Rankings of smart cockpit component suppliers in China (Jan.-Jul. 2025): China’s local substitution deepens, top-tier players strengthen dominance

According to data compiled by the Gasgoo Automotive Research Institute, China's automotive smart components market showed strong localization for the Jan.-Jul. period, high concentration, and rapid iteration. In key areas such as smart speech solution, cockpit domain controller, head-up display (HUD), and screen integration, Chinese suppliers gained a dominant position due to their fast response, tailored technology, and integrated ecosystems. iFLYTEK led the smart speech solution segment with a 44% share, while Desay SV and Foryou Multimedia also maintained leading positions across several niches.

Meanwhile, premium features such as augmented reality HUD (AR-HUD) and large-screen integration are spreading quickly, pushing supply-chain technology competition to a deeper, more complex stage. Against the backdrop of accelerating localization, the market is moving toward clearer technology tiers, tighter ecosystem collaboration and more differentiated innovation.

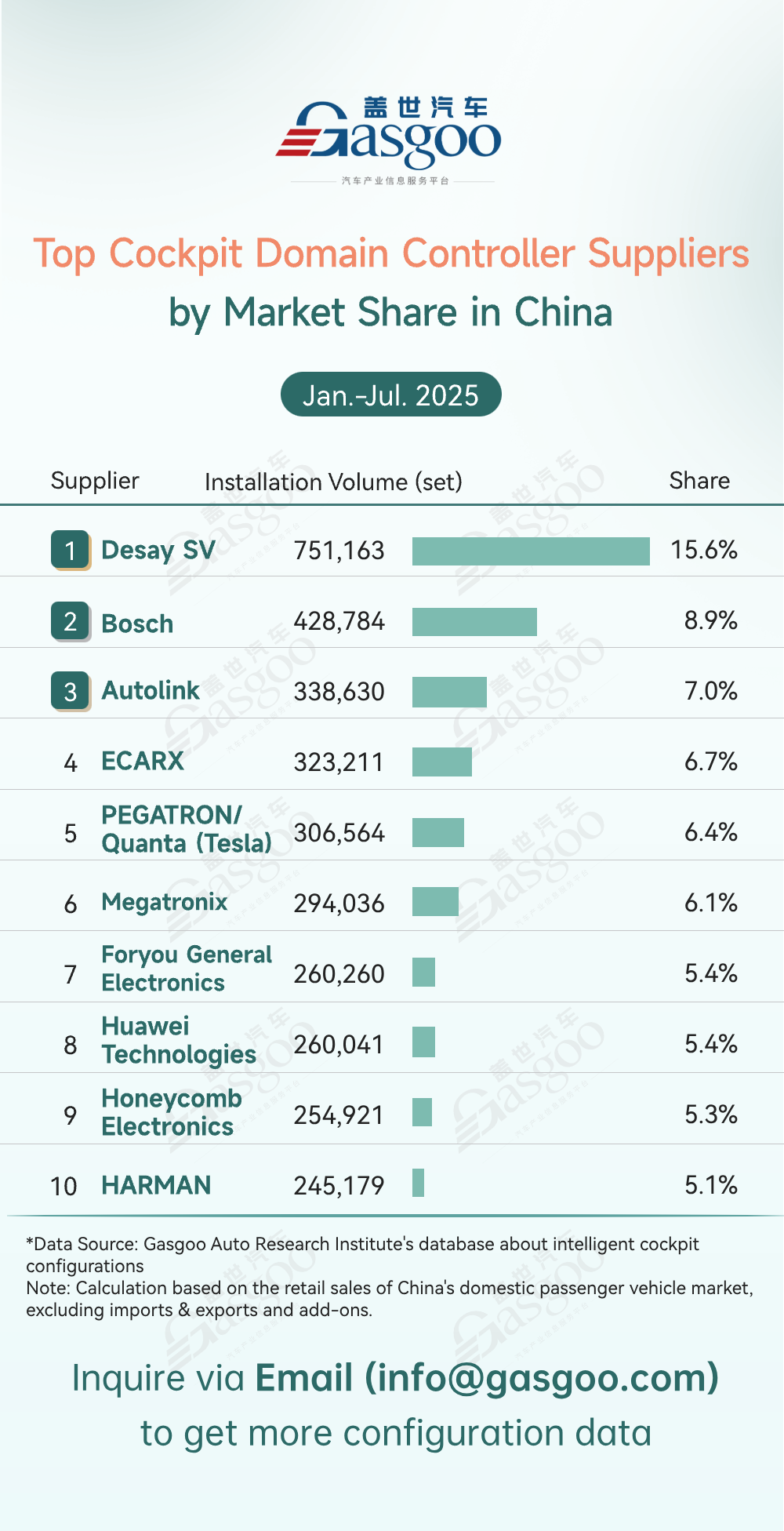

Top cockpit domain controller suppliers

Desay SV: 751,163 sets installed, 15.6% market share

Bosch: 428,784 sets installed, 8.9% market share

Autolink: 338,630 sets installed, 7.0% market share

ECARX: 323,211 sets installed, 6.7% market share

PEGATRON/Quanta (Tesla): 306,564 sets installed, 6.4% market share

Megatronix: 294,036 sets installed, 6.1% market share

Foryou General Electronics: 260,260 sets installed, 5.4% market share

Huawei Technologies: 260,041 sets installed, 5.4% market share

Honeycomb Electronics: 254,921 sets installed, 5.3% market share

HARMAN: 245,179 sets installed, 5.1% market share

From Januarary to July, China's cockpit domain controller market took shape around a few clear leaders and a growing mix of challengers. Desay SV led the pack with 751,163 sets installed (15.6% share). Bosch (8.9%), Autolink (7.0%) and others formed a solid second tier, while Huawei Technologies (5.4%), Foryou General Electronics (5.4%) and PEGATRON/Quanta (Tesla) (6.4%) added a strong tech edge to the field. With cockpit integration accelerating, scale, software capability and ecosystem ties became decisive, and both traditional suppliers and new players reshaped the competitive map.

