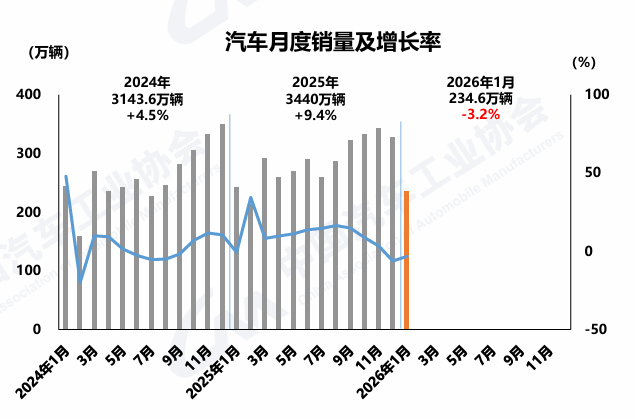

Gasgoo Munich- China's auto sector held steady in January 2026, according to the latest data from the China Association of Automobile Manufacturers (CAAM). Output edged up 0.01% year-on-year to 2.45 million units, while sales slipped 3.2% to 2.346 million.

Image Source: CAAM

The association attributes the January contraction to three main factors. First, the shift in new-energy vehicle purchase tax policies rattled market expectations. Second, a transition period for local subsidies in key consumer cities created a temporary vacuum. Finally, demand pulled forward in the fourth quarter of 2025 has weighed on early-year performance.

Breaking down the data, passenger vehicle output and sales declined both month-on-month and year-on-year. The new-energy vehicle market remained stable, while exports stood out as a bright spot—continuing their year-on-year growth and cementing China’s status as a major auto exporter.

Data shows passenger vehicle output and sales reached 2.062 million and 1.988 million units respectively. That represents a 4.1% and 6.8% drop from a year earlier, and a steeper 28.4% and 30.2% decline from December.

New-energy vehicle production and sales came in at 1.041 million and 945,000 units, up 2.5% and 0.1% respectively. NEVs accounted for 40.3% of total new vehicle sales.

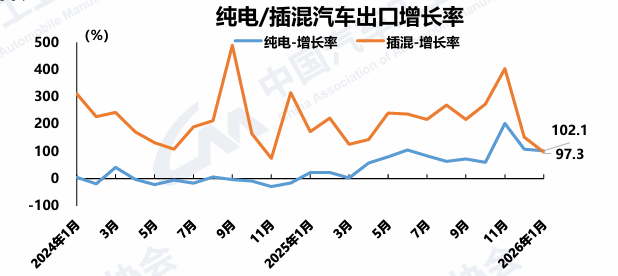

Image Source: CAAM

Exports totaled 681,000 units in January. While that’s a 9.5% dip from December, it marks a 44.9% surge year-on-year. New-energy vehicle exports jumped 100% to 302,000 units, edging up 0.5% month-on-month. Breaking that down, pure electric vehicle exports doubled to 202,000 units—up 16.9% from the prior month—while plug-in hybrid exports climbed 97.3% to 99,000 units, despite a 21.8% monthly decline.

Overall, January’s performance aligns with typical seasonal lows and policy adjustment periods, setting a steady tone for the start of the 2026 market.