Leapmotor’s emerging operation and IPO pursuit on Hong Kong Stock Exchange

On March 17th, China’s electric vehicle startup Leapmotor officially kicked off its IPO application on Hong Kong Stock Exchange (HKEX), entering the team of HKEX-listed EV startups in China, after NIO, Li Auto, and XPeng.

CICC, Citi, J.P. Morgan Chase, and CCB International are co-sponsors of Leapmotor’s IPO.

Photo credit: Leapmotor

By the end of 2021, rumors had that several local EV startups were pursuing an IPO, including Hozon Auto, WM Motor, and Leapmotor. Apparently, Leapmotor has become the lead player in this round.

Founded on December 24th 2015, in Zhejiang province, Leapmotor is Zhu Jiangming’s ambitious attempt in the automobile field. Zhu Jiangming is the founder of Dahua Technology, a public-listed conglomerate focusing on camera-based IoT technologies, including smart transportation products like parking solutions, traffic signals and more. It is safe to say that before Leapmotor, Zhu Jiangming had accumulated profound experiences in the transportation intelligence field.

Photo credit: Dahua Technology

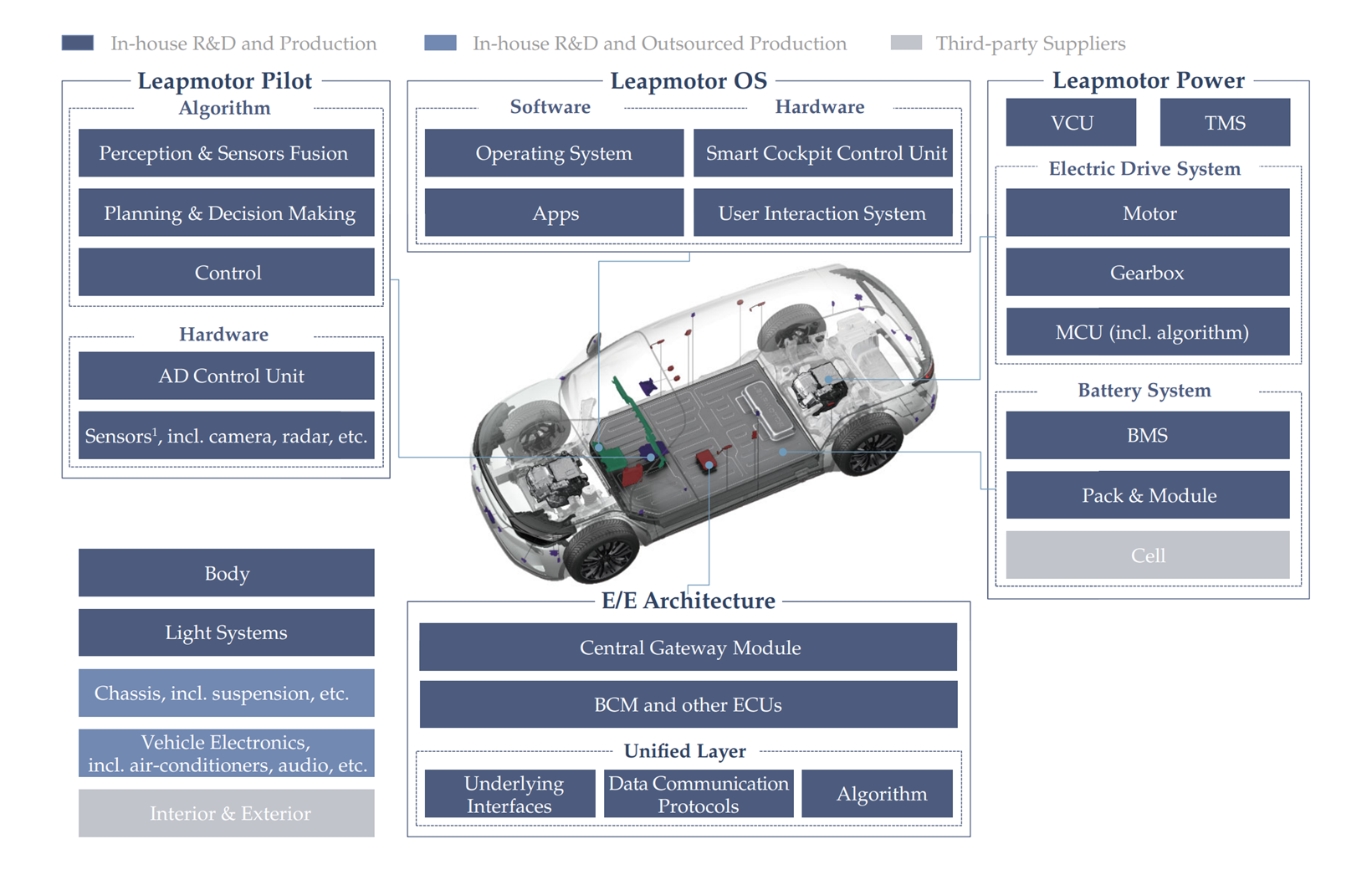

As a startup, Leapmotor could fall back on the experience and support that Dahua Technology provides, in terms of technological R&D. During the past years, Leapmotor has self-developed and produced electric motors, cross-platform systems, and electronic components, including its intelligent power system (Leapmotor Power), autonomous driving system (Leapmotor Pilot), and smart cockpit system (Leapmotor OS).

