Monthly insurance registrations of China-made passenger vehicles (PV) achieved the second best results in November, only less than the volume of January, while the Wuling Hongguang MINIEV became the most registered vehicle model in China.

Data from the China Banking and Insurance Regulatory Commission (CBIRC) showed that, the insurance registrations of locally-made PVs in China totaled 1,709,753 vehicles in November, falling 11.4% from a year ago and increasing 4.6% from the previous month. Among the vehicles registered last month, 55,805 were for renting and leasing.

By the end of November, the market had registered a total of 18,067,601 new locally-made PVs, up by 9.7% versus the same period of last year. But from July on, the monthly registration volume in the country had been outnumbered by the same period of last year for five consecutive months.

TOP 20 brands and models

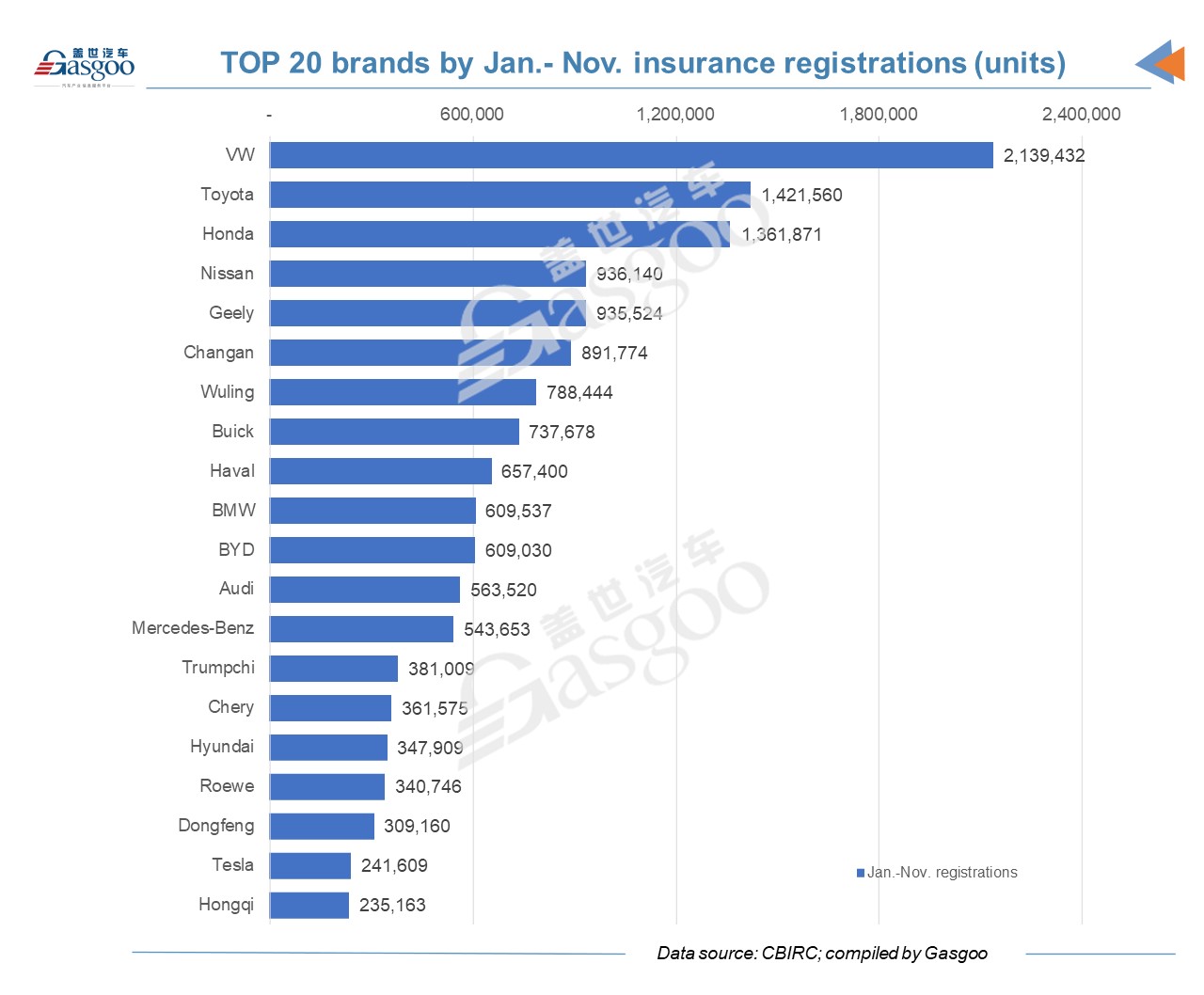

The players on the monthly top 20 brands list seemingly saw few changes, if any, in the past several months. Half of them were local brands. Volkswagen remained the champion while Toyota and Honda occupied the next two spots. BYD climbed to the fourth, 32,938 fewer than the volume of the third. And the gap between Geely, the sixth, and Changan, the seventh, was fewer than 5,000 units.

13 brands on the list had two digit decrease from a year ago while Hyundai declined the most with a decrease of 44.6%. BYD saw the largest growth rate on the list, at 134%. The other brands whose registrations increased from a year ago were Wuling (20.67%), Trumpchi (20.79%), Chery (29.1%), Tesla (49.12%), Dongfeng (31.49%) and Hongqi (33.13%). Ford ranked 21st.

