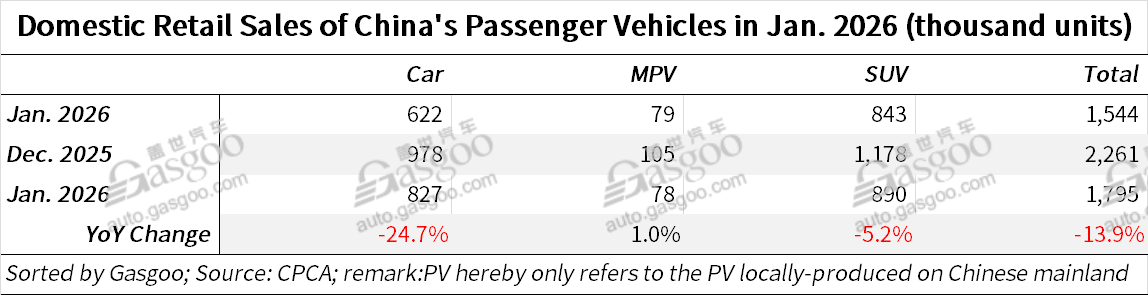

Gasgoo Munich- China's passenger vehicle (PV) retail sales totaled 1.544 million units in January 2026, down 13.9% from a year earlier, according to data issued by the China Passenger Car Association ("CPCA").

For clarity, the PVs mentioned here are all locally produced on the Chinese mainland.

However, January figures in recent years have been volatile, reflecting a pattern of weak starts followed by stronger performances later in the year. Since 2020, year-on-year changes for January have swung sharply, ranging from deep contractions to double-digit growth. Against that backdrop, the 13.9% decline this year sits near the midpoint of historical fluctuations rather than signaling an extreme downturn.

The normalization of the new energy vehicle (NEV) market has also played a role. China's purchase tax exemption for NEVs, in place since September 2014, officially ended in December 2025. In the final month before the policy expired, some buyers advanced their purchases to lock in tax benefits, creating a pull-forward effect that dampened January demand. The CPCA views this as a short-term adjustment rather than an indicator of the market's long-term trajectory.