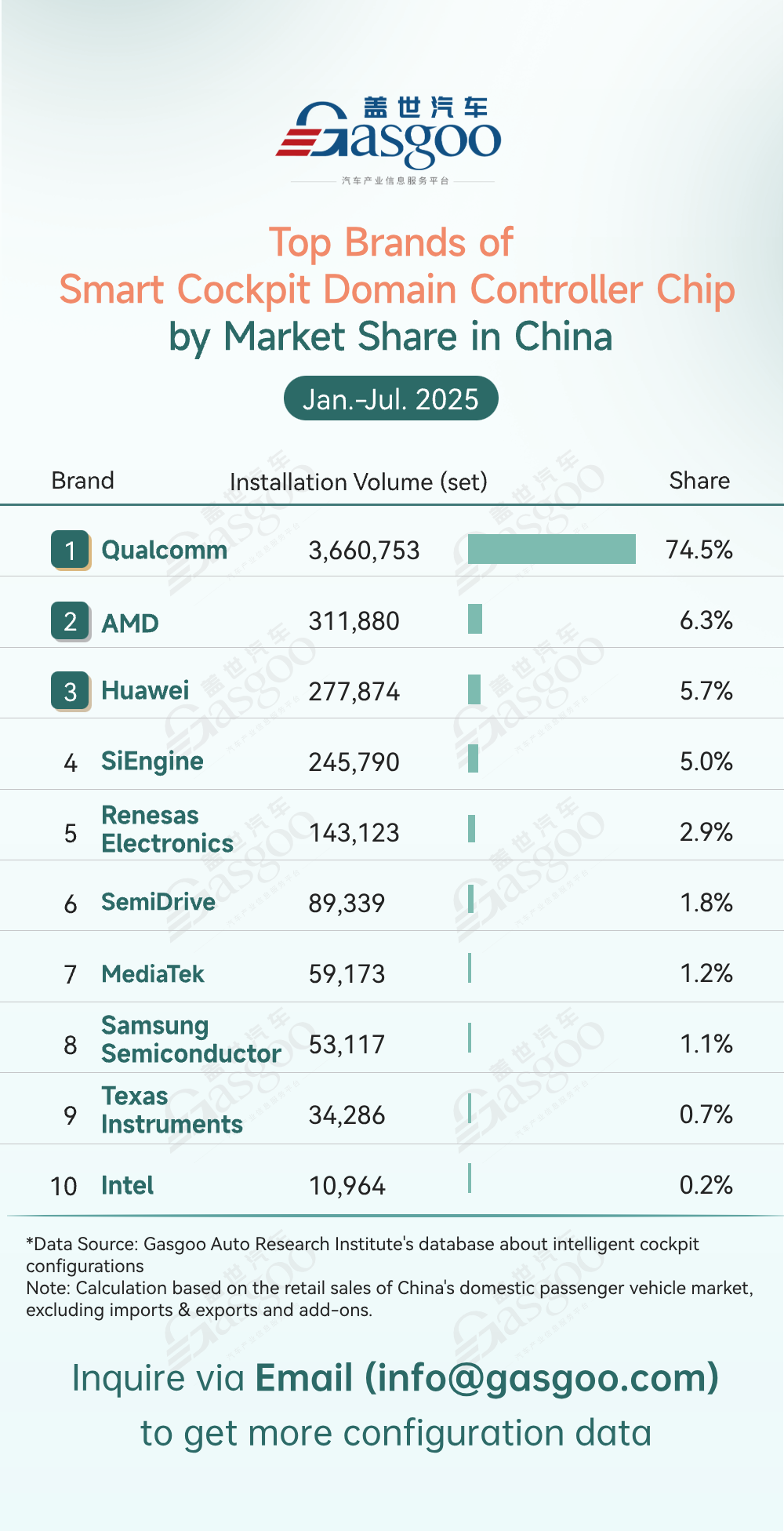

Top brands of smart cockpit domain controller chip

Qualcomm: 3,660,753 units installed, 74.5% market share

AMD: 311,880 units installed, 6.3% market share

Huawei: 277,874 units installed, 5.7% market share

SiEngine: 245,790 units installed, 5.0% market share

Renesas Electronics: 143,123 units installed, 2.9% market share

SemiDrive: 89,339 units installed, 1.8% market share

MediaTek: 59,173 units installed, 1.2% market share

Samsung Semiconductor: 53,117 units installed, 1.1% market share

Texas Instruments: 34,286 units installed, 0.7% market share

Intel: 10,964 units installed, 0.2% market share

Cockpit domain controller chip market showed a clear "one dominant, many contenders" pattern, with Qualcomm holding over 70% of the market thanks to its scale and technical strength. China's local players such as Huawei (5.7%), SiEngine (5.0%) and SemiDrive (1.8%) steadily increased their shares, pushing localization above 10% and signaling real progress in homegrown automotive chips. While Qualcomm's lead remains hard to challenge in the short term, the rapid advances in technology and installations by Chinese suppliers are opening space for import substitution and pointing to a more diversified market ahead.

