China sees wholesale volume of locally-produced new energy PVs plunge in Oct.

Shanghai (Gasgoo)- Last month, China's automakers sold nearly 66,000 locally-produced new energy passenger vehicles (NEPVs), including all-electric PVs and plug-in hybrid PVs, posting a steep decline of 45.4% from a year ago, according to the China Passenger Car Association (CPCA).

The slump mainly resulted from the hike in sales cost led by the NEV subsidy phase-out starting late June and the shortage of PHEVs meeting the “China Ⅵ” emission standard.

(Photo source: BAIC BJEV)

Besides, roughly 844,000 China-built NEPVs were sold during the first ten months. The latest plunge made the growth in year-to-date wholesale volume decreased to 17% as of October from 29.4% by September.

The wholesale volume of all-electric PVs tumbled 46% year on year to 51,016 units in October. Of that, sales of cars and SUVs reached 33,368 units (-52%) and 17,570 units (-26%). It is noteworthy that SUVs accounted for 34% of total Oct. BEV sales, rising from 25% for the year-ago period. Nonetheless, the share of cars fell to 65% from 75% in October, 2018.

(Photo source: BYD)

In the pure electric PV area, the Oct. sales of A-segment (equal to compact size) vehicles climbed 6% from the previous year to 28,547 units with its share surging to 56% from 29% in the prior-year period. In contrast, the share of A00-segment (equal to mini size) vehicles slumped to 22% from 53%. With 11,239 units sold last month, the A00 segment suffered a steep year-on-year decrease of 78%.

(Photo source: WM Motor)

Startups are becoming important players in NEV domain. In October, the vehicles developed by Chinese startups like NIO, WM Motor and Xpeng Motors took up around 12% of total all-electric PV sales, higher than that of joint-venture ones.

The Oct. sales volume of China-made plug-in hybrid PVs plummeted 44% year over year to 14,551 units. Year-to-date sales slid 8% to 179,901 units. Thanks to the increasingly more participants and products, the share of PHEVs was lifted between March and May, while the sector still features weaker demands and policy supports than that of BEVs, according to Cui Dongshu, secretary general of the CPCA.

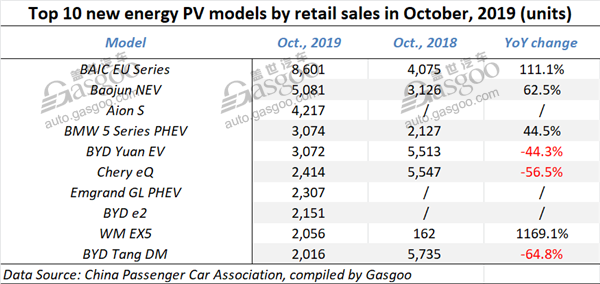

The top six NEPV models by Oct. retail sales remained unchanged compared with the previous month. The startup WM Motor's EX5 was ranked ninth with a splendid year-on-year surge of 1169.1%.

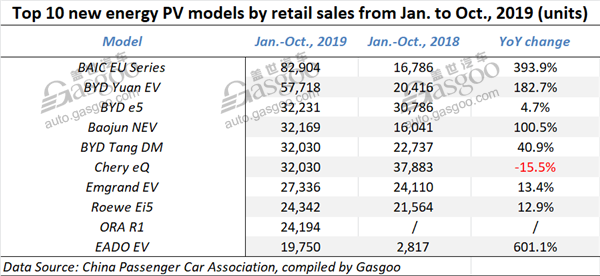

With respect to year-to-date sales, the BAIC EU Series was still the best-selling NEPV models among consumers. BYD took three places on the top 10 model list. Aside from the Chery eQ and the ORA R1, the other models all gained year-over-year increase.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com