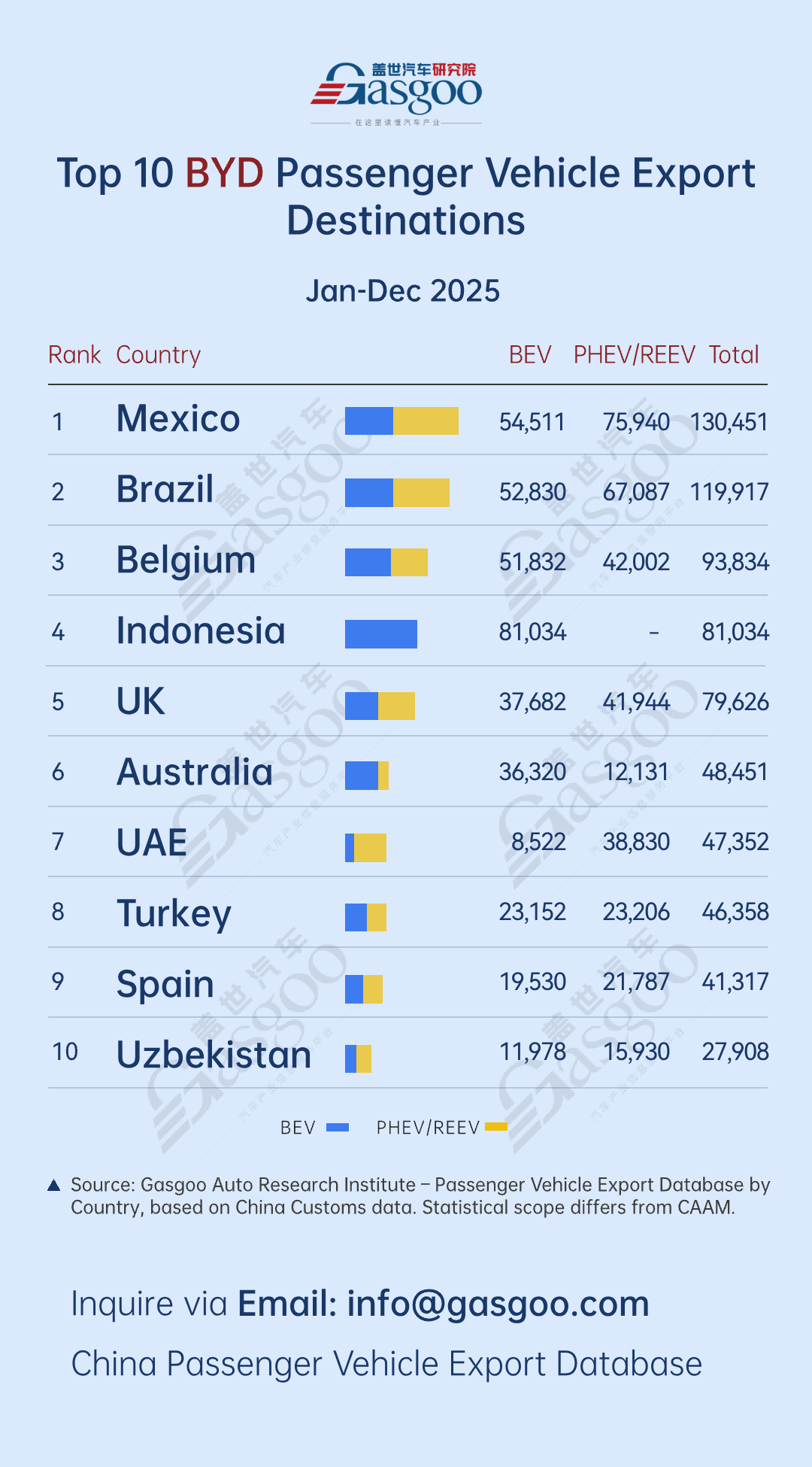

From January to December 2025, BYD continued to advance its global passenger vehicle exports, with market concentration and regional differentiation becoming increasingly evident. Mexico and Brazil ranked first and second with exports exceeding 100,000 units each, together accounting for nearly 40% of total volumes. Belgium led BYD's steady expansion in Europe, while Indonesia emerged as a benchmark market in Southeast Asia driven by strong sales of a single battery electric model. Markets such as Australia and the UAE also displayed distinct powertrain preferences shaped by local demand. Supported by a highly adaptable product portfolio, BYD continues to strengthen the foundations of its global expansion.

