China's monthly registrations of locally-made passenger vehicles (PVs) reached 1,873,452 units in August 2023, climbing 2.73% from the previous year and also rising 7.9% from the previous month, according to the data compiled by Gasgoo Auto Research Institute ("GARI").

For clarity, the PVs hereby refer to the vehicles locally produced and registered on the Chinese mainland.

The month of August 2023 showcased strong government policies aimed at promoting consumption, keeping sales promotions at their peak level. Additionally, the Chengdu Motor Show that kicked off in late August introduced a plethora of new and affordably priced models, further stimulating consumers' car shopping demands.

Despite disruptions from extreme weather conditions such as typhoons, rainstorm, and high temperatures, the enthusiasm for summer travel remained high, contributing to the overall growth of the automotive market. The national-level policies targeted towards the automotive industry continue to be rolled out, aimed at stabilizing and expanding car consumption. Besides, initiatives like the "Hundred Cities Connectivity" auto festival and the "Thousand Counties, Ten Thousand Towns" new energy vehicle (NEV) consumption season initiated by China's Ministry of Commerce have yielded positive results, with diverse promotional activities, auto shows, and the distribution of consumer vouchers effectively boosting consumer confidence.

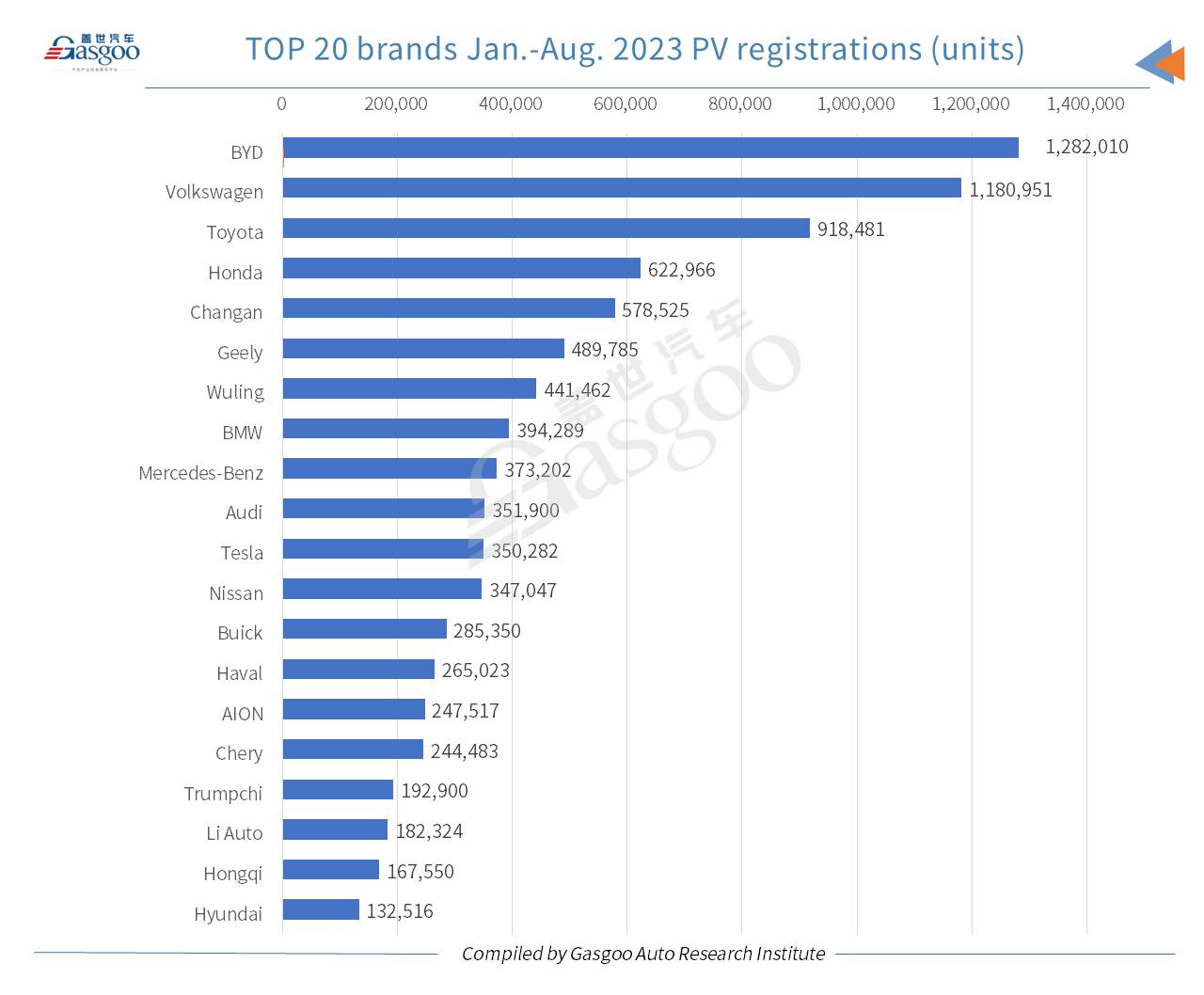

