As the Lunar New Year approaches, looking back and mapping the year ahead is every industry's ritual. In the hyper-competitive auto sector, sales and earnings remain the most central — and most visible — yardsticks.

Put simply, the sales targets from this group of automakers are already nearing the size of China’s domestic market. Ambition for 2026, it seems, is still running high.

Newcomers are aggressive, traditional carmakers play it safe

Among companies that have published targets, Leapmotor stands out as one of the most aggressive.

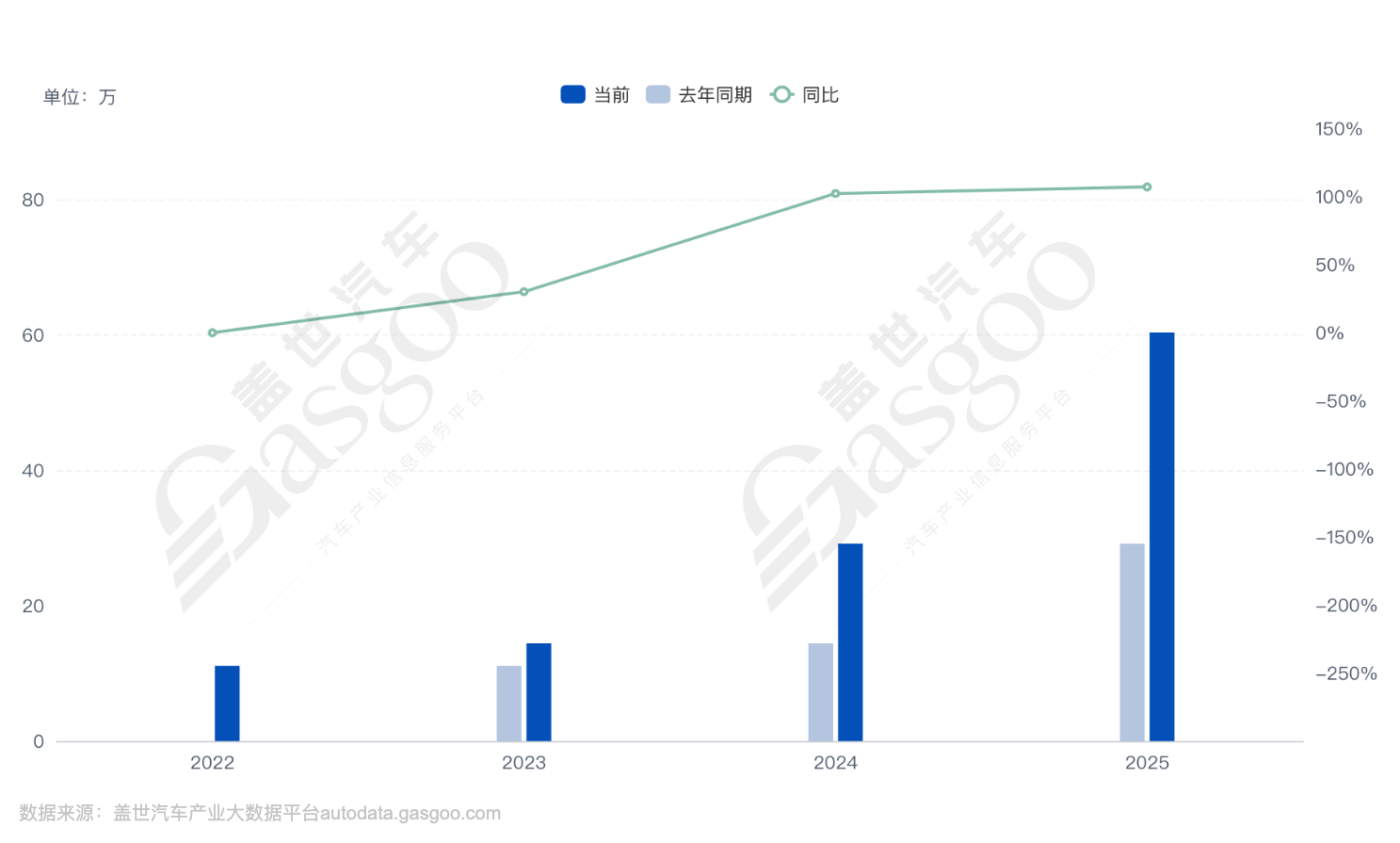

In 2025, Leapmotor's full-year deliveries reached 597,000 — up 103% and overshooting its goal. Building on that, Leapmotor set a 2026 sales target of 1 million, implying 68% year-on-year growth.

