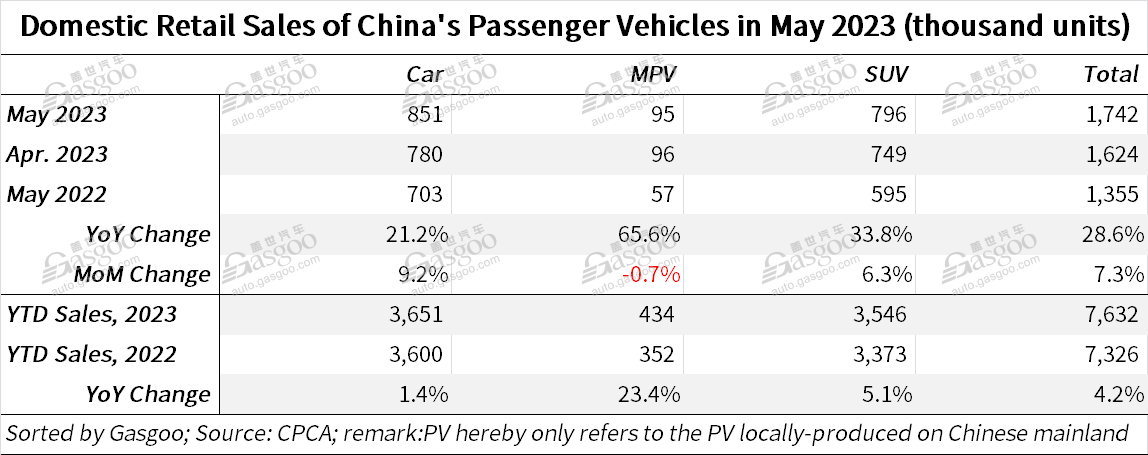

Shanghai (Gasgoo)- China's passenger vehicle (PV) retail sales amounted to 1.742 million units in May 2023, jumping 28.6% from the previous year, while also rising 7.3% from the previous month, according to the China Passenger Car Association (CPCA).

For clarity, the passenger vehicles hereby refer to the cars, SUVs, and MPVs locally produced on the Chinese mainland.

The first five months of 2023 have witnessed a consecutive month-on-month (MoM) rise in car retail, demonstrating a favorable upward trend in the PV market, said the association. The price reduction spree that started in March has gradually subsided, but promotions still remain high. This, along with the release of a number of new models and lower-priced newcomers, has quelled consumer hesitations, thereby driving up shopping demands.

The Auto Shanghai 2023 served as a powerful platform propelling the exchange of advanced automobile technologies and fostering auto consumption. New product launches, car exhibitions, and a variety of promotional activities like voucher distributions have significantly bolstered consumer confidence.

Following the clarification on the postponed sale of China VI B vehicles in inventory, market sentiment has further stabilized, maintaining a vibrant retail environment, added the CPCA.

Factors like the earlier Spring Festival holiday, unfulfilled anticipation of stimulus policies, aggressive promotions for China VI A inventories, and the half-year delay of the old China VI vehicles, as well as a relatively low base from last year have collectively resulted in a total retail of 7.632 million units for the Jan.-May period, marking a 4.2% year-on-year (YoY) increase.

In May, China's indigenous brands recorded combined retail sales of around 870,000 units, a YoY growth of 41.0% and a MoM growth of 11.0%. These brands accounted for 50.3% of domestic PV retail sales in May 2023, an increase of 4 percentage points over the previous year.

Mainstream joint-venture brands retailed 620,000 locally-produced PVs in May, an increase of 12.0% YoY and 2.0% MoM. While the market shares of German and Japanese brands saw a decrease, American brands experienced a growth of 1.2 percentage points in their market retail share, reaching at 8.1%.

Luxury vehicle brands sold 250,000 units in May by retail, indicating a 39.0% YoY and 8.0% MoM increase. The previous chip supply constraints last year has gradually been resolved, leading to a robust market climate.

