Rankings of ADAS component suppliers in China (Jan.-Jul. 2025): Leaders consolidate, competition intensifies

According to Gasgoo Automotive Research Institute's rankings of ADAS suppliers (Jan.-Jul. 2025), China's local suppliers gained ground and competition deepened across China's ADAS market. In key areas such as air suspension system, HD map, high precision positioning system, and LiDAR, Chinese suppliers continued to gain market share, demonstrating significant technological breakthroughs and cost-control capabilities while accelerating the large-scale adoption of premium features.

At the same time, leading companies leveraged technical expertise, scale, and collaborative ecosystems to further consolidate their positions. The market structure is gradually shifting from foreign dominance toward a competitive landscape where Chinese and global players contend on more equal footing. These developments not only reflect the overall strengthening of China's automotive supply chain but also signal that the localization of core smart-vehicle components has entered a rapid growth phase.

Top air suspension system suppliers

KH Automotive Technologies: 197,668 sets installed, 36.1% market share

Tuopu Group: 180,763 sets installed, 33.0% market share

Baolong Automotive: 106,080 sets installed, 19.4% market share

Vibracoustic: 46,432 sets installed, 8.5% market share

Continental: 16,461 sets installed, 3.0% market share

Others: 514 sets installed, 0.1% market share

From January to July, Chinese suppliers reshaped the air suspension system market. KH Automotive Technologies, Tuopu Group and Baolong Automotive together secured more than 88% of total demand, sharply narrowing the space for global players such as Vibracoustic and Continental. Their edge in engineering, cost efficiency and fast response—along with advances in core air suspension technologies—is speeding up adoption in the domestic passenger vehicle sector and signalling the rise of China's auto parts industry in the premium segment.

Top LiDAR suppliers

Huawei Technologies: 521,082 units installed, 40.2% market share

Hesai Technology: 416,606 units installed, 32.2% market share

RoboSense: 264,792 units installed, 20.4% market share

Seyond: 93,073 units installed, 7.2% market share

Others: 175 units installed, 0.01% market share

China's LiDAR market expanded rapidly in the first seven months of 2025, with a clear concentration at the top. Huawei Technologies led the pack with a 40.2% share, leveraging its technological strength and automaker partnerships. Hesai Technology and RoboSense followed with 32.2% and 20.4%, respectively, giving the three leaders a combined share of over 92%. Smaller players, including Seyond, held only marginal shares, highlighting the steep technological barriers and strong market influence of the top suppliers. As ADAS adoption continues to rise, overall demand is set to grow, though smaller firms will face significant hurdles, reinforcing the dominance of the leading companies.

