NIO Inc. Reports Unaudited Third Quarter 2019 Financial Results

SHANGHAI, China, Dec. 30, 2019-- NIO Inc. (“NIO” or the “Company”) (NYSE: NIO), a pioneer in China's premium electric vehicle market, today announced its unaudited financial results for the third quarter ended September 30, 2019.

(Photo source: NIO)

Operating Highlights for the Third quarter of 2019

Deliveries of vehicles were 4,799 in the third quarter of 2019 including 4,196 ES6s and 603 ES8s, compared with 3,553 vehicles delivered in the second quarter of 2019.

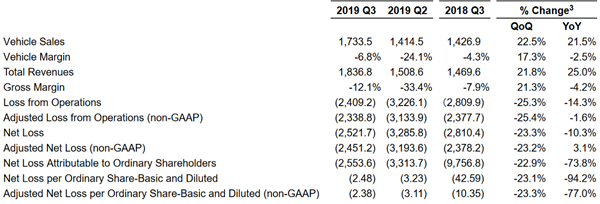

Financial Highlights for the Third quarter of 2019

Vehicle sales were RMB1,733.5 million (US$242.5 million) in the third quarter of 2019, representing an increase of 22.5% from the second quarter of 2019 and an increase of 21.5% from the same quarter of 2018.

Vehicle margin1 was negative 6.8%, compared with negative 24.1% in the second quarter of 2019 and negative 4.3% in the same quarter of 2018.

Total revenues were RMB1,836.8 million (US$257.0 million) in the third quarter of 2019, representing an increase of 21.8% from the second quarter of 2019 and an increase of 25.0% from the same quarter of 2018.

Gross margin was negative 12.1%, compared with negative 33.4% in the second quarter of 2019 and negative 7.9% in the same quarter of 2018.

Loss from operations was RMB2,409.2 million (US$337.1 million) in the third quarter of 2019, representing a decrease of 25.3% from the second quarter of 2019 and a decrease of 14.3% from the same quarter of 2018. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB2,338.8 million (US$327.2 million) in the third quarter of 2019, representing a decrease of 25.4% from the second quarter of 2019 and a 1.6% decrease from the same quarter of 2018.

Net loss was RMB2,521.7 million (US$352.8 million) in the third quarter of 2019, representing a decrease of 23.3% from the second quarter of 2019 and a decrease of 10.3% from the same quarter of 2018. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB2,451.2 million (US$342.9 million) in the third quarter of 2019, representing a decrease of 23.2% from the second quarter of 2019 and a 3.1% increase from the same quarter of 2018.

Net loss attributable to NIO’s ordinary shareholders was RMB2,553.6 million (US$357.3 million) in the third quarter of 2019, representing a decrease of 22.9% from the second quarter of 2019 and a decrease of 73.8% from the same quarter of 2018. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB2,451.3 million (US$342.9 million).

Basic and diluted net loss per American depositary share (ADS)2 were both RMB2.48(US$0.35) in the third quarter of 2019. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB2.38(US$0.33).

Cash and cash equivalents, restricted cash and short-term investment were RMB1,960.7 million (US$274.3 million) as of September 30, 2019.

Key Financial Results

(in RMB million, except for perordinary share data andpercentage)

New Product Announcements

On December 28, 2019, the third NIO Day was held in Shenzhen, China. The Company announced the 100-kWh battery pack and 20-kW DC Power Home. Deliveries of 100-kWh battery pack are estimated to begin in 2020 Q4 and expected to significantly improve the driving range of all NIO vehicle models. Aided by the Company’s proprietary battery-swap technologies, NIO offers its users flexible battery upgrade programs, making “Battery as a Service” a unique value proposition.

At this event, the Company unveiled its third production model, the EC6, a smart premium electric coupe SUV. The EC6 performance version is equipped with a 160-kW permanent magnet motor and a 240-kW induction motor and capable of accelerating from zero to 100 kph in just 4.7 seconds. With the 100-kWh battery pack, the EC6 performance version boasts an NEDC range of up to 615 km. NIO plans to announce the prices and specifications of EC6 in July and the delivery is expected to begin in September 2020.

During the NIO Day, the Company released the all-new ES8, the flagship smart premium electric SUV. With the 100-kWh battery pack, the all-new ES8 has an NEDC range of up to 580 km, a major improvement in its range performance. The Company plans to commence deliveries of the new ES8 in April 2020.