Taking into account factors such as the early timing of the Chinese New Year, intense promotions to clear the inventories of the China VI-a vehicles, the delayed launch of China VI-b vehicles, the cumulative PV registrations for Jan.-Aug. period reached 12,898,677 units in China, demonstrating a year-on-year growth of 3.86%.

BYD was still crowned the highest-ranking brand in China with 212,714 PVs registered in August. It was closely followed by Volkswagen, which posted a 3.89% month-on-month increase in its August registrations. The two Japanese brands—Toyota and Honda—continued to sit at the third and fourth places, and both of them attained a growth compared to the previous month.

The fifth to seventh spots were all occupied by China's domestic brands, namely, Changan, Geely, and Wuling. Compared to the rankings based on July's data, Tesla jumped nine spots to the 8th place in August, scoring a notable surge of 98.86% from a month earlier. The “Germany's Big Three”, namely, BMW, Mercedes-Benz, and Audi held the 9th to 11th places with their August registration all between 50,000 units and 60,000 units.

Besides, AION ranked 13th with 50,389 vehicles registered last month. It was another brand (in addition to Tesla) on the top 20 brands list to have only all-electric vehicles available for sales.

Regarding the cumulative PV registrations for the Jan.-Aug. period of this year, the top 20 brands included 10 China's domestic brands, four of which (BYD, Changan, Geely, and Wuling) entered the top 10 rankings.

