Here are the major stories from the global automotive sector this week.

Mandatory National Standard for Vehicle Door Handles Officially Released

Gasgoo learned on February 4 that the mandatory national standard "Safety Technical Requirements for Vehicle Door Handles" (GB 48001-2026) was approved and published on January 28, 2026. Organized by the Ministry of Industry and Information Technology of China, it was released by the State Administration for Market Regulation and the Standardization Administration. The standard will officially take effect on January 1, 2027.

Image Source: Screenshot from MIIT

Rapid advancements in vehicle electrification have reshaped the structure and system architecture of door handles. This standard emerged to regulate product design and enhance safety amid these shifting trends. The drafting process spanned nearly a year, beginning with the project announcement on May 8, 2025. It brought together over 40 domestic automakers, parts suppliers, and testing institutes. More than 100 industry experts joined multiple rounds of discussion, drafting, public consultation, and review before its final release.

The standard explicitly applies to door handles on M1 and N1 category vehicles and multi-purpose cargo vans, with other vehicle types referencing it for compliance. It covers core aspects including scope, technical requirements, and test methods. Regarding safety, outer door handles on every door—excluding the tailgate—must be equipped with a mechanical release device to allow opening after an accident. The standard also specifies layout zones and hand operation space. For performance, vehicles with electric-release latches must allow doors to be opened via the mechanical release handle without tools after testing. The handle itself must withstand a force of no less than 500N without fracturing or detaching.

For inner door handles, the standard mandates at least one independently operated mechanical release handle for each door, excluding the tailgate. The placement must be unobstructed, clearly visible, and meet distance requirements. Additionally, permanent markings and operating instructions are required, with the marking measuring no less than 10mm by 7mm and the instruction text standing at least 6mm high. Strength-wise, non-electronic button inner handles must withstand a force of no less than 200N, while electronic button variants must endure at least 50N.

Regarding implementation, models applying for type approval from January 1, 2027, must comply with all clauses except the hand operation space requirement. By January 1, 2028, they must meet all requirements. Models already granted type approval must achieve full compliance by January 1, 2029.

Gasgoo Comment: Better late than never. As electrification reshapes door handle designs, this national standard fills a critical gap. The mandatory requirement for mechanical release devices secures a baseline for escape in accident scenarios.

Renault to Use Chinese Components for EV Motor Assembly in France

On February 4, media reports stated that a spokesperson for French automaker Renault confirmed plans to manufacture a new small electric vehicle motor in France. It will use components supplied by China's Shanghai e-drive. The move aims to cut costs and safeguard margins against the backdrop of a sluggish European market.

