China's monthly registrations of locally-made passenger vehicles (PVs) reached 1,921,353 units in June 2023, edging up 2.49% from the previous year, while also growing 12.16% from the previous month, according to the data compiled by Gasgoo Auto Research Institute ("GARI").

It is worth mentioning that the PV registrations in June were the highest number recorded so far this year in the world’s largest auto market.

For the first half of this year (H1), there were 9,288,933 homemade PVs registered across the Chinese mainland, reflecting an increase of 4.76% year-over-year.

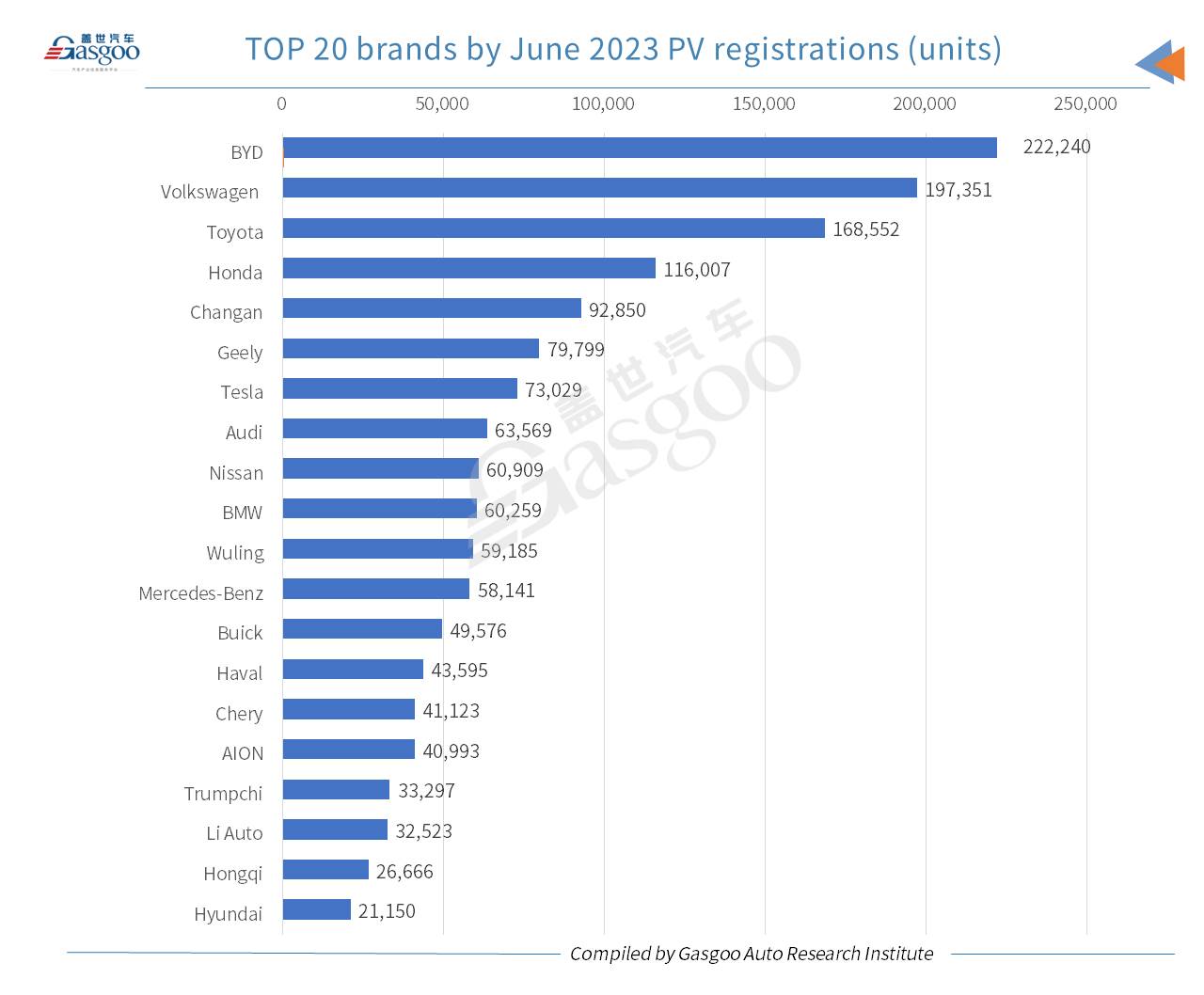

In June 2023, four brands saw their monthly PV registrations in China exceed 100,000 units, namely, BYD, Volkswagen, Toyota, and Honda. Of them, BYD was the only one to get over 200,000 PVs registered.

