VW boss thinks he'll beat his 2018 target for 10 million sales

Rapid growth at Volkswagen Group has convinced CEO Martin Winterkorn that the company not only will be the first automaker to sell 10 million cars in a year but will do so before his target of 2018.

Since Winterkorn took over for Bernd Pischetsrieder in 2007, VW Group consistently has increased unit sales and operating profits despite a prolonged and severe downturn in Europe. He has done so by investing heavily outside of Europe, a move that has made China the largest global market for the VW and Audi brands. This has turned Asia Pacific into the VW Group's No. 1 region.

By comparison, struggling rival PSA Peugeot Citroen still relies on Europe for the majority of its sales.

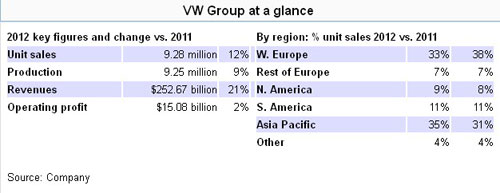

Through May, VW Group increased global sales by 6 percent, to 3.87 million. This follows a 12 percent sales gain in 2012 compared with 2011. That rise pushed total VW Group unit sales to a record 9.34 million.

When Winterkorn announced his 10-million sales goal for 2018 in 2007, many said the target was too ambitious, especially for a company that was selling about 6 million units a year.

During the first five years of the plan, VW Group increased unit sales by nearly 50 percent compared with 2007. That leaves the company six years to boost its global volume by 7 percent to 10 million vehicles compared with 2012.

VW Group is so far ahead of schedule because its global growth has offset the slowdown in western Europe, where the debt crisis has led to austerity measures that have kept customers from big purchases such as cars. The result is that May sales in Europe fell to a level not seen since 1993.

Last year, western European sales of VW Group's nine car and light commercial vehicle brands declined by 3 percent to about 3 million units. In contrast, sales in all of the automaker's other regions rose, led by Asia Pacific, where the volume was up 23 percent to 3.17 million units.

VW has been able to defy the European downturn because it is relying less on western Europe. Last year Asia Pacific accounted for 34 percent of VW Group vehicles sales, up from 32 percent in 2011, while Europe's share dropped to 33 percent of the automaker's total sales, from 38 percent in 2011.

While Winterkorn has no doubt VW Group will reach its 10-million target before 2018, he is reluctant to tinker with his plan, which includes a range of other goals. But he admitted in an interview that he can't rule out a readjustment of the company's goals ahead of the deadline. "If we have to adjust our goals at one point or another, then we will do that," he said.

Bernd Osterloh, deputy chairman of the VW supervisory board and the company's top union official, says that the automaker should set a new target.

"We definitely need a new [growth] strategy," Osterloh told reporters in January. VW's is mulling new targets that the automaker might reach by 2022, he said.

China will play a key role in VW Group's future. The automaker plans to increase China production by 60 percent to 4 million units by 2018. Last year the company's plants needed to work overtime to build 2.6 million units from a network with installed capacity of 2 million. To increase its output in China, VW Group will spend 9.8 billion euros, or about $12.84 billion, in the next three years in addition to the $20.57 billion it invested in the country from 1985 to 2012.

"We will be building a minimum of 10 additional plants in the coming years, of which seven will be in China," Winterkorn told shareholders in April. The expansion plan would increase the number of VW Group plants in China to 19.

Last year VW sold 2.81 million vehicles in China, of which about 2.62 million were built there. The target for this year is to reach 3 million China sales, but experts say that target might be difficult to reach.

"There's still enormous potential in China, but the market has slowed from double-digit growth to single digits, and that will remain so in the future," said Stefan Bratzel, director of the Center of Automotive Management at the University of Applied Sciences in Bergisch Gladbach, Germany.

"The risk of overdependence and overcapacity naturally rises with such a plan. It's up to VW to manage that."

Stumbling block

Winterkorn said another possible stumbling block could prevent VW Group from reaching 10 million sales before 2018. That would be if the new vehicles and the technologies that reduce carbon dioxide planned by the company fail to win customers.

But he added: "I don't believe that will happen. Plug-in hybrids are examples of vehicles that can be driven electrically and conventionally and that combine efficiency and suitability for everyday use, especially with regard to range."

VW has been slow to offer electric vehicles, which has protected it from the weaker-than-expected sales of the battery-powered models. The VW Golf Blue-e-Motion EV car is due to launch this year, as is the VW E-Up minicar EV.

The automaker had been pushing for continuous improvement of its internal combustion engines, and it aims to team those powerplants with different combinations of electrification. The aim is to offer plug-in hybrids to provide low emissions and high fuel economy at a moderate price.

The company's first plug-in hybrid will be the low-volume XL1, which debuted this year. When asked which plug-in hybrids would be the first to provide large volumes for the company, Winterkorn said it would be the VW Golf variant with the powertrain and the Audi A3 E-tron.

"They were the vehicles that fascinated me the most during a trip last summer with my colleagues on the management board," Winterkorn said. "These models are completely quiet and run emission-free in electric mode. And on the autobahn they generate 200 hp."

U.S. slowdown

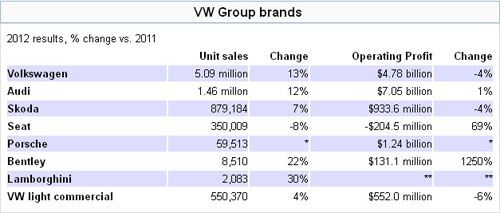

VW Group also faces slowing sales in the United States, where it aims to have a volume of 1 million units by 2018, with VW brand accounting for 800,000 units and Audi the rest. In 2012, the company sold 438,133 VW-brand vehicles, and Audi's U.S. total was 139,310. Both brands gained market share, but the automaker is still a long way from 1 million.

The VW brand is stagnating in the United States. Through May, the brand's sales were flat at 169,835 units, in a market that grew by 7 percent.

The problem has been flat sales of the U.S.-built Passat mid-sized sedan. In response to the lower-than-expected Passat sales, VW said in April it would eliminate 500 contract jobs and cut shifts at its new plant in Chattanooga to reduce an oversupply of the car.

The move is a setback for VW, which re-established a manufacturing presence in the United States to help it meet its 2018 goal for the market. The company opened the Chattanooga factory in 2011, giving it local assembly in the United States for the first time since closing a plant in Pennsylvania in 1988.

Demand for the redesigned Passat has been well below the plant's 150,000-unit capacity as VW sold 117,023 units of the car in the United States last year. VW also is facing increased competition in the United States from Japanese automakers that are benefiting from the weakness of the yen against the dollar.

No cuts in Europe

VW Group is not planning to cut capacity in Europe despite a potential sales slowdown in China, the possibility that customers will not buy its low-CO2 models and weaker-than-expected U.S. results. Europe, including Russia, is VW's largest manufacturing region, with worldwide exports of about 900,000 vehicles last year. While VW Group produced half of its vehicles in Europe in 2012, the region accounted for just 40 percent of its global sales.

If VW Group is forced to take action in Europe, it will cut temporary jobs, but it won't close factories or reduce its permanent work force, Winterkorn said.

"We will not withdraw any capacity from Europe but rather preserve capacity in Europe," Winterkorn told an Austrian TV station. "The regular staff is certainly something we will hold on to. We will have to think about temporary staff."

Stuart Pearson, a financial analyst at Morgan Stanley in London, summed up VW Group's chances for reaching its 2018 goals: "The ability of VW to continue to harvest high profits in mass-market China and remain the aggressor in the low-margin world of the European mass market will remain the key determinants of its success going forward."

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com