Tesla’s China-made Model 3 registrations hit another record high

Shanghai (Gasgoo)- In May, 11,362 consumers in China purchased the Mandatory Liability Insurance for Traffic Accidents of Motor Vehicles (MLI) for the China-built Tesla Model 3 cars, a precipitous growth of 173.52% month on month, according to the China Insurance Regulatory Commission (CIRC).

During the same month, the insurance volume of the imported Model 3, Model S and Model X reached 102 units, 2 units and 97 units respectively, all showing decrease over a month ago.

After topping 10,000 units in March, the registrations of the locally-made Model 3 plunged to 4,154 units in April. In the eye of Cui Dongshu, the secretary general of the China Passenger Car Association, this was a relatively abnormal level. The downturn might be partly attributable to the automaker's frequent price adjustments which led to consumers' wait-and see attributable towards a further price reduction. Another probable factor is that the act-first-and-report-afterwards hardware downgrade to some extent bruised consumers' confidence and trust.

Moreover, the emerging effect from the government's roll-out of incentives to spur car sales, and the overseas supply chain disruption caused by the coronavirus pandemic also contributed to the sales slump, according to a senior analyst at Gasgoo Auto Research Institute (GARI).

(Model 3, photo source: Tesla China's official website)

Last month, the Model 3 was once again honored the best-selling China-built NEV model, holding a safe leading over others. Mr. Cui thought this was a normal performance for Tesla on condition of stable production and sale. Aside from a steady growth in receiving orders, Tesla is carrying forward local production in an orderly manner. As a result of its direct selling business model, the flexible price change has somewhat curbed the demand growth, while the U.S.-born EV brand is still highly recognized by Chinese consumers by virtue of its powerful product competitiveness.

It is noteworthy that Tesla kicked off on May 20 the delivery of the China-made Model 3 long-range RWD, only forty days after starting the presale. Besides, the construction of the Shanghai plant's second phase being pushed ahead with at a faster-than-expected pace and the forthcoming Model are likely to make Tesla a regular NEV seller with over 10,000-unit monthly sales.

However, there are still many challenges that lay ahead of the high-profile EV maker, like the potential disruption in supply chain stemming from the ongoing global spread of COVID-19 pandemic. It still has a long way to go in building user service system, expanding charging network, improving the vehicle assembly quality, and localizing autonomous driving and infotainment software in China.

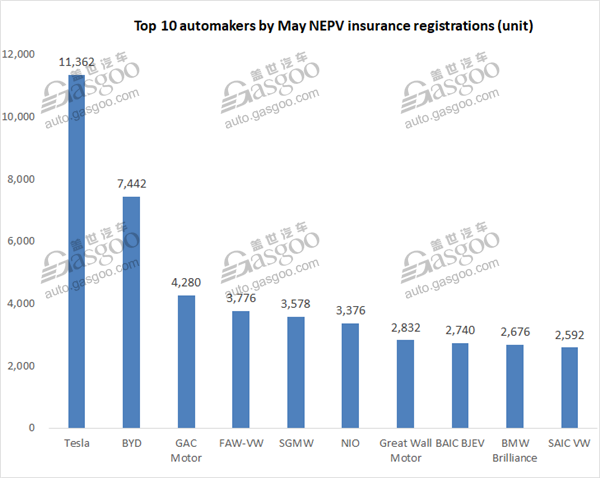

Tesla gets a good lead over local rivals in China-made NEV registrations

With only one model on sale, Tesla was the No.1 automaker in May by the insurance registrations of locally produced new energy PVs (NEPVs), outselling the runner-up BYD by 3,920 units.

Among 65,728 China-made NEPVs insured last month, 7,442 units came from BYD. Its main sales contributors include the Qin EV, the e2, the Yuan EV, the Song PHEV and the Tang PHEV, while none of them can compete head-on with the Model 3.

Occupying the second runner-up place, GAC Motor accounted for 6.5% of the country's totals. With 3,863 units insured, the Aion S was the hottest-selling one, followed by the Aion LX, the Trumpchi GE3, and the Trumpchi GS4 PHEV.

There were three automakers whose respective registrations all surpassed 3,000 units in May, namely, FAW-VW, the SAIC-GM-Wuling (SGMW), and NIO.

Model 3 wins landslide victory over China's startup-made models

It needs no long argument that Tesla was streets ahead of Chinese local startups in May deliveries. Nevertheless, some bright spots are still noteworthy.

As one of most well-received all-electric SUV model in China, the NIO ES6 featured an insurance volume of 2,651 units in May, only 235 units fewer than that of April. For the first five months, its registrations amounted to 9,148 units, 87.1% of which was for car owners’ personal use.

The Leading Ideal One became the only PHEV model whose May insurance volume exceeded 1,000 units. The insurance purchased by private users took up 86.6% of the total volume. The major four cities where the vehicles were registered were Beijing, Shenzhen, Zhengzhou and Guangzhou, according to the CIRC.

Moreover, the Nezha N01 was ranked third among Chinese startup-made NEV models, outnumbering the WM Motor’s EX5 by only five units. The volume of the Xpeng G3 failed to surpass 1,000 units, sliding from 1,234 units for the month of April.

Tesla, Germany's Big Three create win-win situation in premium car sector

Someone argue that the advent of the homegrown Tesla vehicles would threaten the dominance of “Germany’s Big Three” (referring to Audi, BMW and Mercedes-Benz) in the premium car market within the same segment. However, it may be too early to make a decisive judgement from the current situation.

Regardless of the unusual decline in April, the Model 3 overtook the Audi A4L, while was still outperformed by the BMW 3 Series and the Mercedes-Benz C-Class in May, which posted continuous growth since bottoming out from the nadir in Feb. It indicates that there might be a win-win situation co-created by both Tesla and traditional luxury auto brands.

“The price range of 300,000-400,000 yuan targeted by the buyers of premium fuel-burning models is also available to the Tesla’s users,” said Yan Jinghui, an analyst of automotive industry. He added those who buy traditional premium vehicles do not reject buying BEVs. Although Tesla has not posted an utter threat to fuel-powered products because of the different application scenarios, it is likely to be a vigorous opponent against the conventional luxury vehicles with the industry going more and more electric.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com