In addition, Changan and Geely, the two main Chinese indigenous brands, ranked fifth and sixth, respectively, in terms of June PV registrations. Tesla, with only two China-made battery electric vehicle (BEV) models available for sale, took the 7th spot.

Among the “Germany’s Big Three”, Audi was the highest-ranking one with 63,569 China-made PVs registered last month.

The 14th to 19th places were all occupied by Chinese indigenous brands, namely, Haval, Chery, AION, Trumpchi, Li Auto, and Hongqi.

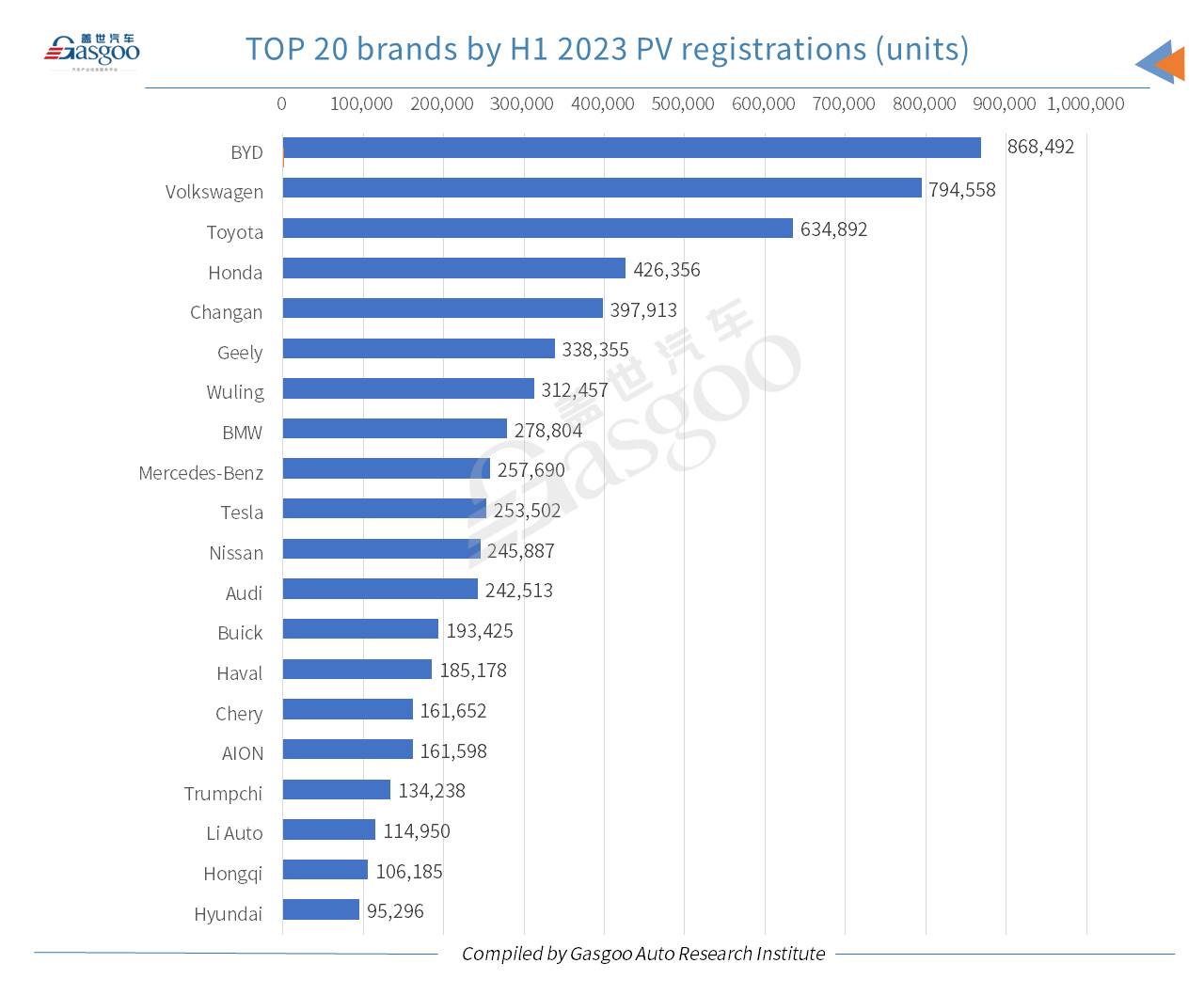

Regarding the PV registrations for H1 2023, BYD outperformed other brands with a registration volume surpassing 800,000 units. Volkswagen was honored the runner-up with 794,558 PVs registered. Among main Japanese brands, both Toyota and Honda appeared on the top 10 brands list, while Nissan immediately followed Tesla as the No. 11 brand.

Apart from BYD, there were still nine China’s wholly-owned members among the top 20 brands by H1 PV registrations, namely, Changan, Geely, Wuling, Haval, Chery, AION, Trumpchi, Li Auto, and Hongqi.

