Summary: Japanese manufacturers' performance in the Chinese passenger automobile market

Gasgoo.com (Shanghai) - According to Gasgoo.com (Chinese) statistics, sales of domestically manufactured Japanese brand passenger automobiles fell in 2012, marking the first year in a decade that that amount experienced negative growth.

Sales of Chinese-made Japanese passenger automobiles (including sedan, SUV and minivan sales) have increased consistently over the last decade, growing from just 440,000 sales in 2003 to 2.8 million sales in 2011. After this period of consistent growth, Japanese sales fell in 2012, due to a backlash following the Diaoyu Island incident, which instigated a wave of activities advocating the boycott of Japanese products. Japanese car sales totaled 2.54 million units that year.

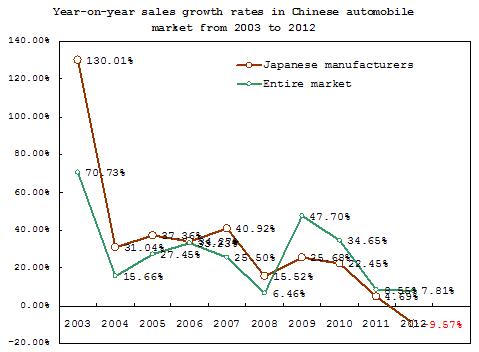

Beginning in 2003, Japanese manufacturers' average year-on-year sales growth rate was higher than that of the market average. However, in 2009 that rate begun falling under the market average, slipping into the negative digits in 2012.

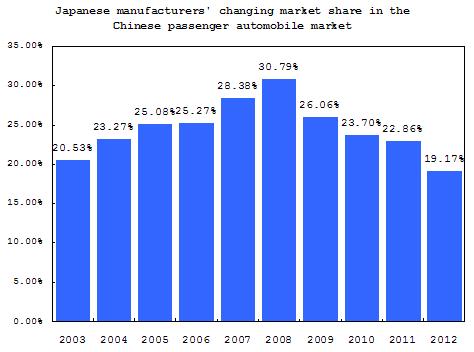

Japanese manufacturers' combined share in the Chinese passenger automobile market reached its highest point in 2008, when it totaled 30.79 percent. The figure is over ten percent higher than the 20.53 percent reported in 2003. However, beginning in 2009, Japanese manufacturers' share begun to fall as year-on-year sales growth rates failed to keep up with the market average. From 2008 to 2012, that share fell over ten percent to just 19.17 percent. The diminishing competitiveness of Japanese models when compared with offerings from other foreign manufacturers has been cited as the key reason behind this decrease.

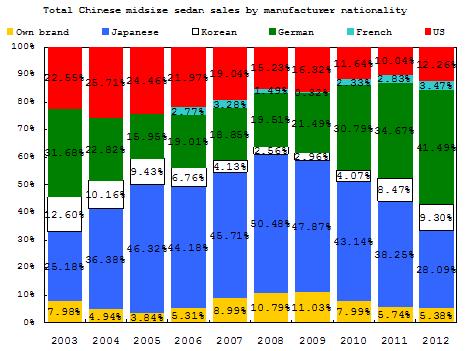

Japanese manufacturers have traditionally performed strongest in China's midsize sedan segment. From 2005 to 2010, Japanese manufacturers' controlled over 40 percent of the midsize segment, reaching a high of 50.48 percent in 2008. In that year, the Nissan Teana, Honda Accord and Toyota Camry all performed strongly, respectively leading the segment. However, since 2008, Japanese manufacturers' foreign rivals, especially German manufacturers, started catching up. In 2012, VW's New Passat and Magotan led the midsize segment, while sales of previously popular Japanese models all fell. That year, Japanese manufacturers' combined market share in the midsize segment totaled just 28.09 percent, compared to the 41.49 percent held by German manufacturers.

SUVs are another strong segment for Japanese manufacturers operating in China. Japanese manufacturers, who are credited with popularizing the 'urban SUV' concept in China, have constantly been the best performing foreign brand in the segment. From 2008 to 2011 sales of Japanese brand SUVs in the country jumped from 148,700 units to 546,500 units. Japanese manufacturers' share in the SUV segment reached a high of 42.64 percent in 2009, when their sales totaled 301,700 units.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com