On Dec. 31 at 10:58 a.m., the first offline experience store jointly launched by JD.com and Unitree Robotics opened at JD MALL (Shuangjing) in Beijing.

While modest in size, the store carries weight beyond commerce: it marks Unitree's pivot from B2B toward consumer touchpoints and could speed the shift in embodied-intelligence robots from stage showpieces to market validation and ecosystem building.

Until now, embodied-intelligence robots mostly lived in labs, trade fairs or commercial performances — far from everyday shoppers. The opening of Unitree’s first store pushes this frontier technology into an open retail setting, adding a fresh marker for the industry’s second half.

The birth of a "non-typical" store

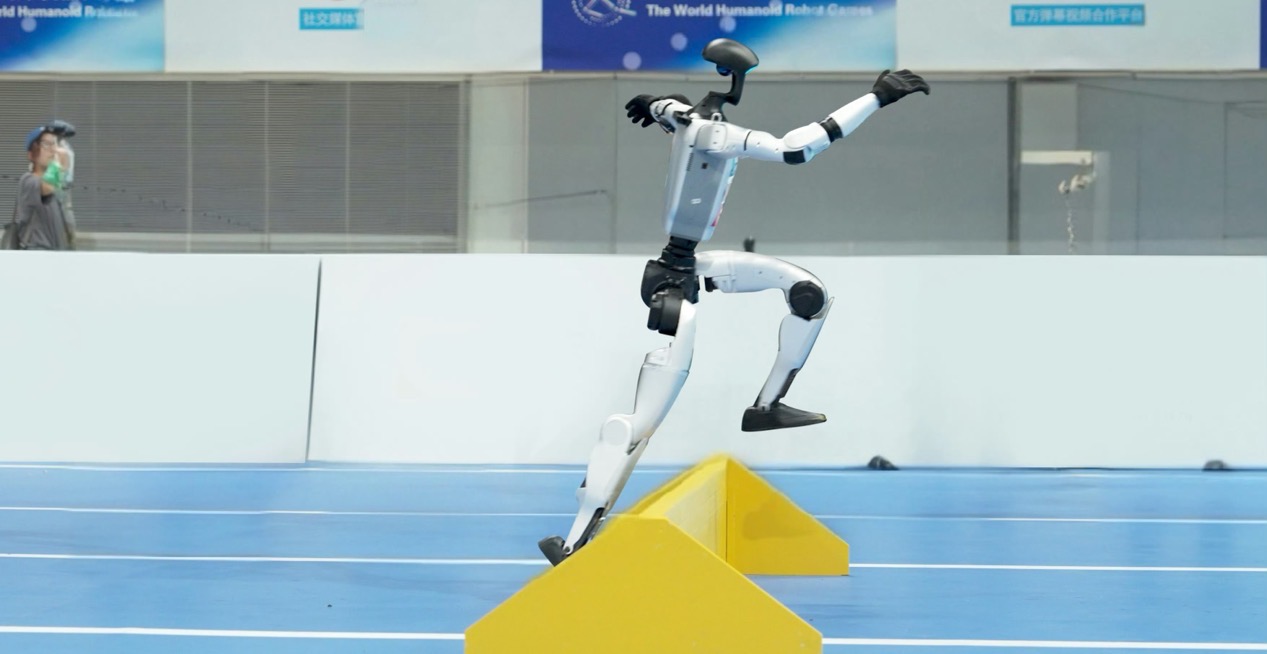

From a Spring Festival Gala routine that lit up social media to a high-wire backflip on pop star Leehom Wang's stage, Unitree's robots have long been viral tech celebrities online.

But traffic-fueled highlights are easy; building a sustainable business is much harder. The real test is turning a flash of fame into durability.

Image: Unitree

This inaugural store is a key step from online buzz to deeper commercial exploration. As a hub, it brings cold robotics tech, expansive market imagination and complex social perceptions into one visible, tangible, interactive space.

