You might shop around carefully for the best deal on a new car, but are you prepared for the "unexpected significant impact" of repair costs in the future?

Recent reports from the CIRI Auto Technology Institute—specifically the 19th and 20th installments of its auto parts-to-whole price ratio system, drawing data from December 31, 2024, and June 30, 2025—have dampened the hopes of current and potential owners. Whether internal combustion or new energy, parts-to-whole price ratios and related indices are on the rise across the board.

This means the cost of repairs and replacements is climbing, putting added pressure on insurers. How much has this core metric—the one directly tied to your "ownership costs"—actually risen? What hidden rules of ownership lie beneath the surface? And is the gap in repair costs between luxury and mass-market brands, or between new energy and fuel vehicles, widening further?

Image source: VCG (AI Digital Content)

Fuel Vehicles Rise Moderately, But Wear Parts Become "Financial Burdens"

While the increase in parts-to-whole price ratios for internal combustion engine (ICE) vehicles isn't drastic, it targets high-frequency maintenance needs with precision. The "hidden costs" of daily driving are quietly mounting.

According to CIRI Auto Technology Institute data, the 20th "Auto Parts-to-Whole 100 Index" for fuel vehicles hit 391.07%, up 2 percentage points from the 19th period—a rise of 0.51%. Over the same span, the "Maintenance Burden 100 Index" climbed to 20.86, an increase of 0.1 percentage points, or 0.47%.

To be clear, the "Auto Parts-to-Whole 100 Index"—the arithmetic mean of the parts-to-whole coefficients for sample models—directly reflects overall fluctuations in aftermarket parts prices. The "Maintenance Burden 100 Index," meanwhile, focuses on cost changes for 18 commonly used parts, offering a closer look at the daily ownership experience.

Image source: CIRI Auto Technology Institute

Behind this seemingly modest rise, newly added models are the primary drivers. The 10 new fuel vehicles included in this statistics batch boast a mean parts-to-whole coefficient of 545.11% and a mean maintenance burden index of 27.74—far exceeding the 20.09 average of the existing 90 models, which directly pulled up the overall index level.

CIRI Auto Technology Institute notes that the rise in the maintenance burden index reflects increasing repair costs for traditional vehicle owners and growing pressure on insurance payouts.

This is borne out by owner feedback. One luxury brand ICE vehicle owner told Gasgoo Auto in an interview: "New cars are getting cheaper to buy, but the price of repairs and parts hasn't really dropped—it's still expensive."

Even more noteworthy is the price shift of common wear-and-tear parts, which directly impacts daily ownership expenses.

CIRI Auto Technology Institute data shows that among the 18 common wear parts for ICE vehicle samples in the 20th period, the mean single-part ratio for 11 items rose. The rearview mirror assembly led the pack with a 4.82% jump. Meanwhile, the mean price for 12 common wear parts increased, with the rearview mirror assembly again topping the list at 7.82%.

Considering that rearview mirrors are among the most vulnerable external components—requiring frequent replacement after scrapes or collisions—their rising prices further burden owners facing repair bills.

The single-part parts-to-whole price ratio represents the ratio of a component's price to the vehicle's total price, reflecting the cost pressure on consumers for individual repairs and on insurers for single-part payouts.

Data indicates that the single-part ratios for high-payout wear parts in the 20th period ICE vehicles generally increased compared to the 19th. The mean single-part ratio for headlights across 100 fuel vehicles stood at 3.2%, up 0.02 percentage points, with the FAW Audi A6L (FV7201BAQEG) recording the highest figure at 10.4%.

Additionally, the mean single-part ratio for front bumpers was 1.18%, a dip of 0.01 percentage points, with the GAC Trumpchi GS3 (GAC7151HCW6A) posting the high of 3.09%. For rear bumpers, the mean was 1.31%, up 0.02 percentage points, led by the Audi Q7 (AUDI Q7 45TFSI QUATTRO) at 4.2%. The mean for engine hoods reached 2.47%, up 0.04 percentage points, with the Audi Q7 again taking the top spot at 6.11%.

