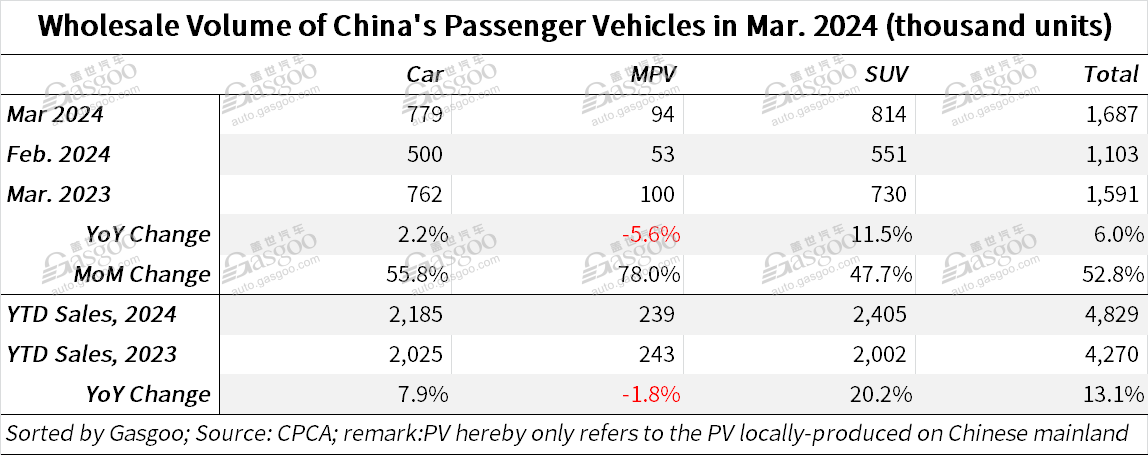

Shanghai (Gasgoo)- In the third month of 2024, China's domestic passenger vehicle (PV) retail sales reached 1.687 million units, marking a year-on-year (YoY) increase of 6% and a month-on-month (MoM) surge of 52.8%, according to data from the China Passenger Car Association ("CPCA").

For the first quarter of this year (Q1 2024), there were roughly 4.829 million locally-produced PVs retailed across the world's largest auto market, representing a 13.1% growth over a year earlier.

The car market in Q1 2024 basically achieved a positive start as anticipated, with significant growth in March retail sales both YoY and MoM, primarily due to post-holiday consumption recovery. The price war escalated after the Chinese New Year holiday led to a noticeable wait-and-see attitude among consumers. This, combined with consumers' interest in certain new models and anticipation for trade-in policies, resulted in a slow but steady start for the March car market.

On a national scale, the policy guidance targeting the auto industry was issued with the goal of further bolstering and broadening automobile consumption. The CPCA noted that efforts by China's Ministry of Commerce, including the "Hundred Cities Coordination" car festival and the "Thousands of Counties and Tens of Thousands of Towns" new energy vehicle shopping season, started to bear fruit. Ongoing consumer promotion policies by many local governments, together with concerted promotional activities by businesses, laid a solid foundation for stability in the early-year car market. Additionally, the anticipation generated by trade-in policies stirred significant consumer interest as well.

In March, China's domestic brands sold 930,000 PVs via retail, marking a 19% YoY increase and a 51% MoM spike. They captured a 54.8% share of the domestic retail market for the month, up by 6 percentage points YoY. In March, China’s indigenous brands held a 59.3% share of the wholesale market, a 6.4 percentage point increase from the previous year.