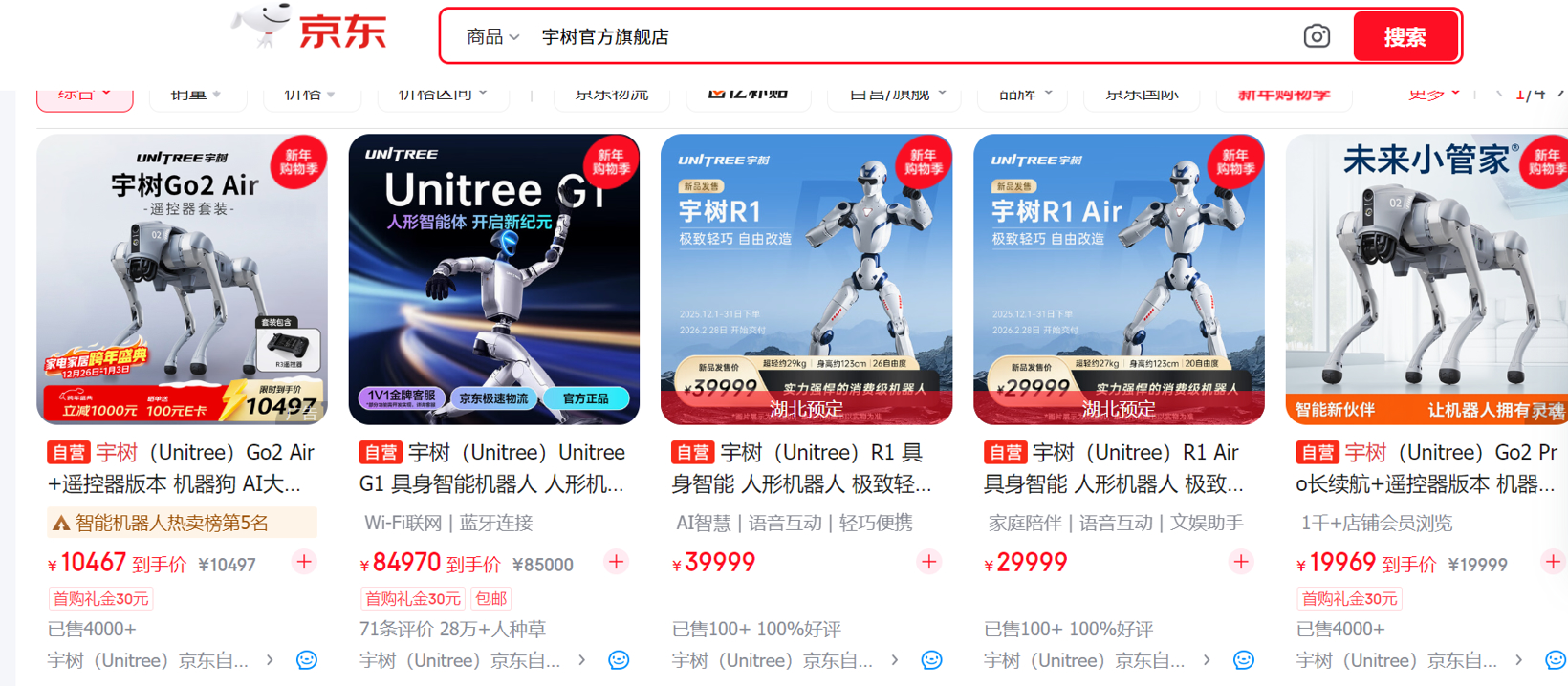

For now, four robots are on sale, including the Go2 Pro quadruped starting at CNY 19,999, the G1 humanoid from CNY 85,000 and the newest R1 humanoid from CNY 29,900, covering home companionship, educational interaction and commercial display. The lineup is built to meet diverse consumer needs.

The store also features an open interaction zone — an immersive tech stage where shoppers can experience how cutting-edge robotics slides into everyday life, turning machines once confined to spec sheets and videos into perceptible, responsive partners.