The most striking figures belong to exterior lighting. The mean parts-to-whole price ratio reached 10.35%, with the FAW Audi A3L soaring to 26.17%. In other words, replacing all exterior lights (headlights, taillights, brake lights, etc.) alone would cost more than a quarter of the vehicle's purchase price.

The "unaffordable to repair" nature of luxury brands is vividly illustrated by these ratios, leading many owners to state that with a luxury car, "you cannot afford to crash it, nor repair it."

NEVs Show Steeper Rises, While Battery Costs Draw Attention

Compared to fuel vehicles, the increase in parts-to-whole price ratios for new energy vehicles (NEVs) is more pronounced, though shifts in core component costs offer a slight positive sign.

Image source: VCG

The 20th "Auto Parts-to-Whole 100 Index" for NEVs came in at 312.24%, an increase of 3.3 percentage points, or 1.07%, from the previous period. The "Maintenance Burden 100 Index" rose to 27.66, up 0.55 points, representing a 2.03% increase. Behind these numbers lies a convergence of factors: an immature NEV aftermarket maintenance system and weak bargaining power for core components.

Newly added models are once again the primary factors. The 22 new NEVs added to the sample have a mean parts-to-whole price ratio of 315.68% and a mean maintenance burden index of 28.79. Meanwhile, the maintenance burden index for the existing 78 models also increased by 0.07 compared to the previous period. This implies that not only are new NEVs expensive to fix, but the repair burden for older models is worsening year by year, creating sustained economic pressure for owners.

The price hikes for wear parts are spreading even further. Compared to the 19th period, the mean single-part ratio for 16 of the 18 common wear parts in the 20th period NEV sample rose, with rear taillights leading at an 11.59% jump. The mean price for 11 common wear parts also increased, with front bumpers seeing the largest rise at 7.22%.

Single-part ratios for high-payout wear parts have increased across the board, with models featuring high individual metrics relatively concentrated. The mean single-part ratio for headlights across 100 NEVs was 2.43%, up 0.17 percentage points, with the FAW Audi Q4 e-tron (FV6469AABEV) recording the highest figure at 7.82%.

Additionally, the mean single-part ratio for front bumpers was 1.09%, up 0.11 percentage points, with the FAW Bestune Pony (CA7000BEVB) peaking at 3.76%. For rear bumpers, the mean was 1.19%, an increase of 0.09 percentage points, led again by the FAW Audi Q4 e-tron (FV6469AABEV) at 4.83%.

Furthermore, the mean single-part ratio for trunk lids reached 2.32%, up 0.13 percentage points, with the FAW Bestune Pony (CA7000BEVB) hitting the high mark of 7.05%. The mean ratio for exterior lights stood at 9.02%, up 0.69 percentage points, with the FAW Audi Q4 e-tron (FV6469AABEV) again topping the list at 22.78%.

Some argue that "since NEVs now come with lifetime warranties, you can just get them repaired at no cost at the dealership," but the reality differs. Many owners report that the conditions for lifetime warranties are so strict that 99% of people can't meet them. Moreover, most brands only offer lifetime coverage for the "three-electric" system (battery, motor, electronic control); wear parts and exterior components are excluded. You still have to pay out of pocket for those repairs.

