Why has China's automotive industry advanced so quickly? The answer lies beneath the visible tip of the iceberg. Over the past few years, China's automotive presence has become unmistakable on the global stage:

The world's largest auto market, the world's largest NEV market, the world's largest vehicle exporter, the most competitive arena for intelligent-driving innovation, and the fastest-iterating automotive ecosystem on the planet.

But if you ask, "Why did Chinese automakers collectively rise at this momen?" Then we must go back to the deep structural forces that power this rise.

At the core are three foundations: China's unparalleled industrial system,continuously expanding pool of engineers,and a cultural DNA defined by diligence, boldness, and a willingness to experiment and embrace trial-and-error.

These three forces may appear intangible, but together they form the bedrock that allowed China's automotive industry to break through and reshape global competition.

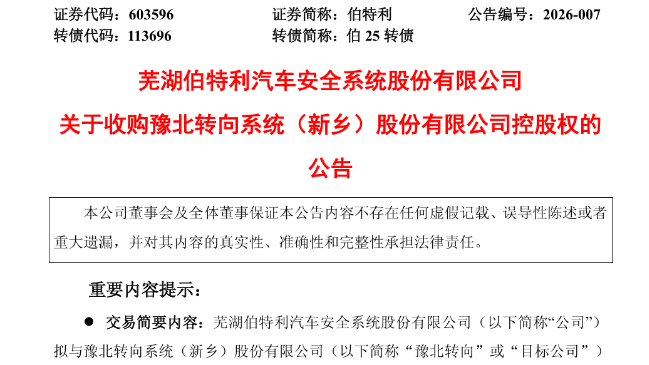

1. The Most Complete Industrial System:The Only Country Capable of Building an Intelligent EV "End-to-End"

China is the only country in the world that can truly close the loop from "the mine" all the way to "the finished vehicle." This is not a slogan—it is statistical fact.

China is the only nation that possesses all industrial categories defined by the United Nations, covering 41 major sectors, 207 medium sectors, and 666 sub-sectors.

This means that every critical component of an electric vehicle, every piece of production equipment, and every material link can be completed domestically. From lithium ore to battery materials; from cell-manufacturing equipment to laser welding; from thermal management systems to domain controllers; from LCD panels to final vehicle assembly—virtually every industrial category required to build an intelligent EV exists within China's borders.

The ultra-dense concentration of factories forms a complete, self-reinforcing, and redundantly backed supply ecosystem.

In contrast, in Europe and the United States, missing even a single link can stall an entire chain.

Take Europe as an example. EV demand is rising rapidly, yet local battery capacity remains insufficient: the core batteries for Volkswagen, Mercedes-Benz, and BMW still rely heavily on suppliers from China, Korea, and Japan. Europe's local battery output covers less than one-third of its automakers' needs. As a result, whenever upstream lithium or nickel prices fluctuate, OEM costs swing dramatically.

Similarly, for key components like cameras, radar, lidar, and power semiconductors, Western supply chains depend largely on China, Korea, Japan, and Taiwan. During the pandemic, U.S. automakers were forced to cut production by more than a million vehicles due to chip shortages—a textbook example of systemic fragility.

Photo source: CATL

In summary: Europe lacks materials; Japan lacks natural resources; the United States lacks manufacturing capacity; China has all three.

And in the era of intelligent EVs, the value of this "completeness" is amplified tenfold, because intelligent vehicles share three characteristics: far more components, far deeper electronics integration, and extremely high demands on supply-chain responsiveness.

A small thermal-management valve, a high-voltage connector, a laser-welding module—any of them can determine whether production can ramp up.

China's advantage is that these links do not need to coordinate across countries, states, or scattered suppliers; most steps close the loop within a 300-kilometer radius. This level of supply-chain synchronization is unmatched globally.

The true value of China's industrial system: It enables fast iteration—not just high output.

Western countries can manufacture, but they cannot iterate quickly.

China's supply chain, however, can bring new technologies from design to mass production in just a few months. It is an industrial foundation capable of absorbing and sustaining extremely rapid iteration.

This is why Chinese EVs iterate so quickly—not because companies are "over-competitive" or "over-working,"but because the system itself is strong enough to support speed.

2. The Engineer Dividend—China's Hidden Superpower

As the automotive world shifts from the "horsepower era" to the "computing-power era," the industry's core has moved away from mechanical engineering toward algorithms, software, chips, communications, electrical architectures, and control systems.

This shift happens to align almost perfectly with the strengths of China's education system over the past two decades. China almost graduates 12 million university students last year, and more than half are in STEM fields. Majors such as automation, control engineering, telecommunications, computer science, and materials can all directly feed into the intelligent-vehicle sector.