Beyond display and demos, the store is a sales terminal. Shoppers can buy Unitree products on the spot or scan a QR code to place orders via the official mini program, then choose in-store pickup or JD delivery. This O2O loop — deep experience + instant feedback + end-to-end service — goes beyond online channels or temporary trade-show booths, serving as both a brand experience center and an early-warning post for user data.

Crucially, real interaction data gathered in-store can feed back into robot-interaction algorithms and scenario optimization — a core advantage pure online sales can't match.

Image: JD.com screenshot

Even with official flagship storefronts on JD.com, AliExpress and Walmart's U.S. website — plus high-profile live commerce in Li Jiaqi's and Make Friends’ livestreams — online channels can't let users truly feel a robot’s gait, interaction nuance and emotional warmth up close.

What matters even more is the store’s address — JD MALL — which speaks volumes about strategy.

JD isn't a mere channel; it has clear ambitions in robotics. At the World Robot Conference 2025, JD announced an Intelligent Robot Industry Acceleration Plan, pledging over CNY 10 billion in resources. The three-year targets: help 100 intelligent-robot brands surpass CNY 1 billion in sales and bring robots into more than 1 million end-user scenarios.

In late October, JD Logistics said that over the next five years it will procure 3 million robots, 1 million unmanned vehicles and 100,000 drones, deploying them across the end-to-end logistics chain.

Image: JD.com

Against that backdrop, the Unitree–JD pairing has a clear internal logic: Unitree brings market-tested hardware, while JD contributes unmatched offline foot traffic, a mature supply-chain system, massive online entry points and a growing robot ecosystem.

From this angle, the birth of a "non-typical" store means far more than adding a sales outlet. It's a conversion hub turning Unitree's accumulated tech momentum and brand buzz into market energy and a commercial flywheel. By creating a composite space for brand storytelling, deep experience, data capture and ecosystem collaboration, Unitree is building a bridge from "internet-famous" to "enduring" — and, with JD, modeling a new commercialization paradigm of hard tech empowered by ecosystem scale.

Unitree's offline "move": a strategic inevitability

Looking across Unitree's trajectory, opening an offline store isn't a passing whim. It's a necessary strategic choice shaped by pressures from the market, capital and competition at different stages of growth.

It's a leap from B2B to the consumer side — and an extension of the company's business narrative on the eve of its IPO.

Since its founding, Unitree Robotics has rolled out quadruped robots including XDog, Laikago, AlienGo, A1, Go1, B1, Go2 and B2. Starting in 2023, it launched humanoid robots H1, G1, R1 and H2.

Founder Wang Xingxing has said that in 2024, sales were split roughly 65% quadrupeds, 30% humanoids and 5% components. About 80% of quadrupeds went into research, education and consumer uses, with the remaining 20% into industrial scenarios such as inspection and firefighting. Humanoids went entirely into research, education and consumer domains. Notably, "consumer" here mostly means commercial display and rentals — a B2B2C model rather than pure personal purchase.

Image: Unitree Robotics

So even with scaled production, Unitree is still serving mainly enterprise and government buyers at this stage.

Longer term, reaching hundreds of billions — even trillions — in market size depends on activating personal consumption. Enterprise and government demand is concentrated and cyclical, tied to sector rhythms and policy. The consumer side touches countless individuals with dispersed, durable demand; once robots slip into daily life, the market energy can be vast.

That’s why the R1 humanoid series, starting at 29,900 yuan this year, is widely seen as Unitree’s key move into consumer territory.

In that context, a physical store helps Unitree reach broader consumers, build mainstream brand recognition and preposition robots as companions or productivity tools — laying a solid foundation to break growth bottlenecks and open a second curve.

Image: Zhiyuan Robotics

Competition in embodied-intelligence robots is intensifying. Companies such as Zhiyuan, UBTECH, Galaxy Universal and Songyan Dynamics are accelerating iteration and product rollout. In this fierce contest, building clear differentiation fast is vital to seize the lead.

Capital-market pressure is also at play.