Founder Zhu Jiangming, in a 10th-anniversary internal letter, also laid out a new-decade ambition to shift "from following to leading," aiming for global sales of 4 million by 2035 and joining the ranks of world-class automakers.

Xiaomi Auto is showing similar appetite for growth. In 2025, its full-year deliveries topped 410,000, achieving 117% of the target. Founder Lei Jun said in a recent livestream the 2026 delivery goal is 550,000 — a 34% increase.

Given Xiaomi is still ramping capacity and competition keeps intensifying, that target remains challenging.

NIO's cumulative deliveries have topped 1 million vehicles. Image source: NIO

By contrast, NIO is confident about its prospects. Chairman William Li said the company plans to sustain annual growth of 40%–50%, which implies a 2026 delivery range of 450,000–490,000. That pace, he stressed, is "not aggressive, but more sustainable." NIO also plans to achieve full-year profitability in 2026.

Harmony Intelligent Mobility, while yet to disclose a 2026 target, is widely expected to aim for 1–1.3 million. Based on roughly 590,000 sales in 2025, that suggests about 70% growth. Even so, the Gasgoo Auto Research Institute estimates Harmony Intelligent Mobility will reach about 800,000 in 2026 — short of the million mark.

XPENG's 2026 sales target is 600,000, a 40% increase from the prior year — roughly 170,000 more vehicles.

Traditional automakers, meanwhile, are more restrained. Market chatter suggests BYD’s 2026 sales target is 5–5.5 million, with year-on-year growth starting as low as 9%.

