Q1 2025 rankings of electrification component suppliers in China: Top player rivalry and tech innovation as key words

In the first quarter (Q1) of 2025, China’s new energy vehicle (NEV) supply chain demonstrates a two-track dynamic. On one side, the top 10 suppliers in segments such as power batteries and onboard chargers (OBCs) control over 90% of the market, reflecting rising industry concentration. On the other, leading players such as FinDreams Technology and CATL are building strong technology barriers through vertical integration and research and development (R&D). As car companies expand in-house production and innovation accelerates, supply chain competition is shifting from product-level rivalry to a broader contest over technology ecosystems and industry influence.

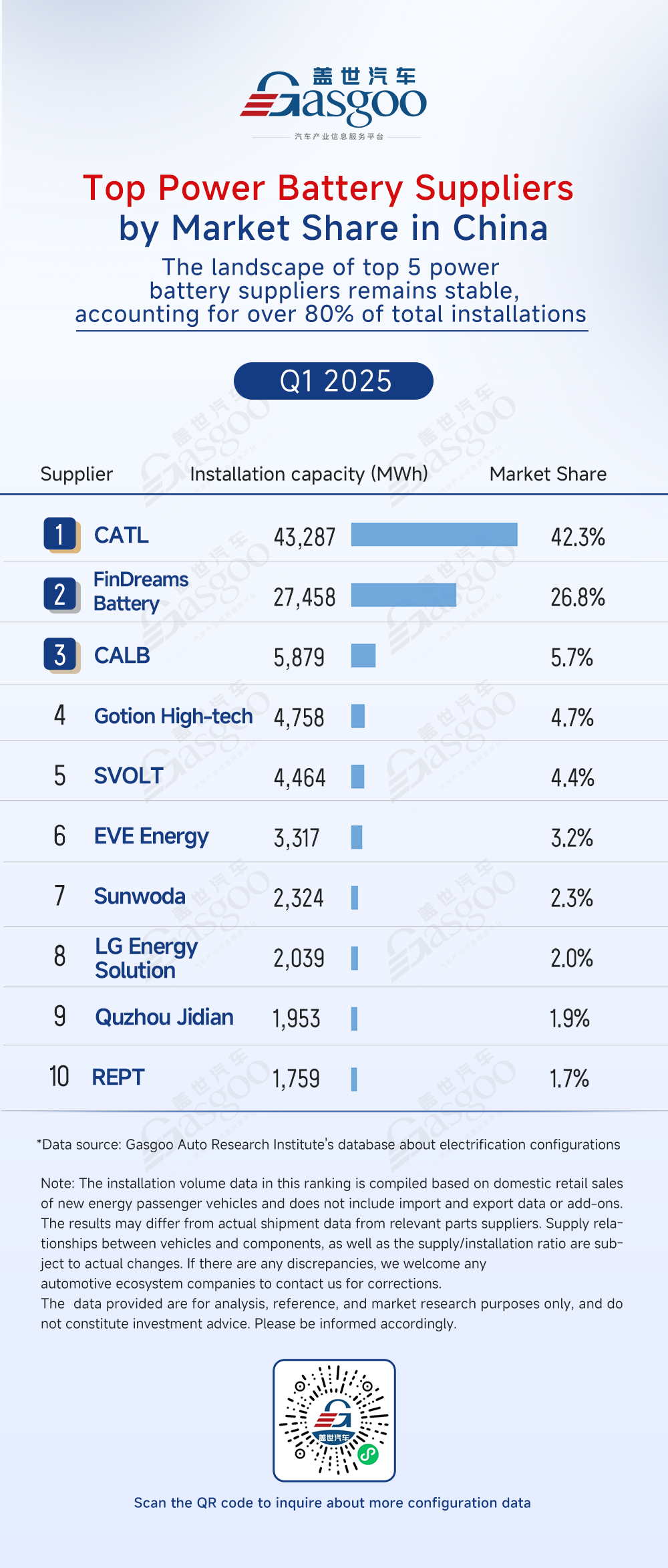

Top power battery suppliers: Landscape of top 5 remains stable, accounting for over 80% of total installations

According to data compiled by the Gasgoo Automotive Research Institute, the top five power battery suppliers together secure 83.9% of the market share in Q1 2025. This concentration reflects a “winner-takes-most” trend, where leading companies leverage technological expertise, economies of scale, and strong customer networks to build formidable market barriers.

