Gasgoo Munich - China's imported car market is displaying a stark mix of fire and ice in 2025.

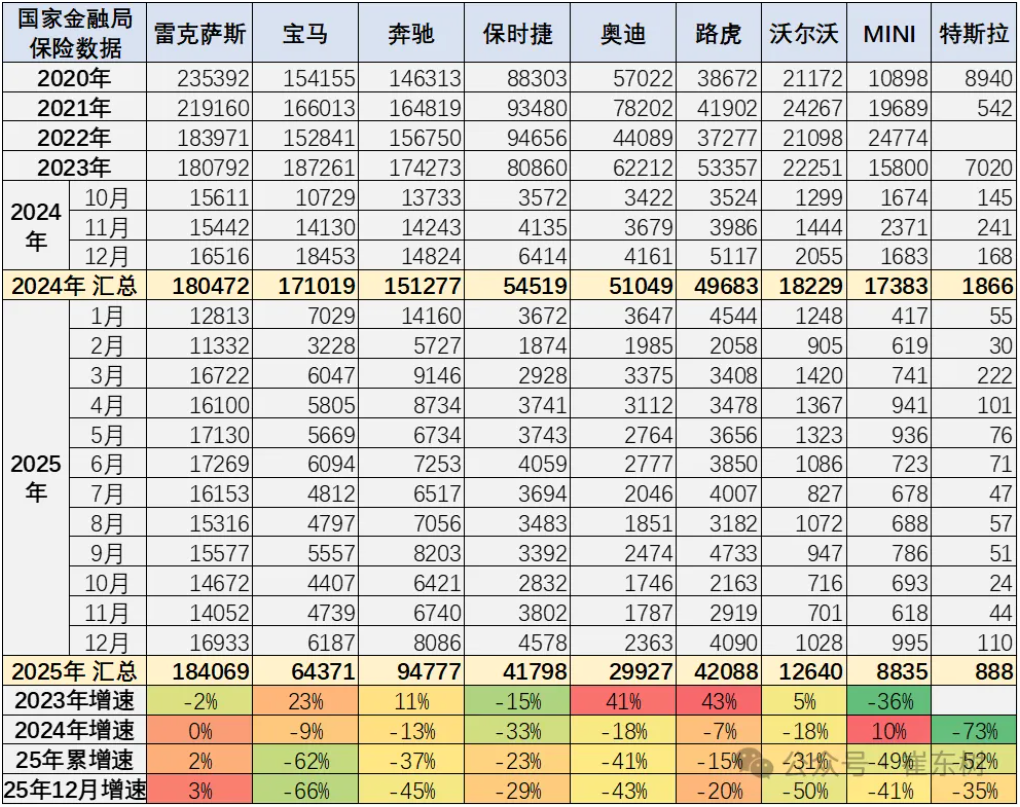

On one hand, the overall market keeps shrinking, with full-year imports plunging 32% year-on-year—a deep freeze. On the other, with 183,800 terminal sales, Lexus not only reclaimed the top spot but also stood as the only mainstream imported luxury brand to post positive growth, marking three straight years of steady expansion.

Against a backdrop where the allure of imports is fading and domestic rivals are squeezing market share, Lexus’s performance stands out. It raises a fundamental question: Why is Lexus the only one navigating the downturn and thriving against the current?

The Import Market Looks Bleak

China's imported car market extended its downward slide in 2025, with the pace of contraction accelerating.

Sales data tells the story: from January to December 2025, cumulative imported car sales totaled 480,000 units—a 32% year-on-year drop that deepens the decline seen in 2024. Imports fell year-on-year every single month, with December hitting rock bottom at just 30,000 units, slumping 56% from a year earlier and 30% from November.

The market structure remains dominated by passenger vehicles and internal combustion engines. In 2025, imported passenger cars accounted for 99% of total imports, while commercial vehicles made up just 1%. Within passenger cars, sedans claimed a 47% share, four-wheel-drive SUVs took 29%, and other models comprised the remaining 24%.

Notably, the share of imported new-energy vehicles fell to 2%. Pure electric models saw a slight dip in sales, while plug-in hybrids nearly ground to a halt, leaving fuel-powered passenger vehicles as the undisputed mainstay of the import market.

Even more striking than the overall decline is the sharp divergence within the market. The ultra-luxury segment has been on a downward trajectory since 2023, accelerated in 2024, and remained severe throughout 2025.

This segment is highly volatile. Aside from a few brands like Rolls-Royce holding relatively firm, names like Ferrari are languishing, and Maserati’s sales are swinging wildly.

Mainstream luxury import brands—including Mercedes-Benz, BMW, and Porsche—are also under pressure, with their import volumes slipping steadily.

In 2025, Mercedes-Benz’s imported sales dropped 37% to 94,800 units. BMW imported 64,400 vehicles, a 62% plunge. Porsche, Audi, and Volvo all posted double-digit declines.

