Summary: Net profits comparison for Chinese automobile manufacturers in Q1

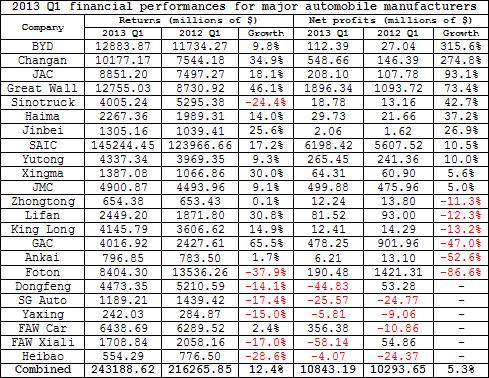

Gasgoo.com (Shanghai) - The first quarter of 2013 saw sales in the Chinese automobile market grow rapidly. As a result of this, business returns and net profits of Chinese manufacturers also increased on the whole. Average year-on-year growth rate for the 23 automobile manufacturers listed on the Shanghai and Shenzhen Stock Exchanges for the quarter reached 12.4 percent, while average net profit growth reached 5.3 percent.

First quarters are traditionally good for Chinese automobile manufacturers, who tend to see an influx of sales prior to the Lunar New Year holiday. This year was no exception, with BYD and Changan Automobile seeing their net profits grow dramatically. FAW Car, meanwhile, reported a net profit of 356 million yuan this quarter, compared to a net deficit of 10.86 million yuan a year ago. The boost in FAW's financial performance was attributed to increased consumer demand and more favorable exchange rates with the Japanese yen, which allowed for lower auto part costs.

BYD recovered strongly from last year, when its net profits fell around 90 percent. The manufacturer reported earning a net profit of 112 million yuan in the past quarter, far more than the 81.38 million yuan it earned in the whole of 2012. BYD's net profit for the first half of the year is anticipated to be between 400 million yuan and 500 million yuan, over 20 times the amount it earned in the first half of 2012. Not only has the manufacturer's automobile sales noticeably increased this year, its cell phone and battery businesses have also performed strongly.

Changan Automobile's net profits for the quarter totaled 549 million yuan, growing 275 percent from the first quarter of last year. Growing sales of the manufacturer's own brand models and increased profits from its Changan Ford joint venture have been cited as major factors behind its strong performance in the past quarter.

Jianghuai Automobile and Great Wall Motor also performed well in the first quarter, with their net profits growing 93.1 percent and 73.4 percent, respectively. Great Wall's reported quarterly net profit of 1.89 billion yuan was only surpassed by SAIC Group, while its net profit rate of 14.9 percent was the highest among the 23 listed manufacturers. Sinotruck, Haima Automobile and Jinbei Automobile also reported year-on-year net profit growth rates of over 20 percent for the quarter.

However, there were a few manufacturers that suffered a net deficit in the first quarter. FAW Xiali, Dongfeng Motors, SG Automotive Group, Yaxing Coach and Zhonghang Heibao all reported net deficits. Among them, FAW Xiali and Dongfeng were notable for having originally gaining a net profit in 2012 before falling into the red this year. Poor sales remained the major factor behind the drop in the financial performances for these two manufacturers.

Finally, six manufacturers–Ankai Automobile, Foton Motor, Guangzhou Automobile Group, King Long Automotive, Lifan Group and Zhongtong Bus–reported negative year-on-year net profit growth rates in the quarter. Among them, Foton's drop of 86.6 percent in net profits was the most severe.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com