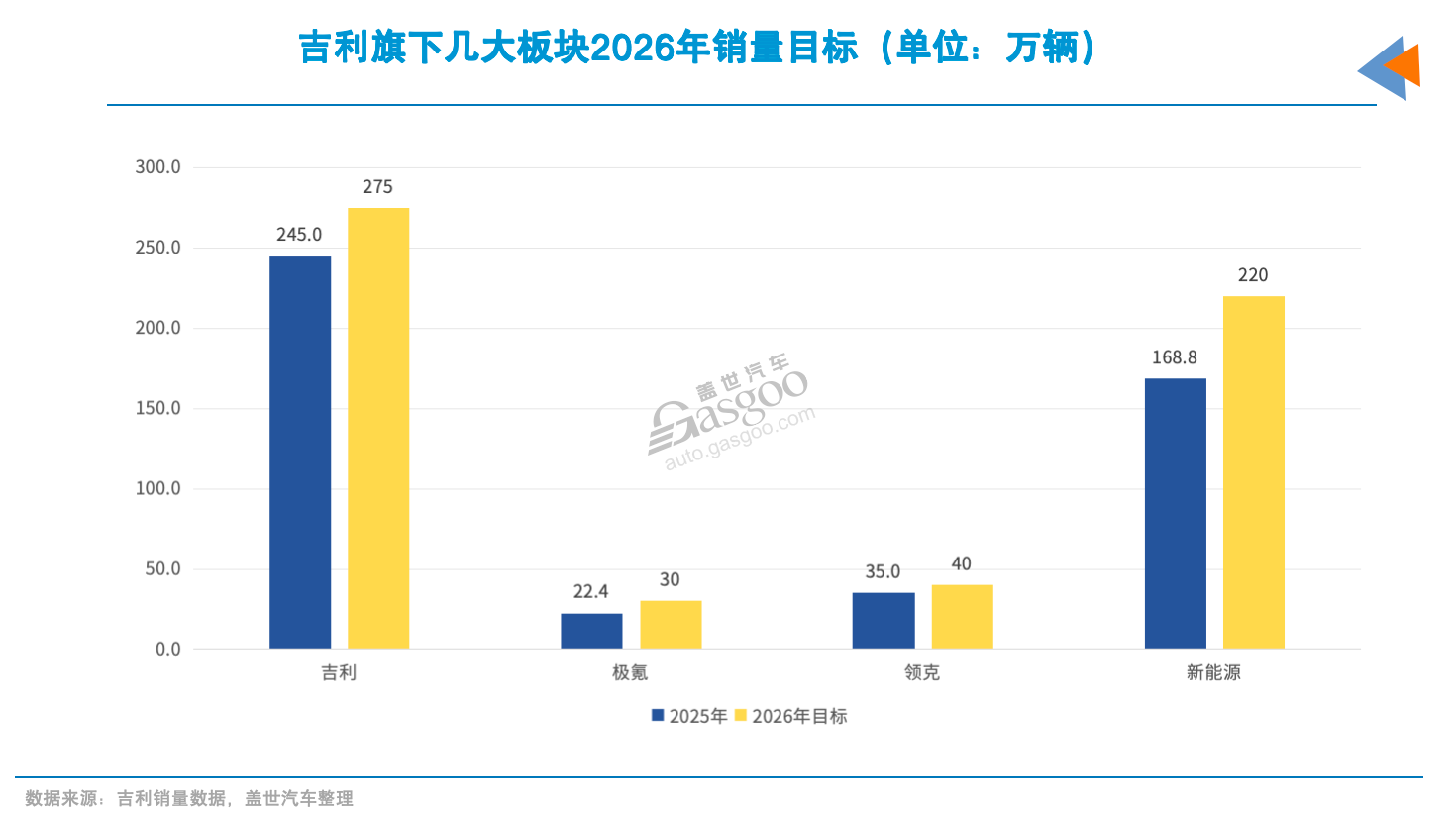

Geely’s 2026 sales target is 3.45 million, up 430,000 from last year — a modest 14% rise. By brand: Geely at 2.75 million, ZEEKR at 300,000, and Lynk & Co at 400,000. For new energy, the target is 2.22 million — a 30% increase from 2025.

Chery Group is also taking a steady approach. In 2025, group sales exceeded 2.8 million, up 7.8%; the 2026 goal is 3.2 million — an increase of just 400,000.

Dongfeng is relatively proactive among legacy players. It set a 2026 overall sales target of 3.25 million, including 1.7 million NEVs (up 63.5% year on year) and 600,000 exports. With total sales expected at about 2.5 million in 2025 and NEVs just crossing the 1-million threshold, Dongfeng will need more than 30% overall growth in 2026.

For joint ventures like GAC Toyota and SAIC Volkswagen, target growth is generally low — mostly single-digit or marginal — with the priority on defending the core base and managing operational risk.

NEV penetration targets also vary. Geely is aiming for 64% in 2026, about 8 percentage points higher than last year; Dongfeng's goal is for NEVs to exceed half of total sales.

Another point worth noting: the sum of published sales targets is already close to domestic market capacity. Against that backdrop, overseas expansion is becoming imperative.

What's behind the slower target growth

Compared with 2025, even NIO and Leapmotor have trimmed their growth ambitions. Most companies’ caution reflects the broader market in 2025, their own performance, and expectations for 2026.

Unusually, the typical year-end "tail-up effect" failed to materialize in 2025. Analysts at Roland Berger said the main reason was the early end of state subsidies, prompting consumers to hold off.

Policy settings also changed for 2026. NEV purchase tax moved from full exemption to a 50% reduction, with the rate restored to 5% and per-vehicle tax cuts capped at CNY 15,000. The impact is especially pronounced in the sub-100,000-CNY market, where pure EVs account for more than 80%.

With demand front-loaded and national subsidies not extended, Gasgoo learned from dealers that since January, local NEV 4S stores have seen a sharp drop in order openings — "some haven’t opened a single order."

Institutions are taking a guarded view of 2026. Gasgoo's research arm argues that with policy withdrawal and demand pulled forward, domestic passenger car sales will face short-term pressure, with full-year volume estimated at 29.9 million — ushering in a new cycle of stock optimization.

Roland Berger analysts told Gasgoo and other media that, assuming GDP growth around 5%, auto market growth in 2026 may be 1–1.5 percentage points higher than last year — a clear slowdown from earlier expectations. UBS Investment Bank even sees domestic passenger car sales growth turning negative.