The core reason lies in the waning competitiveness of their imported models. They are being squeezed by domestic luxury rivals while simultaneously accelerating their own localization strategies, narrowing the positioning of their import lineups.

Amid the overall gloom, Lexus stands alone. With 183,800 terminal sales in 2025, it retained the import crown, remaining the only imported luxury brand to grow. Moreover, its sales have held steady at the 180,000-unit level for three consecutive years from 2022 to 2024.

Image source: Screenshot of Cui Dongshu's WeChat official account

As Cui Dongshu, secretary-general of the China Passenger Car Association, put it, Lexus managed to keep growing in 2025 despite the multi-year slump—and even surpassed its 2022 volume. It’s a miracle in the import market that has helped stabilize the overall sales landscape.

Lexus’s official explanation for this counter-cyclical performance reveals the core logic it adheres to. In an interview with Gasgoo, a Lexus representative stated: "Sales volume is not our only metric. We have always prioritized quality and customer satisfaction." He emphasized: "Lexus persists in excellence and the spirit of hospitality, continuously listening to Chinese users. From products to technology and service, we aim to meet diverse needs. At the same time, we are strengthening our youth-oriented strategy to build closer emotional bonds with users."

The broader malaise in the import market is the result of multiple forces converging.

On the policy front, starting July 20, 2025, the threshold for the super-luxury car consumption tax was lowered from 1.3 million yuan to 900,000 yuan, covering pure electric and fuel cell models. This directly raised acquisition costs for high-end imports, dampening demand for ultra-luxury cars and indirectly weighing on expectations for mainstream luxury imports.

On the competitive front, domestic luxury brands like Hongmeng Zhixing, Red Flag, and Li Auto have risen rapidly. Their product strength and intelligence levels match or even exceed imported models, yet their prices are 10% to 20% lower. Coupled with robust distribution networks and convenient after-sales service, they have siphoned off a significant portion of core users from imported luxury brands.

In terms of consumer perception, the trend toward rational spending has eroded the allure of imports. Buyers no longer chase foreign badges blindly; they prioritize value, after-sales service, and smart features. Demand is saturated in traditional wealthy regions, while purchasing power in emerging areas remains limited, further weakening the practicality and economic advantages of imported cars.

Additionally, global uncertainty has impacted imports from certain regions. Meanwhile, the deep localization strategies pursued by international brands have pushed their import lineups into niche high-end segments, continuously compressing their market share.

Why Is Lexus Defying the Downturn?

Lexus’s growth is no accident. It is the result of synergy across product, pricing, strategy, and brand—centered on capturing niche needs and achieving differentiated competition.

Product strength is its core competitive edge. Lexus has precisely matched the core demands of Chinese consumers through a solid product matrix and continuously evolving hybrid technology.

The ES series is the absolute mainstay. In 2025, sales reached 118,700 units, accounting for 65% of the brand’s total—making it the only single imported luxury model to break the 100,000-unit mark.

Positioned precisely as a mid-to-large luxury family sedan, its dimensions and interior comfort fit home-use needs perfectly. Leveraging its imported quality, it has carved out a distinct label of "reliable, quiet, and comfortable." With a price range of 299,900 to 488,900 yuan, it covers the mainstream price band, catering to diverse consumer tiers.

Image source: Lexus

Regarding this "anchor" model, Lexus shared its philosophy. A representative told Gasgoo: "As of 2025, cumulative sales of the Lexus ES have surpassed 1.1 million units." The secret lies in this: "Developed with a 'people-first' philosophy, we directly address the diverse needs of Chinese users. By deeply researching rear-seat spaciousness, rich feature configurations, and easy entry and exit, we strive to provide the 'best product and service.'"

On balancing value with brand prestige, the representative replied: "We focus on delivering a 'full-cycle value experience'—not just the product itself, but user-centric service guarantees, allowing customers to feel intrinsic value that goes beyond price."

Supporting models like the RX and NX provide effective backup. In 2025, the RX sold 34,000 units (18.5% share), while the NX sold 18,400 units (10% share), covering the mid-to-large and medium SUV segments respectively.

Though sales volumes are lower, high-end flagships like the LX and LM effectively maintain the brand's premium tone and reputation, satisfying a niche yet stable demand for top-tier consumption.

Continuous iteration of hybrid technology has further solidified its competitive edge. Take the 2025 ES300h: its WLTC combined fuel consumption dropped to 4.8L/100km, and power response latency was cut to 0.25 seconds, achieving a dual boost in efficiency and driving experience.

In 2025, electrified models accounted for 52% of Lexus sales. Hybrids, with their advantages in low fuel consumption and high reliability, avoided the competitive pitfalls of pure electric models and won high consumer recognition.

Cui Dongshu also attributes Lexus’s success to timely product adjustments, noting that the strong performance and high consumer acceptance of its hybrid models were inseparable factors.

Amid intensifying price competition in the luxury sector, Lexus fine-tuned its pricing strategy to drive sales growth while holding the line on brand premium.