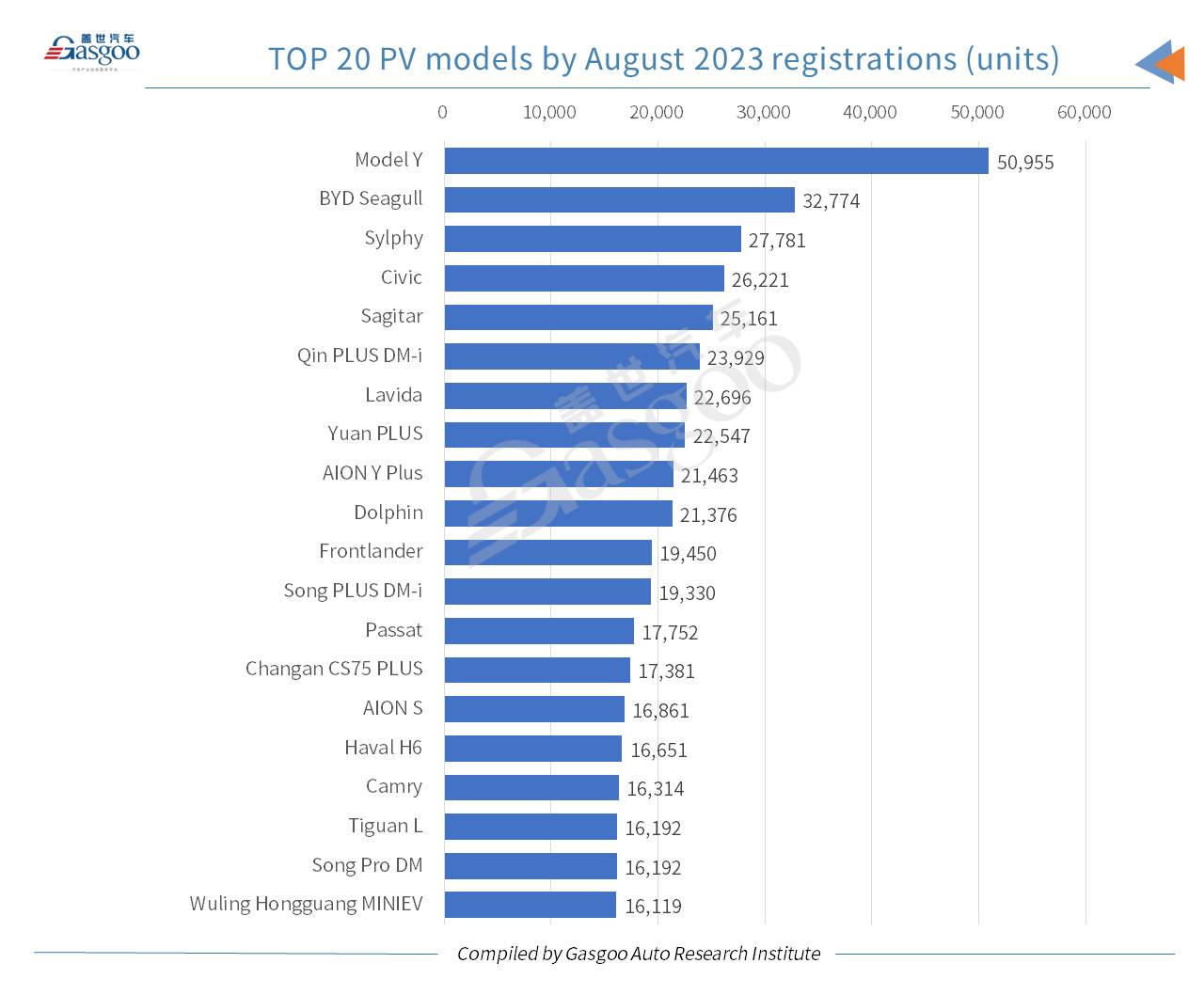

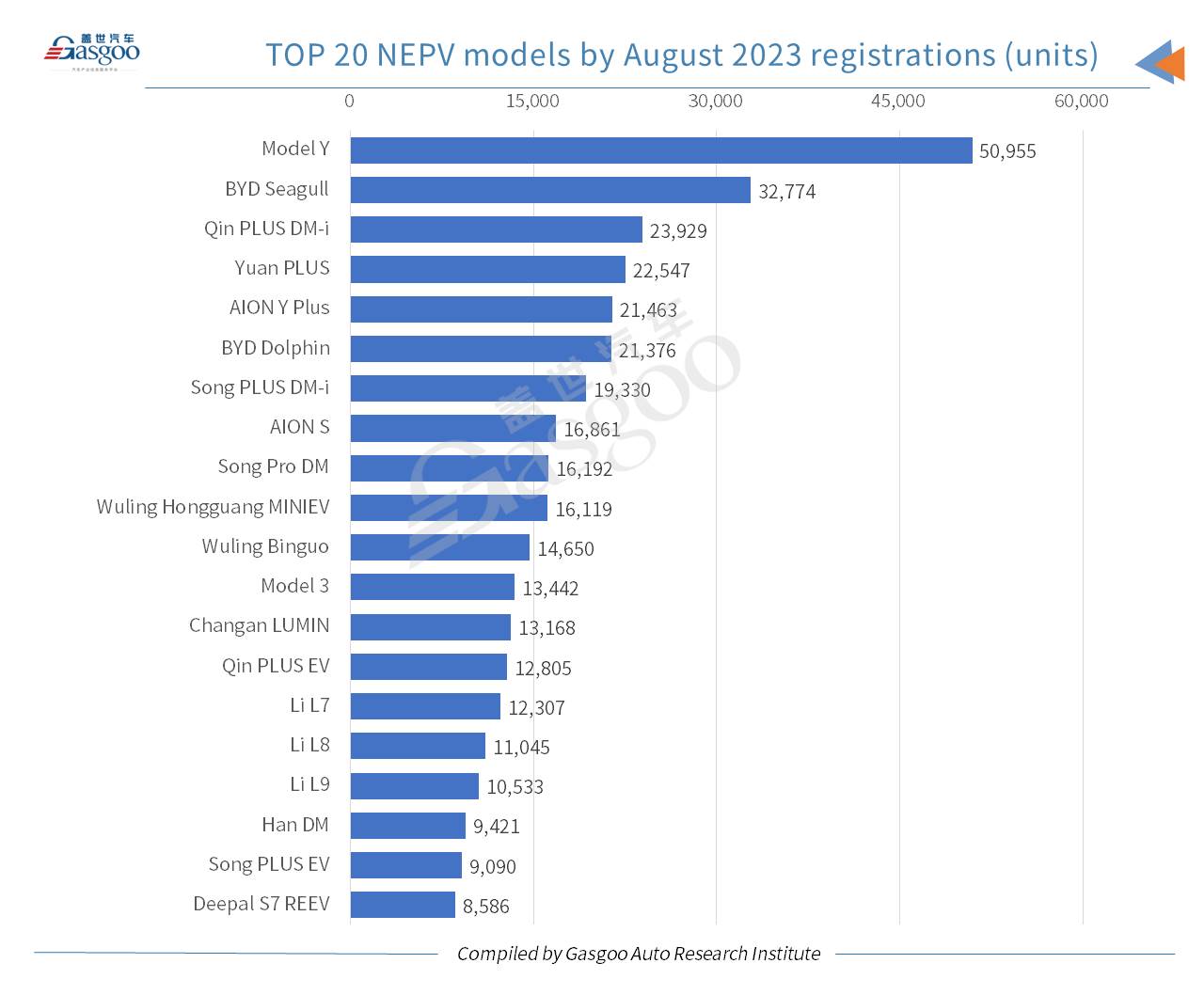

In August, the best-performing PV model by monthly registrations was the Model Y, which accounted for 79.13% of Tesla's total registrations in the month. It is noteworthy that the BYD Seagull, which just hit the market in late April, moved up to the second place mainly thanks to its reasonable pricing strategy, fashion exterior, comfortable driving experience, and other amenities.

The No.3 to No.5 PV models by August registrations were all gasoline-powered ones, namely, the Sylphy, the Civic, and the Sagitar. The Lavida ranked 7th with a registration volume of 22,696 units.

Aside from the Seagull, BYD brand still had three models on the list of top 20 PV models by August registrations, namely, the Qin PLUS DM-i, the Yuan PLUS, and the Dolphin. Notably, the Yuan PLUS was also honored the second best-selling SUV model last month, following the Model Y.

Based on the Jan.-Aug. PV registrations, the Model Y and the Sylphy were the only two models with over 200,000 vehicles registered cumulatively. The Lavida was the second runner-up with its year-to-date registrations almost hitting the 200,000-unit mark. The 4th to 7th places were all taken by BYD's vehicles (the Dolphin, the Qin PLUS DM-i, the Yuan PLUS, and the Song PLUS DM-i). On the top 20 PV models list, the Audi A6L and the Mercedes-Benz E-Class were the only two models from the three German premium auto brands.

Among cities on the Chinese mainland, Shanghai, Beijing, and Chengdu took the first three seats by August PV registrations, all of which had over 50,000 PVs registered in the month.

Moreover, there were nine cities whose respective registrations stood between 30,000 units and 50,000 units last month, three of which surpassed the 40,000-unit mark.