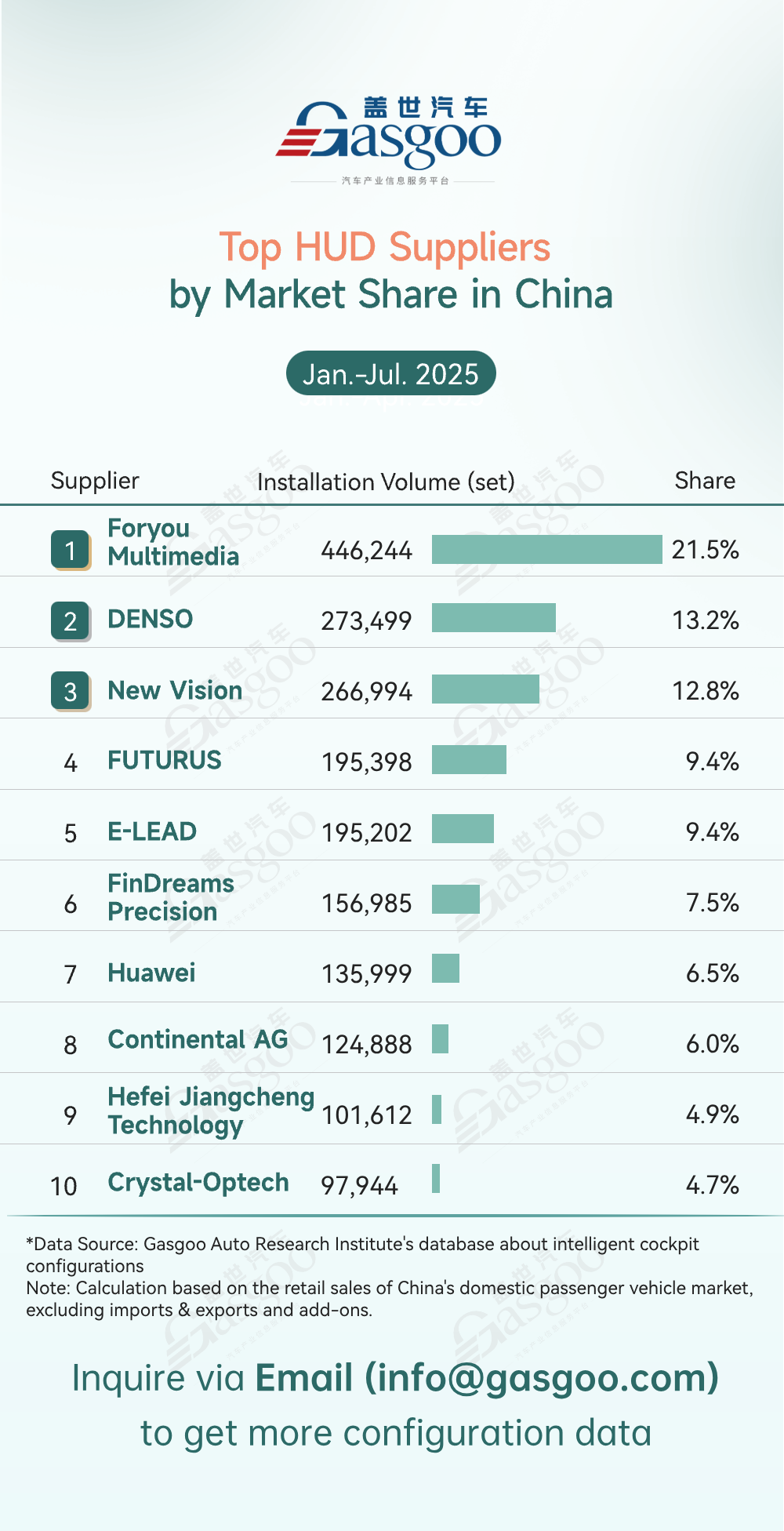

Top HUD suppliers

Foryou Multimedia: 446,244 sets installed, 21.5% market share

DENSO: 273,499 sets installed, 13.2% market share

New Vision: 266,994 sets installed, 12.8% market share

FUTURUS: 195,398 sets installed, 9.4% market share

E-LEAD: 195,202 sets installed, 9.4% market share

FinDreams Precision: 156,985 sets installed, 7.5% market share

Huawei: 135,999 sets installed, 6.5% market share

Continental AG: 124,888 sets installed, 6.0% market share

Hefei Jiangcheng Technology: 101,612 sets installed, 4.9% market share

Crystal-Optech: 97,944 sets installed, 4.7% market share

Foryou Multimedia led the HUD market for the Jan.-Jul. period with a 21.5% share, followed by DENSO (13.2%) and New Vision (12.8), with top suppliers benefiting from scale and established client networks. FUTURUS and E-LEAD held similar shares (9.4%), reflecting tight competition, while tech companies like Huawei (6.5%) and Continental AG (6.0%) alongside traditional Tier-1s captured notable portions of the market. As differentiation in automotive displays accelerated, HUD suppliers increasingly focused on AR-HUD innovation, deeper integration with OEMs, and production capacity expansion to secure growth opportunities.