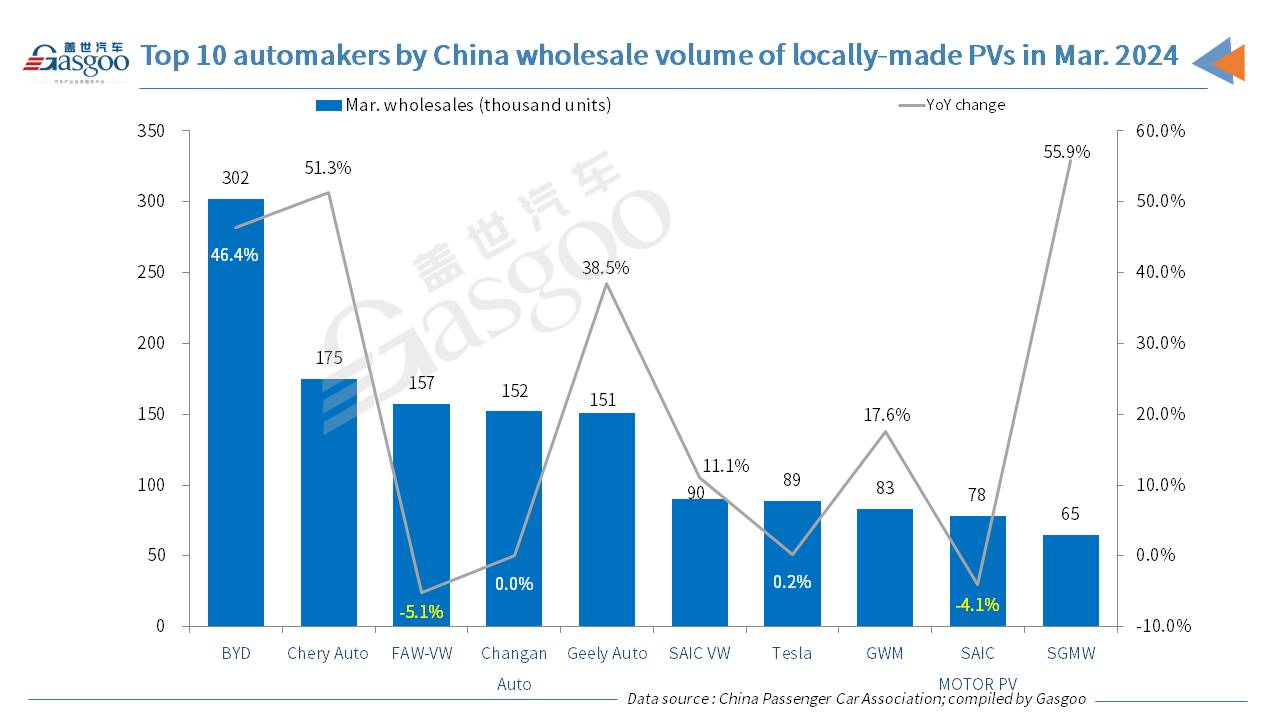

The CPCA commented that domestic brands saw significant growth in the new energy vehicle and export markets, with leading legacy automakers like BYD, Chery Auto, Geely Auto, and Changan Auto exhibiting excellent performance in their corporate transformation and upgrade efforts, resulting in notable market share gains.

Mainstream joint-venture brands retailed 500,000 vehicles in March, experiencing an 8% YoY decline, but a 49% MoM leap. German brands’ retail shares stood at 20.4% in March, down by 1.5 percentage points YoY, while Japanese brands accounted for 13.8% of the overall PV retail sales, a decrease of 2.2 percentage points from the previous year. American brands secured an 8.2% retail market share, down by 1.8 percentage points over a year earlier.

Premium vehicle sales totaled 270,000 units in March, a 3% YoY decline but a 67% MoM hike. Premium brands accounted for 15.6% of China’s overall PV retail sales in March, indicating a 1.6-percentage-point YoY drop. Although the supply issues related to chip shortages that had previously plagued the luxury car segment has been ebbing, demand in the traditional luxury car market remains subdued.