By comparison, Western and Japanese markets face structural constraints: The United States produces far fewer engineers, and many are drawn to AI foundation models, internet companies, or finance. Europe suffers from a shortage of software and algorithm talent. Japan's engineering workforce is rapidly aging. Only China possesses a young, massive, and structurally well-matched engineering population perfectly aligned with the needs of intelligent EVs.

But more importantly: China not only has many engineers—it knows how to organize them effectively. This point is crucial.

China's leading automakers have built some of the most efficient engineering organizations in the world, such as: Huawei's "Corps Model" for cross-functional product warfare, BYD's dual-mentor system linking R&D and manufacturing, XPeng's full-stack in-house development, Li Auto's scenario-driven product organization.

The results are remarkable:

New model development cycles have been cut from 48 months to 18 months, even shorter.

OTA update frequency is 4-6 times higher than that of Europe or the U.S.

Infotainment and intelligent-driving functions iterate in weeks, not months.

China's engineer dividend is not just about quantity—it is about extraordinary organizational efficiency.

3. Cultural DNA — The Source of China's Automotive Soft Power

Beyond its industrial system and engineer dividend, the rise of China's automotive industry over the past decade is also powered by something deeper and less visible—its cultural DNA.

Photo source: 699pic.com

First: a culture of diligence and pragmatism.

Chinese engineering teams are willing to put in the effort and persist through complexity. They break down massive system-engineering problems into countless micro-tasks and solve them one by one.

From vehicle operating systems to autonomous-driving stacks, from battery systems to thermal management, much of the progress is not "headline-grabbing."

Yet it is precisely this steady, granular effort that allows new features to be upgraded weekly and optimized monthly.

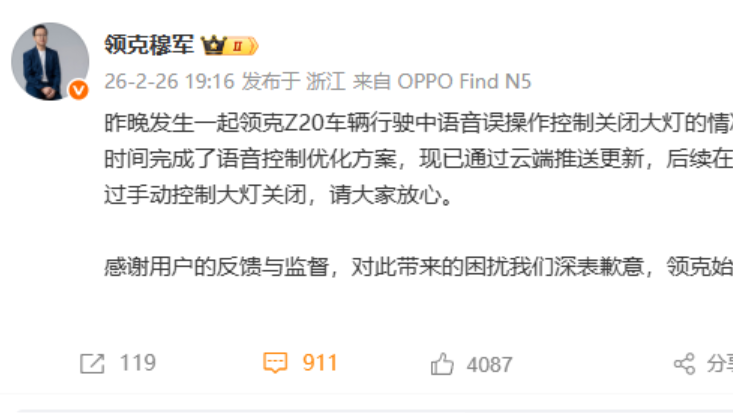

Second: boldness to experiment.

Chinese society embraces new technologies at an extraordinary pace. From autonomous driving to in-car digital ecosystems, users are willing to try early, accept imperfections, and give feedback.

Companies dare to build; users dare to test.

Together they form a real-world rapid-iteration loop unmatched anywhere else in the world—where technology evolves continuously within everyday life.

Third: long-termism and a sense of responsibility

Whether in building supply chains, investing in core technologies, or exploring new business models, Chinese companies share a resilience for "doing the hard but right things."

In the face of uncertainty, engineers, cities, and suppliers are willing to commit for the long run and shoulder the risks required to shape the future.

Lastly: a culture of coordinated action.

In China, when a new technology needs to be deployed, automakers, suppliers, local governments, and testing ecosystems can align within a remarkably short time.

This high-efficiency, multi-stakeholder coordination is rare on a global scale.

Diligence and pragmatism, bold experimentation, long-termism, and a culture of coordination— together, they form the irreplicable soft power behind China's automotive leap. These cultural forces are the true lift beneath this industry's transformation.

Conclusion: China's True Competitive Advantage Is Not "Cost Performance," but Systemic Capability.

Looking back at the transformation of China's automotive industry over the past decade, one realization becomes clear: China's rise was not determined by price advantages or isolated breakthroughs, but by the simultaneous maturity of three foundational capabilities:

(1) A comprehensive industrial system:enabling China to build a vehicle end-to-end, with every link fully in place.

(2) A structurally advantaged engineer workforce:enabling China to build faster and build stronger.

(3) A cultural DNA rooted in openness and long-term commitment:enabling China to dare to build, dare to test, and dare to innovate.

Once these foundational capabilities converged, the rise of China's automotive industry was not accidental— it was inevitable.

Here is "Tina's Talk."

And in our next episode, we're going to tackle an even bigger question: EP6: Can Chinese automakers actually become global rule-setters? Because in the next phase of global competition, rules and standards may matter even more than pure technology.

Stay tuned — and I'll see you in the next episode.

Written by Xiaoying Zhou — CEO and Editor-in-Chief, Gasgoo International