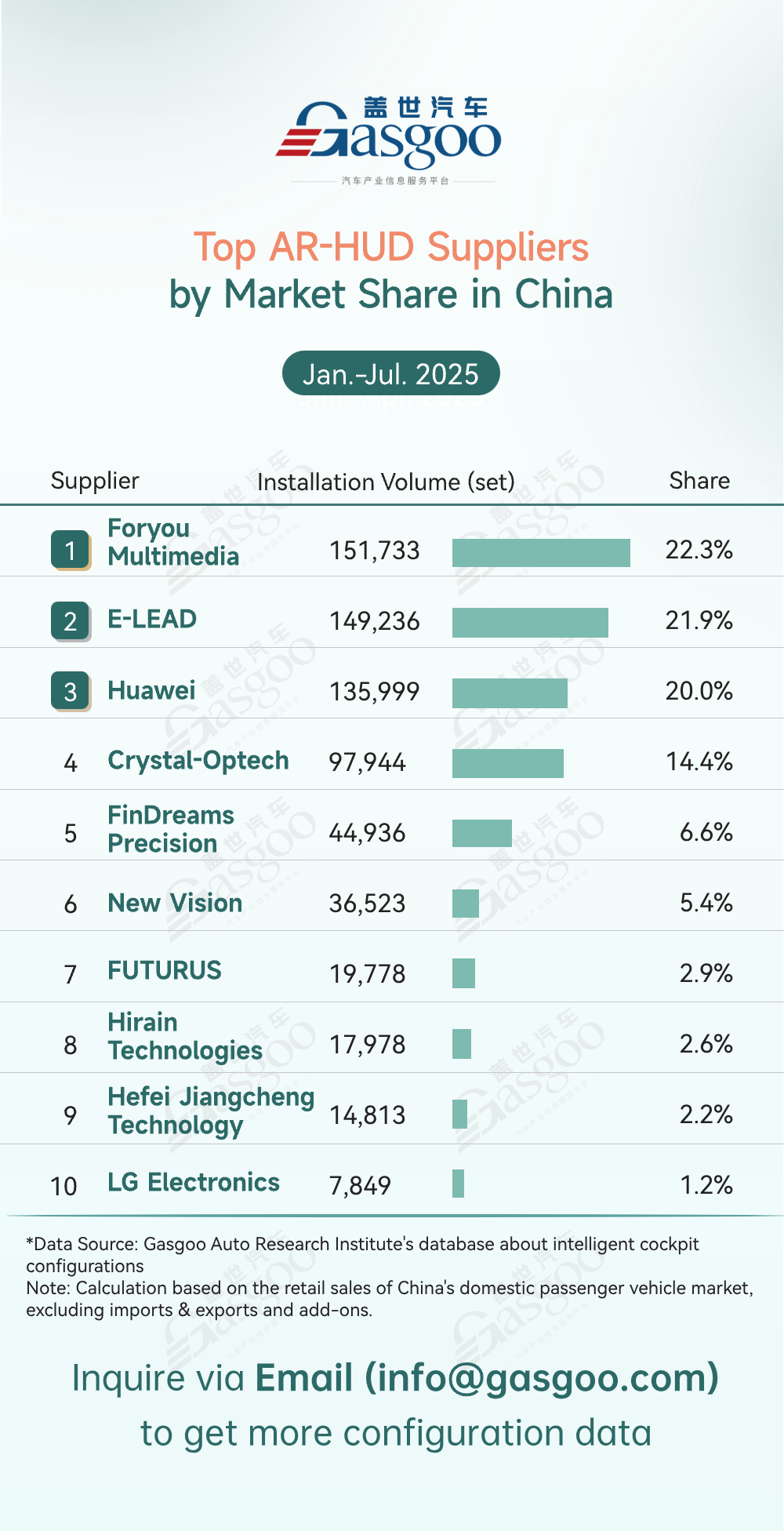

Top AR-HUD suppliers

Foryou Multimedia: 151,733 sets installed, 22.3% market share.

E-LEAD: 149,236 sets installed, 21.9% market share.

Huawei: 135,999 sets installed, 20.0% market share.

Crystal-Optech: 97,944 sets installed, 14.4% market share.

FinDreams Precision: 44,936 sets installed, 6.6% market share.

New Vision: 36,523 sets installed, 5.4% market share.

FUTURUS: 19,778 sets installed, 2.9% market share.

Hirain Technologies: 17,978 sets installed, 2.6% market share.

Hefei Jiangcheng Technology: 14,813 sets installed, 2.2% market share.

LG Electronics: 7,849 sets installed, 1.2% market share.

From January to July, China's AR-HUD market highlighted the growing strength of domestic suppliers, with a clear concentration at the top. Foryou Multimedia (22.3%), E-LEAD (21.9%) and Huawei (20.0%) ranked the top 3 with a combined share of over 64%, underscoring their scale advantage. China's local players accelerated breakthroughs through technology innovation and supply chain integration, driving rapid penetration of AR-HUD in passenger vehicles. Meanwhile, a diverse group of smaller suppliers competed in niche segments such as optics and interaction design. Overall, localization gained momentum, and mass-production capability and cost control emerged as core competitive factors as the market entered a phase of faster adoption and reshaping.