Here are the top 10 destination countries by BYD passenger vehicle exports in 2025 with detailed data:

Mexico: 54,511 battery electric passenger vehicles and 75,940 plug-in hybrid electric passenger vehicles were exported in 2025, totaling 130,451 units

Brazil: 52,830 battery electric passenger vehicles and 67,087 plug-in hybrid electric passenger vehicles were exported in 2025, totaling 119,917 units

Belgium: 51,832 battery electric passenger vehicles and 42,002 plug-in hybrid electric passenger vehicles were exported in 2025, totaling 93,834 units

Indonesia: 81,034 battery electric passenger vehicles were exported in 2025, totaling 81,034 units

UK: 37,682 battery electric passenger vehicles and 41,944 plug-in hybrid electric passenger vehicles were exported in 2025, totaling 79,626 units

Australia: 36,320 battery electric passenger vehicles and 12,131 plug-in hybrid electric passenger vehicles were exported in 2025, totaling 48,451 units

UAE: 8,522 battery electric passenger vehicles and 38,830 plug-in hybrid electric passenger vehicles were exported in 2025, totaling 47,352 units

Turkey: 23,152 battery electric passenger vehicles and 23,206 plug-in hybrid electric passenger vehicles were exported in 2025, totaling 46,358 units

Spain: 19,530 battery electric passenger vehicles and 21,787 plug-in hybrid electric passenger vehicles were exported in 2025, totaling 41,317 units

Uzbekistan: 11,978 battery electric passenger vehicles and 15,930 plug-in hybrid electric passenger vehicles were exported in 2025, totaling 27,908 units

From a regional perspective, the Latin American market stood out, with Mexico and Brazil firmly ranking as the top two destinations. Exports to these markets totaled 130,451 units and 119,917 units, respectively, accounting for nearly 40% of the combined top-10 export volume, making them a core pillar of BYD's overseas market presence.

In Mexico, sales of plug-in hybrid vehicles (PHEVs) reached 75,940 units, significantly exceeding battery electric vehicle (BEV) volumes. This sales structure aligns closely with local consumers' core demand for flexible long-range driving and convenient fuel refilling. At the same time, as a key gateway to the North American market, Mexico's rising export volumes carry strategic significance for BYD's North American supply chain and its efforts to deepen penetration in core markets. It is worth noting that, starting January 1, 2026, Mexico will raise import tariffs on vehicles originating from China, from the current 20% to 50%. Anticipating this policy change, BYD accelerated exports to the Mexican market at the end of 2025, further consolidating its position as the top-selling brand locally.

In Brazil, a balanced development pattern of "dual-track growth" between BEVs and PHEVs emerged. BEVs achieved steady growth with 52,830 units, supported by the local ride-hailing market's ongoing upgrade and government incentives for NEVs. PHEVs led the segment with 67,087 units, precisely matching the diverse commuting needs across Brazil's vast geography, and serving as the key driver of market expansion locally.

In Europe, BYD continued to steadily deepen its presence, with Belgium (93,834 units), the United Kingdom (79,626 units), and Spain (41,317 units) successfully ranking among the top 10 export destinations. Belgium, the third-largest market, serves as a key logistics and port hub in Europe. Leveraging efficient shipping and distribution networks, a large number of BYD vehicles enter through Belgian ports and are then distributed to major European markets. In Belgium, BEVs outsold plug-in hybrids, reflecting Europe's broader shift toward full electrification. Meanwhile, mature markets such as the UK, Spain, and Turkey demonstrated stable performance, with a relatively balanced ratio of BEVs to PHEVs. European consumers maintain higher expectations for brand reputation and localized services, meaning future growth will rely on network expansion, pricing optimization, and deeper brand penetration.

Meanwhile, Indonesia ranked fourth with 81,034 BEV units from a single model, emerging as a benchmark market in Southeast Asia, supported by government incentives and fleet renewal in ride-hailing and taxi services. Australia showed a BEV-dominated structure, with 36,320 BEV units, reflecting strong consumer acceptance of BEVs. By contrast, markets such as the UAE and Uzbekistan displayed stronger demand for PHEVs than BEVs, driven by local fuel prices, driving conditions, and the need for greater powertrain flexibility.

Overall, BYD's product portfolio demonstrates strong cross-market adaptability, effectively aligning with varying energy structures and usage scenarios across countries, and laying a solid foundation for its global expansion.

![[Gasgoo Express] Xiaomi EV releases first Vision GT supercar concept](https://gascloud.gasgoo.com/production/2026/03/05414465-1cec-4d23-a308-c90908f26ea1-1772534888.png)