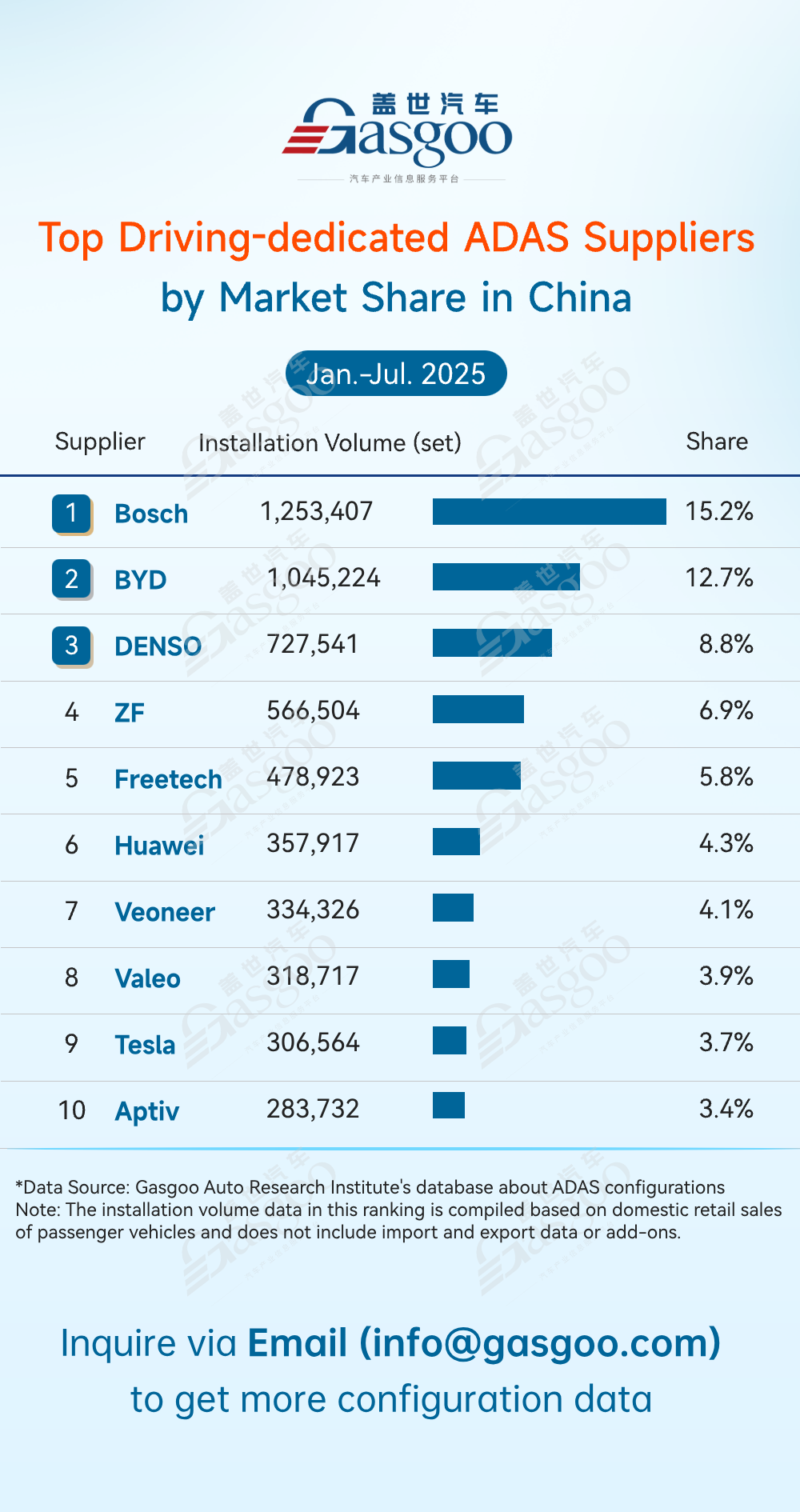

Top driving-dedicated ADAS suppliers

Bosch: 1,253,407 sets installed, 15.2% market share

BYD: 1,045,224 sets installed, 12.7% market share

DENSO: 727,541 sets installed, 8.8% market share

ZF: 566,504 sets installed, 6.9% market share

Freetech: 478,923 sets installed, 5.8% market share

Huawei: 357,917 sets installed, 4.3% market share

Veoneer: 334,326 sets installed, 4.1% market share

Valeo: 318,717 sets installed, 3.9% market share

Tesla: 306,564 sets installed, 3.7% market share

Aptiv: 283,732 sets installed, 3.4% market share

For the Jan.-Jul. period, Bosch led the driving-dedicated ADAS market with a 15.2% share, while Tier-1s like DENSO and ZF leveraged engineering expertise and supply-chain strength. BYD gained traction with in-house ADAS solutions, and tech players such as Huawei rose through innovation. Front-view integrated systems remained dominant, highlighting established commercialization paths. Overall, the ADAS landscape evolved into a competitive dynamic for suppliers, automakers, and tech firms alike.