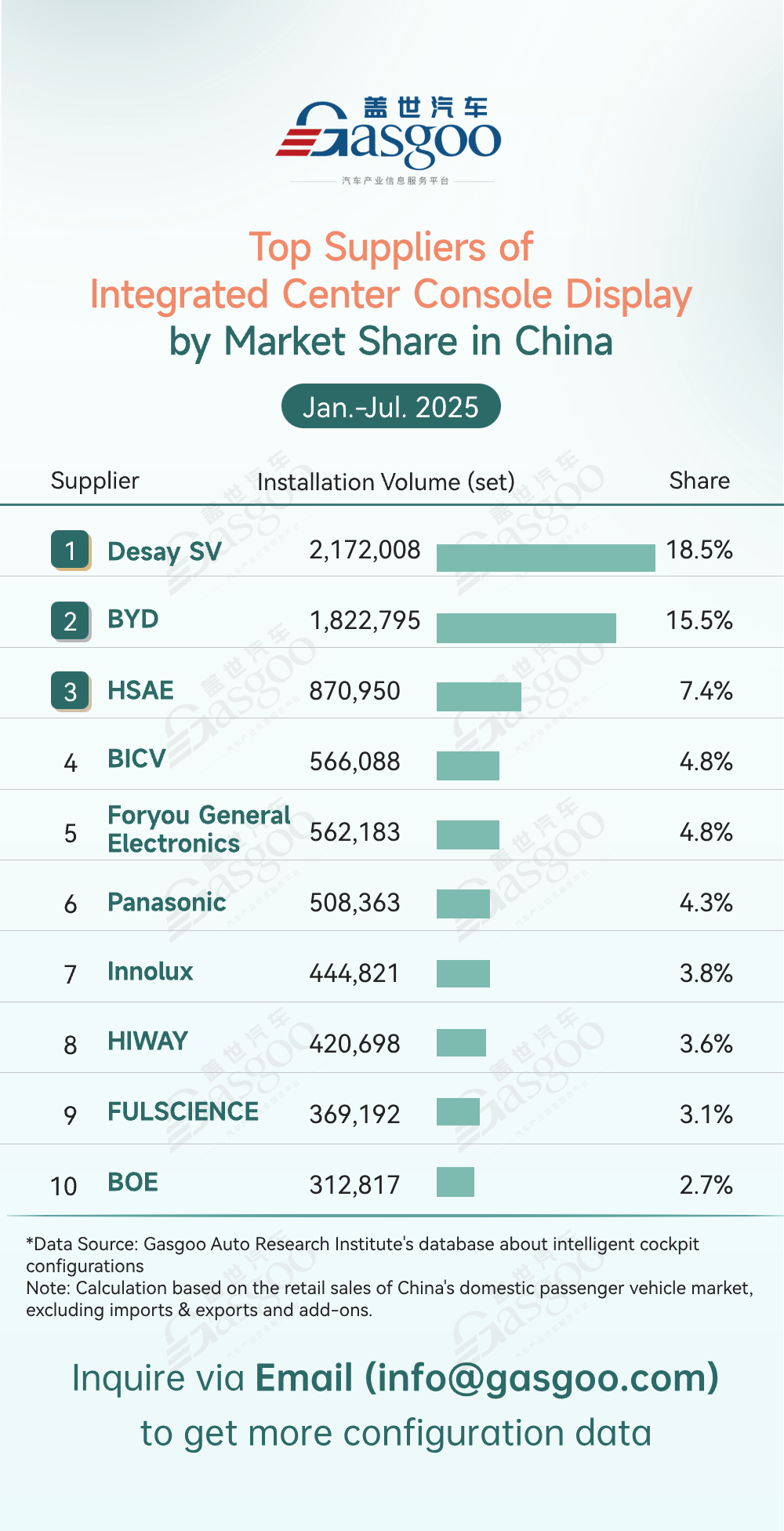

Top suppliers of integrated center console display

Desay SV: 2,172,008 sets installed, 18.5% market share

BYD: 1,822,795 sets installed, 15.5% market share

HSAE: 870,950 sets installed, 7.4% market share

BICV: 566,088 sets installed, 4.8% market share

Foryou General Electronics: 562,183 sets installed, 4.8% market share

Panasonic: 508,363 sets installed, 4.3% market share

Innolux: 444,821 sets installed, 3.8% market share

HIWAY: 420,698 sets installed, 3.6% market share

FULSCIENCE: 369,192 sets installed, 3.1% market share

BOE: 312,817 sets installed, 2.7% market share

From January to July, China's integrated center console display market was dominated by local suppliers. Desay SV (18.5%) and BYD (15.5%) held the top two positions with a combined share of over 34%, underscoring their strong competitiveness. Players such as HSAE (7.4%) and BICV (4.8%) also leveraged technology and supply-chain synergies to secure key positions. As in-vehicle smartization accelerates, China's local suppliers are rapidly expanding their share by aligning closely with local demand and responding quickly, driving the localization of supply.