CATL maintains its leading position with a 42.3% market share (43,287 MWh installed). FinDreams Battery follows closely with a 26.8% share (27,458 MWh installed). As a key element of BYD’s vertical integration strategy, FinDreams Battery has significantly improved energy density of its Blade Battery through structural innovation. Widely deployed across more than 95% of BYD models, this technology is also attracting interest from external car companies including FAW Hongqi and Toyota. With a combined 14.8% market share, CALB (5.7%), Gotion High-tech (4.7%), and SVOLT (4.4%) represent the second tier of players in the market.

Leading players hold a dominant position due to their technological expertise, economies of scale, and strong customer networks. Meanwhile, small and medium-sized companies must rely on innovation or niche focus to find growth opportunities. With the NEV market continues to expand, the concentration of the power battery industry is expected to remain high in the future.

Top power battery pack suppliers: Carmaker-backed suppliers make up over 50% of total installation volume

According to the rankings below, carmaker-backed suppliers dominate the power battery pack market with over 50% share, profoundly shaping the industry landscape. As a whollyowned subsidiary of BYD, FinDreams Battery supplies more than 98% of its installed volume to BYD vehicles. Both producing packs in-house, Tesla and Leapmotor rank third and ninth respectively, holding 5.8% and 3.1% market shares.

FinDreams Battery, Tesla, and Leapmotor together secure 41.4% of the market share. Including other in-house production capacity not listed, their total share exceeds 50%. CATL tops independent suppliers with an 18.8% market share. The second tier consists of companies like REPT and SVOLT, holding 4.8% and 4.5% shares respectively, with a combined installation volume around 100,000 sets.

Car companies are building in-house power battery pack systems to strengthen control over core components—reflecting their drive to sharpen technological edge and the industry’s shift toward deeper vertical integration. As carmakers and independent suppliers navigate this mix of competition and collaboration, the future landscape will hinge on technological openness and cost efficiency.

Top BMS suppliers: Automakers increasingly seek self-control

The BMS (battery management system) supplier rankings below reveal a shifting landscape in this core technology segment. As NEVs become increasingly intelligent and connected, car companies are placing greater emphasis on gaining independent control over BMS—the “brain” of the power battery system.

FinDreams Battery leads the market with a 33.2% share, supplying BYD’s entire vehicle lineup and achieving full vertical integration from battery cells to system integration. VREMT holds 8.5% of the market, supplying brands like Zeekr and Lynk & Co, highlighting a typical strategy of car companies using subsidiaries to drive technological self-reliance. Leapmotor ranks seventh with a 3.1% share, developing its BMS hardware and software entirely in-house.

As the vital bridge between battery cells and the vehicle, BMS has become a new benchmark for car companies’ technological strength. In this race for technology sovereignty, carmakers need to keep investing in R&D, while suppliers are challenged to explore innovative partnerships. Going forward, BMS market competition will go beyond just market share—it's a contest for technological leadership and influence over the industry ecosystem.

