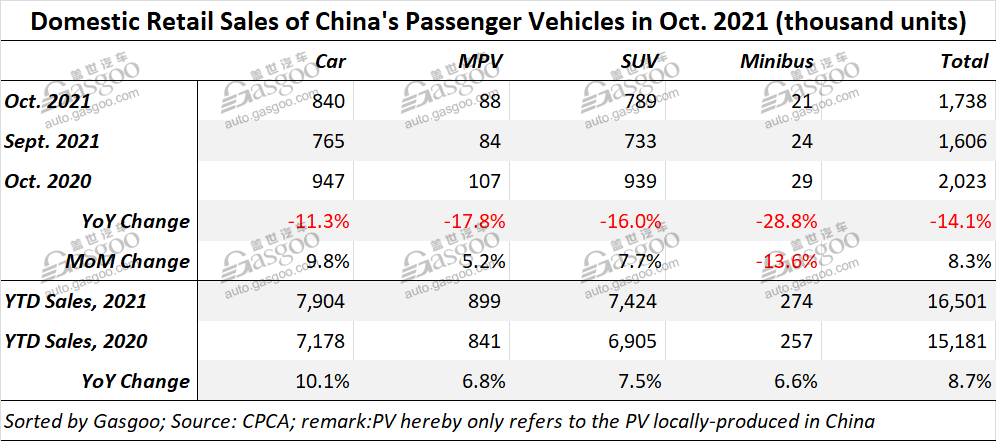

Shanghai (Gasgoo)- In October 2021, the retail sales of locally-produced PVs (referring to cars, MPVs, SUVs and minibuses) in China amounted to around 1.738 million units, dipping 14.1% year on year, while climbing 8.3% month on month, according to the China Passenger Car Association (CPCA).

The month-over-month growth was partially thanks to the effective prevention and control of the coronavirus pandemic that made travel restrictions lifted in many regions, and the gradual improvement of chip supply at the end of September, according to the CPCA.

While the government is controlling total energy consumption and energy intensity, the orderly use of electricity has been widely implemented across China due to the coal resource supply constraint and the topsy-turvy prices of coal-fired power. The phenomenon somewhat affected the production of auto parts suppliers, while the impact was limited, said the association.

Besides, the car lead-time was extended as dealerships were facing low level of inventories. Under the stock pressure, dealers withdrew the discounts launched for sales promotion and raised the prices of derivatives to pursue higher profits, hence the car deliveries were reduced correspondingly.

The four segments all recorded two-digit year-on-year decline in Oct. retail sales. However, compared to the previous month, the car, MPV, and SUV units all posted rising movement.

China's retail sales of locally-made luxury PVs reached roughly 180,000 units in October, sliding 27% year on year and falling 11% from a month earlier, while ticking up 1% compared to October in 2019. The stable performance hinted at the robust consumer demands of replacing old cars with premium ones and had little effect on the competition landscape of the overall PV market.

The retail sales of Chinese indigenous auto brands reached about 770,000 PVs last month, representing a 4% growth year on year, an 11% increase month on month, and a 9% rise compared to October in 2019. The market share of China's self-owned brands reached 45.6% in October by retail sales, 8 percentage points higher than that of the year-ago period.

The retail sales of mainstream joint-venture brands also totaled about 770,000 units in October, down 24% and 19% compared to the same period in 2020 and 2019 respectively, while jumping 12% over a month earlier.