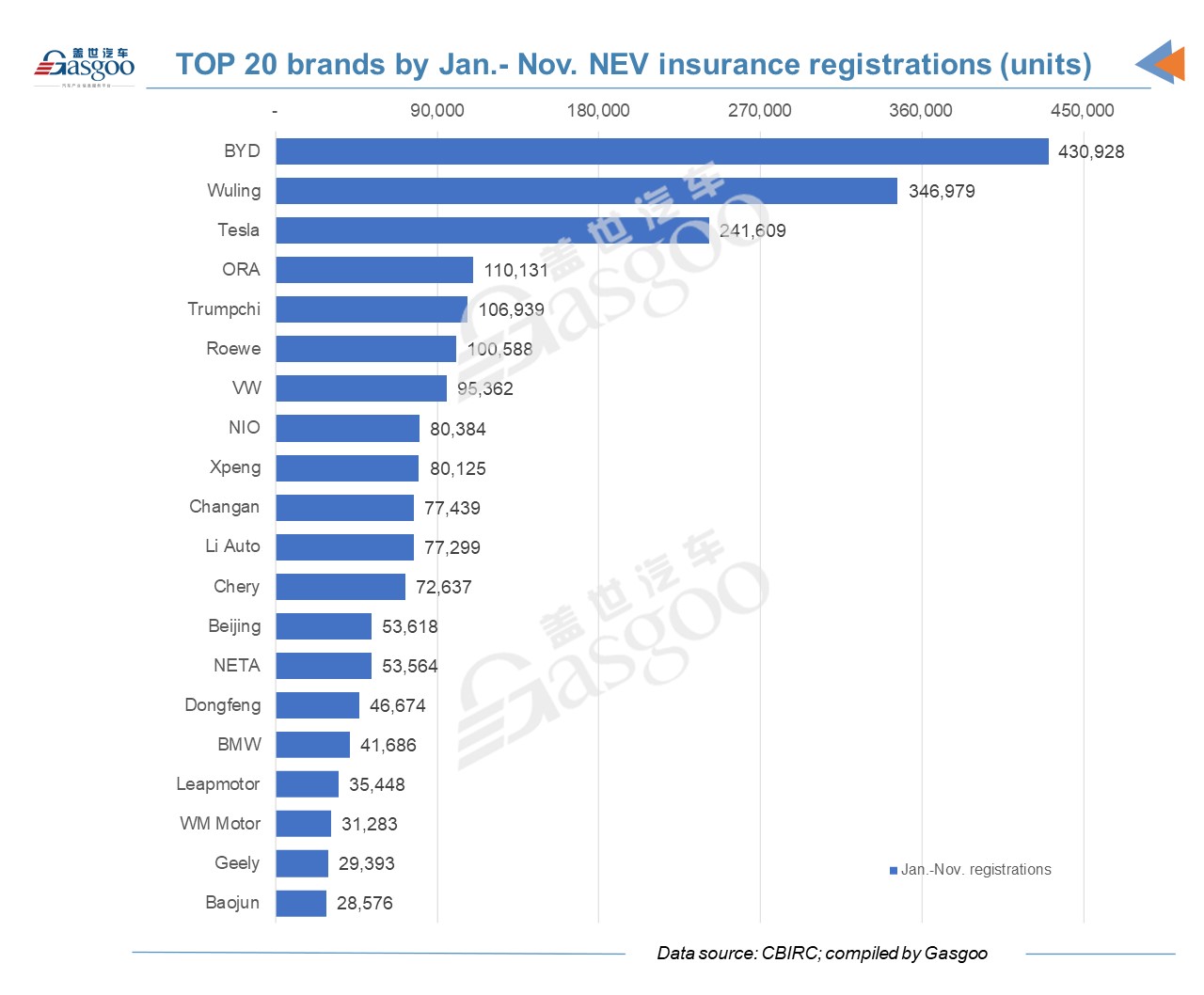

The market registered 241,609 Tesla vehicles in the first eleven months of this year, representing an increase of 110% year on year and ranking 19th on the year-to-date list. BYD and Dongfeng also reported three-digit year-on-year jump in Jan.-Nov. registrations, at 104.9% and 207.2% respectively.