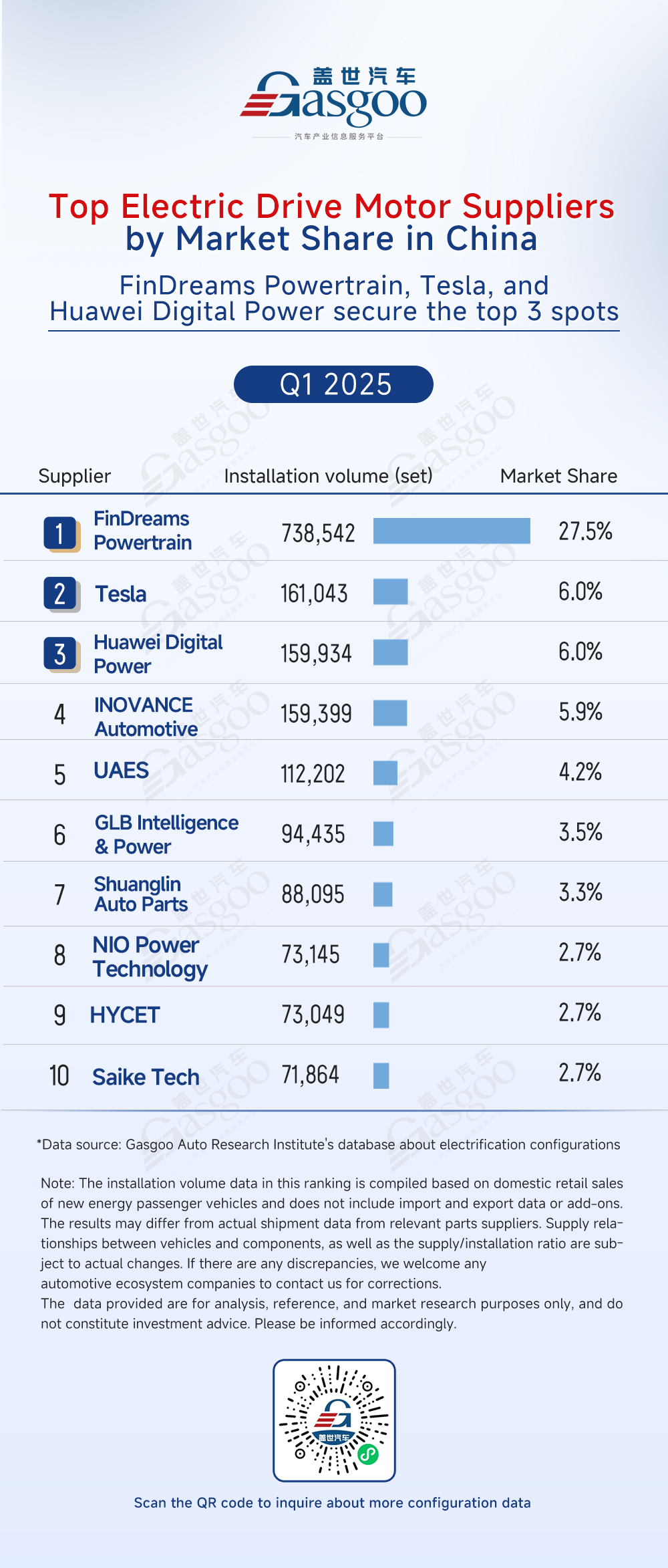

Top electric drive motor suppliers: Technology reshapes industry landscape

According to the rankings below, the electric drive motor supplier market is experiencing a new competitive shift. FinDreams Powertrain, Tesla, and Huawei Digital Power hold the top three positions, signaling a crucial phase of technology-driven innovation and ecosystem reshaping in the sector.

FinDreams Powertrain takes the lead with a 27.5% share (738,542 sets installed). Tesla and Huawei Digital Power share second place with a 6.0% market share each, having 161,043 sets and 159,934 sets installed, respectively. Tesla represents the in-house development path of car companies, while Huawei Digital Power reflects how tech giants are extending their influence into the electric drive motor market. With fewer than 2,000 sets of gap, the competition between the two remains tight.