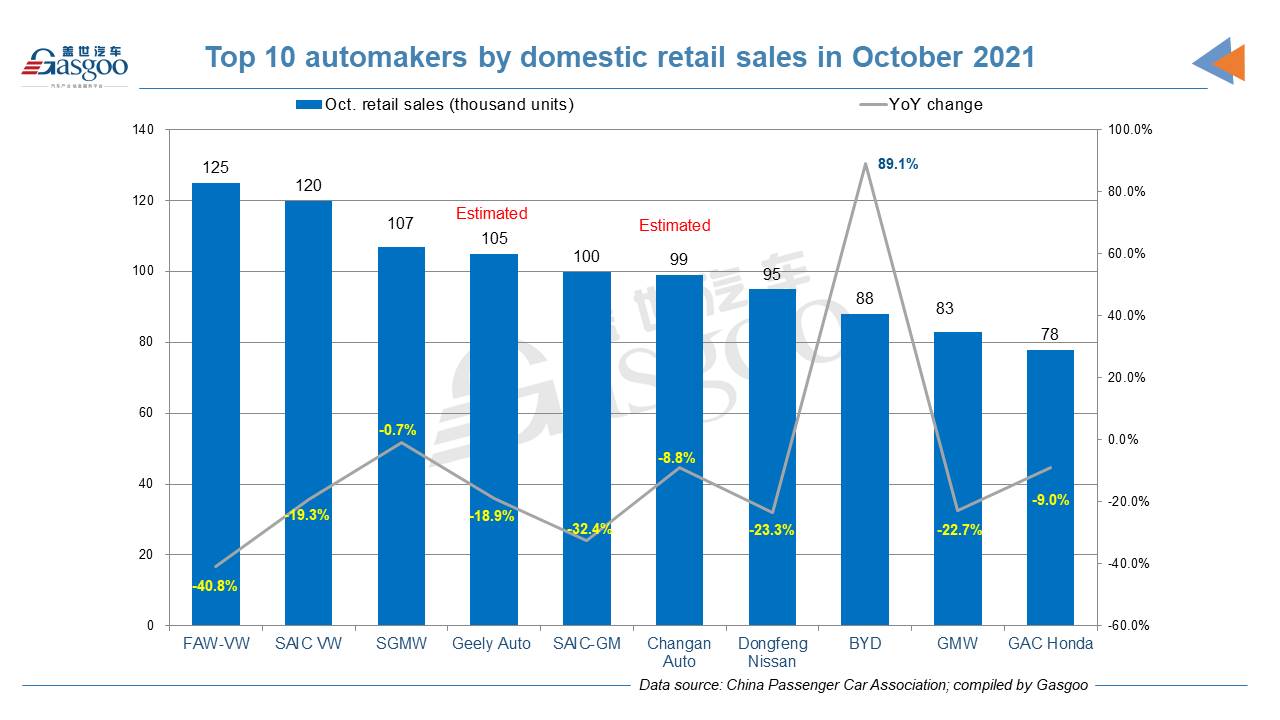

Among the top 10 automakers by domestic PV retail sales in October, FAW-VW, SAIC VW, SGMW, and Geely Auto were the top 4 with sales all topping 100,000 units. On the top 10 automakers list, only BYD posted a year-on-year upward movement. Compared to the rankings for September, the occupants of the sixth to tenth places remained the same in October.

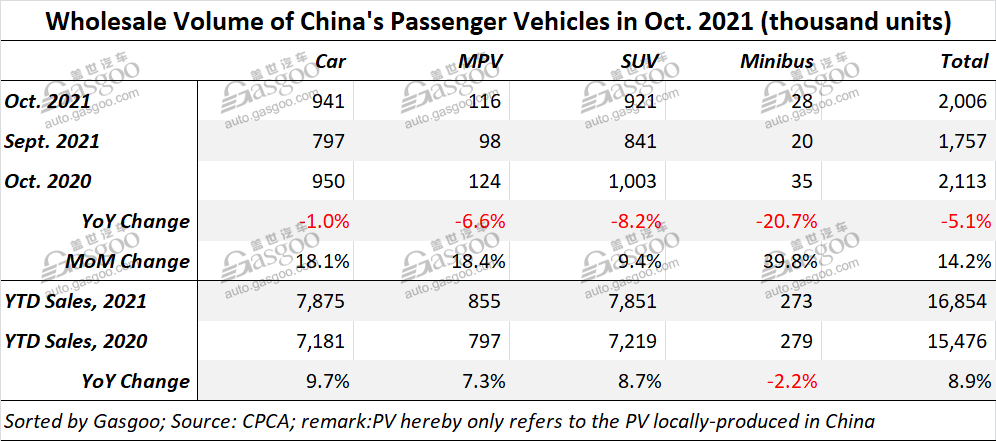

PV wholesale volume in China reached 2.006 million units in October, sliding 5.1% from a year earlier with the car, MPV, SUV, and minibus segments all recording decline. Nevertheless, compared to the previous month, the four segments all attained growth to result in a 14.2% increase in the country's overall PV wholesales.