Notably, on April 24th, Leapmotor officially unveiled its CTC (cell-to-chassis) technology. The technology eliminates the need for standalone battery packs by integrating the battery, chassis and underbody into the vehicle, forming a unified piece.

By doing so, the CTC technology allows a 10 mm increases in the vertical space of the vehicle compared to conventional solutions, and increases the battery layout space by 14.5%. Electric vehicles adopting the technology will also see a 10% increase in range.

Photo credit: Leapmotor

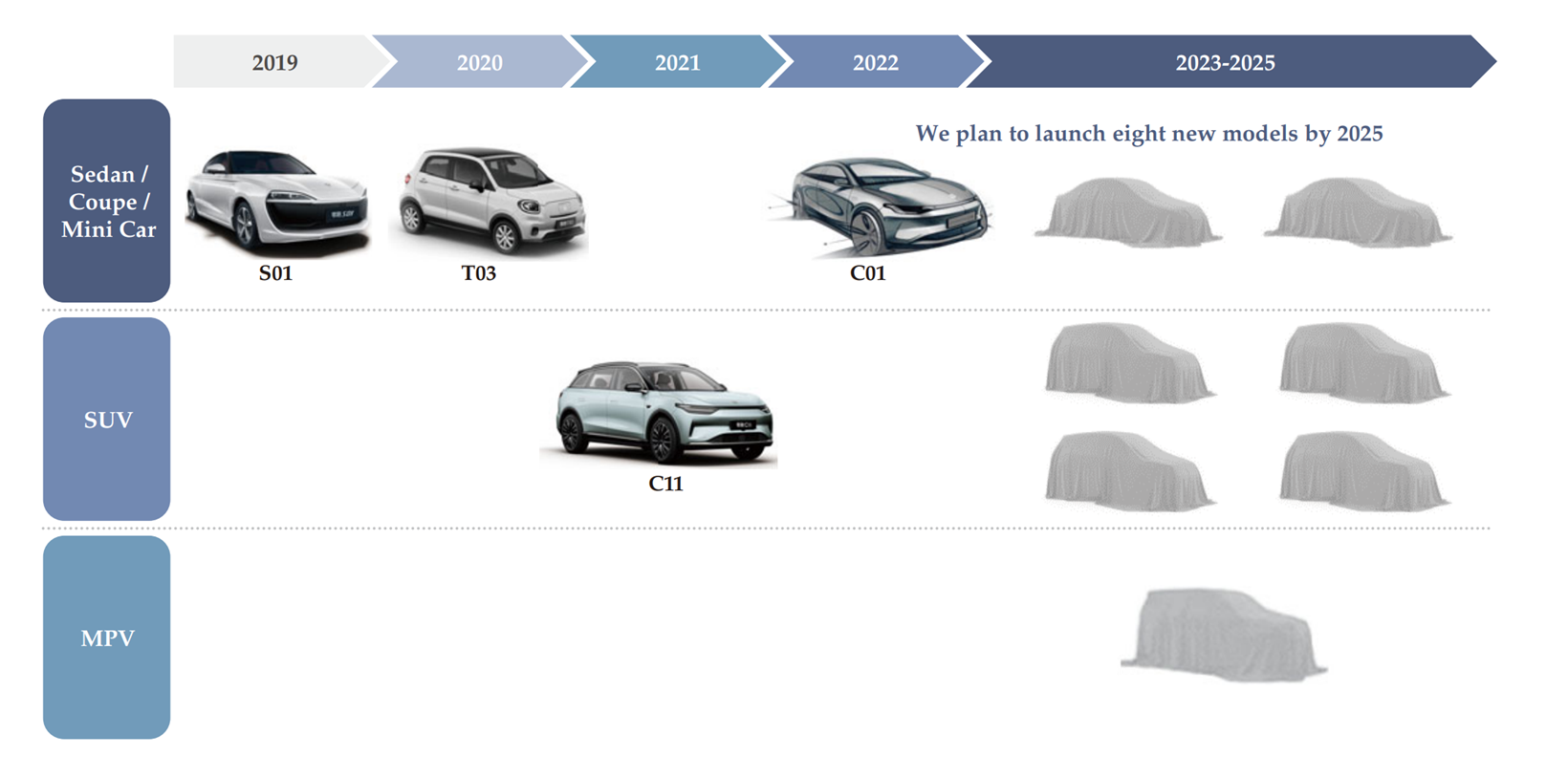

In July 2019, Leapmotor started the delivery of its first mass-produced model, the S01 coupe. In May 2020, the company launched the T03, a mini EV model, which has become Leapmotor’s mainstay model since it hit the market. In October 2021, the company introduced its third production model, the C11 mid-sized SUV.

