Top 10 models from Chinese startups by H1 2019 insured car number

Shanghai (Gasgoo)- During the first half of 2019, consumers purchased the mandatory liability insurance for traffic accidents of motor vehicles (MLI) for a total of 30,101 vehicles made by Chinese startups, according to data released by the China Insurance Regulatory Commission (CIRC).

In June, the number of insured startup-made vehicles reached 9,162 units, compared with 5,223 units for the month of May.

(Photo source: WM Motor)

The MIL refers to the compulsory liability insurance of an insurance company, which gives compensation within the limit of liability to the victims other than the personnel of the motor vehicles and the insured for their bodily injuries and death and property losses arising from the road traffic accidents caused by the insured motor vehicles.

Buying the MIL is an indispensable process in China for car owners to get their vehicles registered. Based on the number of MIL-covered vehicles (hereinafter referred to as insurance number/volume), people can surmise the delivery performance of each startup.

For the first six months, China sold around 617,000 new energy vehicles, a year-on-year jump of 49.6%, said the China Association of Automobile Manufacturers (CAAM). Besides, national NEV sales in June reached 152,000 units, surging 80% over a year ago despite the 12th-month-in-a-row sales wane for overall auto market.

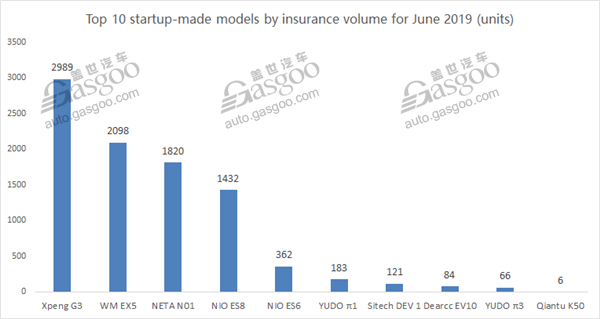

Gasgoo hereby rounded up the top 10 EV models offered by startups by June and first-half (H1) insurance numbers.

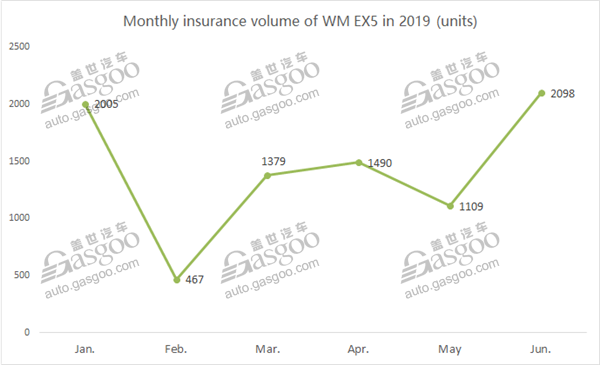

The WM EX5 was crowned the best seller with 8,548 units insured during the first two quarters. It was also the runner-up model by June insurance number.

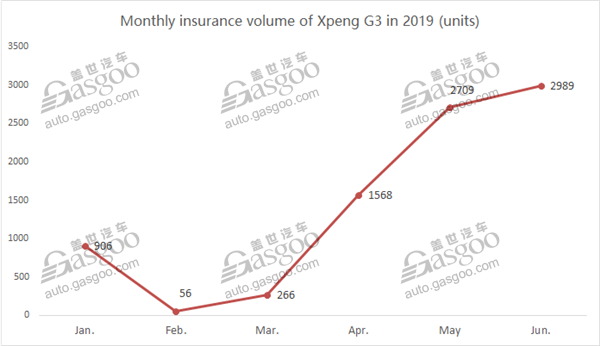

Following the WM EX5, the Xpeng G3 took the second place by cumulative number, and won the championship by June volume.

The second runner-up by year-to-date number was the NIO ES8. Regarding monthly performance, both the NIO ES8 and ES6 entered the top 5 model list.

Hozon Auto's NETA N01 outperformed the NIO ES8 and the ES6 in terms of June insurance number, ranking the third on the list. The all-new NETA N01 2020 is scheduled to hit the market next month.

WM Motor

WM Motor said before new NEV subsidy policy came into effect that prices across its entire vehicle lineup would not be changed. Besides, the EV manufacturer launched the EX5 400 Mate that further enriched customers' options over battery range.

The rapid growth in delivery was partly buoyed by the fast expansion of sales channels. WM Motor also said it has so far cooperated with 96 dealers in 63 cities of China, a remarkable surge of 92% compared with the cumulative number by the end of March.

WM Motor founded a financial leasing subsidiary on July 3 as part of its efforts to make inroads into the automobile financial rental domain, according to a record from TianYanCha.com, a large data technology service company with a vast repository of Chinese enterprise information.

Deliveries are expected to be further boosted after the WM EX6 mid-sized SUV hitting the market in the second half of the year.

Xpeng Motors

The Xpeng G3 went on sales on December 12, 2018 with the NEDC-rated range of up to 365km. The after-subsidy prices rose to RMB155,800-RMB199,800 from the previous range of RMB135,800-RMB165,800 since February 1.

The Guangzhou-based startup is likely to fulfill the 10,000-unit delivery target before August in accordance with its delivery performance for now.

The EV maker on July 10 launched the Xpeng G3 2020, the new enhanced high-performance version of its G3 SUV, boasting a world-beating extended NEDC driving range of 520 km and energy density of 180 Wh/kg.

The Xpeng G3 2020 model is available in two versions: The G3 400 and the G3 520, with the price range RMB143,800 – RMB196,800, and delivery to customers starting September 2019.

Xpeng Motors has already operated experience centers in a number of China's major cities including Guangzhou, Beijing, Shenzhen, Shanghai, Hangzhou, Wuhan and Dongguan, and plans to open up 100 more offline centers within 2019.

NIO

In a bid to boost sales, NIO adjusted its subsidy schemes in response to the NEV subsidy phase-out. A user who buys an ES8 on or after July 1 and gets license plate before December 31 will enjoy subsidy of up to RMB20,000. An ES6 user will enjoy subsidy worth as much as RMB25,000 under the same condition.

NIO announced on June 27 a voluntary recall of 4,803 ES8s for battery safety concerns after the ES8 battery safety incidents occurred in Shanghai and other locations in this country. This is also the first recall plan in China offered by EV startup, a very significant case for the whole industry to more highlights the EV safety not just the speed of mass production.

Moreover, the EV maker is expanding the deployment of charging infrastructures. NIO said via its Sina Weibo account on July 10 that its first supercharging station has been put into trial operation in Suzhou.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com