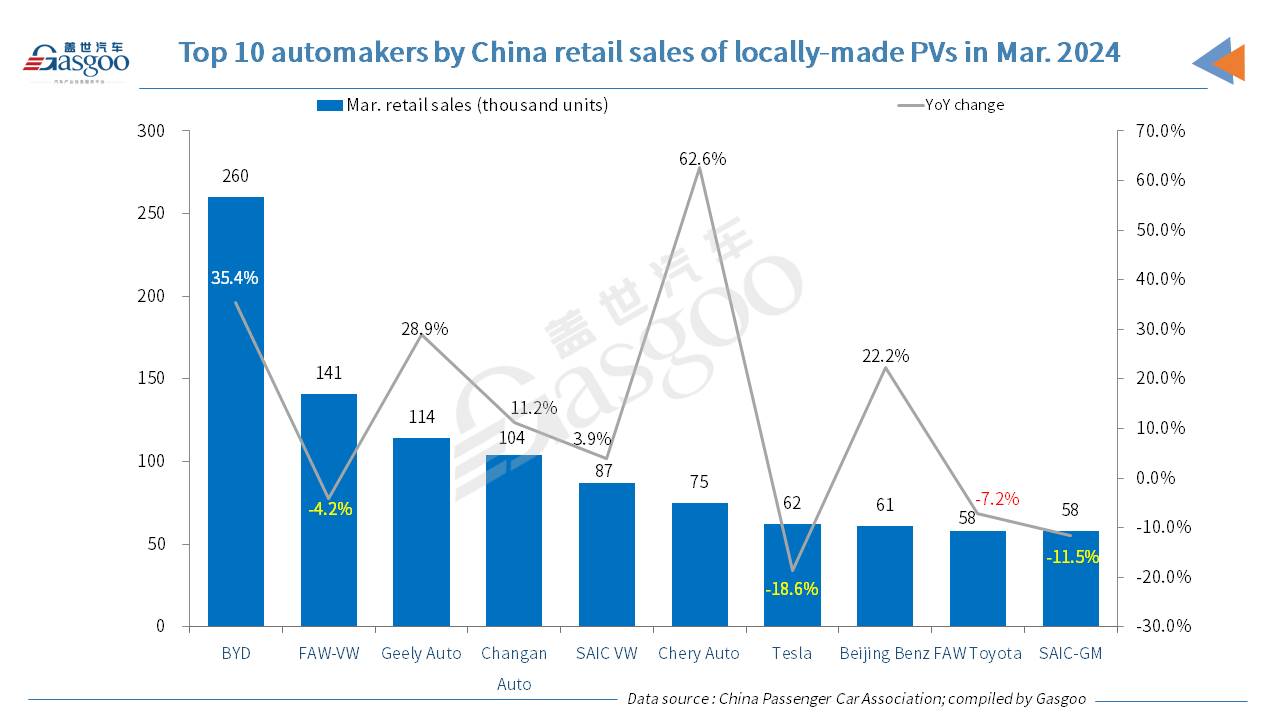

Among the top 10 carmakers by Mar. retail sales of homemade PVs, there were six companies that boasted a YoY growth. Of them, BYD secured the top position by retail volume, while Chery Auto was honored the fastest-growing one in terms of YoY change.

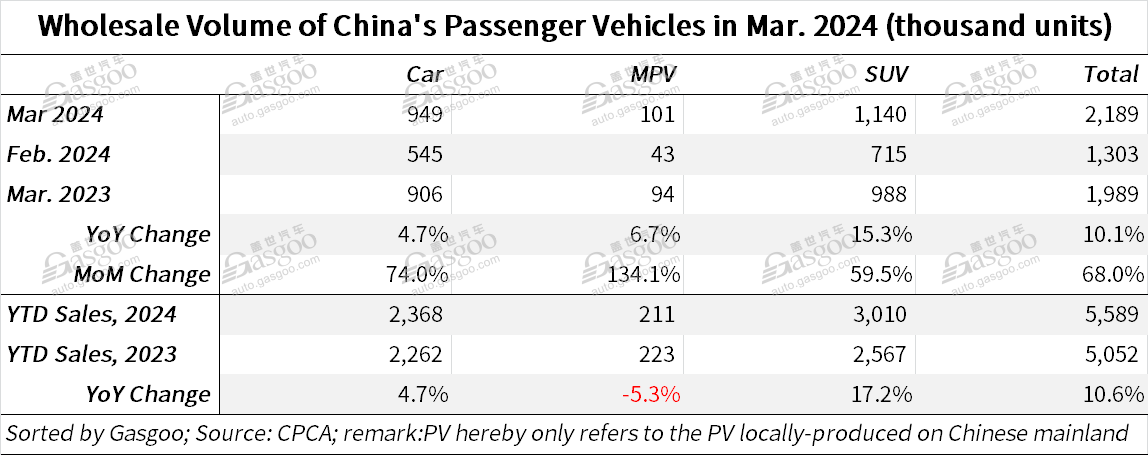

In March, passenger car manufacturers in the country wholesaled 2.189 million vehicles, marking a 10.1% YoY increase and a 68% MoM surge. Driven by the stable market performance and a boost in exports, PV manufacturers' sales hit a new high level compared to the corresponding period in previous years.

To be specific, China's domestic car manufacturers wholesaled 1.296 million units in March, up 23% YoY and 66% MoM. Mainstream joint ventures wholesaled 580,000 units, down 9% YoY but up 78% MoM. Premium car makers wholesaled 310,000 PVs, up 6% YoY and 60% MoM.

In March, there were 33 PV manufacturers with wholesales exceeding 10,000 units in March (up from 28 in February and 30 in the same period last year), accounting for 96.8% of the country's overall wholesale volume. Among these, 3 manufacturers saw a YoY growth rate exceeding 100%, 16 had over 10% growth, and 14 experienced a decline. Besides, a total of 8 manufacturers with wholesale volumes over 10,000 units had a growth rate exceeding 100% from February.

Moreover, China's PV production volume reached 2.192 million units in March, a 5.3% YoY increase and a 77.5% MoM soar. In the month, premium brands' output decreased by 2% YoY but shot up by 53% MoM; joint ventures' production decreased by 16% YoY but zoomed up by 83% MoM; indigenous brands' production increased by 21% YoY and 82% MoM.

China's overall car exports continued the strong growth trend from the end of last year, said the CPCA. In March, the country’s PV exports (including complete vehicles and CKD) reached 406,000 units, a 39% YoY growth and a 36% MoM increase, achieving the highest-ever monthly export volume in history. From January to March, the cumulative export volume reached 1.063 million units, up 36% YoY. New energy vehicles accounted for 29.3% of total exports in March, a 5.4-percentage-point increase from the same period last year.