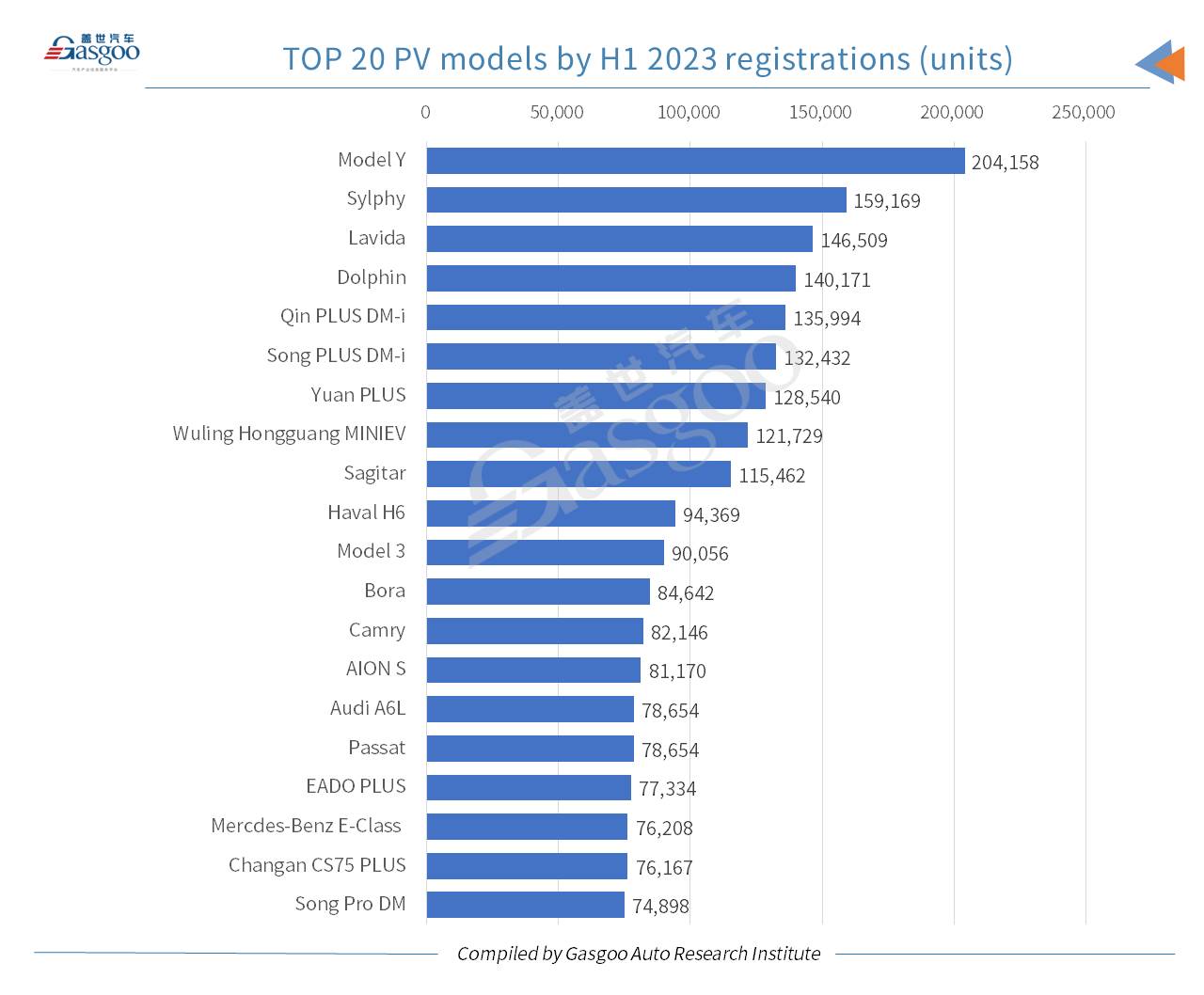

Among all China-made PV models, Tesla’s Model Y still stood at the highest place by June registrations. The other two of the top 3 models were both oil-fueled ones, namely, the Sylphy and the Sagitar.

In June, the Dolphin was the best-performing BYD-branded model. The Lavida ranked fifth among all PV models, while the No.6 to No.8 spots were all obtained by BYD’s products.

On the side of car type, the top 2 SUV models by June registrations—the Model Y and the Yuan Plus—ranked 1st and 7th among all PV models. Between them were all car models. None of the MPV models entered the top 20 models list.

As for the year-to-date performance, the Model Y was also at the head of the pack among all PV models with over 200,000 vehicles registered. The Sylphy and the Lavida were honored the runner-up and second runner-up. The 4th to 7th places were all seized by BYD’ models, namely, the Dolphin, the Qin PLUS DM-i, the Song PLUS DM-i, and the Yuan PLUS.

The German trio had two models on the top 20 models list by H1 registrations, namely, the Audi A6L and the Mercedes-Benz E-Class.

Among cities on the Chinese mainland, Shanghai, Beijing, and Chengdu took the first three seats by June registrations, all of which had over 50,000 domestically-built PVs registered in the month.

As for the most popular models in major cities, the top 5 models by June registrations in Shanghai were the Model Y, the Model 3, the Corolla, the Model 3, the Yuan PLUS, and the Dolphin, four of which were all-electric ones. Besides, the top two models in Beijing were the Model Y and the Yuan PLUS, while Chengdu had the Model Y, the AION S, and the Model 3 as its top 3 best-selling models last month.

For the Jan.-Jun. period, a total of 6 cities had over 200,000 locally-made PVs registered each, of which the top-ranking city’s volume surpassed 300,000 units.

In June 2023, China's monthly locally-made new energy passenger vehicle (NEPV) registrations came in at 645,702 units, jumping 29.06% year on year, while also rising 16.09% month on month. The number also reached a new high level so far this year.

For the first six months of this year, the cumulative NEPV registrations across the Chinese mainland leapt 39.44% over the prior-year period to 2,914,441 units.