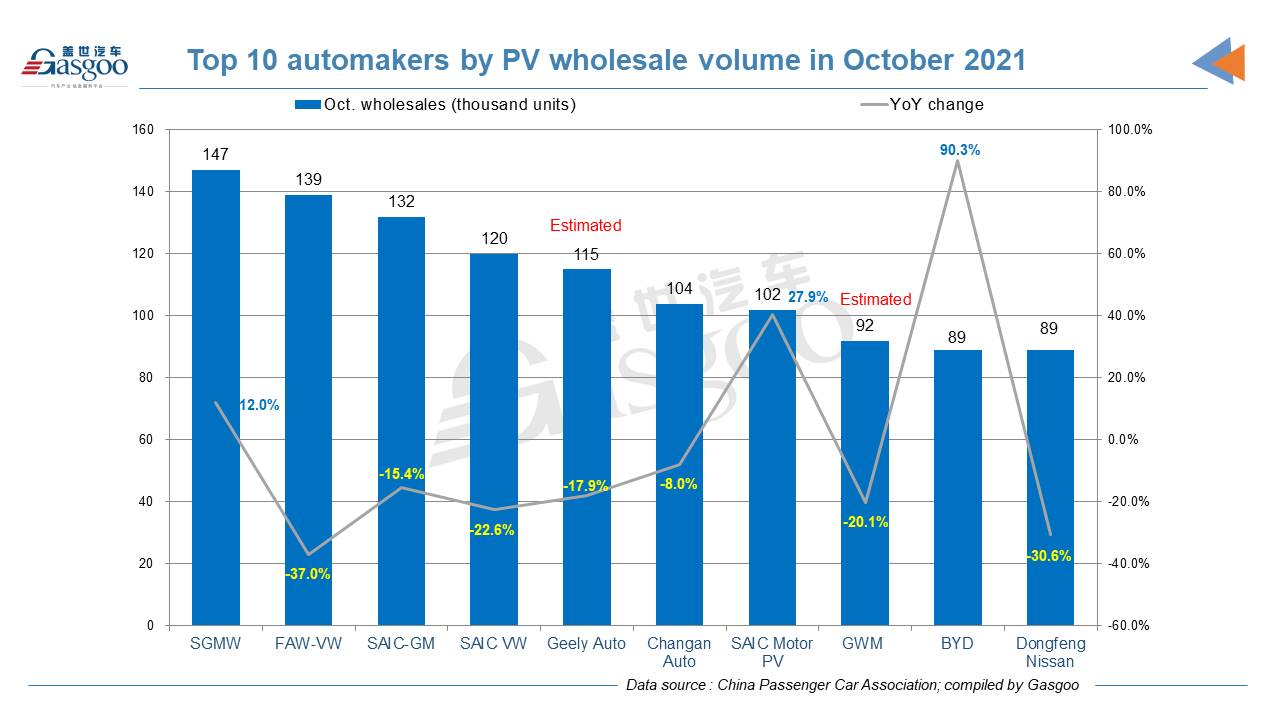

On the top 10 list of automakers by Oct. PV wholesales, SGMW, SAIC Motor PV and BYD were the only three scoring year-on-year growth mainly thanks to the robust rise achieved by their new energy vehicle businesses. Besides, SAIC Motor had four subsidiaries on the top 10 list, namely, SGMW, SAIC-GM, SAIC Volkswagen, and SAIC Motor PV.

While elucidating the PV sales performance in October, the CPCA also revealed its expectation for next year, saying the year-on-year growth in the 2022's China-made PV wholesales is anticipated to reach around 5%, remaining flat over the increase the association forecasted for 2021’s full-year volume.

The prediction was made by considering complex factors including pandemic control status, chip shortage, recovery of consumers’ purchasing power, uncertainties on export business, holidays, policies, and will be revised based on future situation.