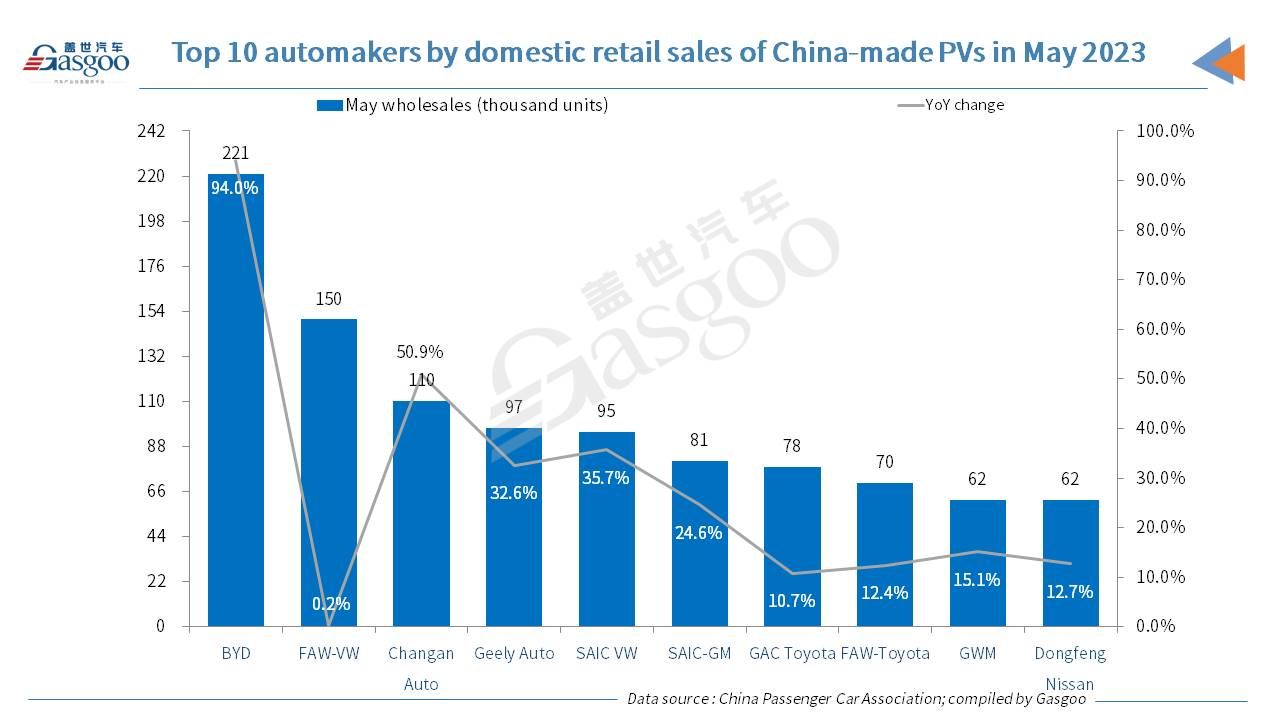

Among the top 10 automakers by May PV retail sales in China, BYD still ranked highest, and was also the fastest-growing one in terms of YoY change. Aside from FAW-VW, the other nine companies all obtained a two-digit YoY increase.

China's PV wholesale volume in May 2023 reached 1.997 million units, up by 25.4% compared to last year and 12.4% from the previous month. The accumulated wholesales have amounted to 8.827 million units so far this year, reflecting a 10.4% YoY growth.

In May, China’s local brands wholesaled 1.096 million units, up 40.0% YoY and 10.0% MoM. Mainstream joint-venture brands wholesaled 621,000 units, marking a 4.0% YoY and 16.0% MoM growth. Luxury brands wholesaled 280,000 units, up 32.0% YoY and 15.0% MoM.

Most of the main passenger car manufacturers showed strong performance in May. There were 30 companies with a sales volume of over 10,000 units, an increase of 3 companies compared to the previous month. Seven of these companies reported a YoY growth rate of over 100%, while 22 saw a growth rate of over 10%.