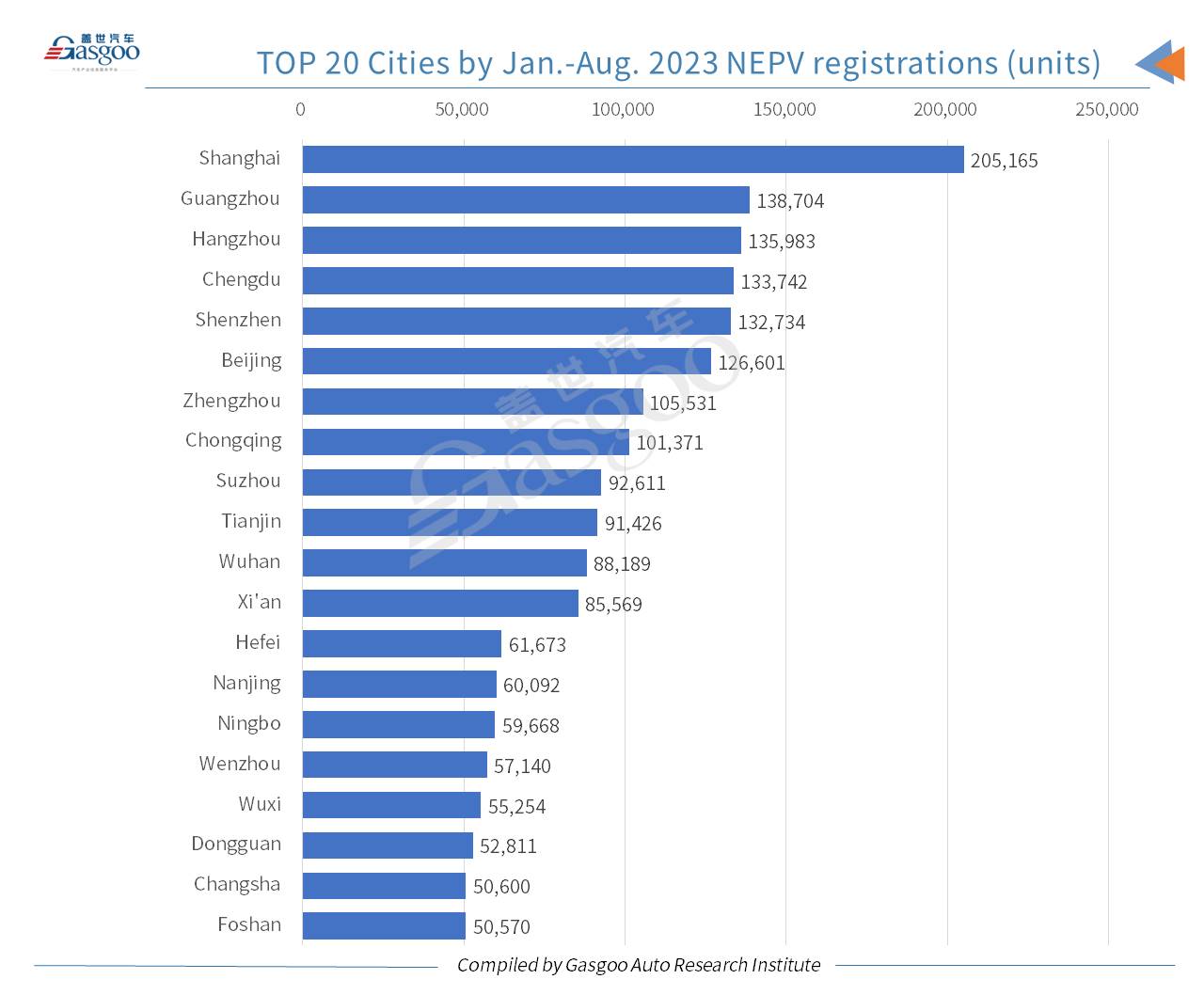

For the Jan.-Aug. period, a total of 12 cities had over 200,000 locally-made PVs registered each, four of which (Shanghai, Beijing, Chengdu, and Guangzhou) saw their respective year-to-date PV registrations surpass 300,000 units.