Moreover, Leapmotor plans to launch a full-sized intelligent electric sedan in the second quarter of 2022, and start delivery in the third quarter. According to its configurations, the C01 is developed under the highest standards yet, and is also the first model in the world to be powered by its exclusive CTC technology.

Photo credit: Leapmotor

Based on the same platform as the C11, the model is equipped with Leapmotor Power and a 90kWh battery, offering an NEDC range of 717 km. According to Leapmotor, a 717km range means that for users whose daily commute is 40km only two charging sessions per month are needed.

The CTC technology frees up 5% of the C01’s weight, allowing a 0.226Cd low wind drag. Pairing the light weight design with a streamline profile, the C01 can zip from 0-100km/h in under 4 seconds.

In the IPO prospectus, Leapmotor pointed out that it is focused on the mid- to high-end segment in China’s NEV market with a price range of RMB150,000-300,000 ($23,440-$46,880). However, the company’s sales results showed otherwise.

Among Leapmotor’s three models on the market, the T03 four-door smart mini EV has won over the market with its appealing post-subsidy price of RMB68,900-RMB84,900 ($10,802-$13,310). The company has delivered a total 46,162 T03s as of December 31, 2021.

In the meantime, Leapmotor has delivered 2,708 units of the S01, which is priced at RMB129,900-RMB149,900 ($20,366-$23,501). Out of a total order volume of 22,526 units, 3,965 C11s were delivered as of the end of 2021. The C11 is priced at RMB159,800-RMB199,800 ($25,053-$31,324).

Notably, Leapmotor’s production capacity could not keep up with its sales.

Initially, the company outsourced the production of the S01 and T03 to Hangzhou Changjiang Passenger Vehicles Co., Ltd. Later on, starting August 2021, the T03s have been produced in the company’s own Jinhua Plant.

The Jinhua Plant takes up over 367,000 square meters of land, and has a construction area of over 220,000 square meters. Its designed annual production capacity is 200,000 vehicles. According to Leapmotor, the Jinhua Plant currently produces the T03 and the C11, and will also produce the C01. Aside from vehicles, the Jinhua Plant is also responsible for the production of electronic components, as well as R&D and vehicle testing. Most of the automaker’s core auto parts are produced in the Jinhua Plant, including battery packs, electric drive systems, lights and others.

In an effort to boost delivery, Leapmotor has struck a deal with the district government of Qiantang New District, Hangzhou city, to build an RMB4 billion-worth ($627.12 million) production base in the district in 2021. Construction of the Hangzhou Plant will start in 2022.

The Hangzhou Plant is expected to occupy over 542,000 square meters of land, with a designed annual production capacity of 200,000 vehicles. The plant is scheduled to start production in 2023.

With surging sales come growing revenues, as shown in Leapmotor’s yearly financial reports.

In 2019, Leapmotor reported a yearly revenue of RMB117.0 million ($18.28 million), with 1,034 vehicles delivered.

In 2020, the company managed to boost its revenue by 439.7% from a year ago to RMB631.3 million ($98.65 million), with 8,050 vehicles delivered.

Finally, in 2021, Leapmotor celebrated a 443.5% year-on-year soar in deliveries, with 43,748 vehicles delivered. The company’s annual revenue surged to RMB3.13 billion ($489.12 million), surging 396.1% from a year ago.

Notably, during the first three months of 2022, Leapmotor’s deliveries have reached a record high. Especially, in the third month of 2022, the up-rising EV maker delivered 10,059 vehicles, almost tripled from a month ago, at a 193% increase. The company has achieved an over 200% year-over-year growth in monthly delivery volume for twelve consecutive months by the end of March.

From January to March, the cumulative delivery volume of the carmaker amounted to 21,579 vehicles, soaring 410% compared to the same quarter a year ago.

Despite its blooming sales records, Leapmotor’s year-round operations in the past three years have brought the company nothing but losses in the books.

In 2019, 2020, and 2021, Leapmotor reported a gradually widened respective attributable net loss of RMB910.13 million ($142.22 million), RMB1.1 billion ($171.91 million), and RMB2.85 billion ($444.7 million).

