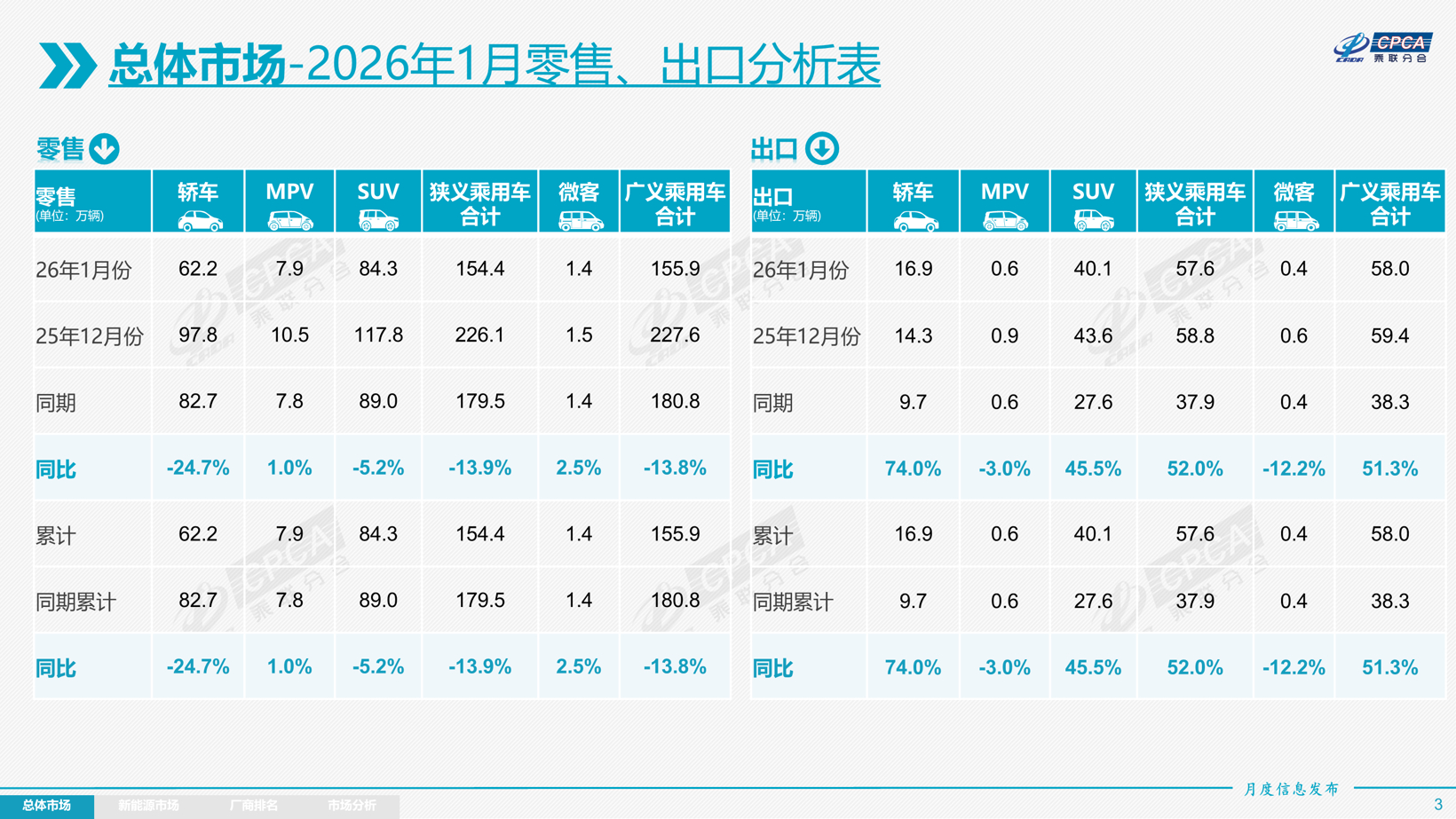

Gasgoo Munich- On February 12, the China Passenger Car Association (CPCA) released the latest data for the national passenger car market in January 2026. The data shows retail sales reached 1.544 million units, down 13.9% year-on-year, meaning the auto market failed to deliver a "good start" to the new year.