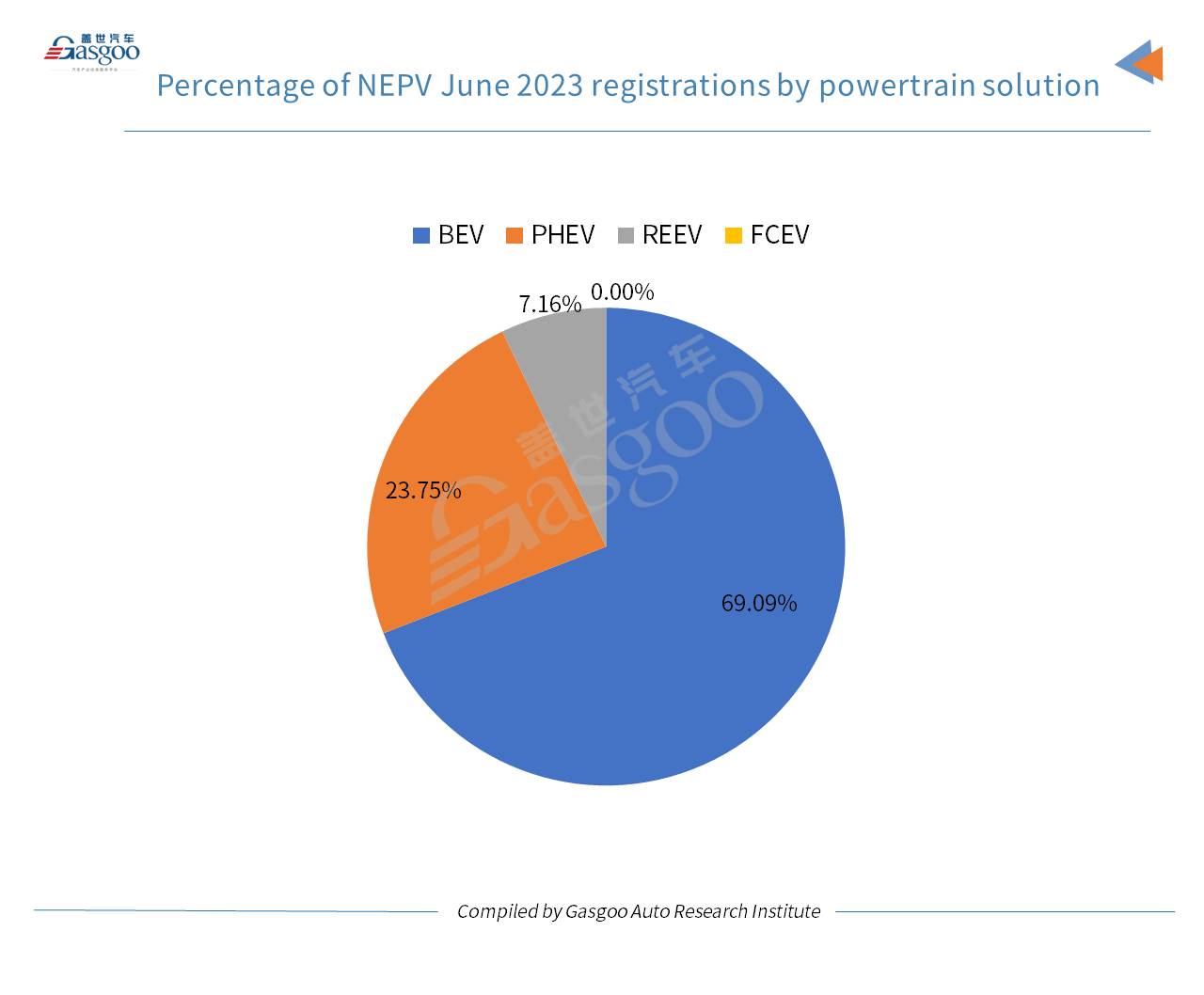

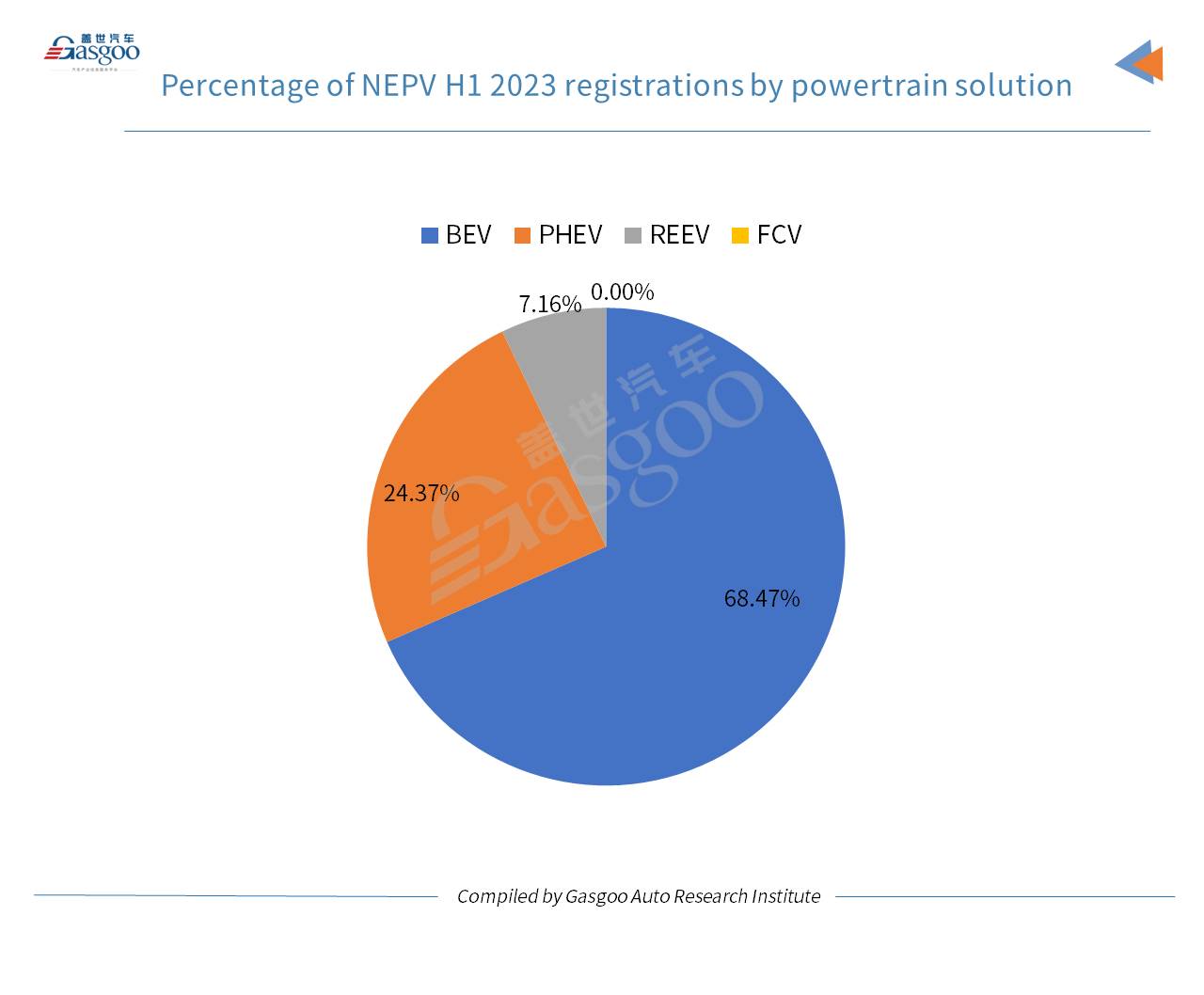

By specific powertrain solutions, the BEV sector logged a registration volume of 446,131 units in June, accounting for 69.09% of the country's total NEPV registrations. The plug-in hybrid electric vehicle (PHEV) registrations reached 199,557 units, which included 46,201 range-extended electric vehicles (REEVs).

There were 14 fuel cell electric vehicles (FCEVs) registered on the Chinese mainland in June, but their proportion was hereby omitted due to the tiny volume.

Of the NEPVs registered in H1 2023, 68.47% were contributed by BEVs.