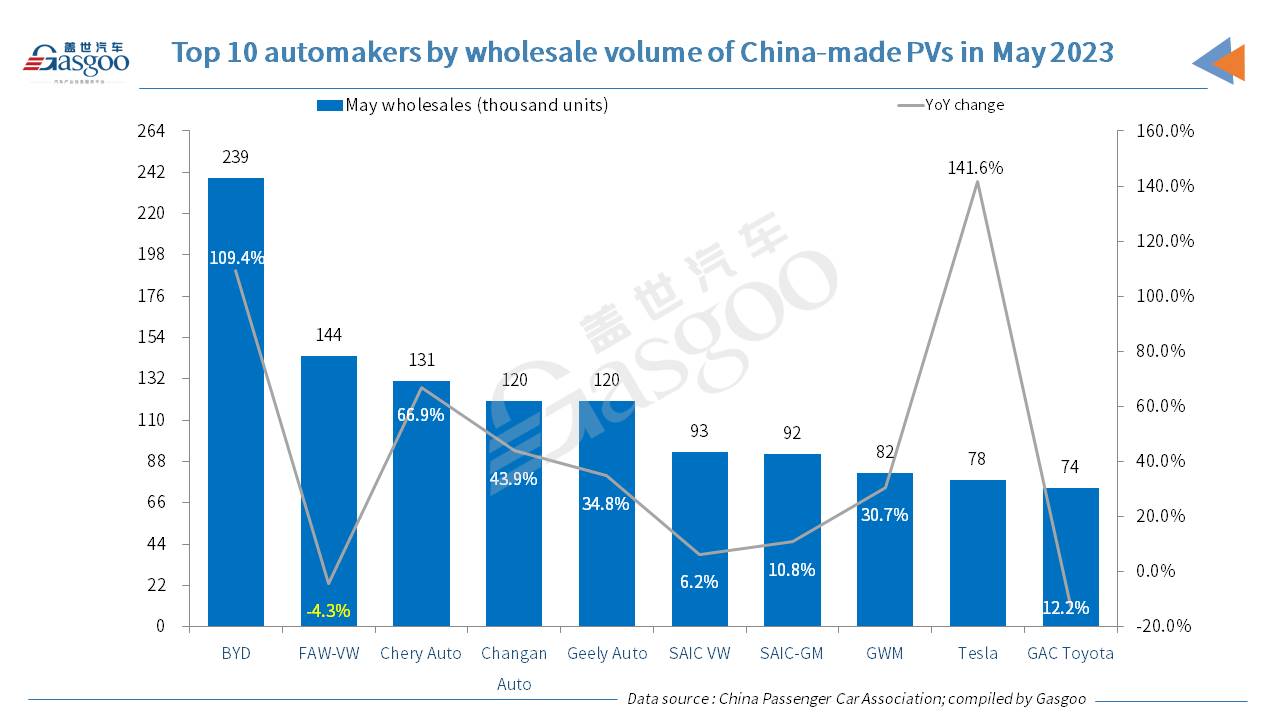

With regard to the PV wholesale volume in May, BYD still outshone other automakers with a volume of around 239,000 units. Nine of the top 10 automakers all scored a year-on-year upward movement in May wholesales with Tesla being the fastest-growing one.

The production volume of locally-manufactured passenger vehicles in May totaled 1.985 million units in the country, a YoY increase of 18.7% and a MoM increase of 14.8%. Due to the China VI emission standard upgrades, enterprises have been extremely cautious in production.

This year's total auto exports continued the strong growth trend from the end of last year. Under the statistical scope of the CPCA, passenger vehicle exports (including complete vehicles and CKDs) reached 302,000 units in May, a YoY growth of 64.0% and a MoM growth of 1.0%. From January to May, China's passenger vehicle exports totaled 1.381 million units, representing a YoY spike of 102.0%. New energy vehicles accounted for 30% of total exports in May.