Image Source: CPCA

Commenting on the performance, CPCA Secretary-General Cui Dongshu noted that due to complex market factors, the "low start, high end" pattern has been distinct in recent years. Since 2020, it has been common for January retail sales to fall short of previous years. For instance, the rates were -21% in 2020, 27% in 2021, -5% in 2022, -38% in 2023, 58% in 2024, and -12% in 2025. "Therefore, the -13.9% in 2026 falls in the middle of the historical volatility for January growth," he said.

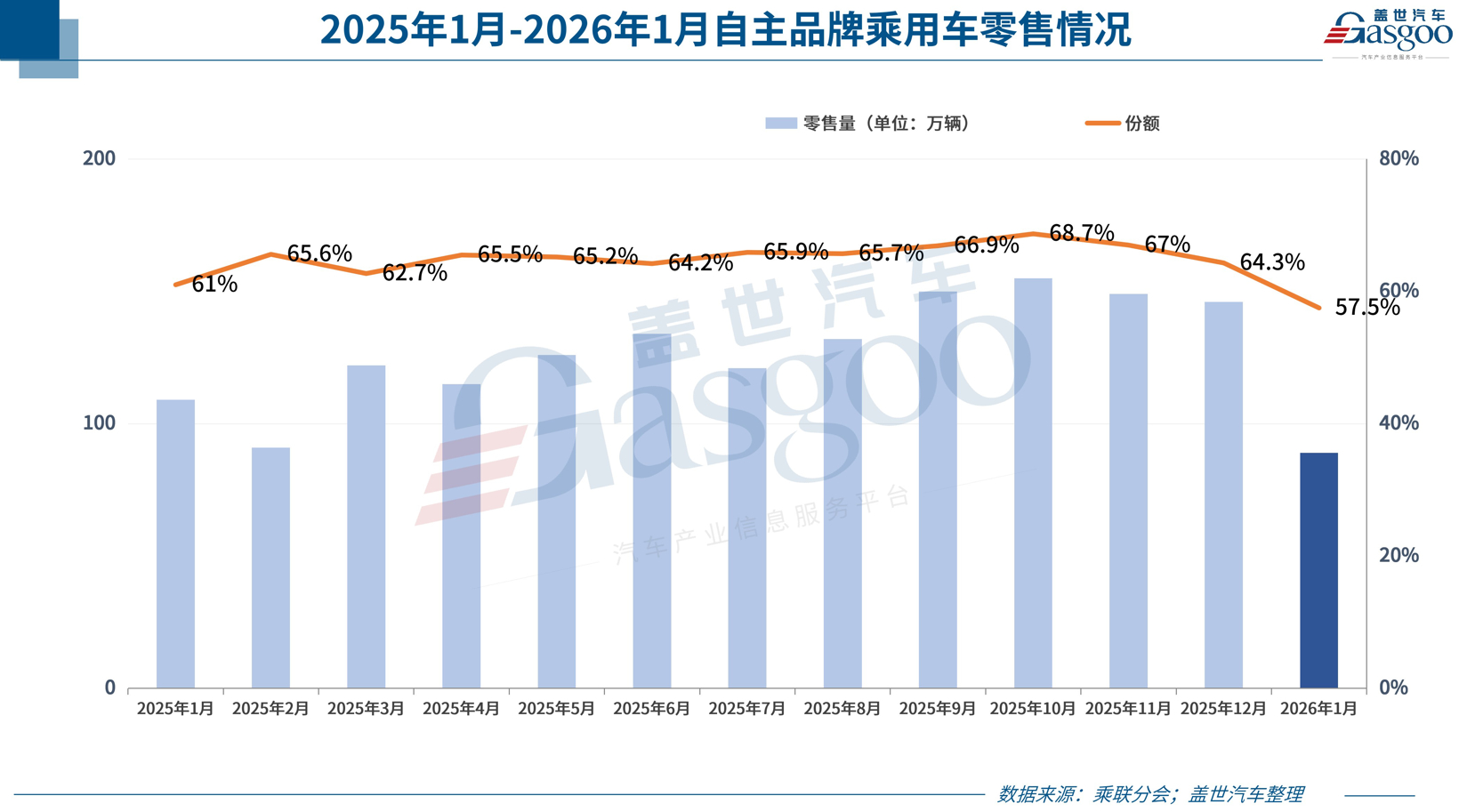

Domestic Brand Share Takes a Short-Term Dip

The competitive landscape saw a shift in January. While domestic brands remain the market's dominant force, their market share experienced a short-term retreat.