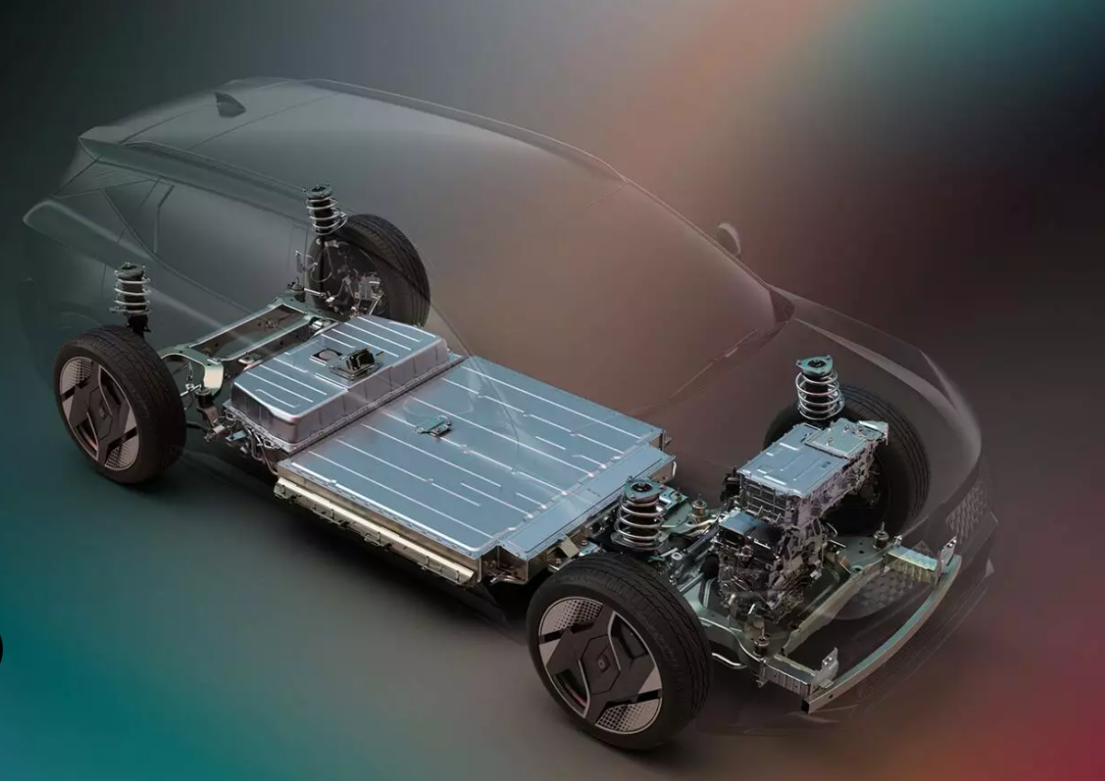

Image Source: Renault

Renault has already imported small electric powertrain systems produced by Shanghai e-drive for its new Twingo model. Thanks to the involvement of this Chinese supplier and its engineers, the vehicle's development cycle was compressed to under two years.

Reuters reported in November 2025 that Renault had terminated a project with French supplier Valeo to co-develop a rare-earth-free high-power motor, shifting instead toward lower-cost Chinese suppliers.

Following a management meeting at a Renault plant last week, the French General Confederation of Labour (CGT) issued a statement saying Renault will assemble this entry-level motor at its Cleon plant in northern France. The company plans to launch a new production line in early 2027 with a maximum annual capacity of 120,000 units.

The motor will be produced on the same assembly line as other motors destined for larger models, such as the Alpine A290, according to reports.

As a smaller player among Europe's mainstream traditional automakers, Renault has established numerous partnerships in recent years to share EV development costs, including collaborations with Geely and Ford.

It remains unclear whether this new small motor from China will be rare-earth-free, like Renault's existing motors.

Gasgoo Comment: The "local assembly plus Chinese supply chain" model is taking hold among European automakers. Renault's move cuts costs and shortens development cycles, reflecting the global reach of China's new energy components.

ZF Signs Long-Term Supply Agreement with BMW

ZF Friedrichshafen AG stated in a February 2 announcement that it has signed a long-term supply agreement with the BMW Group covering passenger car driveline systems. The core of the agreement focuses on the supply and continued iterative development of the market-proven 8-speed automatic transmission (8HP). Worth billions of euros, the contract extends into the late 2030s. This lays a solid foundation for future open technology roadmaps and low-carbon mobility.

Image Source: ZF

As part of the collaboration, the 8HP transmission kit will undergo continuous optimization and upgrades. The goal is to provide customers with the highest-performance and most efficient transmission products to meet the demands of various future drivetrain concepts.

"The new agreement with BMW confirms the importance of long-term planning for technological progress," explained Sebastian Schmitt, head of ZF's Electrified Driveline Technologies division. "It creates clear direction and stable expectations for both parties. This allows us to tailor the next generation of the 8HP specifically for efficiency, performance, and long-term applicability."

This move further cements ZF's position as a systems supplier and provides additional planning reliability. Close collaboration in the future will help mitigate risks in a rapidly changing market environment and pave the way for subsequent low-carbon mobility solutions.

Gasgoo Comment: A mutual embrace during the transition. ZF leverages the 8HP to consolidate its supply chain standing, while BMW secures a stable supply of a core component—essentially extending the value of traditional drivetrain technology.

Foxconn's 1 Billion Yuan NEV R&D Center Opens in Zhengzhou

On February 4, the Foxconn New Energy Vehicle R&D Center—representing a total investment of 1 billion yuan—officially commenced operations in the Zhengzhou Airport Economy Zone in Henan Province.

Invested and built by Foxconn New Energy Vehicle Industry Development (Henan) Co., Ltd., the center launched in July 2024. Located within the Zhengzhou Airport Economy Zone's Auto City, it is positioned as a global smart benchmark factory and an engine for industrial innovation. Its primary focus will be on core R&D tasks, including new energy vehicle product planning, platform development, and vehicle manufacturing.

Image Source: Foxconn

Li Guangyao, General Manager of Foxconn's New Energy Vehicle Business, stated at the opening ceremony that the R&D center is built upon a contract design and manufacturing service model. By leveraging digital R&D, smart factories, and efficient supply chain collaboration, the center has successfully shortened the development cycle for new models. It now takes just 24 months.