CEO and CFO Comments

“NIO delivered a total of 4,799 ES8 and ES6 vehicles in the third quarter of 2019, representing a 35.1% increase from the second quarter. The electric vehicle sector experienced substantial softness in the second half of 2019 after the reduction of EV subsidies in China. Despite the challenges, NIO’s sales improved solidly since September,” said William Bin Li, founder, chairman and chief executive officer of NIO. “Our strong performance was attributable to the competitiveness of our products and services, the recognition and strong support from our user community, and our sales network expansion strategy as we continue to launch more efficient NIO Spaces. We expect over 8,000 vehicles to be delivered in the fourth quarter, a record of quarterly deliveries in our history. With that, the total aggregate deliveries in 2019 are estimated to reach over 20,300.

“On December 28, we hosted our third annual NIO Day, dedicated to and for, our user community. During the event, we unveiled a brand-new model, the EC6, a smart premium electric coupe SUV, showcasing our pursuit of both high performance and stylish design in our products. We also launched the all-new ES8, NIO’s flagship model, being well positioned to become the most competitive electric SUV in the mid to large size segment. Furthermore, we will make available a 100-kWh battery pack, which will significantly increase the NEDC driving range of the new ES8, ES6 and EC6 to 580, 610 and 615 kilometers respectively.

“We had delivered over 30,000 vehicles in 296 cities since June 2018, expanded our product offerings to 3 competitive SUV models, and successfully established the only premium EV brand from China. We are proud of our team for the speedy and solid execution. We will continue to drive forward by improving our products and services, enhancing our sales and service network, as well as building our user community,” concluded Mr. Li.

“Facing a continuous soft auto market, we strongly

believe the smart premium EV sector will outperform the industry in its

growth rate in the foreseeable future. NIO ranked the highest in new

vehicle quality among all brands in JD Power’s 2019 New Energy Vehicle

Experience Index Study. Additionally, ES6 achieved No.1 in electric SUV

sales and top 10 ranking in mid-size premium SUV sales, including ICE

and electric vehicle models, in China in October and November. We are pleased to see the momentum continues,” added Wei Feng,

NIO’s chief financial officer. “During the quarter, we also implemented

comprehensive cost control measures across the organization to improve

operational efficiency. As a result, our third quarter SG&A and

R&D expenses decreased by 18.1% and 21.3% respectively, compared

with the second quarter, and we expect further efficiency gains in the

fourth quarter.”

Financial Results for the Third Quarter of 2019

Revenues

Vehicle sales in the third quarter of 2019 were RMB1,733.5 million (US$242.5 million) in the third quarter of 2019, representing an increase of 22.5% from the second quarter of 2019 and an increase of 21.5% from the same quarter of 2018. The increase in vehicle sales over the second quarter of 2019 was mainly contributed by the sales of ES6s.

Other sales in the third quarter of 2019 were RMB103.4 million (US$14.5 million), representing an increase of 9.9% from the second quarter of 2019 and an increase of 142.1% from the same quarter of 2018. The increase in other sales over the second quarter of 2019 was mainly attributed by the increased sales of charging piles and accessories, which was in line with the increase in vehicle deliveries.

Total revenues in the third quarter of 2019 were RMB1,836.8 million (US$257.0 million), representing an increase of 21.8% from the second quarter of 2019 and an increase of 25.0% from the same quarter of 2018.

Cost of Sales and Gross Margin

Cost of sales in the third quarter of 2019 was RMB2,058.4 million (US$288.0 million), representing an increase of 2.3% from the second quarter of 2019 and an increase of 29.8% from the same quarter of 2018. The slight increase in cost of sales over the second quarter of 2019 was due to the increase of sales in the third quarter of 2019 and was offset by the decreased cost of sales compared to cost of sales in the second quarter, which included accrued recall costs in relation to the Company’s voluntary recall of 4,803 vehicles announced on June 27, 2019.

Vehicle margin in the third quarter of 2019 was negative 6.8%, compared with negative 24.1% in the second quarter of 2019 and negative 4.3% in the same quarter of 2018. The improved vehicle margin was mainly due to the recall costs in the second quarter of 2019 as above mentioned, and the lack thereof in the third quarter of 2019.