Domestic brands posted retail sales of 890,000 units for the month, an 18% year-on-year decline. Their share of the domestic retail market stood at 57.5%, down 3.5 percentage points from the same period last year, signaling a slowdown in growth momentum.

By contrast, mainstream joint ventures demonstrated greater resilience amid market fluctuations. Their January retail sales hit 470,000 units, a modest 4% drop. Performance varied among specific joint venture brands: German brands captured 19.8% of retail share, up 1.4 percentage points; Japanese brands held 15.5%, gaining 2.1 percentage points; American brands slipped slightly to 5%, down 0.3 percentage points; while Korean and other European brands saw marginal gains.

The luxury market faced significant pressure in January. Retail volume reached 180,000 units, a 15% decline, with retail share falling 0.5 percentage points to 11.6%.

Industry insiders generally view this dip in domestic brand share as a short-term phenomenon that does not alter the long-term upward trend.

In an interview with Gasgoo, Cui predicted the divergence between domestic and joint venture brands will widen further this year. The core gap lies in the speed of energy transition, intelligent technology, and cost control. Leveraging full supply chain advantages and surging exports, domestic brands could see their market share breach 70%, accelerating both in high-end segments and electrification. Meanwhile, joint ventures, hampered by a shrinking internal combustion engine base and slower EV transitions, will see their share slide below 30%, with only top-tier players stabilizing their footing through localized new products. Overall, China's auto market in 2026 will further concentrate into a landscape dominated by domestic brands and driven by electrification.

This long-term trend is clearly visible in January's new energy vehicle (NEV) penetration data. Among domestic retail sales, the NEV penetration rate hit 61.7%, compared to 16.1% for luxury cars and just 4.3% for mainstream joint ventures. The vast gap highlights how differences in NEV transition progress have become the primary driver of brand competitiveness.

Breaking down monthly NEV retail shares, domestic brands saw a year-on-year decline but still commanded a dominant 60.1%. Mainstream joint ventures saw their NEV share rise to 3.9%, yet their presence in the NEV market remains faint.

Image Source: Leapmotor

The "new force" camp emerged as a key growth engine, capturing 31.2% of NEV retail share—a 10 percentage point surge. XPENG, Leapmotor, and Xiaomi were the core drivers. Meanwhile, independent NEV brands incubated by traditional automakers—dubbed "second-generation startups"—shone brightly. With an 18.4% market share (up 6 percentage points), brands like Deepal, eπ, ZEEKR, Arcfox, and Voyah delivered strong results.