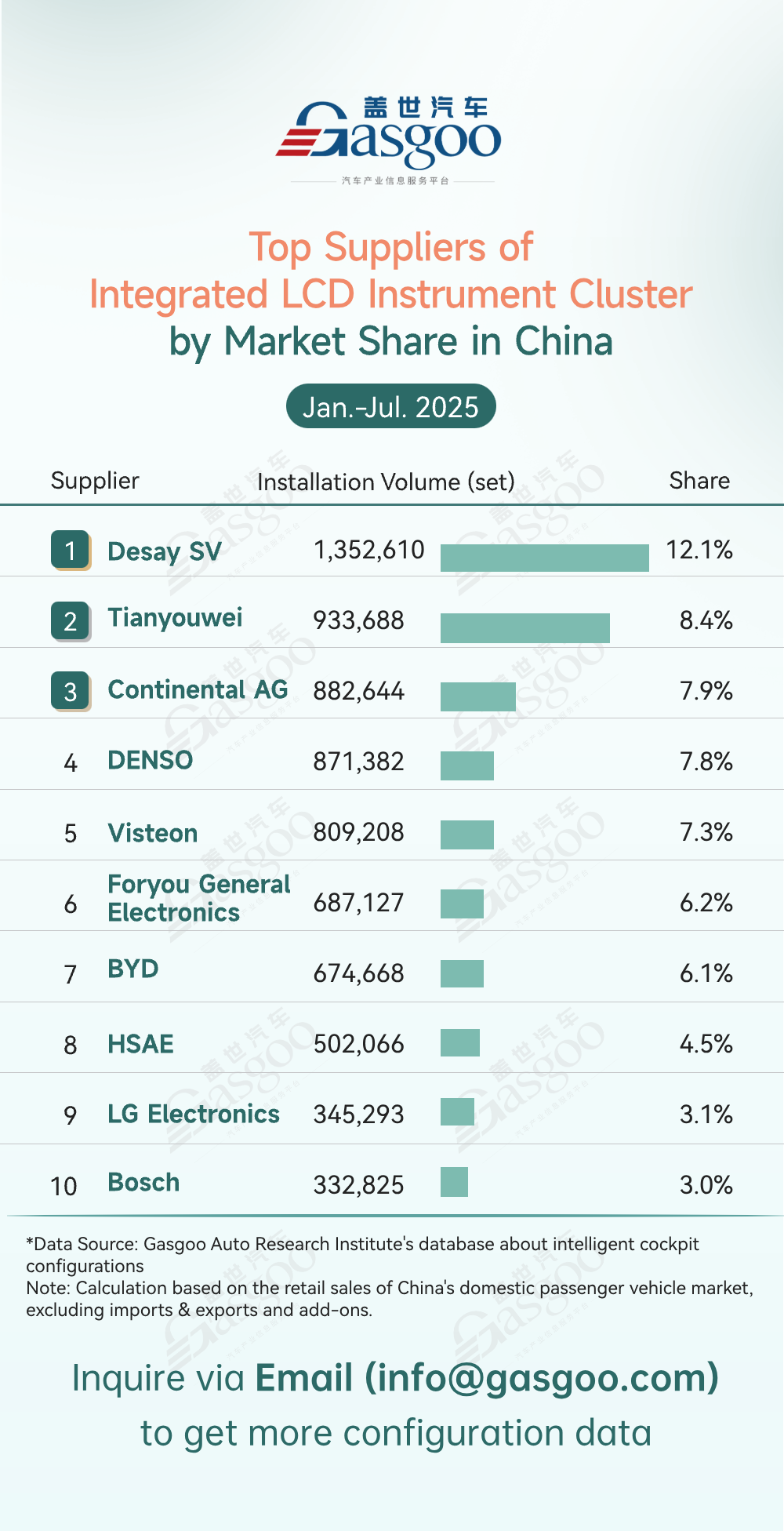

Top suppliers of integrated LCD instrument cluster

Desay SV: 1,352,610 sets installed, 12.1% market share

Tianyouwei: 933,688 sets installed, 8.4% market share

Continental AG: 882,644 sets installed, 7.9% market share

DENSO: 871,382 sets installed, 7.8% market share

Visteon: 809,208 sets installed, 7.3% market share

Foryou General Electronics: 687,127 sets installed, 6.2% market share

BYD: 674,668 sets installed, 6.1% market share

HSAE: 502,066 sets installed, 4.5% market share

LG Electronics: 345,293 sets installed, 3.1% market share

Bosch: 332,825 sets installed, 3.0% market share

From January to July, China's passenger vehicle LCD instrument cluster market displayed a competitive landscape with multiple strong players. Desay SV led the pack with a 12.1% share (1,352,610 sets installed), followed by Tianyouwei (8.4%), Continental AG (7.9%), DENSO (7.8%), and Visteon (7.3%), each holding 7.3%-8.4%. China’s local companies like Desay SV and BYD competed closely with international Tier-1s such as Continental and Bosch, highlighting the growing capability of local suppliers to rival global brands. The market reflects both high concentration at the top and a diverse competitive environment driven by the widespread adoption of high-definition LCD clusters.