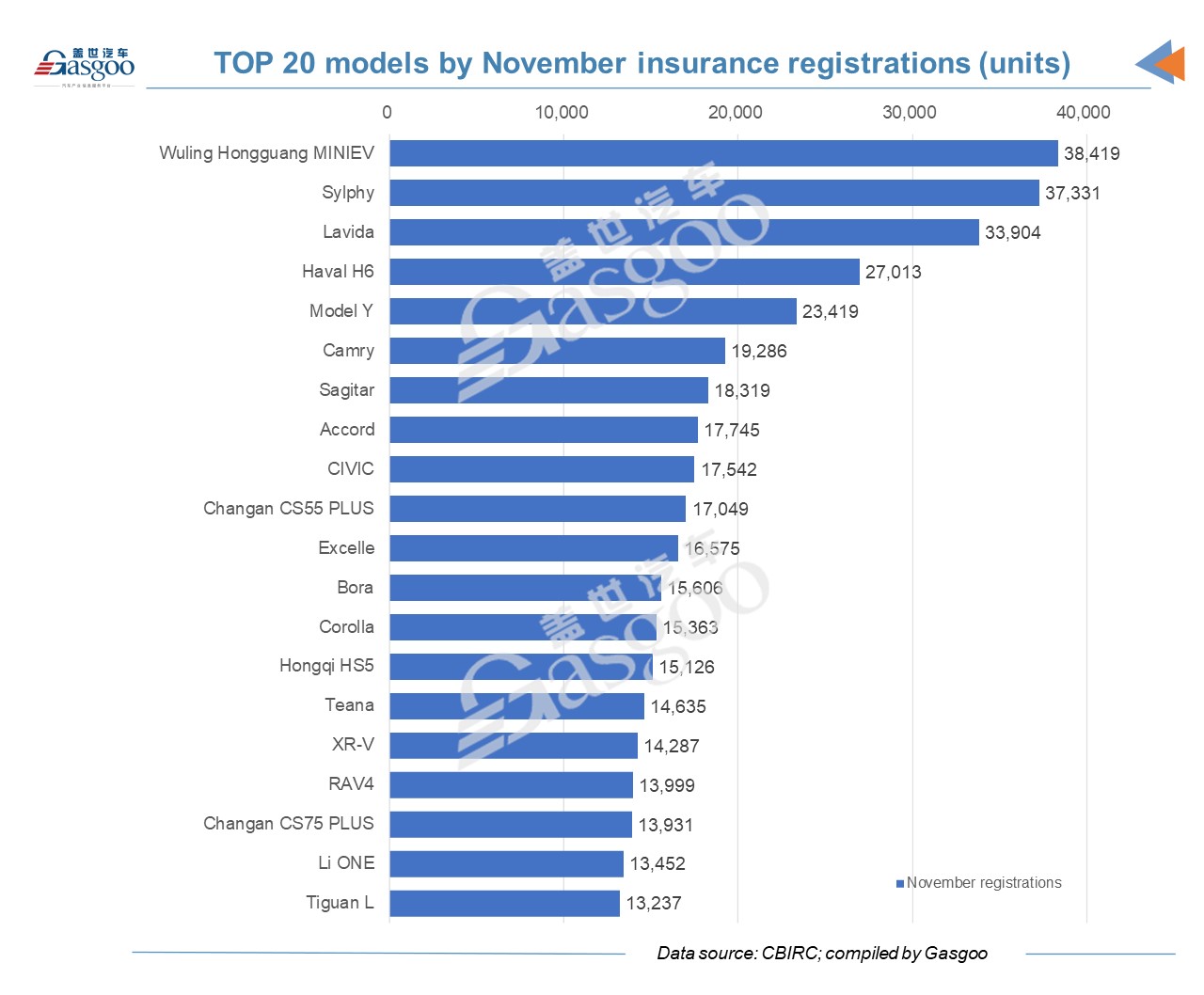

The Wuling Hongguang MINIEV became the most registered locally-made model in China in November for the first time, outplacing the Sylphy. Apart from the mini car, the Model Y from Tesla was the other electric model among the top 5 registered models in November. The Li ONE ranked the nineteenth, with monthly registrations surging 188% year on year.