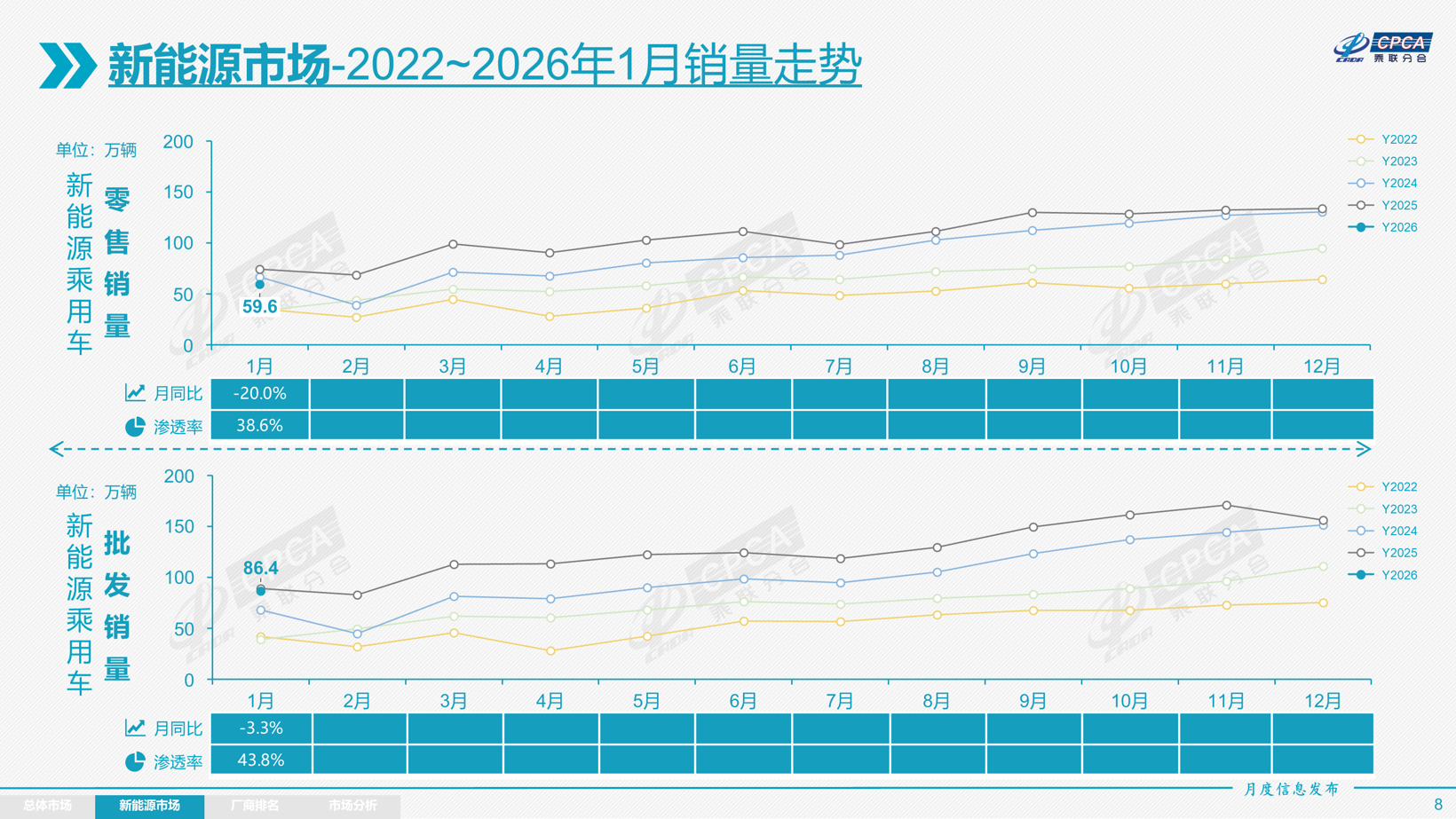

NEV Market Trails Internal Combustion

Focusing on the NEV passenger vehicle market, January saw a phased retreat due to policy rollbacks and front-loaded consumption. However, a standout performance in exports became the market's highlight and a key engine for industry growth.

Data shows domestic NEV retail sales reached 596,000 units, down 20% year-on-year. Conventional internal combustion engine (ICE) vehicles fared better, with retail sales of 948,000 units, down just 10%, underscoring their resilience. Consequently, the retail penetration rate of NEVs in the overall passenger car market fell to 38.6%, a drop of 3 percentage points from last year.

Image Source: CPCA

Cui noted that the historical pattern of ICE vehicles outperforming NEVs ahead of the Lunar New Year continued. In January, domestic ICE retail sales fell 10%, while the pure EV market dropped 17%, extended-range EVs grew 0.8%, and plug-in hybrids plunged 31.2%.

However, this decline is not a long-term trend. A major factor was the consumption pull-forward effect before the expiration of the NEV purchase tax exemption at the end of last December. Cui believes that as this effect fades, the NEV market is poised to return to a growth trajectory.

Looking at domestic NEV retail performance, ten brands surpassed the 20,000-unit mark in a fierce contest for the lead. BYD took the top spot with 94,176 units, followed closely by Geely at 92,135. HarmonyOS Mobility ranked third with 57,915 units. Xiaomi, Changan, Li Auto, NIO, Dongfeng, GAC Aion, and SAIC-GM-Wuling also joined the "20,000 club," acting as core drivers for the domestic NEV market.

In sharp contrast to the domestic dip, NEV exports exploded in January, becoming a vital growth point. NEV exports reached 286,000 units, a 103.6% surge year-on-year, accounting for 49.6% of total passenger vehicle exports—up 12.5 percentage points from last year. Structurally, pure EVs made up 65% of NEV exports, slightly down from 67% last year. However, A00- and A0-segment pure EVs—the core focus of exports—rose to 50% of pure EV exports, up significantly from 41%, making small EVs the main force for overseas markets.