All point to the same conclusion: the high-growth era is fading, and the market is entering a new normal of high volume, low growth.

Some companies are already bracing for it. "The only thing I’m sure of is that competition in 2026 will be even more brutal and bloody. Every automaker will be on edge," said XPENG Chairman and CEO He Xiaopeng. NIO's William Li calls this year the "final stage." Leapmotor's Zhu Jiangming, in an internal memo, underscored the need for stronger cost control.

Legacy players' caution also stems from anticipating how competition will unfold. After multiple rounds of price wars, many are wary of "inflated targets" and their knock-on risks: miss them, and you invite market doubts, disrupt internal KPIs, pile pressure on channel inventories, and sap dealer confidence.

Leapmotor sales, 2022–2025

New-energy challengers can set bold targets in part because they're still expanding. Leapmotor grew from roughly 300,000 sales in 2024 to nearly 600,000 in 2025 — scale that doubled, with momentum still carrying through. Its network surpassed 1,000 outlets by end-2025, and both capacity and channels have room to be unlocked.

Xiaomi Auto, buoyed by Lei Jun's personal IP and a loyal base of "Mi fans," is enjoying a clear brand dividend. As product strength gets validated, the climb in sales has a solid foundation. NIO, XPENG and Harmony Intelligent Mobility share similar tailwinds.

Promotional playbooks are in motion

With growth set to slow and competition heating up, stimulating consumption and stabilizing the market have become the core tasks at the start of 2026. From policy to corporate action, a wave of promotions and incentives is rolling out to inject demand.

Luxury brands led by BMW and Tesla moved first, and others quickly followed. In short order, more than a dozen automakers introduced price cuts, subsidized financing and trade-in bonuses.

Image source: Tesla

Tesla China, for its part, offered financing on three current models with "7-year ultra-low interest" or "5-year zero interest." BMW cut MSRPs across 31 mainline models, with peak reductions of 24%. Volvo is providing a 14,000-yuan purchase tax subsidy along with usage perks.

Among domestic brands, NIO’s Firefly rolled out a 10-year Intelligent Pilot Assist service, a 2,000-yuan purchase tax subsidy and repurchase rewards; Xiaomi’s YU7 range offers "3-year zero interest"; GAC Trumpchi announced up to 70,000 yuan in "government-enterprise subsidies"; and Wuling is fully covering purchase tax on several NEV models. Dongfeng, Chery and Deepal have also launched targeted deals.

Most are now splitting incentives into "combo packages" to lower the buying threshold while keeping list prices relatively stable — for example by using financing to reduce down payments and monthly installments, or bundling subsidies with trade-ins and owner benefits to limit long-term pricing damage.

From the company side, this concentrated push reflects the urge to clean inventory and secure a strong start — and, indirectly, that end-demand is under pressure and needs prices and financing to close the deal.

Consumers, however, have grown used to it after years of price wars, despite the breadth and depth of today's discounts. One dealer told Gasgoo, "Customers now think the factory's subsidies are just something they're supposed to get."

Against that backdrop, the industry is pinning more hope on continued and optimized national stimulus. The China Automobile Dealers Association and others have clearly suggested China should maintain trade-in subsidies in 2026 to offset demand swings and keep the market steady — calls that have drawn a policy response.

At the end of 2025, the Ministry of Commerce and seven other agencies released the Detailed Rules for Implementing 2026 Car Trade-in Subsidies, confirming the policy's extension but with a key shift: from fixed amounts to proportional subsidies tied to the new-car price, with a tilt toward consumption upgrades.

In practice, individual consumers who scrap an old car and buy a new NEV passenger car will receive a subsidy equal to 12% of the new-car price, capped at CNY 20,000; for eligible ICE cars, the subsidy is 10%, capped at CNY 15,000. If the old car is transferred (rather than scrapped) before purchase, the NEV and ICE subsidies fall to 8% and 6%, with caps of CNY 15,000 and CNY 13,000 respectively.

The change is aimed at encouraging disposal of older vehicles and upgrades to NEVs and higher-value models. CPCA Secretary General Cui Dongshu expects national subsidies will remain the backbone of 2026 sales growth. Multi-brand dealers agree: "National policy is more guiding."