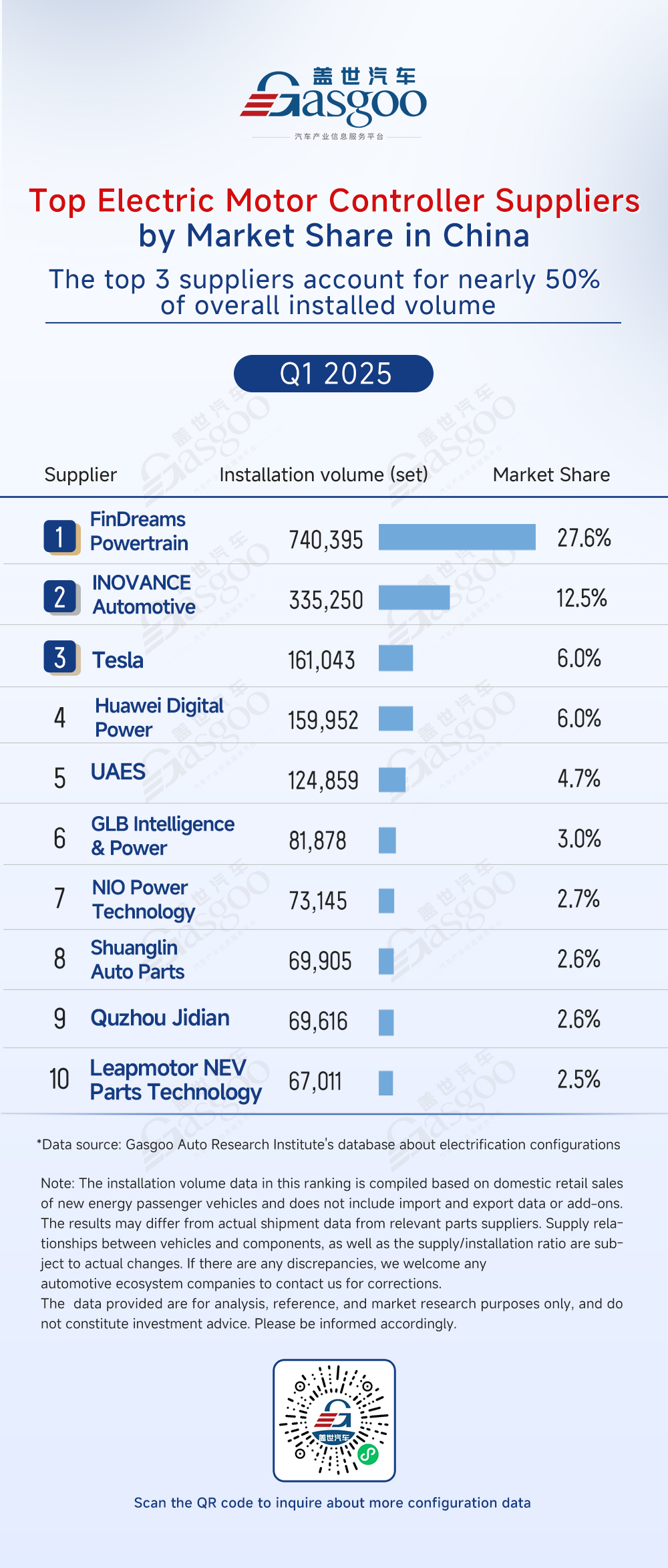

Top electric motor controller suppliers: Top 3 suppliers account for nearly 50% of overall installed volume

According to the rankings below, FinDreams Powertrain, INOVANCE Automotive, and Tesla secure a combined 46.1% of the market—an indication that the electric motor controller industry is undergoing significant consolidation.

FinDreams Powertrain takes the lead with a 27.6% market share (740,395 sets installed), serving as a typical example of in-house electric motor controller development by a carmaker. INOVANCE Automotive ranks second with a 12.5% share (335,250 sets installed), followed by Tesla at 6.0% (161,043 sets installed). As a vertically integrated car company, Tesla has deeply integrated its electric motor controller into the vehicle's electronic and electrical architecture, creating a distinctive technological edge. Notably, the gap in installation volume between INOVANCE Automotive and Tesla reaches 174,207 sets.

Top power semiconductor device (dedicated to e-drive) suppliers: Import substitution by locally-sourced parts reshapes landscape

According to the rankings below, the power semiconductor device (dedicated to e-drive) market shows a clear tripartite dominance pattern. BYD Semiconductor, CRRC Times Semiconductor, and Silan Microelectronics—three local companies—together secure 49.4% of the market share, forming a local challenging force as import substitution.

Specifically, BYD Semiconductor leads the market with a 27.5% share (739,562 sets installed). CRRC Times Semiconductor ranks second with 13.8% market share (371,745 sets), followed by Silan Microelectronics in third place with 8.1% (218,521 sets). These figures reflect a significant shift in the industry landscape: China’s import substitution is evolving from isolated breakthroughs to comprehensive, system-level leadership. As local firms continue to make major technological strides, a golden era of local alternatives replacing foreign technologies is clearly underway.

Top OBC suppliers: Top players deepen industry concentration

The top 10 OBC suppliers together secure a 92.8% market share. FinDreams Powertrain leads with 29.5% market share (690,436 sets installed). Its OBC products are extensively integrated across BYD's entire vehicle lineup, achieving full industry chain coverage from power semiconductor devices to complete systems. VMAX ranks second with a 17.9% market share (419,583 sets installed), followed by SHINRY in third place with 10.8% market share (251,883 sets installed).