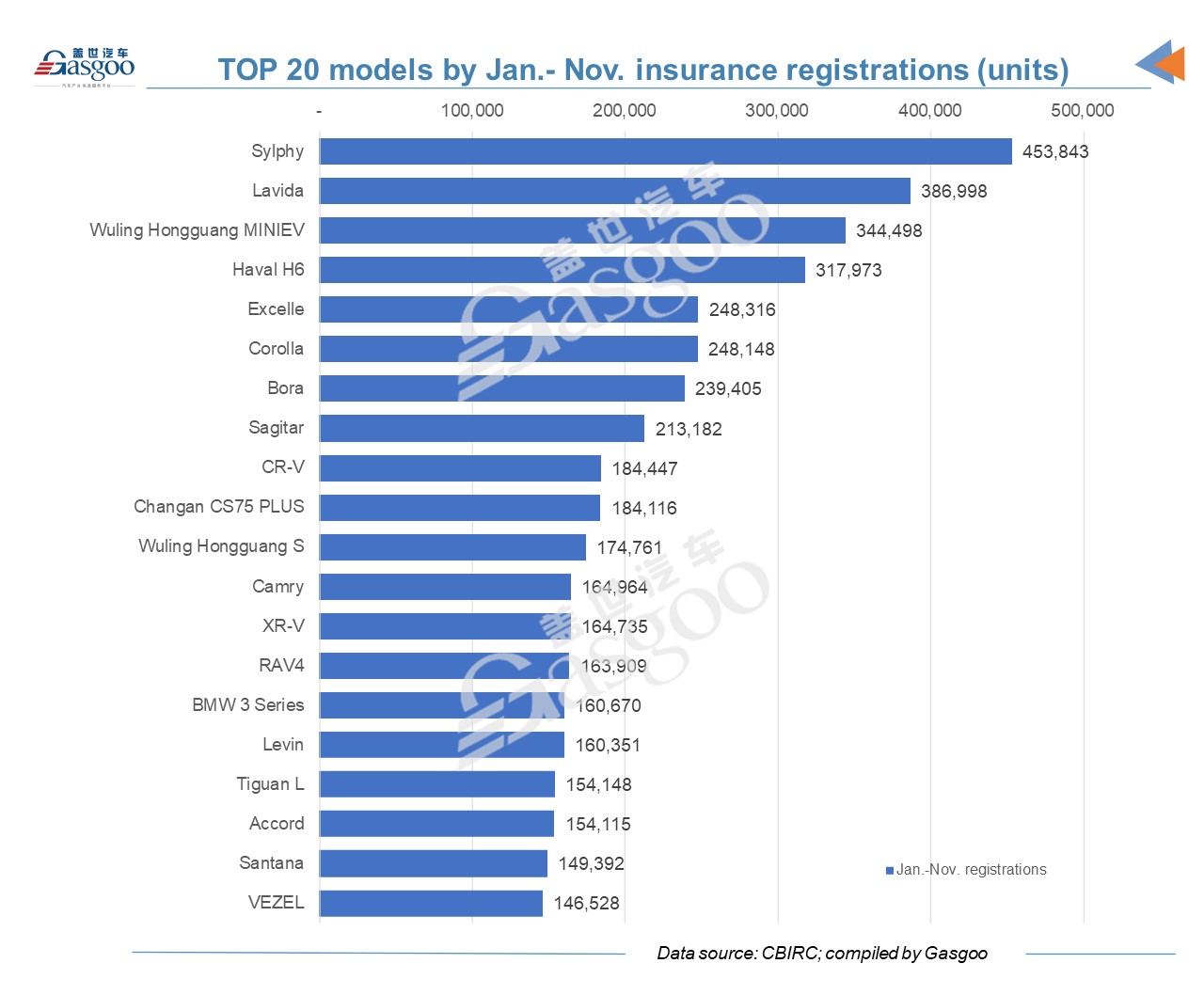

In terms of Jan.-Nov. results, the Wuling Hongguang MINIEV was the third, but its gap with the second model, the Lavida, narrowed to 42,500 units. Another Chinese-branded model on the top 5 list was the Haval H6, whose Jan.-Nov. registrations jumped 13.88% year on year.