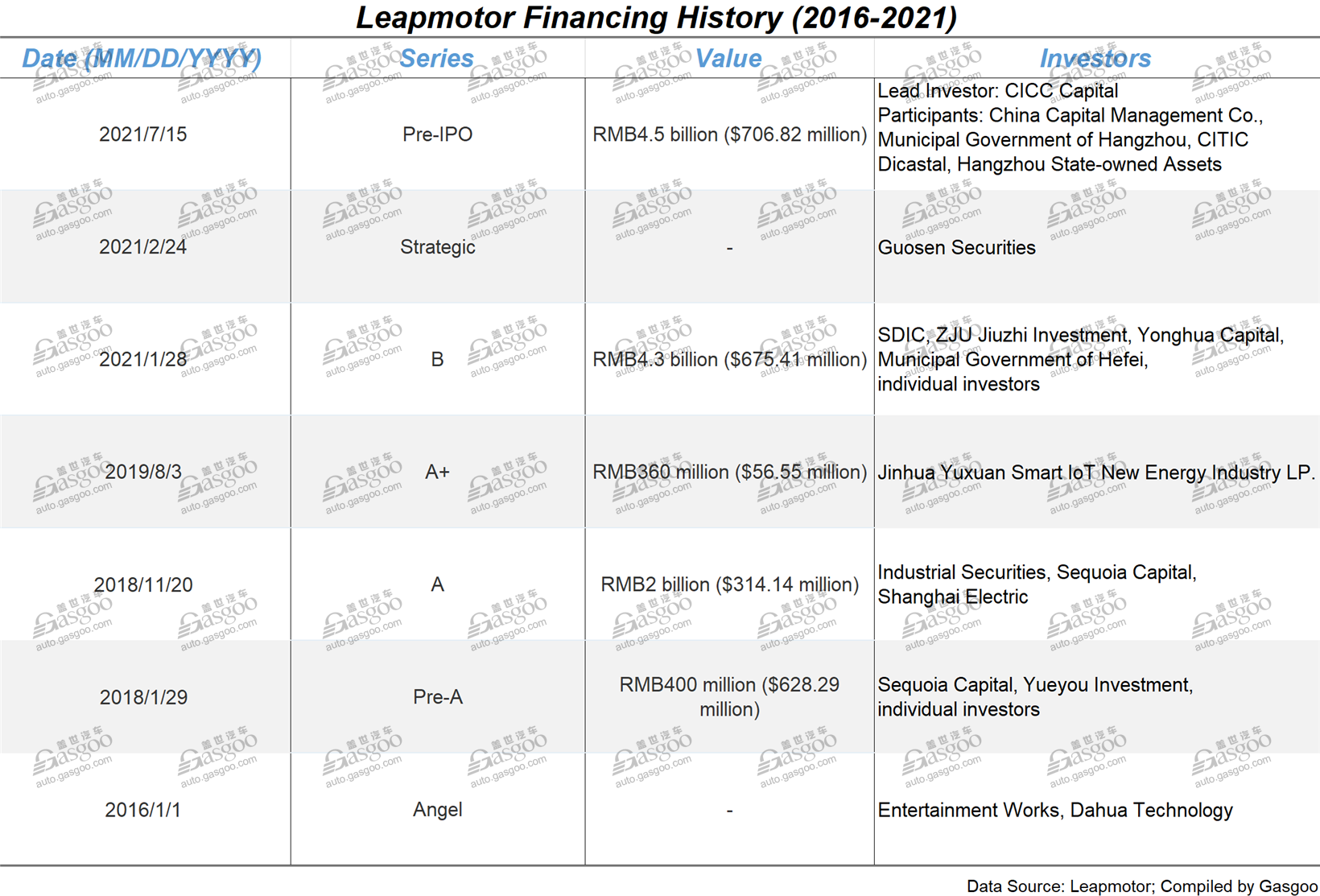

Nonetheless, the company was never short on funding.

Before its IPO application, Leapmotor had completed seven financing rounds, raising double-digit billions of yuan. Reportedly, its valuation during the pre-IPO round has reached RMB22 billion ($3.44 billion).

From state-owned funds to foreign capital ventures, Leapmotor has attracted the investment of dozens of well-known entities during the past six years.

The abundant technology and monetary support behind Leapmotor emboldened it in operations.

According to Leapmotor, the company plans to further invest in automotive intelligence and electrification technologies. In particular, the company aims to put its Leapmotor Pilot with NOA function on the road by 2024.

Photo credit: Leapmotor

Moreover, Leapmotor is determined to penetrate the mid-to-high-end EV market in China, by launching eight new models by 2025. Specifically, the company aims to introduce one to three models every year, covering compact and full-sized sedans, SUVs, and MPVs.

Furthermore, the Zhejiang-based EV startup also has its eyes on the worldwide market. In accordance to its plans, Leapmotor will open its first overseas flagship store in Europe by 2023.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com