Gross margin in the third quarter of 2019 was negative 12.1%, compared with negative 33.4% in the second quarter of 2019 and negative 7.9% in the same quarter of 2018. The increase of gross margin over the second quarter of 2019 was mainly due to the improved vehicle margin in the third quarter.

Operating Expenses

Research and development expenses in the third quarter of 2019 were RMB1,023.2 million (US$143.2 million), representing a decrease of 21.3% from the second quarter of 2019 and relatively unchanged compared with the same quarter of 2018. Excluding share-based compensation expenses, adjusted research and development expenses (non-GAAP) were RMB1,003.6 million (US$140.4 million), representing a decrease of 21.7% from the second quarter of 2019 and an increase of 5.9% from the same quarter of 2018. The decrease in research and development expenses over the second quarter of 2019 was primarily attributed to less testing expenses incurred in the third quarter after the initial launch of ES6 in June.

Selling, general and administrative expenses in the third quarter of 2019 were RMB1,164.4 million (US$162.9 million), representing a decrease of 18.1% from the second quarter of 2019 and a decrease of 30.3% from the same quarter of 2018. Excluding share-based compensation expenses, adjusted selling, general and administrative expenses (non-GAAP) were RMB1,116.3 million (US$156.2 million), representing a decrease of 17.4% from the second quarter of 2019 and a decrease of 15.6% from the same quarter of 2018. The decrease in selling, general and administrative expenses over the second quarter of 2019 was primarily driven by the Company’s overall cost-saving measures in marketing and other supporting functions.

Loss from Operations

Loss from operations in the third quarter of 2019 was RMB2,409.2 million (US$337.1 million) in the third quarter of 2019, representing a decrease of 25.3% from the second quarter of 2019 and a 14.3% decrease from the same quarter of 2018. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB2,338.8 million (US$327.2 million) in the third quarter of 2019, representing a decrease of 25.4% from the second quarter of 2019 and a 1.6% decrease from the same quarter of 2018.

Share-based Compensation Expenses

Share-based compensation expenses in the third quarter of 2019 were RMB70.4 million (US$9.9 million), representing a decrease of 23.6% from the second quarter of 2019 and a decrease of 83.7% from the same quarter of 2018. The decrease in share-based compensation expenses over the second quarter of 2019 was primarily due to the continuous decrease of employee numbers, as well as the decreased expenses part of the share-based compensation recognized under the accelerated method.

Net Loss and Earnings Per Share

Net loss was RMB2,521.7 million (US$352.8 million) in the third quarter of 2019, representing a decrease of 23.3% from the second quarter of 2019 and a 10.3% decrease from the same quarter of 2018. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB2,451.2 million (US$342.9 million) in the third quarter of 2019, representing a decrease of 23.2% from the second quarter of 2019 and a 3.1% increase from the same quarter of 2018.

Net loss attributable to NIO's ordinary shareholders in the third quarter of 2019 was RMB2,553.6 million (US$357.3 million) in the third quarter of 2019, representing a decrease of 22.9% from the second quarter of 2019 and a decrease of 73.8% from the same quarter of 2018. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO's ordinary shareholders (non-GAAP) was RMB2,451.3 million (US$342.9 million).

Basic and diluted net loss per ADS in the third quarter of 2019 were both RMB2.48(US$0.35). Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB2.38(US$0.33).

Balance Sheets

Balance of cash and cash equivalents, restricted cash and short-term investment was RMB1,960.7 million (US$274.3 million) as of September 30, 2019.

The Company operates with continuous loss and negative equity. The Company’s cash balance is not adequate to provide the required working capital and liquidity for continuous operation in the next 12 months. The Company’s continuous operation, which has also constituted the basis of preparing the Company’s third quarter unaudited financial information, depends on the Company’s capability to obtain sufficient external equity or debt financing. The Company is currently working on several financing projects, the consummation of which is subject to certain uncertainties. The Company will announce any material developments or information subject to the requirements by applicable laws.

On January 1, 2019, the Company adopted ASC 842 Leases and used the additional transition method to initially apply this new lease standard at the adoption date. Right-of-use assets and lease liabilities were recognized on the Company's consolidated financial statements.

Business Outlook

For the fourth quarter of 2019, the Company expects:

Deliveries of vehicles to be over 8,000 units, representing an increase of over 66.7% from the third quarter of 2019.

Total revenues to be approximately RMB2,810 million (US$393.2 million), representing an increase by approximately 53.0% from the third quarter of 2019.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com