4 billion yuan.

Image source: Li Auto

Although cash reserves are in the tens of billions, losses and investment demands will test investors' patience.

Moreover, talent competition and technological gaps are challenges.

Li's call to "recruit back" confirms severe talent competition. Key technical personnel have left to join the embodied intelligence race.

The loss of talent weakens Li Auto. It affects morale, shifting its position in the market.

Beyond talent, the technological leap is difficult.

Currently, achieving fully autonomous driving on structured roads remains a world-class challenge. Expecting humanoid robots to function in complex environments is far harder.

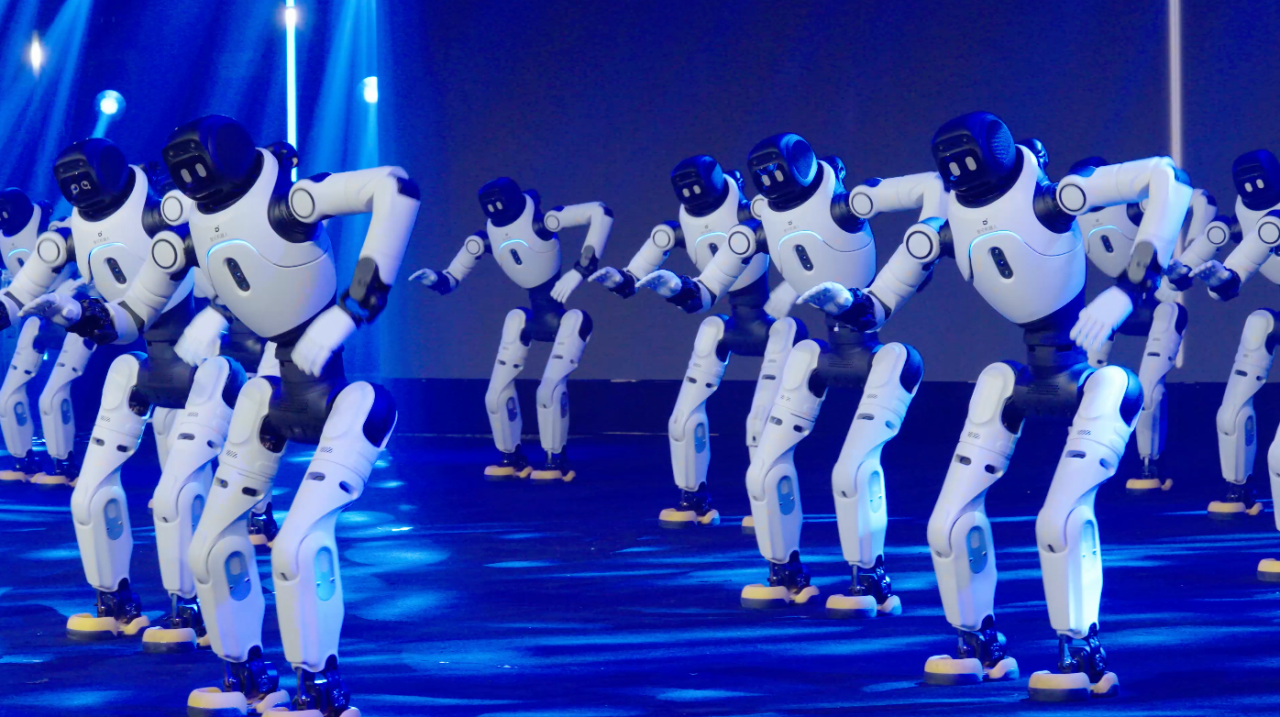

Image source: UBTECH

Analysts suggest Li Auto needs a top team to catch up. Leading players like Tesla and XPENG have invested for years.

Challenges in internal alignment and management cannot be ignored.

Li's impromptu meeting received polarized feedback. Some viewed it as necessary. Others found it "hard to understand." They hoped for specific reviews of the auto business.

This reveals growing pains during a strategic transition. Fighting on two fronts is a test of resource allocation and leadership.

Li announced a return to a "startup model." Whether this can steer car-making and robot-building remains unknown.

Are Humanoid Robots Still a Good Business?

Data shows that by 2025, humanoid robot companies in China exceeded 140. Over 330 products were released.

For a latecomer like Li Auto, is the business still a good bet?

The answer is split. Traditional metrics suggest it is "hard-to-monetize" due to high costs.

However, tech industry timelines suggest it is a "big business." It is the "admission ticket" to the next era.

Optimistic market expectations support this.

Image source: AgiBot

Morgan Stanley predicts China's humanoid robot sales could surge in 2026. By 2035, the number could climb to 2.6 million.

Foundational conditions for industrialization are accumulating. Component costs are declining as the supply chain matures.

This potential attracts automakers like Li Auto and Tesla.

The gap between prospects and reality cannot be ignored.

The primary obstacle is the "reliability gap." Robots face tests in real, complex settings.

There is a gap between the "brain" and the "cerebellum." High-quality data is also scarce.

There is a "dilemma of validation." Industrial deployment requires clear answers on profitability.

Few companies can achieve stable shipments. Capital pushes valuations up, but revenue climbs slowly.

The technological path is divisive. Li Auto seems likely to choose the general path. It is grander but harder.

For Li Auto, entering robotics is an adventure. It seeks a breakthrough when the core business faces bottlenecks. It is an extreme stress test of the company's resolve.

The outcome depends on balancing "holding the present" and "betting on the future."