TOP 20 brands and models by NEPV registrations

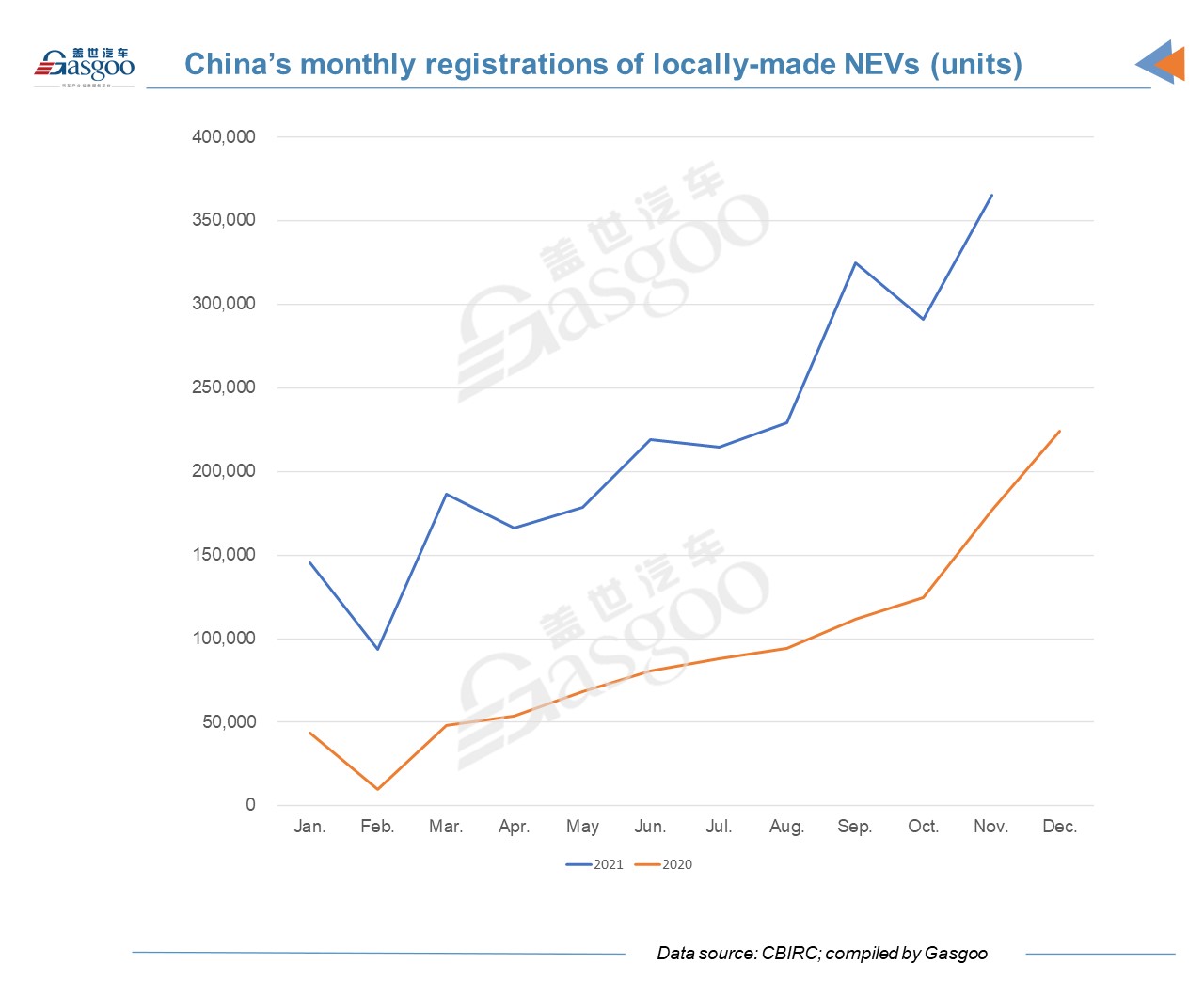

In November, China registered 365,298 locally-built new energy passenger vehicles (NEPVs), soaring 106.7% from a year ago and jumping 25.5% compared with the previous month. That was the best results so far this year and had a share of 21.4% out of the total monthly registrations.

Battery electric vehicles (BEVs) accounted for 80.8% of the monthly NEPV volume with 295,202 registered. 15,803 range extended electric vehicles were registered last month and 13,435 were the Li ONEs. Besides, the country also registered 54,292 more plug-in hybrid electric vehicles. And 45,817 NEPVs were registered for renting and leasing.