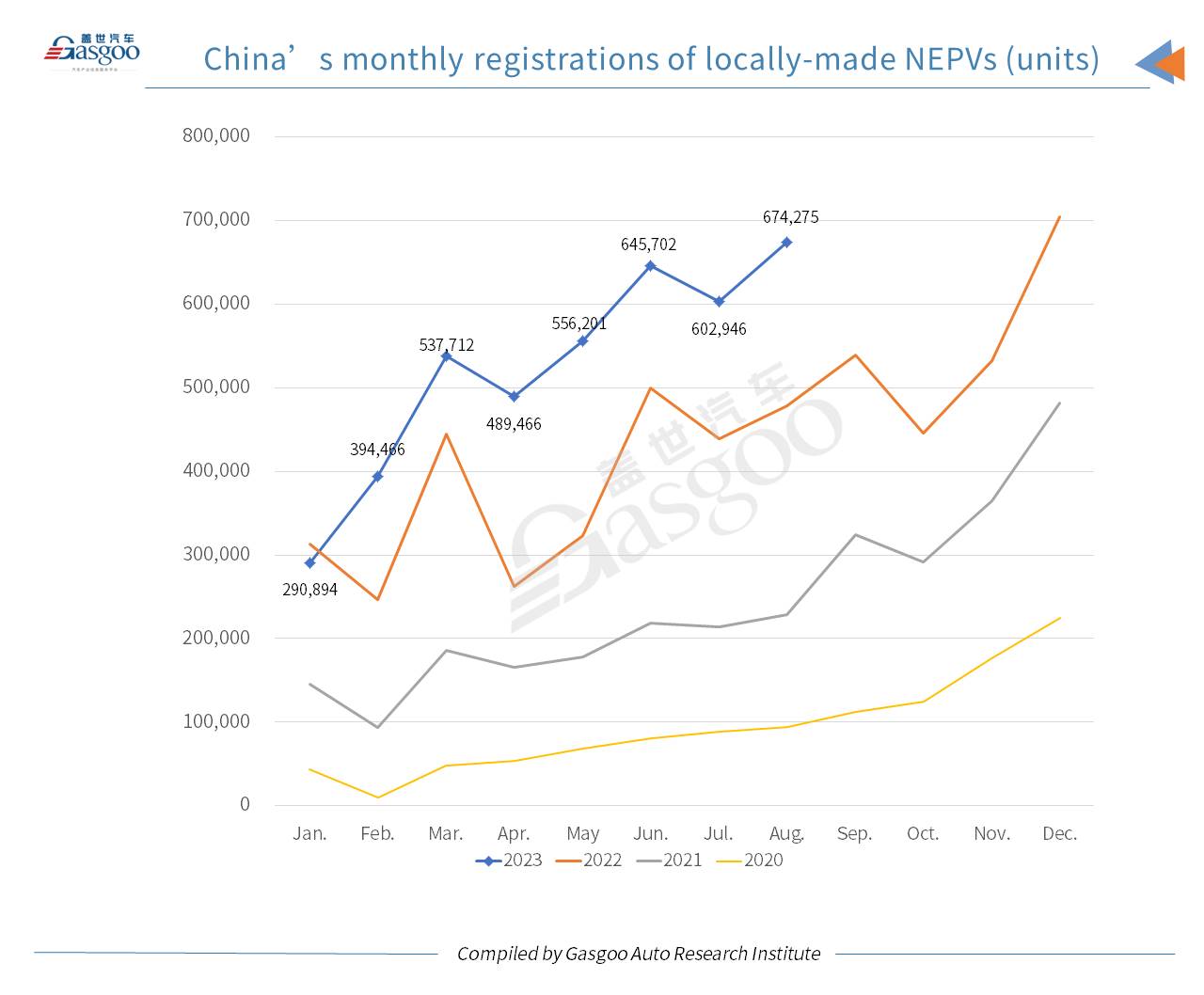

In August 2023, China's locally-made new energy passenger vehicle (NEPV) registrations came in at 674,275 units, soaring 40.83% year on year and also growing 11.83% month on month.

Notably, the NEPV registrations recorded last month reached the second highest level China has ever achieved, only following December 2022, which witnessed a volume of 704,474 units.

For the first eight months of this year, the cumulative NEPV registrations across the Chinese mainland leapt 39.35% over the prior-year period to 4,191,662 units.

Speaking of the share of each powertrain solutions, battery electric vehicles (BEVs) made up 71.74% of China's NEPV registrations in August. The plug-in hybrid electric vehicle (PHEV) registrations reached 190,519 units (including 53,741 range-extended electric vehicles) last month, accounting for 28.26% of the country's total NEPV registrations.

Of the NEPVs registered in Jan.-Aug. 2023, 69.07% were contributed by BEVs. Meanwhile, the FCEV (fuel cell electric vehicle) sector registered a year-to-date volume of only 319 units, 56 units of which were recorded last month.

