SAIC Motor says May sales only drop 1.63% YoY

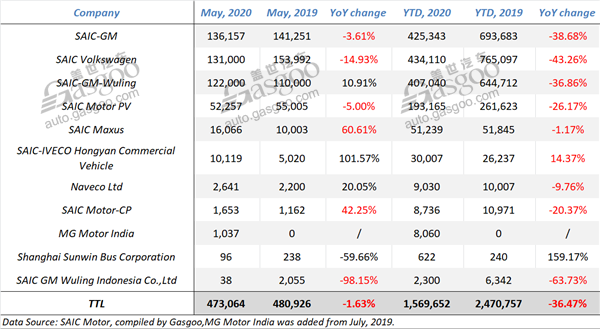

Shanghai (Gasgoo)- SAIC Motor reported a wholesale volume of 473,064 vehicles in May, representing a slight year-on-year decrease of 1.63%. With 1,569,652 units sold in total, the Chinese automaker posted a 36.47% decline for the first five months, 8.42 percentage points fewer than the drop in Jan.-Apr. volume.

Three PV subsidiaries' sales continue to pick up

The sales of two PV joint ventures have been back to normal. In May, SAIC-GM saw its wholesales edge down 3.61% over a year ago to 136,157 units, for the first time outnumbering SAIC Volkswagen (“SAIC VW” for short) over the past 21 months. Compared to April, it also achieved a 23.78% growth.

(Cadillac CT4, photo source: Cadillac China)

The manifest recovery in SAIC-GM sales mainly stemmed from both the strengthened sales promotion and the faster launch of new products. In the month of April and May, the joint venture rolled out a number of heavyweight new models such as the Cadillac CT4, the Chevrolet Blazer, the new-generation Buick GL8 ES and GL8 Legacy and the refreshed Buick sedan family.

SAIC-GM said both Cadillac and Buick gained year-on-year and month-on-month increase in May sales, and the mid-/high-end models accounted for 55.7% of its total sales.

(Viloran, photo source: SAIC VW)

SAIC VW's wholesales fell 14.93% from the previous year to 131,000 units, posting a milder rebound that that of SAIC-GM partially due to fewer new products launched. On May 28, the Viloran premium MPV hit the market with its prices starting at 286,800 yuan ($40,501) to compete head-on with the Buick GL8.

SAIC Motor PV, the group's self-owned PV subsidiary, saw its wholesales shrink 5% year over year to 52,257 units in May. There were around 35,000 Roewe-branded vehicles handed over to consumers, said the PV automaker, of which roughly 14,600 units were the RX5s.

It is important for whether Roewe or MG to move upscale, especially the share of low- or mid-end markets is harder to get by decreasing prices. For the second half of the year, remaining stable year on year might be a good result for SAIC Motor PV, which is working on its brand transition and upgrading.

SAIC-GM-Wuling, SAIC Maxus gain blooming sales growth

Amid the COVID-19 pandemic, SAIC-GM-Wuling (SGMW) must be the least-hit and fastest-recovering one among all SAIC's subsidiaries. Its wholesales in May amounted to 122,000 units, rising 10.91% over the year-ago period. Besides, the joint venture also boasted a year-over-year hike of 47.7% with 13,588 completed vehicles exported during the first five months, SGMW announced via its WeChat account.

SAIC Maxus, whose product lineup also includes both PVs and CVs, boasted a 60.61% year-on-year hike by selling 16,066 vehicles in May.

On May 18, SAIC Maxus' EUNIQ series hit the market, marking the company's start of a NEV onslaught and portending a possible growth point for future sales.

CV sector logs vigorous sales jump thanks to governmental policy, rising demands

Except Sunwin Bus which targets business users, the other CV brands all attained manifested increase in May. Notably, the growth in SAIC-IVECO Hongyan Commercial Vehicle's volume stood at up to 101.57%.

(Genlyon, photo source: SAIC Hongyan)

Compared to PV sector, the CV market still has a bigger room to expand sales mainly due to policies and users' demands, said a senior analyst from Gasgoo Auto Research Institute. In spite of the probable economy recession caused by COVID-19 pandemic, a large amount of key programs related to the new infrastructures would directly drive the domestic CV sales growth. Possessing a complete CV portfolio, covering buses, light-duty and heavy-duty vehicles, SAIC Motor features a great potential in increasing CV sales, particularly stimulated by governmental incentives.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com