Analysis: FAW-VW’s control of the market in 2017 H1 and beyond

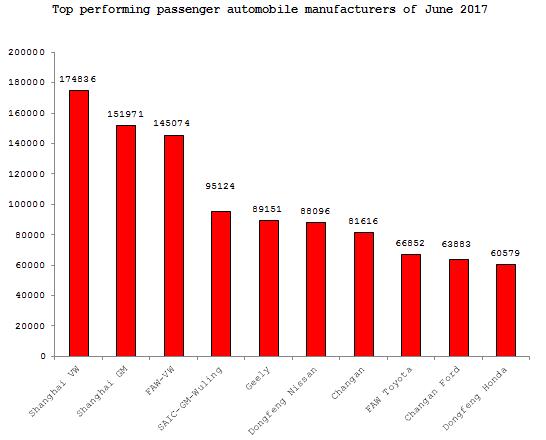

FAW Volkswagen has sold a total of 145,074 vehicles in the month of June. That figure, which represents positive growth of 2.06% from the previous year and 0.91% from the previous month, puts FAW-VW in third place among all Chinese passenger automobile manufacturers. The joint venture has sold 900,439 vehicles over the first half of the year, up 0.27% from the previous year and ranking second overall among all manufacturers operating in the country.

Worth mentioning is that FAW-VW was the only manufacturer which managed to sell over 800,000 sedans over the first half of the year. Its 1.5% growth rate is especially commendable when remembering that the average growth rate in the sedan segment is -3.3%. Many analysts have commented that FAW-VW should be concerned from negative fallout due to its slow market response times and lack of innovation. However, newly released crossover models like the Golf R and C-Trek have performed exceptionally well and helped pioneer new markets, seemingly proving many of these fears to be unfounded.

FAW-VW’s sales growth over the first half of this month primarily came from three sources: the Magotan, the Bora, and the combined performances of its two new models, the Golf R and C-Trek.

The Magotan (pictured above) managed to send shockwaves through the midsize sedan segment with its latest revision, built on the all-new MQB platform. The car managed to achieve year-on-year sales growth of 31.2% for the first half of this year, exceeding the aging Passat and becoming the only midsize to sell over 100,000 units over the first half of the year.

However the Magotan may have to deal with new challenges later in the year. Not only is the Buick New Excelle also scheduled for a revision in the latter half of the year, the all-new Chevrolet Camry and Honda Accord are also going to be announced. Many analysts have been singling out the midsize sedan segment as a focal point for a newer generation of consumers. FAW-VW will require to continuously adjust the Magotan over the following years in order to maintain its current market success.

Having successfully resolve problems with production capacity limitations, the Bora has succeeded in achieving nearly 40% year-on-year sales growth in the first half of 2016. Despite lagging behind heavy hitters like the VW Lavida and Buick Excelle, the Bora still managed to finish in the top ten sales charts alongside the Sagitar and Jetta. That’s a very impressive result given the relative low amount of resources the JV invests into marketing the car.

FAW-VW’s two new crossover models, the Golf R and the C-Trek (pictured above), are targeted towards buyers looking around in the 150,000 RMB price range who are not in the market for a sedan and have an affinity for German brands. With the C-Trek managing to outsell the Gran Lavida and Cross Lavida, and the Golf R outperforming the Touran L, the joint venture has managed to carve out a new segment in addition to the traditional sedan and SUV markets.

While things are looking on the up for FAW-VW, there are still some areas of concern the JV would do well to keep in mind. Although its Sagitar and Jetta (pictured above) remain its best-selling sedan models and leaders in their respective segments, their sales have fallen over 10% over the first half of the year. Without offering massive price cuts, it is difficult to see how FAW-VW could quickly reverse these trends.

There are still measures FAW-VW could consider taking, however. For instance, outfitting the Jetta with a 1.5L engine and repositioning it as a taxi could allow the JV to replicate the success of the Santana. A 1.2L engine could help the Sagitar pull up some slack.

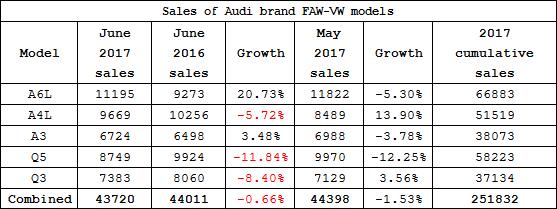

Having to deal with unsuccessful product revision and increased competition from its rivals, FAW-VW’s Audi brand is facing unprecedented levels of pressure. Stumbling from its once secure position as the leading luxury brand in the country to third place behind German rivals Mercedes-Benz and BMW, Audi’s problems can be traced back to its products.

Although the Audi A6L (pictured above) continues to lead the fullsize sedan market, FAW-VW has had to resort price wars to maintain this edge. With increasing pressure from the Mercedes Benz E-Class and BMW 5 Series, it is unclear whether the Audi A6L will be able to continue to retain the number one spot. Audi may want to consider something like holding the global release of the next year’s new generation Audi A6 in China.

The Audi Q5 (pictured above) is a major problem for the brand. The Audi Q5’s sales over the first half of the year were only 559 units more than the Mercedes GLC. However, while the Q5’s sales have been falling over 10%, the GLC’s has been growing nearly 50%. Worth pointing out is that FAW-VW is offering nearly 100,000 RMB in discounts for the Q5, while no comparable discounts are available for the GLC.

Given that that’s the case, it goes without saying that the launch of the next generation Q5 in 2017 will be highly significant for FAW-VW. The locally-built extended wheelbase BMW X3 will also be launched next year, which will only increase market competition.

Ever since its update last September, the Audi A4L (pictured above) has yet to see a recovery in sales. Premium versions of the model were only available a half year afterwards, further hampering sales. The Audi A4L’s sales fell 18.4% year-on-year, while those of its two closest competitors, the BMW 3 Series and Mercedes-Benz C-Class, increased 31.7% and 22.9%, respectively.

The Audi Q3 is competing alongside the Mercedes-Benz GLA and BMW X1 in the compact SUV segment. This year, the newly expanded BMW X1 has managed to make significant sales increases in comparison with the Q3, outselling it by 5,593 units.

It seems FAW-VW’s strategy is to remain as steady as possible until 2018, when it will welcome a number of new products. Hopefully FAW-VW’s preparations this year will pay off then.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com