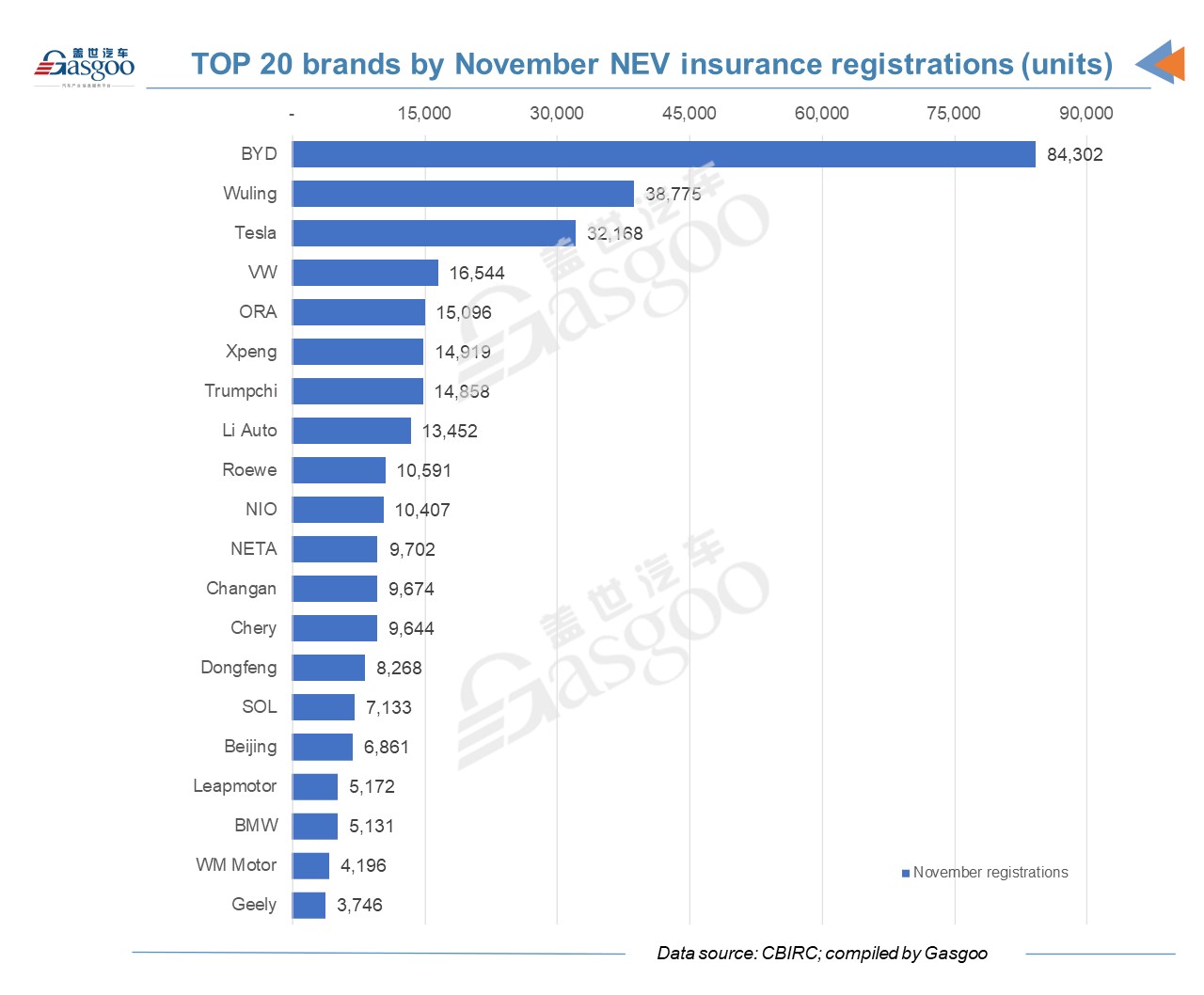

The top 3 brands by monthly NEPV registrations in China remained BYD, Wuling and Tesla, but BYD has widened the lead over the other two brands. VW ranked fourth, but the next four brands were not so distant. The three U.S.-listed Chinese automaking startups, XPeng, Li Auto and NIO, entered the top 10 list with respective registrations over 10,000 units. On the second half of this list, there was only one foreign brand, namely BMW.

Totally different from the overall monthly top 20 models list, 19 brands on the monthly NEPV list had over 20% registration growth year on year. Only Beijing brand had a slight decrease of 1.29%.

By Jan.-Nov. volume, only three on the top 20 list were foreign brands. All the top 12 brands all saw three-digit growth rate compared with the same period of last year. And 6 brands had a year-to-date registration volume over 100,000 units. Baojun, ranking 20th, was the only brand on the list which had a year-on-year decline.