Unitree has kicked off an IPO and completed pre-IPO counseling in November. For investors, technology and B2B orders alone are thin. To secure durable advantage and a sustainable profit model, Unitree needs a clearer path into consumer markets with room for exponential growth. Ultimately, the vision for humanoids is the home — general-purpose service.

A brand experience store in a prime urban mall adds flesh to that capital story. It’s not just a point of sale, but a market thermometer, a source of high-value user data and a stage to show integration into home, education and entertainment.

A tipping point in collective resonance

The opening of Unitree’s first offline store is like a stone hitting a lake, and the ripples reflect structural shifts across the industry.

First, it marks a collective move from a tech-driven demo phase into a commercialization period led by markets and ecosystems.

Over the past two years, embodied-intelligence robots were mostly confined to labs, trade fairs or corporate showrooms. Now, with Unitree’s brand store and Beijing Yizhuang’s "world’s first embodied-intelligence robot 4S store," robots are entering open, everyday commercial venues.

In July 2025, the world’s first robot 6S store opened at the Galaxy WORLD complex in Bantian, Longgang District, Shenzhen. The six-in-one scope covers sales, parts supply, after-sales service, information feedback, leasing and customization — aiming to ferry robots from labs into daily life.

Notably, beyond traditional retail services, the store adds two functions tailored to robotics: a data-feedback mechanism to capture user needs in real time and inform R&D; and leasing, letting users experience robots without purchasing. At launch, a dozen-plus models were available to rent, and more than 200 upstream and downstream companies expressed interest in moving in.

In August, Robot Mall — billed as the world’s first "humanoid intelligent robot 4S store" in Beijing’s Economic-Technological Development Area (Yizhuang) — opened to the public alongside its robot-themed restaurant, "Robot Flame Lab." The 4S store bundles display, sales, maintenance and testing with the dining venue to provide an end-to-end validation environment from technology to scenarios. According to official data, more than 50 companies have stationed over 100 robot models there.

Image: China Optics Valley official WeChat account

In recent months, Hangzhou, Changsha, Jinan, Wuhan and Suzhou have also built similar offline experience and service venues.

Though names and functions vary, they point to the same trend: robotics is moving from the lab-first stage into a new phase centered on user experience, scenario deployment and ecosystem collaboration.

More broadly, the industry’s core task has shifted from "going from nothing to something, proving feasibility" to "going from something to usable, testing market acceptance and product reliability." These stores face the randomness of everyday consumers, setting a higher bar for reliability, friendly interaction and scenario fit than a lab or semi-closed booth.

Second, the Unitree–JD cooperation could set a template for "new retail": alliances between technology pioneers and ecosystem giants.

JD is more than a channel. As noted, its "10-billion acceleration" plan stitches together investment, in-house technology, scenario applications and omni-channel sales into a full-stack ecosystem. For companies like Unitree, that can sharply lower the hurdles of market education, channel building and supply-chain management — speeding the jump from "geek gadget" to "mass-market product."

Expect deeper tie-ups between leading robot makers and big-tech or consumer-electronics platforms.

Third, competition is shifting from paper debates over technical routes to a multidimensional trial by user experience. Brick-and-mortar stores, as public arenas, will force different approaches to face consumers’ final verdict.

Ultimately, how offline stores perform may become a filter for who truly has commercial potential.

Conclusion

Unitree’s global first store at JD MALL may look like a routine retail move, but it’s a milestone for humanoid robotics — marking a pivot from "technical spectacle" to "market validation and ecosystem building," and offering a replicable sample for commercialization.

Company-wise, it's Unitree's inevitable choice to span B2B and consumer fronts, convert technical advantages and strengthen its capital story. Industry-wise, it signals the rise of new retail paradigms, an upgraded competitive landscape and a shift in core tasks. Looking ahead, it’s the starting point for channel-building, data flywheels and social cognition.

As more players invest in offline channels, embodied-intelligence robots could shed their "niche tech" label and find their way into more homes and business scenarios.

Unitree's first offline store opens a door connecting technology and markets, companies and society — behind it lies an intelligent future with room to grow. Its opening suggests humanoid robotics is on the cusp of a genuine breakout.