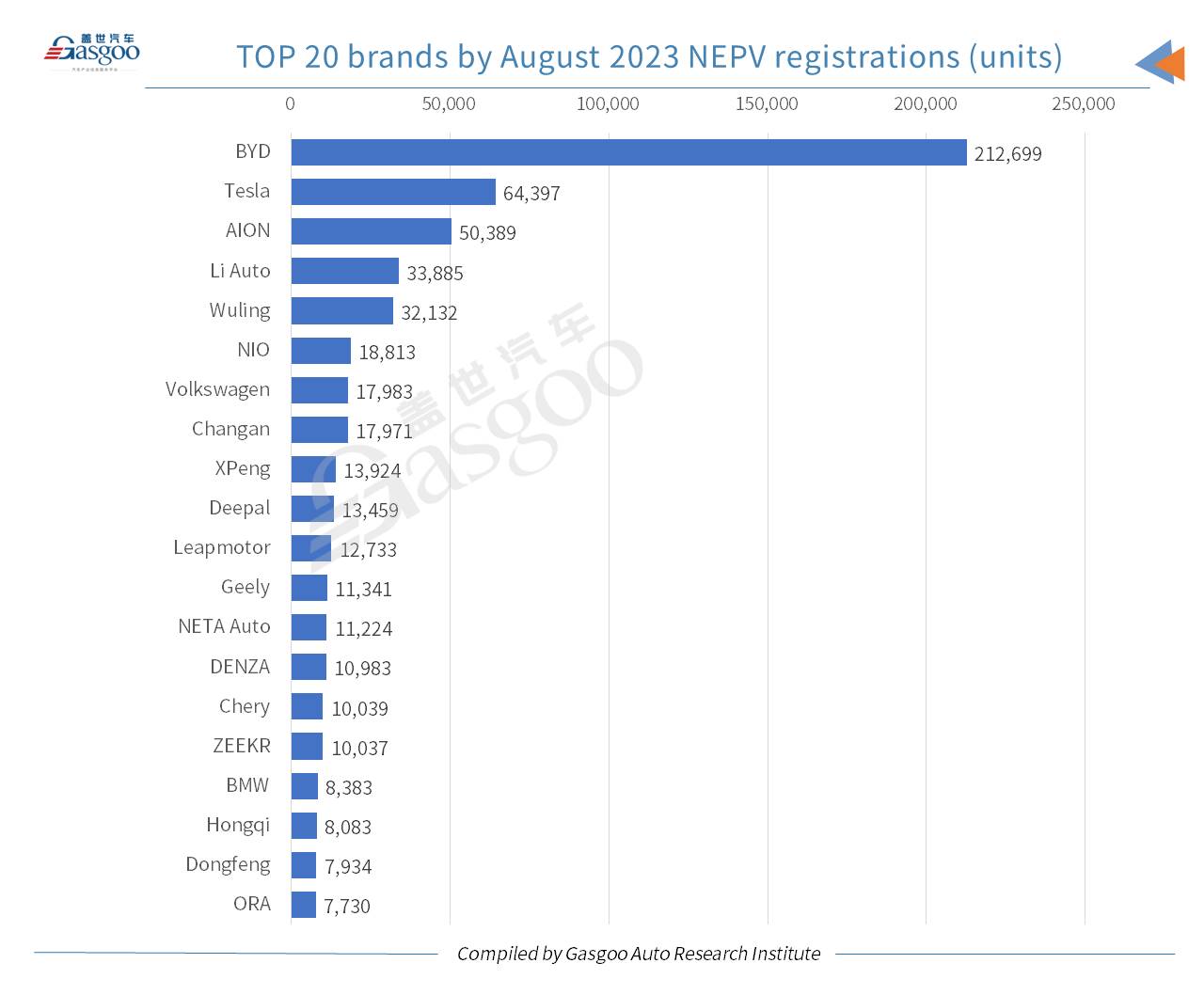

With respect to the NEPV registrations in August, BYD still took a significant lead over other brands. It had 212,699 NEPVs registered in the month, which were even more than the sum of the No.2-No.6 occupants. Tesla was credited the runner-up, while GAC Group's AION, Li Auto, Wuling, and NIO ranked 3rd to 6th.

Volkswagen ranked 7th with 17,983 NEPVs registered in August, including 15,710 BEVs, which were entirely contributed by the ID. series, and 2,273 PHEVs.

What's more, some NEV-dedicated brands under domestic legacy automakers, such Deepal, ZEEKR, and ORA, showed presence on the top 20 brands list by August NEPV registrations as well.

In terms of the year-to-date NEPV registrations, the top six brands—BYD, Tesla, AION, Wuling, Li Auto, and Changan—all witnessed their cumulative volume surpass 100,000 units. DENZA, which is majority backed by BYD Auto, ranked 10th, while the three main Chinese NEV startups—NETA, XPeng, and Leapmotor—took the 11th to 13th seats.

With regard to August registrations, the Model Y no doubt topped other homemade NEPV models. Six BYD-branded models—the Seagull, the Qin PLUS DM-i, the Yuan PLUS, the AION Y Plus, the Dolphin, and the Song PLUS DM-i—took the 2nd to 7th spots among all domestically-built NEPV models. Besides, BYD's Song Pro DM, Qin PLUS EV, Han DM, and Song PLUS EV were also capsulated into the top 20 NEPV models list. Li Auto saw its three L series models all enter the top 20 rankings (15th-17th).

Judging from the Jan.-Aug. performance, there were 10 NEPV models in total whose respective cumulative registrations all exceeded 100,000 units. Of them, the Model Y was the only one to surpass the 200,000-unit mark.

On the top 20 NEPV models list by Jan.-Aug. registrations, BYD Auto held 11 spots in total (including the DENZA D9).

