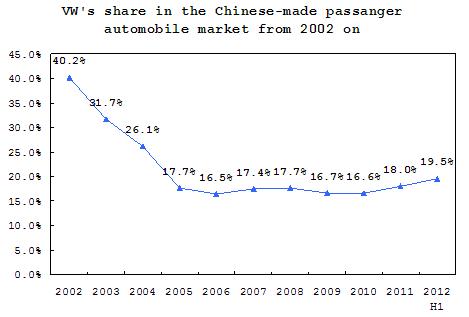

Summary: VW's share in Chinese passenger automobile market from 2002 onwards

Gasgoo.com (Shanghai) - Starting in 2002, Volkswagen saw its share in the market for Chinese made passenger automobiles halve from over 40 percent. In 2006, the manufacturer's market share reached a low of 16.5 percent. Since then, VW's market share has remained between 16 and 18 percent. Its market share reached 19.5 percent over the first half of this year.

In the over ten years it has been active in the Chinese market, VW remained one of the leading enterprises in the overall passenger automobile market. However, facing increasing competition, VW has seen its share in the market for domestically manufactured vehicles slip.

VW saw its share in the market fall from 40.2 percent in 2002 to 17.7 percent in 2005. Worth noting is that in 2003, the sales growth rate for VW passenger automobiles was only 36.4 percent, far lower than the industry average of 72.1 percent. Over the next two years, VW saw its sales volume fall. Then President and Head of China Business for VW China Winfried Vahland attributed the poor performance to the manufacturer's failure to adjust to changes in the country's automobile market. "Not making the proper adjustments was our error, and is the primary reason [our] market share was lost."

At the same time, multinational manufacturers began pouring into the Chinese market. Now facing competition from the likes of GM, Toyota, Nissan and Hyundai, VW was caught off-guard. These manufacturers offered several new models at low prices, which made VW's limited product line even less appealing. In 2004, VW released only two new Chinese-made models, the Touran minivan and the Santana 3000, an upgrade to the Santana 2000. Furthermore, VW was not willing to lower prices in response to market changes. However, in the end, the manufacturer not only ended up losing sales and market share, but its profits also took a hit.

In order to prevent further losses, VW begun modifying its Chinese market strategy in 2005. That October, Dr. Vahland unveiled the so-called 'Olympic Plan'. According to the plan, VW would bring over ten to 12 new models from 2006 to 2009. At the same time, the manufacturer would reduce localization costs by 40 percent.

Following the plan's announcement, VW saw its sales grow steadily. Then, in 2009, VW announced a new strategic plan to improve its sales volume in the south of the country. The plan was a success, with VW China President and CEO Karl-Thomas Neumann boasting that the manufacturer's market share in the south of the country had jumped from 12 percent to 15.8 percent in just two years. At the same time, VW rose to the top of the Hong Kong market for the first time ever.

Last year, VW's share in the Chinese passenger automobile market reached 18 percent. That figure rose to 19.5 percent in the first half of this year. This increase was due to the fact that VW was able to maintain double digits sales growth while average market growth has fallen below ten percent. Other factors behind VW's remarkable performance include increasing production capacity of its Chinese joint ventures, continuing demand for luxury vehicles and SUVs in the country and decreasing sales among its competitors.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com