Facing the trend of consumption downgrading and price shocks from domestic luxury rivals, Lexus didn’t stubbornly resist prices or stand on the sidelines. Instead, it implemented a targeted strategy of trading volume for price.

For core models like the ES and RX, the market offered attractive incentives. This allowed Lexus to maintain a premium over domestic rivals like the German trio while effectively reaching price-sensitive consumers who still value brand quality and reliability.

The key to this strategy is balance: leveraging incentives to boost volume without getting dragged into a brutal price war with domestic models or second-tier luxury brands, thereby preserving the brand's long-term pricing power.

Long-term strategic planning provides a solid foundation for this growth. In 2025, Lexus began its localization process, with production slated to start in 2027. This clear path signals to the market its firm commitment to deepening its roots in China and embracing electrification.

Although domestic pure electric models are still a way off, the move is already having a positive impact. It shows consumers and investors the brand's future potential and reserves room for development. Relying on China's mature NEV supply chain, Lexus expects to significantly reduce procurement and logistics costs for core parts and enhance supply chain stability, supporting price adjustments now and in the future.

Deep brand heritage and a solid user base have built a formidable competitive moat. Since entering the Chinese market in the 1990s, Lexus has long adhered to a pure import sales model, shaping and reinforcing an image of "reliable, luxurious, quiet, and service-first" for decades.

Its user profile aligns perfectly with its positioning: core users are families aged 35 to 50. This group has stable income and rational spending habits, prioritizing reliability, fuel economy, and comfort—a perfect match for Lexus’s home luxury positioning. Their demand for aggressive smart features is relatively mild; instead, they have high expectations for vehicle durability, fuel economy, and after-sales service.

Thus, as the market turns toward rational consumption, the brand trust Lexus has built over the years acts as a massive stabilizer, allowing it to weather short-term volatility and lock in its core user base.

Lexus’s Path to the Next Level

Although Lexus has shown strong resilience and achieved growth against the current in a complex market, its ability to continuously evolve and plan ahead will determine whether it can translate short-term advantages into long-term leadership.

The global auto industry is marching into a new era of electrification and intelligence, and China's market is transforming at a particularly rapid pace.

For Lexus, this is both an opportunity granted by the times and a catalyst for comprehensive advancement.

Regarding the highly anticipated localization strategy for electric vehicles, Lexus has clarified its core considerations and determination.

A representative stated: "The most important consideration is our desire to produce and develop closer to our users, reflecting Chinese customers' expectations into our products at 'China speed.'"

He further elaborated: "In the Chinese market, where actual demand for NEVs—represented by pure electric vehicles—is strongest and related technology leads the world, we uphold the philosophy of 'becoming the best local company.' We will rely on Shanghai and the Yangtze River Delta's advanced, mature industrial chain, logistics networks, talent pools, and market scale to develop Lexus-branded pure electric models."

In the field of electrification, Lexus has drawn a clear blueprint and is accelerating. While the market scale for pure electric models still needs growth, its deep accumulation of hybrid technology provides a steady transition and unique technical foundation for the shift.

It is understood that the brand announced in 2025 the establishment of a wholly-owned NEV company in Jinshan District, Shanghai. It is investing heavily in the R&D of pure electric models and battery technology, with plans to start localized production in 2027.

This strategic move marks Lexus's full embrace of China's NEV market with firm determination and systematic planning, aiming to extend its craftsmanship and superior reliability into the electric era.

Image source: Lexus

Facing the wave of intelligence, Lexus is actively exploring and deepening local cooperation to rapidly enhance user experience.

The brand recognizes the strong demand for smart technology among Chinese consumers and is dedicated to integrating smoother smart cockpit interactions and advanced driver-assistance features with its traditional product traits of quietness, luxury, and reliability.

By partnering with leading Chinese tech companies and supply chain allies, Lexus is poised to accelerate the deployment and application of intelligent technologies, injecting a more competitive technological vitality into future products.

In terms of product structure, Lexus's solid foundation provides strong support for diversified expansion. The ES series, as the pillar, has proven the brand's precise positioning in core segments.

Building on this foundation, the brand is continuously strengthening the product power of SUVs like the RX and NX, while consolidating its high-end brand image through flagships like the LM and LX.

Moving forward, by introducing new products at a better cadence and optimizing its existing lineup, Lexus will be able to cover a wider range of luxury consumption needs, building a more balanced and healthy product matrix.

Conclusion

Lexus’s counter-cyclical growth in 2025 is the inevitable result of its long-term adherence to the strategy of "precise product positioning, steady technological iteration, and reputation first." As the brand insists, its dedication to "long-termism" and the "full-cycle value experience" forms the bedrock for navigating market cycles.

The road ahead holds both challenges and opportunities. By launching localized electrification, engaging in open cooperation on intelligence, strengthening its core product matrix, and aligning localization with brand value, Lexus is charting an ambitious blueprint. The results will be worth watching.