Overall passenger vehicle performance

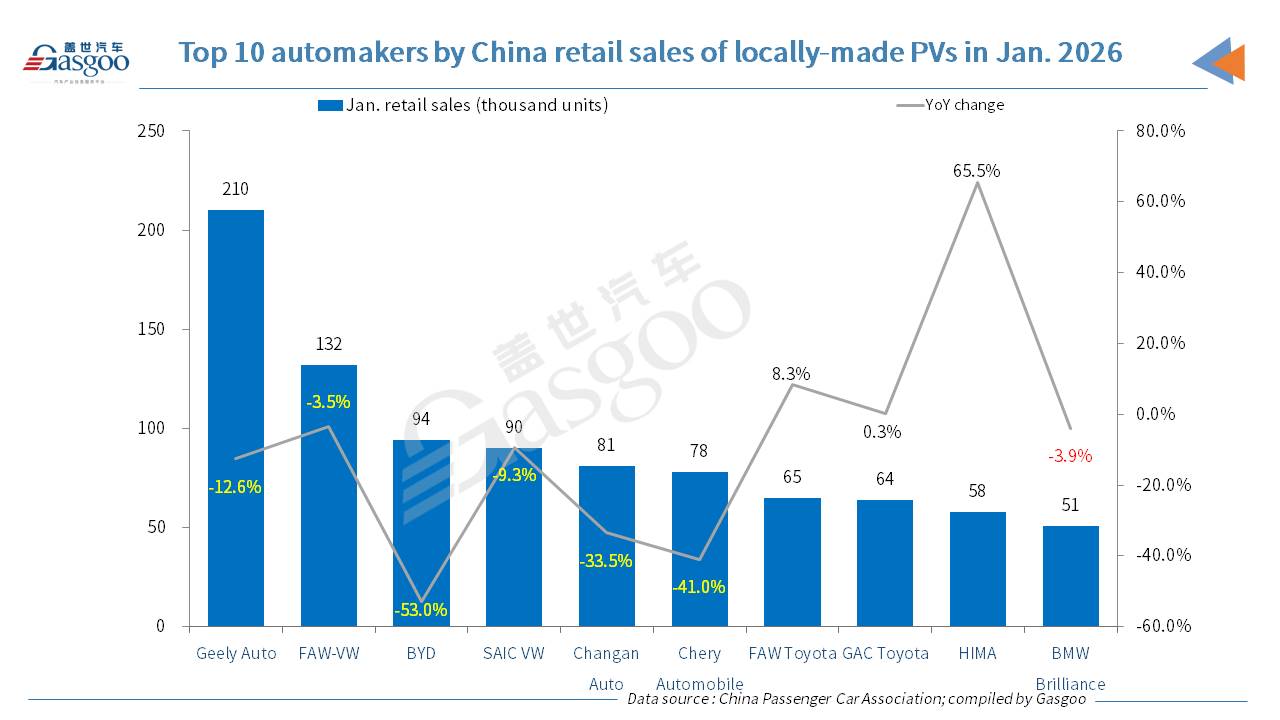

China's local brands recorded retail sales of 890,000 units in January, down 18% year on year, with their market share slipping to 57.5%, a decline of 3.5 percentage points. Even so, local manufacturers continued to expand in the NEV segment and overseas markets, offsetting some domestic pressure. Established automakers undergoing transformation, including Geely, Changan and Great Wall Motor, showed clear gains in brand positioning as they accelerate electrification and product upgrades.

Mainstream joint-venture brands posted retail sales of 470,000 units, down 4% from a year earlier. German and Japanese marques both improved their share, reaching 19.8% and 15.5% respectively, while U.S. brands edged down slightly to a 5% share. South Korean and other European brands saw modest gains. The data suggest that while overall volumes softened, certain foreign brands managed to stabilize or even strengthen their competitive footing.

Premium PV sales fell to 180,000 units in January, a 15% decline year on year, with their share slipping to 11.6%. Traditional premium brands appear to be facing greater headwinds than mainstream joint-venture players, as intensifying competition from high-end domestic NEV offerings reshapes the upper end of the market.