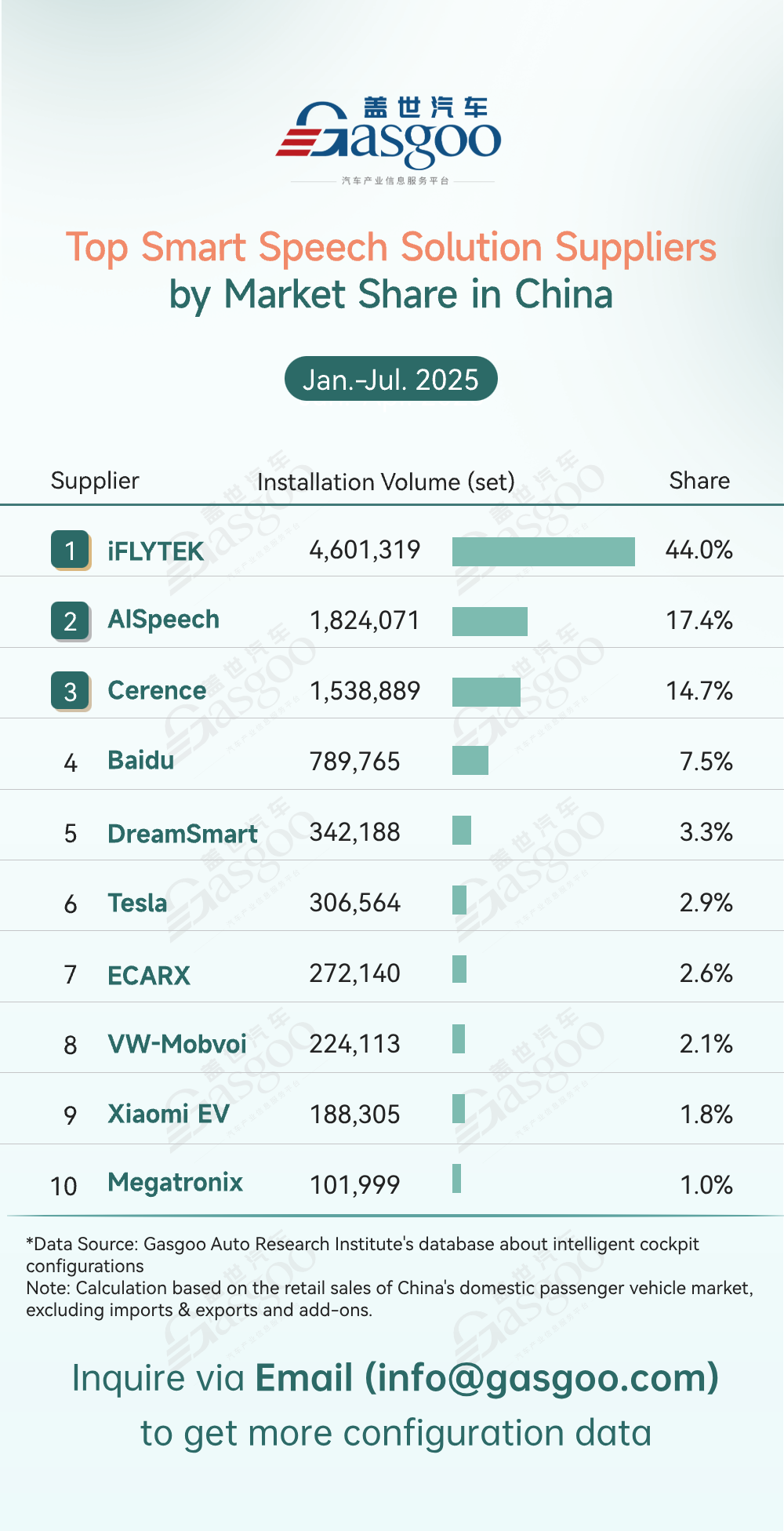

Top smart speech solution suppliers

iFLYTEK: 4,601,319 sets installed, 44.0% market share

AISpeech: 1,824,071 sets installed, 17.4% market share

Cerence: 1,538,889 sets installed, 14.7% market share

Baidu: 789,765 sets installed, 7.5% market share

DreamSmart: 342,188 sets installed, 3.3% market share

Tesla: 306,564 sets installed, 2.9% market share

ECARX: 272,140 sets installed, 2.6% market share

VW-Mobvoi: 224,113 sets installed, 2.1% market share

Xiaomi EV: 188,305 sets installed, 1.8% market share

Megatronix: 101,999 sets installed, 1.0% market share

Chinese suppliers dominated the smart speech solution market for the Jan.-Jul. period. iFLYTEK led the pack with a 44.0% share, leveraging its technical expertise and deep industry experience. AISpeech (17.4%) and Cerence (14.7%) followed closely, driving the rapid iteration of voice functionalities. Baidu (7.5%), DreamSmart (3.3%), and other ecosystem players participated through cross-industry initiatives, while global brands like Tesla (2.9%) held relatively limited shares. Overall, local suppliers shaped the market through adaptability and fast service, with future competition expected to hinge on technological iteration and ecosystem integration, requiring foreign brands to strengthen localized innovation to enhance their market influence.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com