Ministry of Commerce data show more than 11 million vehicles benefited from trade-in subsidies in the first 11 months of last year — about one-third of total sales.

Where will the incremental volume come from?

Promotions and subsidies are painkillers, not cures. To hit 2026 targets, automakers need more durable sources of growth, mainly in two directions: building products with sustained competitive strength and deepening globalization.

Product strength is the bedrock. Recent years show that even in fierce competition, vehicles with advantages in price, performance or user experience can still scale steadily. With 2026 in mind, most companies are cranking up product plans to open new market space.

NIO plans to launch three new large-sized models in the second and third quarters of 2026, while accelerating development of a sub-200,000-yuan platform. Li notes the 100,000–300,000-yuan band represents roughly a 15-million-vehicle market in China — a mainstream arena where NIO needs more products.

XPENG will roll out the 2026 P7+ and a G7 "Super Range-Extended" variant in early 2026, using "one car, dual energy" (BEV + range extender) to broaden coverage, while expanding the MONA series. To chase 1 million sales, Leapmotor is planning new A- and D-series models and refreshing the B and C series — completing a product matrix spanning 50,000–300,000 yuan.

For traditional homegrown brands with scale, the focus beyond new launches is increasingly on technical strengthening and top-level strategy.

BYD's 2026 priorities include consolidating its technological lead. Chairman Wang Chuanfu said late last year the company will unveil technology surpassing its blade battery and DM systems. Backed by a 120,000-strong engineering team, BYD is targeting pain points in electrification and advancing its intelligent tech reserves.

Geely is reinforcing its Aegis "Gold Brick" battery, Thor AI hybrid and full-stack AI technology system, while pushing a "sky–earth integrated" ecosystem. The Galaxy brand carries the volume mandate, with ZEEKR seeking scale expansion while maintaining a premium positioning.

Great Wall Motor's incremental volume is set to come more from high-end NEVs. WEY has built 500+ stores and plans at least four mid-to-large hybrid/BEV SUVs in 2026; TANK will launch the 800 — nicknamed the "Baoding Cullinan" — with continued upgrades in intelligence across the lineup.

Broadly, automakers are accelerating new launches to gain the upper hand: refreshing and upgrading mainstay models through platforms and scale to cut costs and lift specs, while moving into undercovered niches — especially high-value-for-money models in mainstream price bands.

At the same time, the combined advance of intelligence and electrification is becoming a decisive separator. As NEV penetration rises, driver-assistance, in-car UX and continuous software iteration are more directly shaping purchases. For carmakers with strong in-house capabilities or early bets on smart tech, those investments should start converting into sales support over the next one to two years.

Roland Berger analysts told Gasgoo that a dense wave of new launches will help keep competition vibrant. Market-wide net profit could improve in the third quarter of 2026, though the turning point for retail prices has yet to arrive.

With the domestic market shifting to stock competition, globalization is moving from "optional" to "mandatory." BYD is the standout overseas: its 2025 overseas sales broke 1 million. Goldman Sachs expects 2026 sales outside the U.S. to reach 1.5 million. The company is advancing localized production in Brazil, Thailand and Hungary, building a coordinated R&D–manufacturing–sales footprint.

Leapmotor, leveraging its tie-up with Stellantis, has entered more than 35 overseas markets, delivered over 60,000 vehicles abroad in 2025, and plans localization in Malaysia and Spain. XPENG's overseas deliveries rose 96% in 2025, covering 60 countries and regions, with projects underway in Indonesia, Austria and Malaysia. NIO and Li Auto have also laid out plans for Europe and the Middle East.

Among traditional export leaders, Great Wall Motor is targeting 600,000 exports in 2026. Through its "One GWM" strategy — combining heavy-asset plant builds with KD kits — it's pushing an all-powertrain, all-category overseas layout. Some analysts say its plug-in hybrids hold advantages in range and cost overseas.

Roland Berger argues the internationalization of China's auto industry is irreversible; over the long run, overseas sales could reach a ten-million-level scale.

Clearly, 2026 won’t be an easy year for carmakers. As the domestic market settles into stock competition, the gap between companies will hinge more on product-system competitiveness and the execution of global expansion. The divergence in sales-target growth, at heart, reflects an accelerating shakeout — and a rewiring of the industry’s competitive logic.