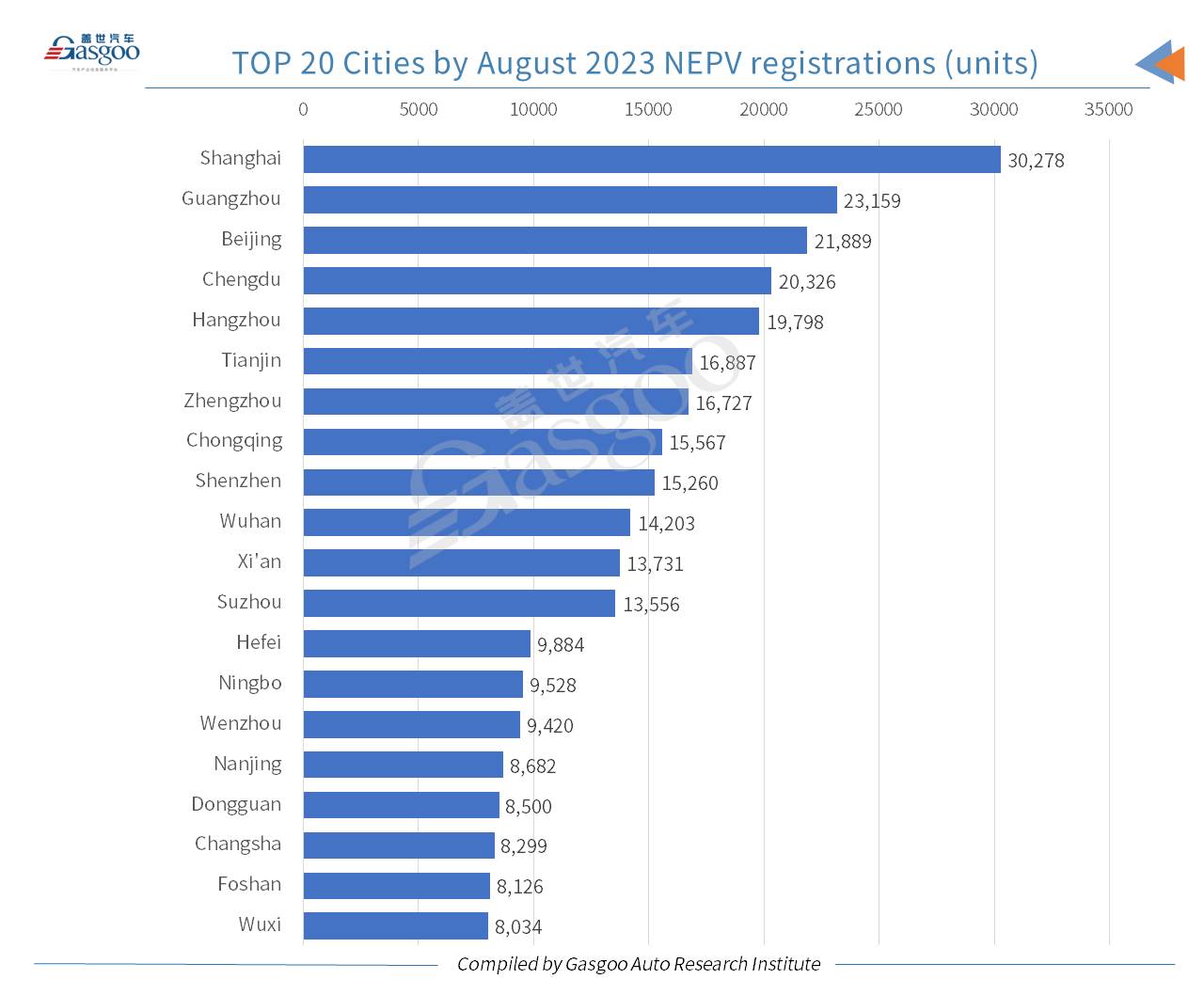

In August 2023, Shanghai outdid other cities with 30,278 locally-made NEPVs registered. The top five best-selling NEPV models in the city were the Model Y, the Yuan PLUS, the Model 3, and the NIO ES6 and ET5.

Guangzhou, Beijing, and Chengdu saw their respective NEPV registrations also surpass 20,000 units last month.

During this year's first eight months, there were 8 cities on the Chinese mainland with over 100,000 domestically-built NEPVs registered each.