Technological barriers and ecosystem integration will increasingly determine market leadership. In this technology-driven transformation, the OBC has evolved from a standalone part into a central node within the vehicle's energy system—one that continues to reshape the landscape of the NEV industry.

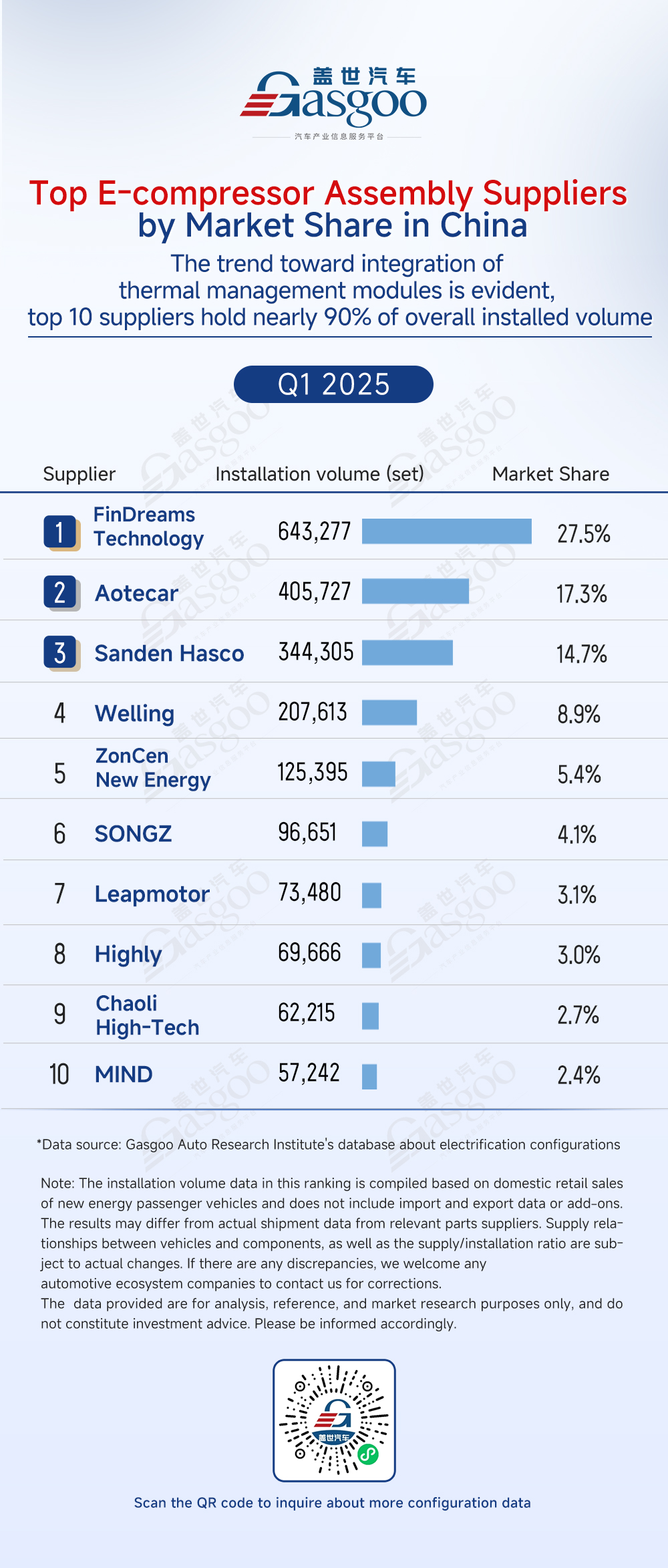

Top E-compressor assembly suppliers: The trend toward integration of thermal management modules is evident

According to the rankings below, the top 10 suppliers of E-compressor assembly together secure 89.2% of the market share, highlighting a significant shift toward integration in the sector. FinDreams Technology takes the lead with a 27.5% share (643,277 sets), followed by Aotecar at 17.3% (405,727 sets) and Sanden Hasco at 14.7% (344,305 sets).

As China’s NEV industry evolves, integration in the E-compressor assembly market is becoming an irreversible trend. The top 10 suppliers are setting high entry barriers and driving upgrades across the supply chain with strong technology and scale advantages.