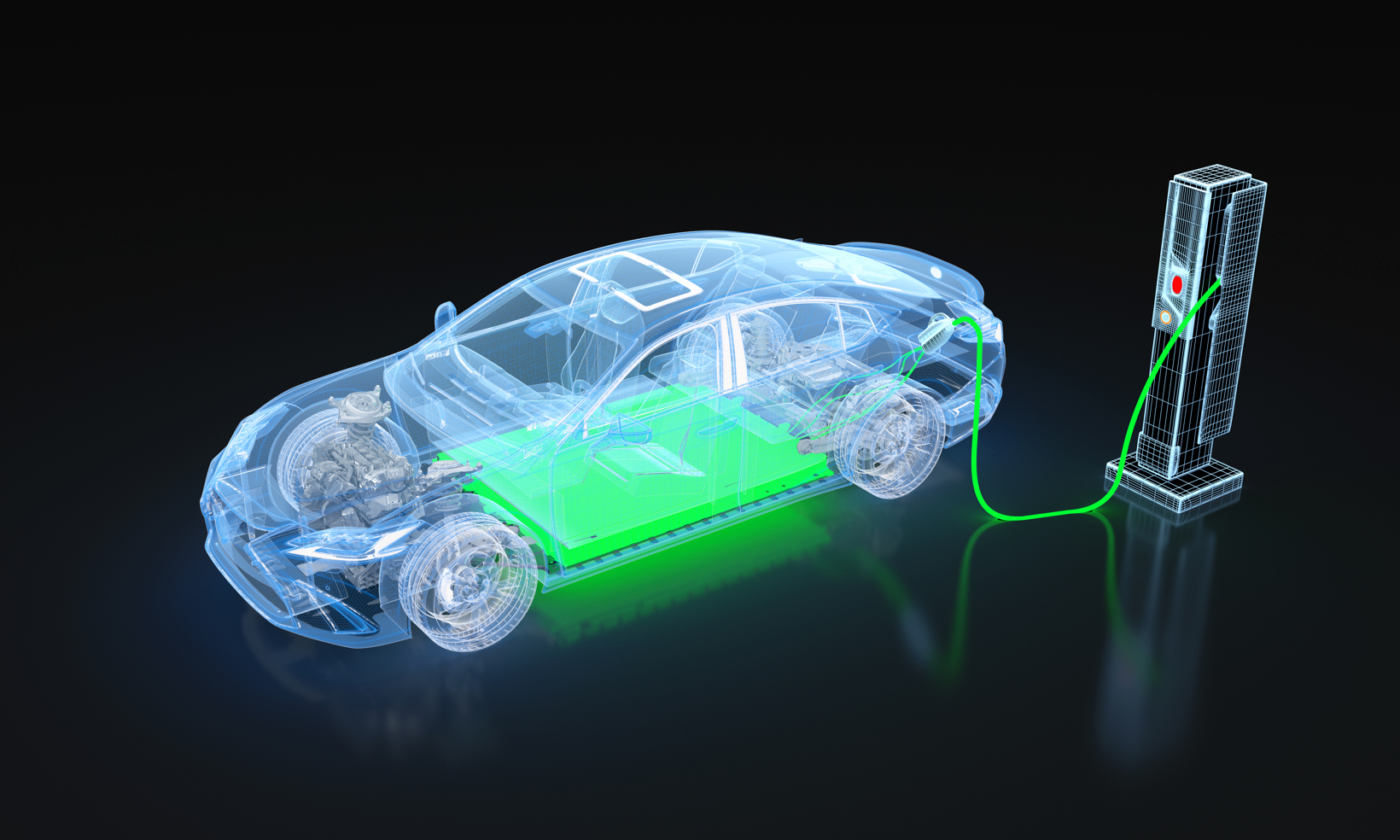

Fortunately, amid the overall upward trend, the shift in power battery costs stands out as a positive sign. As the core component of pure electric vehicles, the battery accounts for the largest share of the vehicle's price and is a key factor influencing insurance payouts.

Among the 20th period NEV samples, 70 were pure electric vehicles. The mean single-part parts-to-whole price ratio for power batteries across these 70 models was 49.59%, a decrease of 0.38 percentage points from the 19th period (49.97%). Additionally, the mean unit energy price for power batteries in these 70 models was 1,538.83 yuan per kWh, a drop of 2.23% overall. This indicates that the unit price of power batteries is falling, offering better value.

This shift is driven by rapid advancements in battery technology and economies of scale. In recent years, falling prices for lithium battery materials and continuous optimization of production processes have driven down unit costs. This not only helps reduce the manufacturing cost of pure EVs but also creates some room for cost savings in future repairs and replacements for owners.

Notably, a divergence is emerging between lithium iron phosphate (LFP) and ternary lithium batteries. The mean single-part ratio for 33 LFP battery models was 47.89%, down 0.34 percentage points from the previous period. In contrast, the mean for 31 ternary lithium battery models was 54.25%, up 0.87 percentage points.