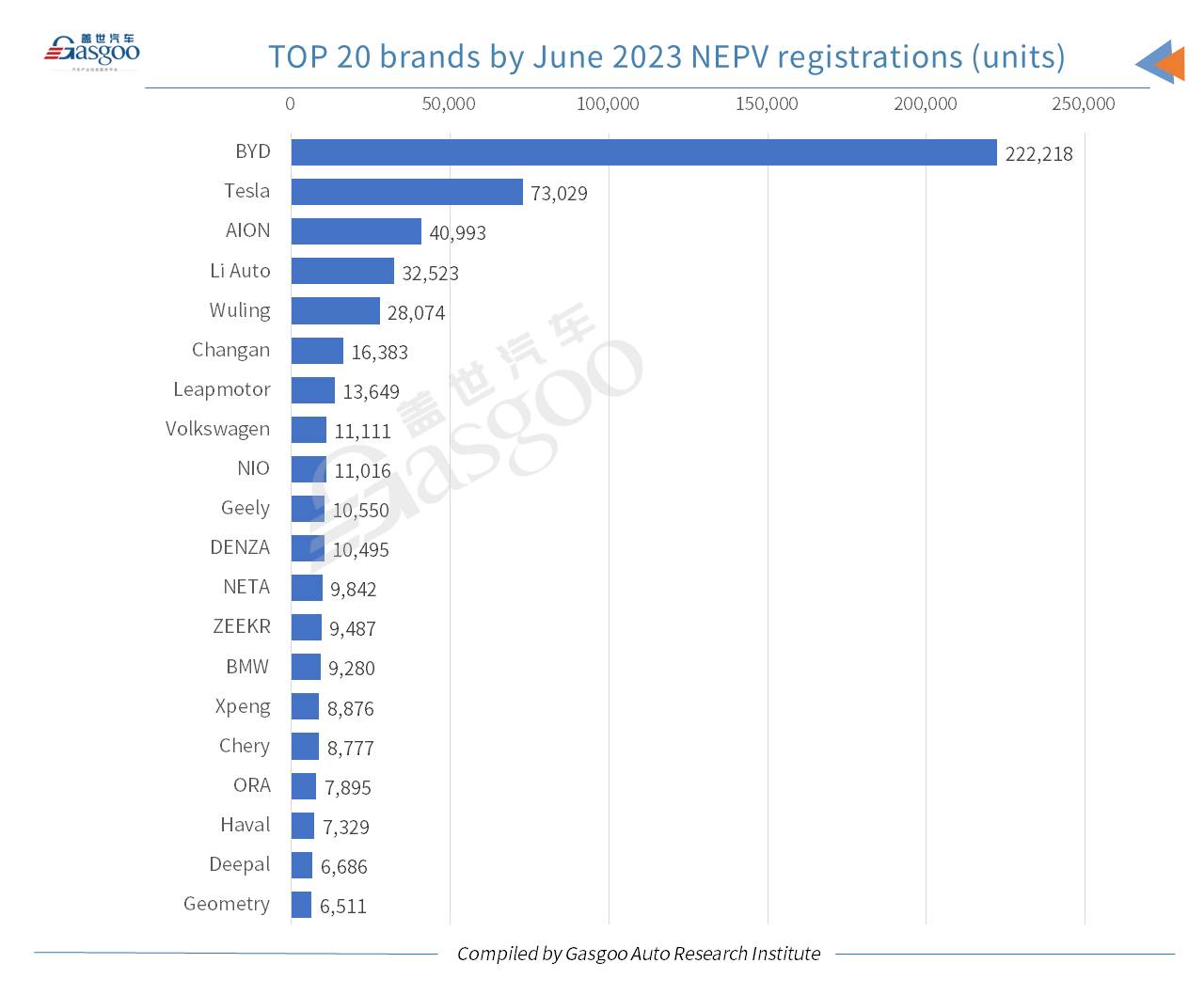

With respect to the NEPV registrations in June, BYD still took a remarkable lead over other brands. It had 222,218 NEPVs registered in the month, which were even more than the sum of the No.2-No.8 occupants. The U.S. EV brand Tesla was credited the runner-up, while AION ranked 3rd.

Li Auto was the top-performer among Chinese NEV startups. The company made up 70.39% of the country’s total REEV registrations last month, demonstrating the high attractiveness of its L series models to family users.

Wuling served as the No. 5 brand with 28,074 NEPVs registered in June, including 14,559 Hongguang MINIEV cars and 12,322 Binguo cars. Changan and Geely occupied the 6th and 10th places, respectively, and their best-selling NEPV models, the LUMIN and the Panda mini, both are small-sized all-electric city car.

In terms of the year-to-date NEPV registrations, the top five brands—BYD, Tesla, AION, Wuling, and Li Auto—all witnessed their cumulative registration volume surpass 100,000 units.

With regard to June registrations, the Model Y no doubt topped other homemade NEPV models. Four BYD-branded models—the Dolphin, the Qin PLUS DM-i, the Yuan PLUS, and the Song PLUS DM-i, took the 2nd to 5th spots among all locally-made NEPV models.

Notably, the BYD Seagull, which hit the market in late April, ranked eighth among all China-made NEPV models, outselling the Wuling Binguo, which regards the former as a main rival.

Judging from the H1 performance, there were six NEPV models in total whose respective cumulative registrations all exceeded 100,000 units.

On the top 20 NEPV models list by H1 registrations, BYD held 10 spots in total (including the DENZA D9). Li Auto saw its three L series models all enter the top 20 rankings.