The dual-drive export pattern for domestic brands is becoming clearer. In January, domestic ICE exports hit 250,000 units (up 17%), while domestic NEV exports soared to 226,000 units (up 115%). NEVs now make up 47.5% of total domestic exports. High growth in core markets like Europe and Southeast Asia signals the expanding global influence of Chinese NEV brands, laying a solid foundation for sustained export growth.

In the manufacturer export rankings, leaders stood out. BYD led with 96,859 units exported, followed by Tesla China at 50,644. Geely, Chery, Leapmotor, SAIC Motor, and SAIC-GM-Wuling also achieved substantial export volumes, collectively supporting the expansion of NEV exports.

Image Source: BYD

Regarding overseas systems, some domestic brands rely heavily on CKD (completely knocked down) exports. SAIC-GM-Wuling's CKD exports accounted for 40.4%, SAIC Motor for 1.2%, and Beijing Hyundai for 10.4%. Overseas production of ICE vehicles is estimated at over 500,000 units. Adding NEV KD exports, overseas sales of Chinese vehicles are projected to exceed 9 million units.

February Market Poised to Hit Annual Low

Commenting on January's overall performance, Cui said: "Following the expiration of the NEV purchase tax exemption policy—implemented since September 2014—at the end of December 2025, the NEV market is in a normal recovery phase. Some consumers rushed to buy in December to enjoy policy benefits, causing a pull-forward effect in January. This is an expected short-term fluctuation and does not represent the long-term market trend."

Cui also provided a detailed analysis and forecast for February and beyond.

From a timing perspective, February has only 16 working days. The 2026 Lunar New Year holiday spans nine days—the longest in history—three days fewer than the 19 working days in February 2025. With the pre- and post-holiday period being a traditional slow season for car consumption, most automakers arrange extra factory shutdowns around the Spring Festival. This further compresses effective production and sales time, making it highly probable that February sales will hit the absolute low point of the year.

Image Source: Chery

However, this slowdown isn't entirely negative. The easing of production and sales rhythms could effectively relieve inventory pressure at the retail level, creating room for smoother market operations later on.

On the consumption side, the pre-Lunar New Year period is typically a golden time for first-time buyers, but this buying fever is cooling. The proportion of first-time buyers has dropped rapidly to under 40% in recent years. Calculations based on vehicle ownership and new registration data show that in 2025, 13.19 million vehicles were scrapped or transferred out, while only 13.0 million new vehicles were purchased. This is a sharp decline from the 17.0 million new purchases in 2024. The particularly weak performance of the entry-level ICE market is a key reason for the lack of pre-holiday consumption momentum.

At the same time, the comprehensive purchase cost of entry-level NEVs has risen noticeably compared to last year, dampening the traditional willingness to "buy a car for the New Year." Additionally, while household savings remain high, consumer sentiment is relatively conservative due to a sluggish property market and capital shifting from stocks to deposits. This has also restrained pre-holiday auto demand to some extent.

Notably, flagship models from several brands have entered an intensive marketing phase recently, driving up expectations for upgrades to mid-to-high-end products. However, most official launches are scheduled for after the Spring Festival. This time lag may cause short-term volatility in orders and deliveries in February.

Despite the multiple pressures facing the February market, there are also opportunities for a rebound.

Consumption patterns suggest that traffic congestion in major cities fluctuates with school schedules. Historically, a wave of back-to-school buying appears after the Lunar New Year. This trend will benefit the gradual recovery of the economy EV market.

Meanwhile, the 2026 Spring Festival travel rush saw record numbers. The pace of returning to work is relatively fast, and some older migrant workers are starting to consider local employment or entrepreneurship. This social trend will generate new demand for vehicles, providing positive momentum for the post-holiday auto market recovery.

![[Gasgoo Briefs] Auto Industry Price Behavior Compliance Guide Released; Wingtech Comments on Nexperia Case Ruling](https://gascloud.gasgoo.com/production/2026/02/2c12fa82-f27c-4aa3-a2d5-de96589089a3-1771080406.png)