This difference stems from variations in energy density, service life, and production costs between the two chemistries. It also serves as a reminder for consumers: if post-purchase repair costs are a priority, LFP models may be the more economical choice.

However, looking at the present, lithium carbonate prices have been rising steadily since the second half of 2025. Reportedly, they have nearly doubled from the June 2025 low of 58,000 yuan per ton, with a rise of nearly 40% just since the beginning of 2026.

This price wave has already reached the power battery sector. Battery and material companies like Dejia Energy and Hunan Yuneng have officially announced price adjustments, with increases in both product sales prices and processing fees. This cost pressure is likely to gradually permeate the aftermarket segment, potentially driving up quotes for core after-sales services like battery maintenance and replacement. Combined with the tight supply-demand balance for lithium carbonate, the pressure for rising after-sales costs for NEVs is expected to persist.

Behind the Rising Ratios: An Interplay of Interests and Balance

The sustained rise in auto parts-to-whole price ratios is not caused by a single factor, but rather the result of a struggle among automakers, parts suppliers, and the insurance industry.

From the automaker's perspective, some brands aim to maintain profit margins on vehicle sales by raising aftermarket parts prices to offset front-end discounts. Luxury brands, in particular, often view the aftermarket as a key profit growth driver, ensuring high returns by controlling parts supply and setting high pricing standards. This model of "concessions at the front, recouping at the back" ultimately leaves the owner holding the bill.

One owner told Gasgoo Auto: "Automakers might be doing it on purpose. If new cars aren't selling, they cut prices to trap you, then make money back by hiking repair parts."

The monopoly status of parts suppliers is also exacerbating price hikes. Some core components are supplied exclusively by a handful of vendors, lacking sufficient market competition, which grants suppliers strong pricing power. Meanwhile, the high technical barrier for core NEV parts makes it difficult for new entrants to gain a foothold quickly, keeping parts prices from falling in the short term.

An industry insider told Gasgoo Auto that the profiteering driven by parts monopolies needs to end. Some original equipment parts cost two or three times as much as aftermarket alternatives, yet there is no effective price regulation.

Image source: VCG

Payout pressure in the insurance industry is also being passed down. Rising parts-to-whole price ratios directly lead to higher insurance claim amounts. To maintain profitability, insurers are forced to raise premiums, creating a vicious cycle of "rising ratios → higher payouts → increased premiums." For owners, this means double the pressure: not only are repairs expensive, but insurance is getting pricier too, driving up the total cost of ownership.

Furthermore, information opacity in the auto aftermarket is a major factor. Consumers are often at an information disadvantage during repairs, making it hard to know the true cost and reasonable price of parts, which allows repair shops to inflate prices. The parts-to-whole data released by CIRI Auto Technology Institute aims to break this information asymmetry, allowing consumers to clearly see the differences in repair costs across different models.

This CIRI Auto Technology Institute report removes the pricing opacity of the auto aftermarket. The sustained rise in parts-to-whole price ratios is essentially a struggle between owner repair burdens, insurance payout pressures, and the industry's cost structure.

For consumers, buying a car shouldn't just be about the sticker price. Parts-to-whole data should be a key reference point—after all, the feeling of being able to afford a car but not its repairs is undesirable. When choosing a vehicle, beyond performance and specs, one should actively check the model's parts-to-whole coefficient and the prices of common wear parts, prioritizing models with relatively lower repair costs. This is especially true for NEVs: while battery costs may be falling, the overall trend of rising repair costs still warrants caution.

For automakers, optimizing aftermarket pricing systems and improving supply chain efficiency is not just a responsibility to protect consumer rights, but also key to enhancing market competitiveness. As competition in the auto market intensifies, the after-sales service experience has become a crucial factor influencing purchase decisions. Only by reasonably controlling parts prices and increasing transparency in maintenance services can companies win the long-term trust of consumers.

The insurance industry, for its part, needs to optimize premium pricing models and underwriting policies based on the latest parts-to-whole data. By formulating differentiated premiums according to different models' ratio levels and repair cost differences, insurers can achieve a precise match between risk and premium, avoiding the unreasonable premium pressure on owners caused by a "uniform" pricing model.