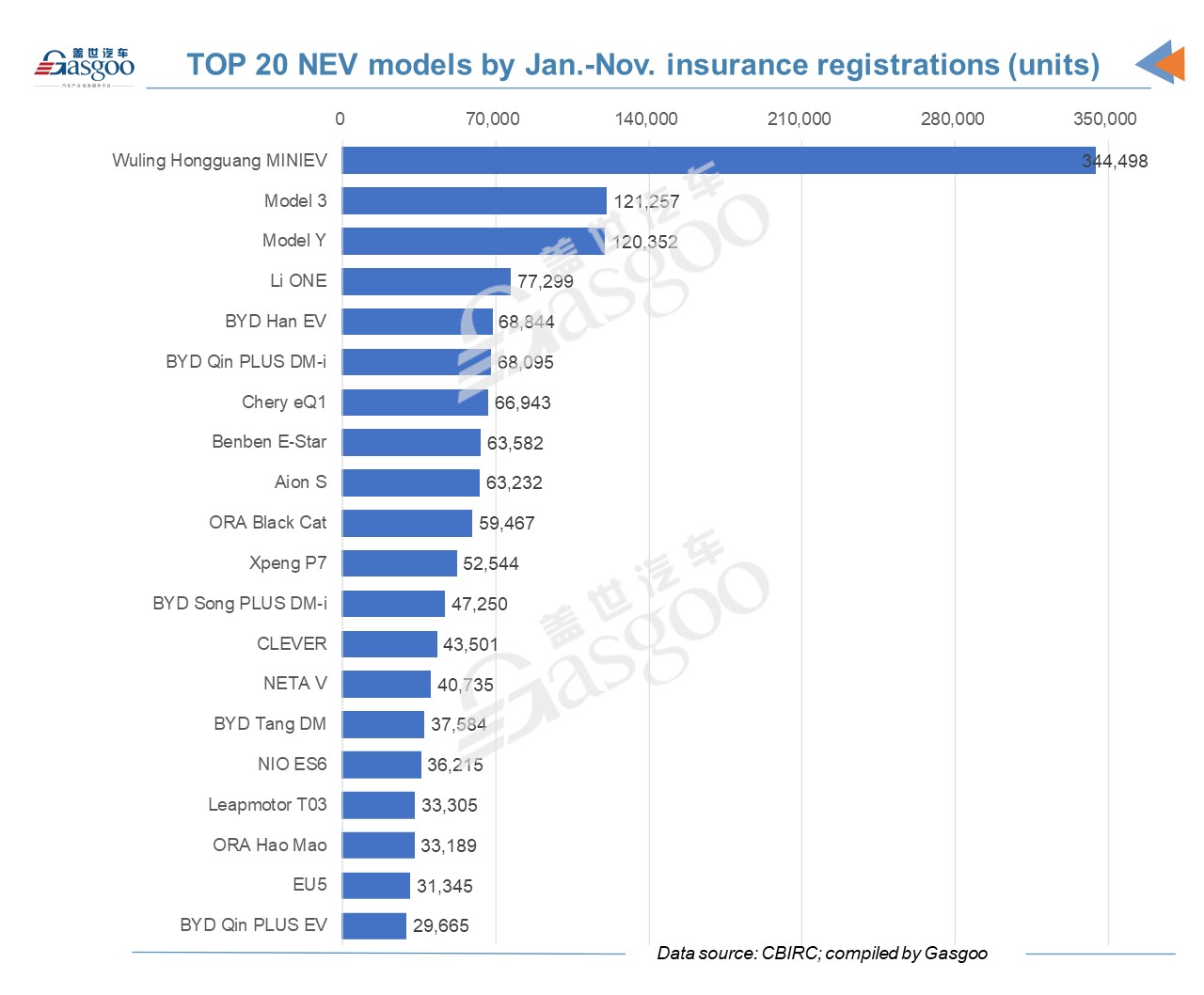

Seven models on the top 20 NEV models list came from BYD brand, with combined registrations occupying nearly 31% of the total volume of the top 20 models. The BYD Dolphin ranked 18th with 6,031 registered. The list includes three models from local startups, the Li ONE, the XPeng P7 and the NETA V.

Three NEV models had year-to-date registrations over 100,000 units while the Wuling Hongguang MINIEV’s results surpassed 300,000 vehicles. Li ONE was the fourth registered NEV model in the first eleven months of this year.

![[Gasgoo News] Mercedes-Benz and Momenta Deepen Cooperation; CATL Signs Agreement with BMW to Jointly Promote Battery Passport Pilot](https://gascloud.gasgoo.com/production/2026/03/962599ce-a051-49cd-b4ee-fe570805602f-1772376677.png)