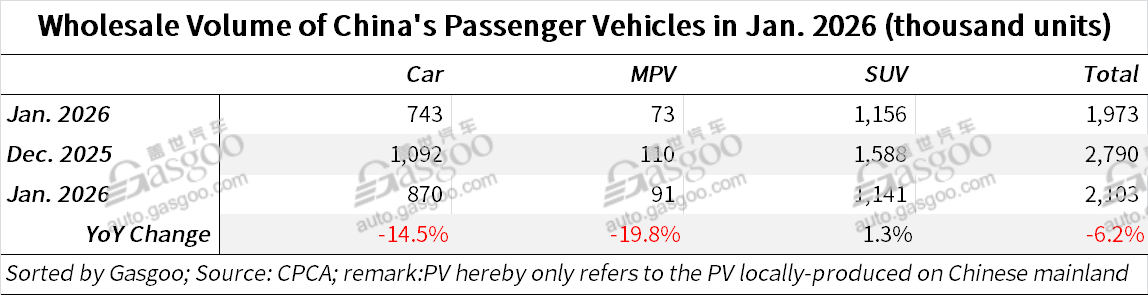

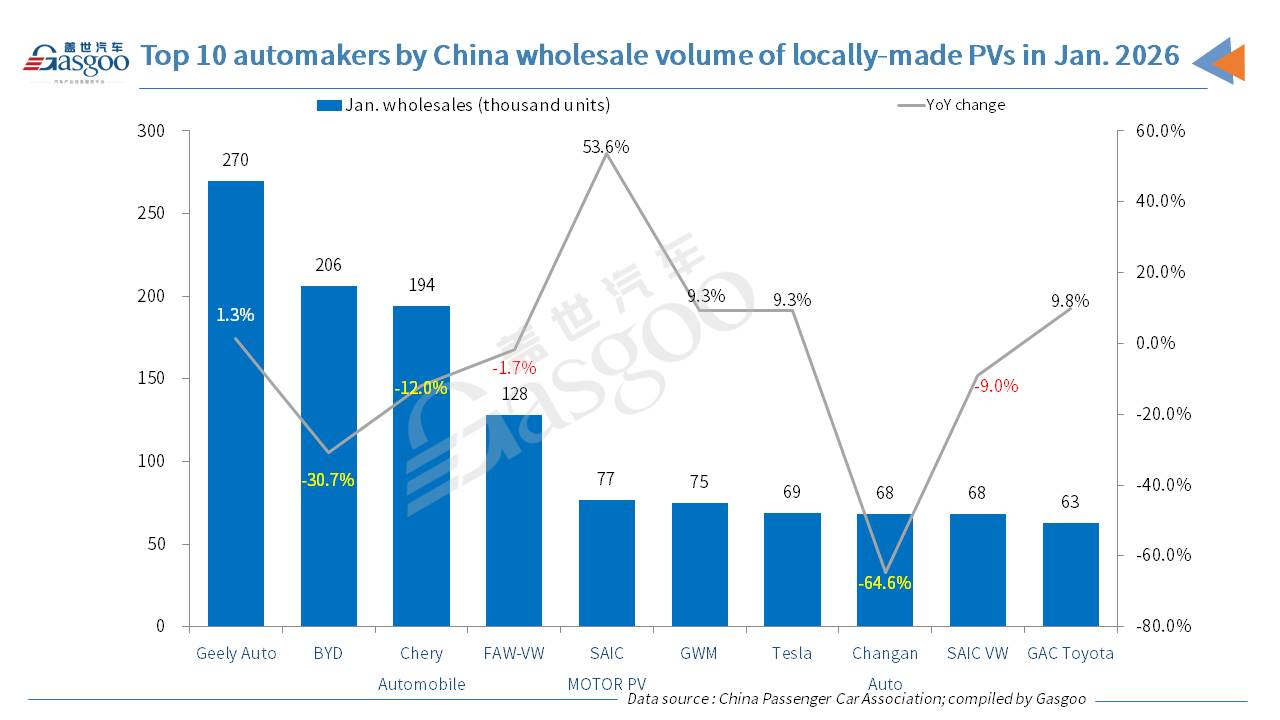

On the wholesale side, automakers shipped 1.973 million passenger vehicles in January, down 6.2% from a year earlier. The narrower decline compared with retail sales indicates inventory adjustments across distribution channels, with wholesale performance outpacing retail by 7.7 percentage points.

China's indigenous automakers wholesaled 1.326 million vehicles, down 8% year on year, while mainstream joint ventures sold 420,000 units, a 4% decline over a year ago. In contrast, premium vehicle wholesale volumes rose 4% to 228,000 units, pointing to differentiated supply strategies across segments.

The wholesale landscape among leading manufacturers continues to evolve, with several mid-tier players showing signs of momentum. Companies such as SAIC-GM-Wuling, Seres, Xiaomi EV, and NIO delivered relatively strong month-on-month performances. The number of automakers exceeding 100,000 units in monthly sales fell to four in January, down from six in December and five a year earlier, accounting for 40% of the total market. Meanwhile, manufacturers in the 50,000–100,000 unit range and the 10,000–50,000 unit bracket expanded their relative presence with a 25% share (growing from the year-ago 18%).

China's PV production reached 2.003 million units in January, down 4.4% year on year, reflecting a cautious start to the year on the manufacturing side. Output diverged sharply by segment: premium brands expanded production by 15% year over year, while joint-venture marques cut volumes by 15%. Domestic brands posted a more moderate 4% year-on-year decline, highlighting differing demand expectations across market tiers.