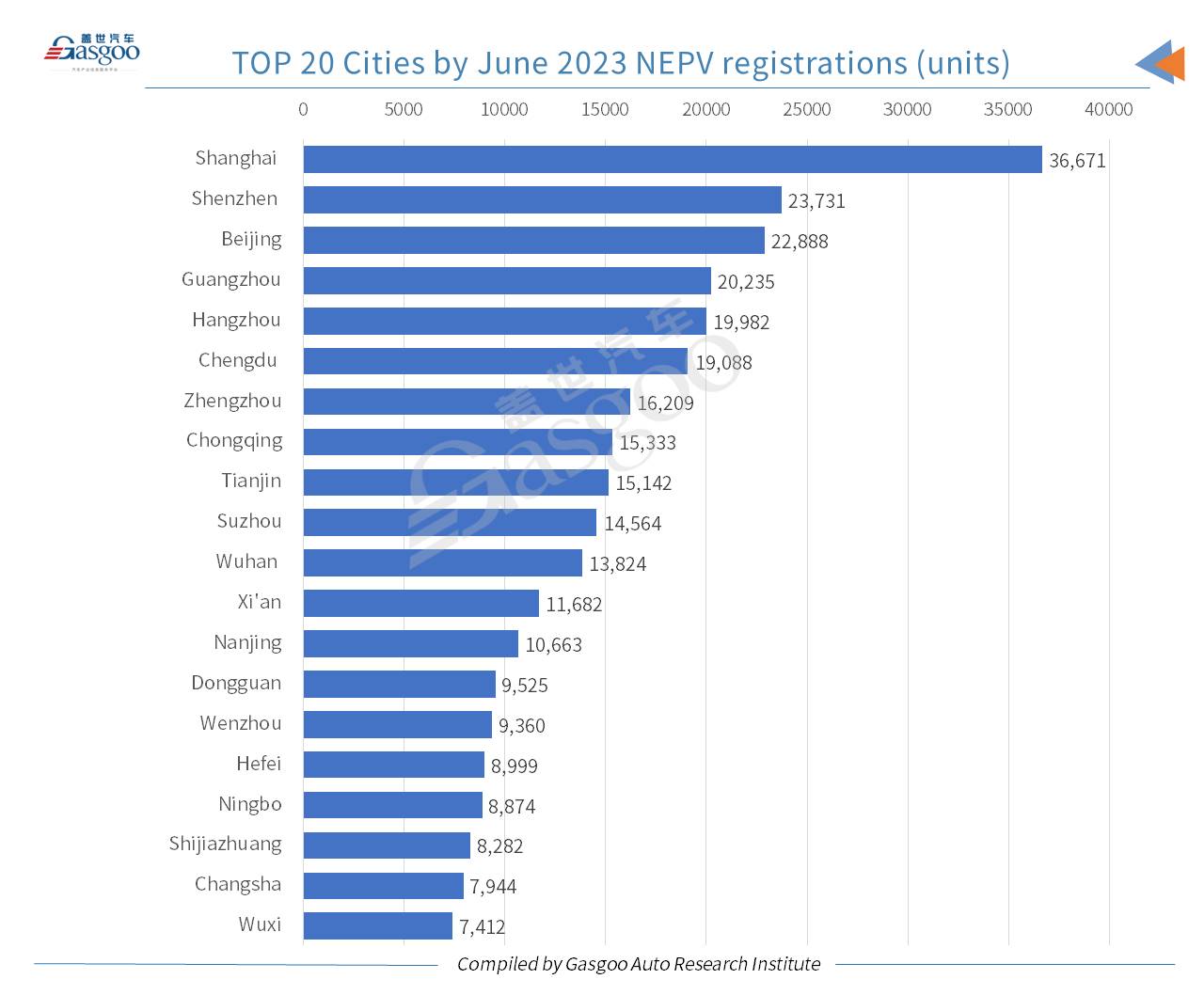

In June 2023, Shanghai outdid other cities with 36,671 homemade NEPVs registered, accounting for 56.79% of the city's overall PV registrations. It was closely followed by Shenzhen and Beijing.

During this year’s first six months, there were 5 cities on the Chinese mainland with over 90,000 domestically built NEPVs registered each.