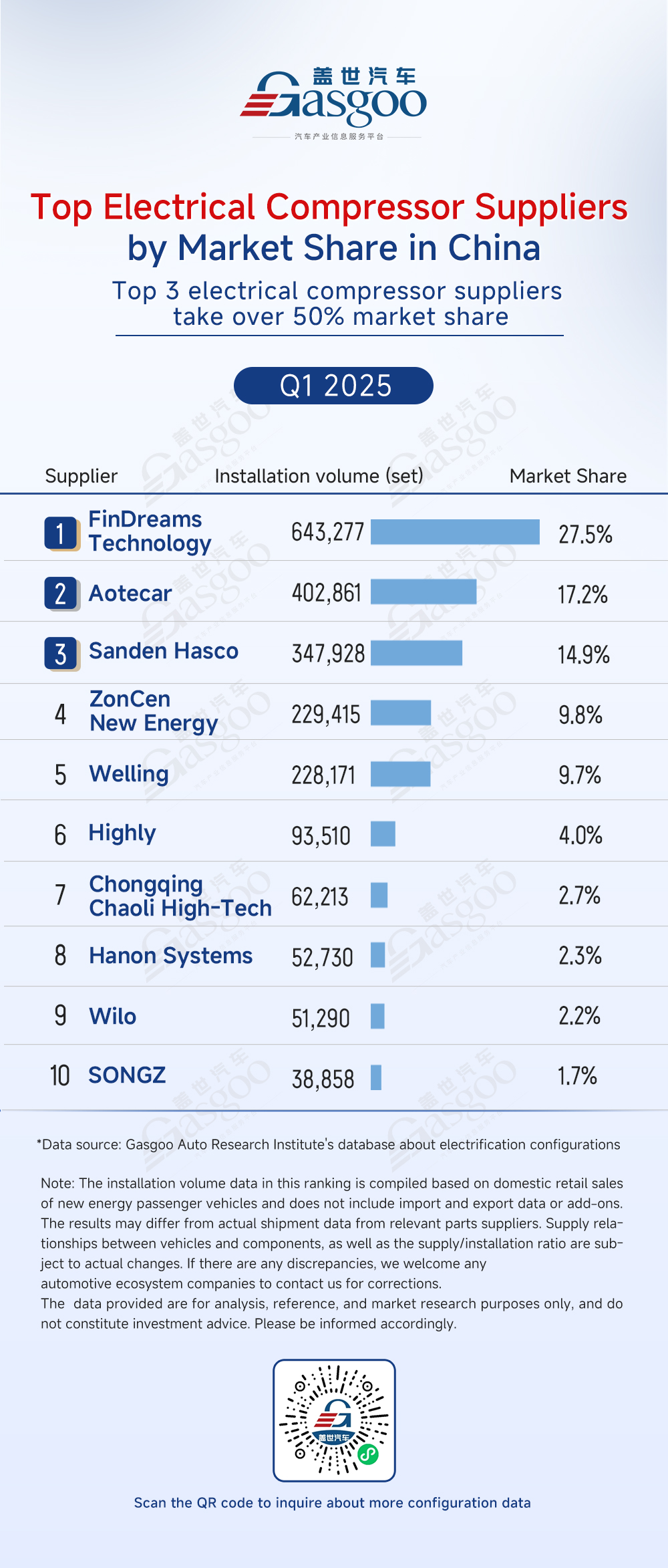

Top electrical compressor suppliers: Top players reshape market landscape

The rankings of electrical compressor suppliers show a clear industry structure: FinDreams Technology, Aotecar, and Sanden Hasco together hold 59.6% of the market, forming a strong top tier. FinDreams Technology leads with a 27.5% share (643,277 sets), driven by its deep integration with BYD’s vehicle lineup. As a key pillar of BYD’s vertical integration strategy, its electrical compressors are widely deployed across BYD’s entire vehicle lineup, enabling full coverage from core components to complete vehicles. Aotecar and Sanden Hasco follow with market shares of 17.2% and 14.9%, respectively.

The dominance of leading players essentially reflects their edge in both technology and cost efficiency. For electrical compressor suppliers, two core capabilities are becoming increasingly critical: first, innovation—developing high-efficiency compression, variable-frequency control, and lightweight materials to meet car companies' needs for energy efficiency and high performance. Second, supply chain collaboration—working closely with car companies from early development stages to strengthen integration and ensure long-term partnerships.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com