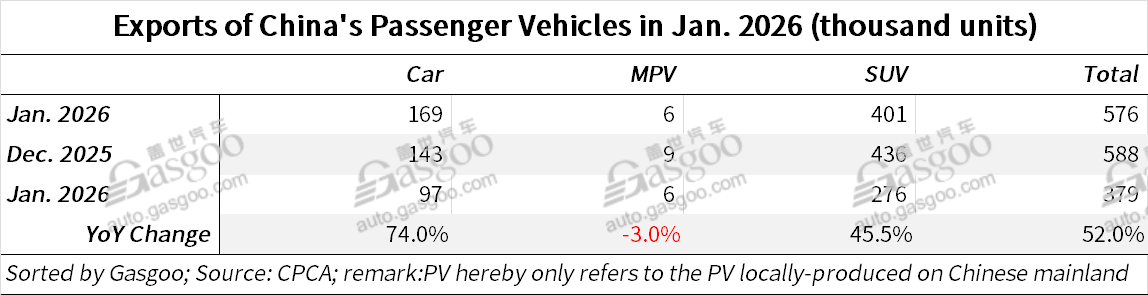

At the same time, overseas shipments continued to power ahead. According to the CPCA's data, total PV exports, including fully built units and CKD kits, climbed to 576,000 units in January, a 52% surge from a year earlier. Nearly half of those exports were NEVs, with NEVs accounting for 49.6% of total outbound shipments, up 13 percentage points year on year.

By brand segments, China's domestic brands shipped 476,000 units outbound (+49% YoY), while joint-venture and premium brands together contributed 100,000 units, marking even faster percentage gains (+65% YoY) from a smaller base.

NEV vs. ICE vehicle detailed data

Domestically, the market showed uneven momentum between electrified and conventional vehicles. Retail sales of new energy PVs fell 20% year on year to 596,000 units, while internal combustion engine models declined 10% from a year earlier to 948,000 units.

On a wholesale basis, NEVs proved more resilient, slipping just 3.3% year over year to 864,000 units, compared with a 9% drop for oil-fueled vehicles at 1.109 million units.

NEV production was broadly stable at 938,000 units, down less than 1% over the prior-year period.

Export data underscore the structural shift underway: NEV exports more than doubled (+103.6% YoY) to 286,000 units, far outpacing the 20% growth recorded by fuel-powered vehicle exports, which totaled 290,000 units.

February market outlook

Looking ahead, February is expected to represent the low point of the first quarter. The month contains just 16 working days, three fewer than a year earlier, due to the extended nine-day Chinese New Year holiday — the longest on record. Automakers typically scale back production around the holiday period, further shortening effective manufacturing and sales windows. As a result, February volumes are widely expected to fall to the lowest level of the year, which may help ease inventory pressure at the retail level, said the CPCA.

Traditionally, the weeks before the Chinese New Year serve as a peak buying season for first-time car owners. In recent years, however, that cohort's share of total purchases has slipped to below 40%, dampening the seasonal boost. Registration and fleet data suggest that in 2025, vehicle scrappage and transfers reached 13.19 million units, roughly matching 13-million-unit new purchases, a sharp drop from 17 million new registrations in 2024. Entry-level oil-fueled vehicles remain particularly weak, while the overall cost of acquiring entry-level NEVs has risen compared with a year earlier, further restraining pre-holiday demand.

Traffic patterns in major cities often shift with school terms, and in previous years a modest purchasing wave has emerged before classes resume after the holiday, lending support to the affordable NEV segment. This year, large-scale holiday travel and a relatively swift return to work could provide additional stimulus. Industry analysts note that some migrant workers, particularly middle-aged and older groups, are increasingly considering local employment or entrepreneurship, a trend that may offer incremental support to post-holiday auto demand as mobility needs evolve.