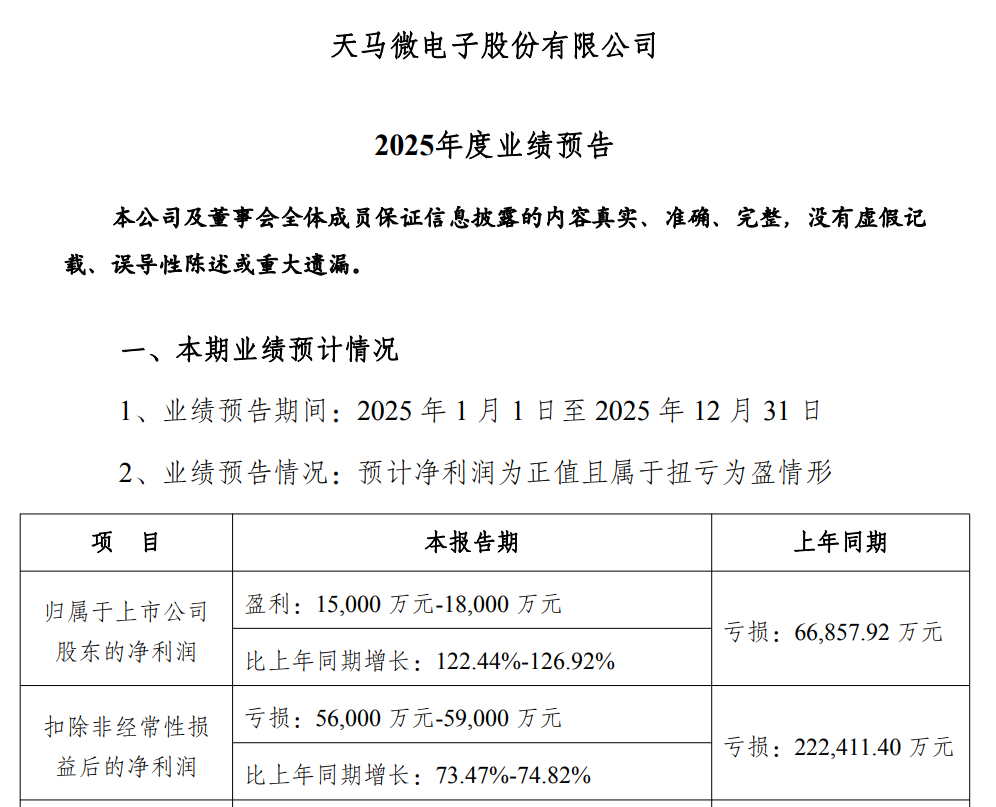

Gasgoo Munich- TIANMA Microelectronics Co., Ltd. projected a return to profitability for 2025 late on January 29, signaling a substantial turnaround in its core operating metrics.

The earnings forecast indicates net profit attributable to shareholders will land between 150 million yuan and 180 million yuan, reversing a loss of 669 million yuan a year earlier. That represents an increase of 122.44% to 126.92% and an improvement of more than 800 million yuan. Meanwhile, the non-recurring net loss narrowed to between 560 million yuan and 590 million yuan—a sharp reduction from the 2.224 billion yuan loss recorded in the prior year, marking a 73.47% to 74.82% improvement. For the period, revenue is expected to break 36 billion yuan, providing a solid foundation for the earnings recovery.

Image source: Company announcement screenshot

The primary driver behind this significant improvement is robust growth in core operations. The company noted that automotive and professional display revenue now accounts for over 50% of the total, serving as the main engine for profit growth. In the automotive sector, TIANMA Microelectronics Co., Ltd. holds the top global spot in shipments of automotive-grade displays, instrument clusters, and head-up displays (HUDs). Continued strength in automotive electronics and new energy vehicle segments has provided strong support for the performance gains.

In the consumer display sector, the flexible AMOLED phone market remains fiercely competitive with prices under periodic pressure. However, technology penetration rates continue to rise, and product upgrades alongside diversification are creating new opportunities. TIANMA Microelectronics Co., Ltd. has effectively navigated these challenges through technical innovation, solution optimization, and aggressive cost-cutting. Its flexible AMOLED phone shipments rank second domestically and third globally, with flagship product volumes seeing rapid growth and profitability improving year-on-year.

Furthermore, the company is actively expanding into diverse application scenarios, advancing its layout in flexible wearables and medium-sized products to strengthen its AMOLED competitiveness. The IT display business secured strategic clients and key projects, while the sports and health display segment broke into new categories. Both businesses saw revenue and profitability grow in tandem, further diversifying the company's earnings drivers.