He noted that moving forward, the center will work with partners to build an open, collaborative industrial ecosystem in key technology areas such as next-generation electronic/electrical architecture and intelligent driving. The operational launch of this R&D center marks a critical step in Foxconn's strategic layout in Henan Province.

Since entering Henan in 2010, Foxconn has driven significant local employment. In recent years, the company has intensified its investment in the province, successively establishing joint ventures focused on the precision manufacturing of high-end electronic products. It has also initiated construction on a series of projects, including a new business headquarters, expanded mobile phone production lines, and modern employee residential communities.

A representative from the Zhengzhou Airport Economy Zone Management Committee noted a rapid progression. From the establishment of the new energy vehicle pilot center in 2024 to the launch of this R&D center, Foxconn's NEV business has achieved a full industrial chain layout. This spans from R&D and prototyping to mass production.

Gasgoo Comment: Extending from electronics manufacturing to new energy R&D, the launch of the Zhengzhou center is a pivotal step in Foxconn's corporate transformation—and one that injects innovative momentum into the regional industry.

SKF Automotive Asia Pacific Headquarters and R&D Center Launch Operations

On February 4, SKF Automotive's Asia Pacific headquarters and R&D center officially launched operations in Anting, Jiading. The new headquarters spans over 30,000 square meters, integrating Asia Pacific management, sales, and R&D functions. Its business coverage extends to more than 20 countries and regions, including China, Japan, South Korea, and Southeast Asia.

Image Source: Jiading Release

Miao Xiaopeng, Legal Director of SKF Automotive China, revealed that to optimize its local production footprint, SKF Automotive Bearing (Shanghai) Co., Ltd. was established in June 2025. The new entity focuses on manufacturing passenger car wheel hub bearings and suspension bearing units. Consequently, SKF has established an integrated strategic layout in Anting combining "headquarters management, R&D innovation, and smart manufacturing."

Building on this strategic foothold, SKF will maintain its focus on four key directions: deepening localization and global collaboration, increasing investment in new energy vehicles and smart chassis innovation, promoting the integration of R&D and digitalization, and building a regional industrial ecosystem.

Gasgoo Comment: By planting its Asia Pacific headquarters in Anting, SKF's integrated "headquarters plus R&D plus manufacturing" layout signals a deepening commitment to the Chinese market while leveraging regional strengths to enhance local capabilities.

Profit Margin Hits 17.9%! Infineon Releases Fiscal 2026 First-Quarter Report

On February 4, Infineon Technologies AG officially released its financial report for the first quarter of fiscal 2026 (October 1, 2025, to December 31, 2025). The report shows revenue of 3.66 billion euros and profit of 655 million euros for the quarter. This results in a profit margin of 17.9%, marking a smooth start to fiscal 2026.

Image Source: Infineon

Regarding its outlook, and assuming an exchange rate of 1.15 euros to the US dollar, Infineon projects revenue of approximately 3.8 billion euros for the second quarter of fiscal 2026, with a profit margin between 14% and 19%. Full-year revenue is expected to achieve moderate growth compared to the previous fiscal year, with an adjusted gross margin forecast at 40%–43% and profit margin maintained at 17%–19%.

On investment planning, Infineon plans to increase its annual investment to 2.7 billion euros, up from a previously planned 2.2 billion. The focus will be on expanding capacity for power solutions in artificial intelligence data centers. Revenue in this sector is projected to reach 2.5 billion euros in fiscal 2027, compared to approximately 1.5 billion euros in the current fiscal year. Adjusted free cash flow is expected to be around 1.4 billion euros, down from a previous estimate of 1.6 billion. Free cash flow is forecast at 1 billion euros, down from 1.1 billion.

Infineon CEO Jochen Hanebeck stated that while other markets remain relatively sluggish, robust demand in the artificial intelligence sector has become a core driver of the company's growth. Currently, power solutions for AI data centers remain a priority, though the expansion of power grid infrastructure is set to become a key focus area in the coming years.

He noted that Infineon is adjusting manufacturing capacity to meet sustained demand in this sector and is investing ahead of the curve. "A significant portion will be used to accelerate the volume production ramp-up of our new Smart Power Fab in Dresden. The plant is set to open this summer. This timing aligns perfectly with market developments."

Gasgoo Comment: With its profit margin holding steady at 17.9%, Infineon finds core support in the power demands of AI data centers. The increased capacity investment underscores its bet on high-growth sectors.

![[Gasgoo Express] Xiaomi EV releases first Vision GT supercar concept](https://gascloud.gasgoo.com/production/2026/03/05414465-1cec-4d23-a308-c90908f26ea1-1772534888.png)