Top 10 China-startup-made models by insured car volume in July

Shanghai (Gasgoo)- In July, consumers in China purchased the mandatory liability insurance for traffic accidents of motor vehicles (MLI) for a total of 2,232 vehicles made by Chinese startups, compared with 9,162 units for the month of June, according to the China Insurance Regulatory Commission (CIRC).

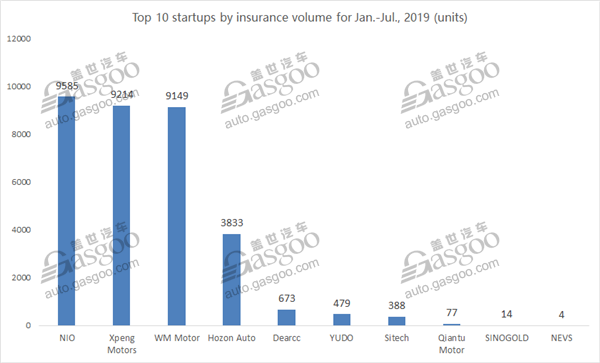

For the first seven months, the insured number of startup-made vehicles totaled 32,336 units.

China's NEV market saw the sales in July drop 4.7% from the previous year to around 80,000 units, the first time hit by year-on-year downturn in terms of monthly volume.

For the first seven months, NEV sales volume in China totaled 699,000 units with a jump of 40.9%, 8.7 percentage points less than that of first-half growth.

The Chinese government in March announced a series of cuts to new energy vehicles subsidies, which have been instrumental in boosting the rapid sales growth that has made China the largest NEV market in the world since 2015.

Quite a few market demands had been overdrawn as consumers scrambled to take advantage of the cheaper prices in June, the last month before the new stricter NEV subsidy policy were implemented.

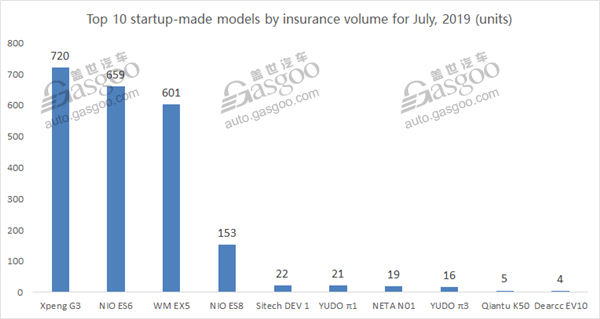

The top 4 startup-made models by July insurance number were the Xpeng G3, the NIO ES6, the WM EX5 and the NIO ES8. However, none of them got a volume exceeding 1,000 units. Numbers of models ranked from 4th to 10th were all below 100 units.

In terms of the year-to-date insurance number, only four startups—NIO, Xpeng Motors, WM Motor and Hozon Auto—witnessed their respective volume surpass 1,000 units.

NIO

(Photo source: NIO)

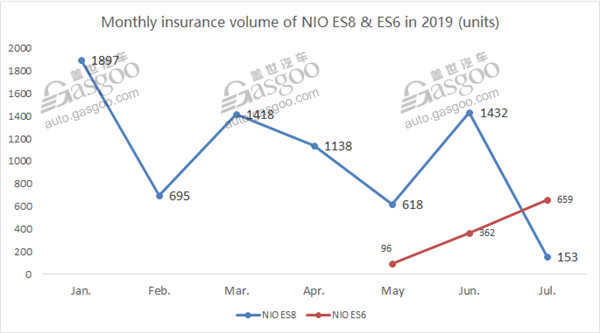

Primarily affected by a voluntary battery recall for 4,803 ES8s, NIO only delivered 837 new vehicles in July, suffering a plunge from 1,340 units handed over a month earlier.

“On the positive side, we completed the ES8 battery recall in roughly half of the time compared to our original timeline”, said William Li, founder, chairman and chief executive officer of NIO. “Going forward, with battery capacity allocation back to normal, we will accelerate deliveries and make up for the delivery loss impacted by the recall. We expect August to be a much stronger month, and target to deliver between 2,000 and 2,500 vehicles,” Mr. Li concluded.

NIO's cumulative insured car number for the first seven months has not topped 10,000 units yet, which was far less than the 40,000-unit minimum sales target.

Xpeng Motors

(Photo source: Xpeng Motors)

The Guangzhou-based startup has its 9,214 vehicles insured through July, almost closing its delivery goal of 10,000 units as of end-July. However, it will still be an arduous task to achieve the annual target of 40,000 units within only five months.

WM Motor

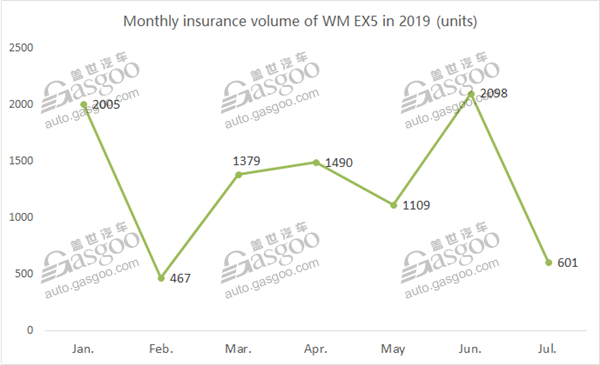

Before new NEV subsidy policy came into effect WM Motor said that prices across its entire vehicle lineup would not be changed. Besides, the EV manufacturer launched the EX5 400 Mate that further enriched customers' options over battery range.

(Photo source: WM Motor)

The rapid growth in delivery was partly buoyed by the fast expansion of sales channels. WM Motor also said it had so far cooperated with 124 dealers in 82 cities of China by the end of July, completing the goal of 100 dealers ahead of schedule.

Besides, WM Motor is actively deploying its products in such areas as tourism vehicle rental, ride-hailing service and urban car sharing through it smart mobility service brand “GETnGO”.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com