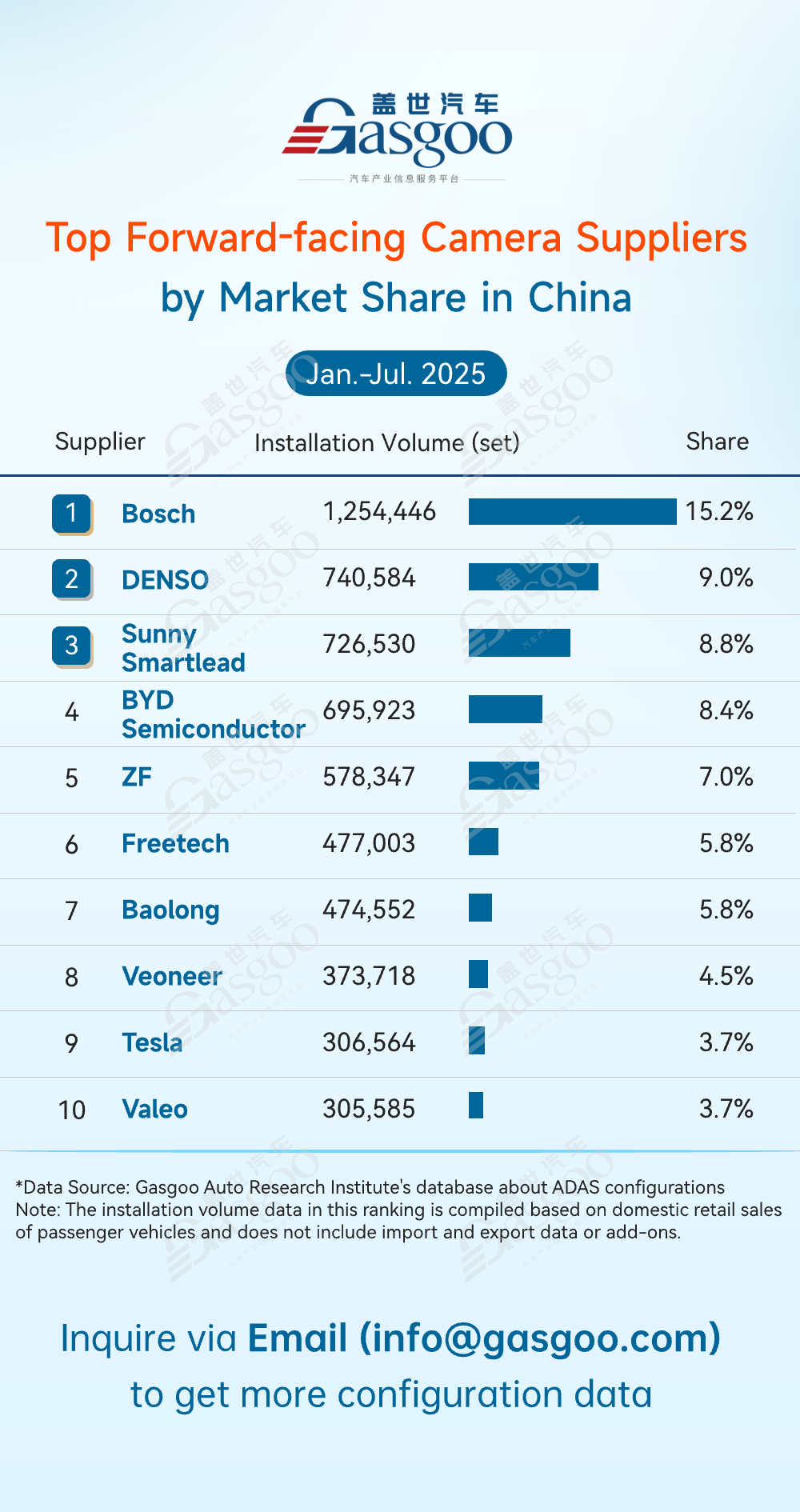

Top forward-facing camera suppliers

Bosch: 1,254,446 sets installed, 15.2% market share

DENSO: 740,584 sets installed, 9.0% market share

Sunny Smartlead: 726,530 sets installed, 8.8% market share

BYD Semiconductor: 695,923 sets installed, 8.4% market share

ZF: 578,347 sets installed, 7.0% market share

Freetech: 477,003 sets installed, 5.8% market share

Baolong: 474,552 sets installed, 5.8% market share

Veoneer: 373,718 sets installed, 4.5% market share

Tesla: 306,564 sets installed, 3.7% market share

Valeo: 305,585 sets installed, 3.7% market share

From January to July, Bosch led China's forward-facing camera market with a 15.2% share, but China's players are quickly closing the gap. Sunny Smartlead and BYD Semiconductor have joined the top ranks, while Freetech and Baolong each hold about 5.8%, signalling rapid advances in ADAS sensing hardware and accelerating import substitution. This shift is diversifying the market and strengthening China's supply chain for large-scale ADAS deployment.

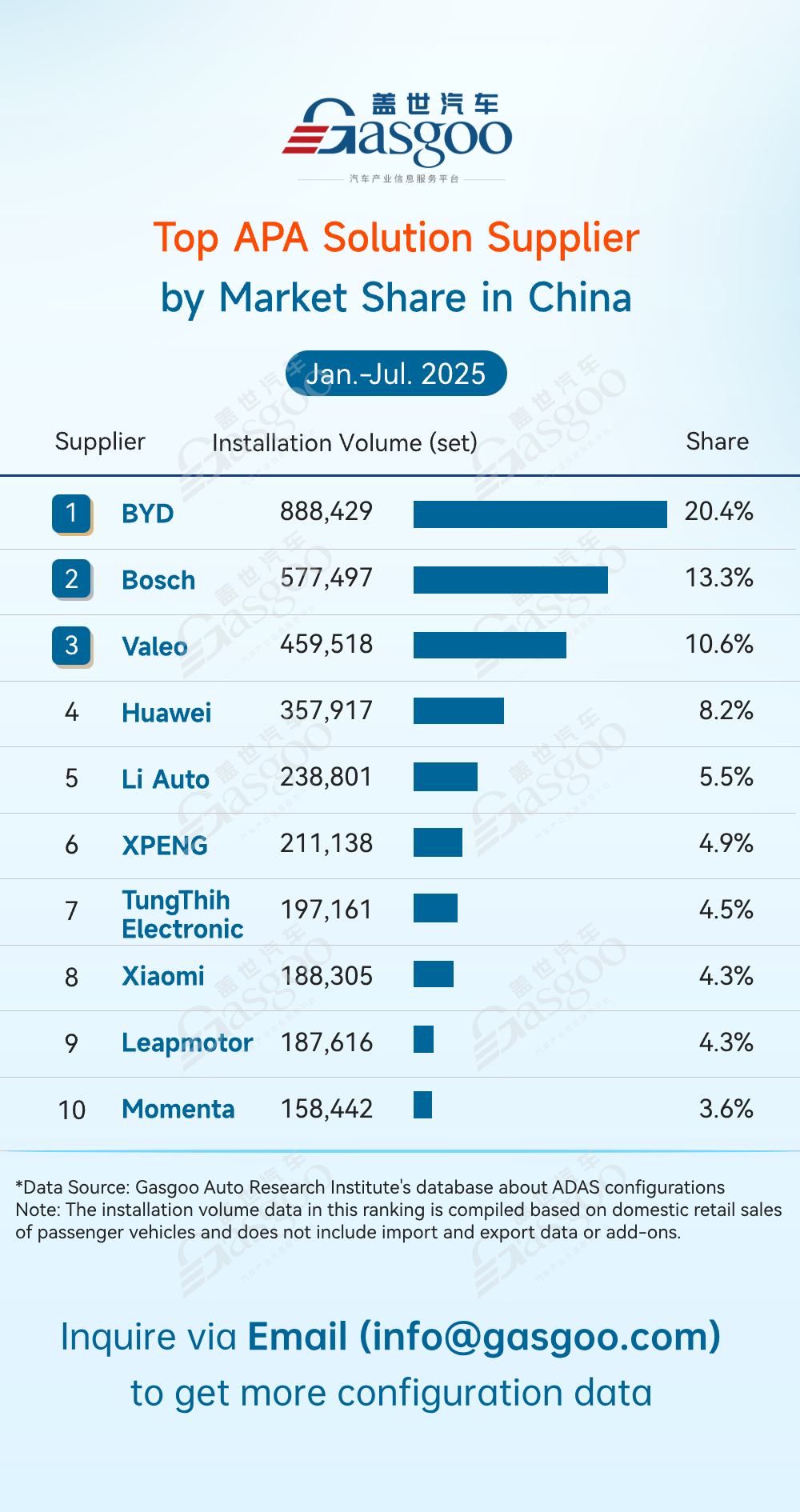

Top APA solution suppliers

BYD: 888,429 sets installed, 20.4% market share

Bosch: 577,497 sets installed, 13.3% market share

Valeo: 459,518 sets installed, 10.6% market share

Huawei: 357,917 sets installed, 8.2% market share

Li Auto: 238,801 sets installed, 5.5% market share

XPENG: 211,138 sets installed, 4.9% market share

TungThih Electronic: 197,161 sets installed, 4.5% market share

Xiaomi: 188,305 sets installed, 4.3% market share

Leapmotor: 187,616 sets installed, 4.3% market share

Momenta: 158,442 sets installed, 3.6% market share

From January to July, China's local suppliers steadily gained share in APA solution market. BYD took the lead with 20.4%, underscoring local companies' growing strength in ADAS solution. Huawei, Li Auto, Xiaomi and other Chinese players joined the top ranks alongside Bosch and Valeo, reflecting faster commercialization and stronger self-sufficiency across the APA solution supply chain. With new energy vehicle (NEV) automakers and tech firms ramping up their presence, competition is intensifying, innovation cycles are shortening and cost efficiencies are improving — all boosting the appeal of homegrown APA solutions.

Top HD map suppliers

AutoNavi: 631,401 sets installed, 55.0% market share

Tencent: 140,028 sets installed, 12.2% market share

Langge Technology: 133,290 sets installed, 11.6% market share

NavInfo: 82,025 sets installed, 7.1% market share

Others: 160,637 sets installed, 14.0% market share

From January to July, China's HD map market was highly concentrated with tiered competition. AutoNavi led the pack with 55.0% (631,401 sets), while Tencent (12.2%) and Langge Technology (11.6%) formed the second tier. NavInfo held 7.1%, and others accounted for 14%, leaving room for niche players. Leading firms strengthened their advantage through scale and technology, while smaller players competed via differentiation and faster iteration.

Top suppliers of high precision positioning system

ASENSING: 1,327,286 sets installed, 53.4% market share

Huawei: 357,574 sets installed, 14.4% market share

CHC Navigation: 188,624 sets installed, 7.6% market share

XPENG: 127,371 sets installed, 5.1% market share

MCT: 70,659 sets installed, 2.8% market share

Others: 413,113 sets installed, 16.6% market share

For the first seven months of the year, China's high-precision positioning market was led by ASENSING with 53.4%, followed by Huawei at 14.4%. CHC Navigation, XPENG, and other players shared the remaining 16.6%. Leading firms leveraged scale and technology to consolidate their advantage, while smaller players competed in niche areas, keeping the market highly competitive.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com