NIO Inc. Reports Unaudited First Quarter 2020 Financial Results

NIO Inc. (“NIO” or the “Company”) (NYSE: NIO), a pioneer in China’s premium smart electric vehicle market, today announced its unaudited financial results for the quarter ended March 31, 2020.

Operating Highlights for the First Quarter of 2020

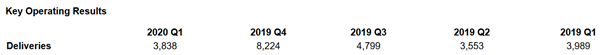

Deliveries of vehicles were 3,838 in the first quarter of 2020, including 3,643 ES6s and 195 ES8s, compared with 3,989 vehicles delivered in the first quarter of 2019. The decrease of the vehicle deliveries was attributed to the impact of the COVID-19 outbreak in the first quarter of 2020.

Financial Highlights for the First Quarter of 2020

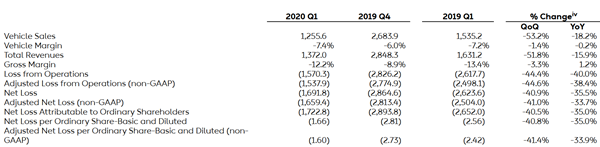

Vehicle sales were RMB1,255.6 million (US$177.3 million) in the first quarter of 2020, representing a decrease of 53.2% from the fourth quarter of 2019 and a decrease of 18.2% from the same quarter of 2019.

Vehicle marginii was negative 7.4%, compared with negative 6.0% in the fourth quarter of 2019 and negative 7.2% in the same quarter of 2019.

Total revenues were RMB1,372.0 million (US$193.8 million) in the first quarter of 2020, representing a decrease of 51.8% from the fourth quarter of 2019 and a decrease of 15.9% from the same quarter of 2019.

Gross margin was negative 12.2%, compared with negative 8.9% in the fourth quarter of 2019 and negative 13.4% in the same quarter of 2019.

Loss from operations was RMB1,570.3 million (US$221.8 million) in the first quarter of 2020, representing a decrease of 44.4% from the fourth quarter of 2019 and a decrease of 40.0% from the same quarter of 2019. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB1,537.9 million (US$217.2 million) in the first quarter of 2020, representing a decrease of 44.6% from the fourth quarter of 2019 and a decrease of 38.4 % from the same quarter of 2019.

Net loss was RMB1,691.8 million (US$238.9 million) in the first quarter of 2020, representing a decrease of 40.9% from the fourth quarter of 2019 and a decrease of 35.5% from the same quarter of 2019. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,659.4 million (US$234.4 million) in the first quarter of 2020, representing a decrease of 41.0% from the fourth quarter of 2019 and a decrease of 33.7% from the same quarter of 2019.

Net loss attributable to NIO’s ordinary shareholders was RMB1,722.8 million (US$243.3 million) in the first quarter of 2020, representing a decrease of 40.5% from the fourth quarter of 2019 and a decrease of 35.0% from the same quarter of 2019. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB1,658.9 million (US$234.3 million).

Basic and diluted net loss per American Depositary Share (ADS)iii were both RMB1.66 (US$0.23) in the first quarter of 2020. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.60 (US$0.22).

Cash and cash equivalents, restricted cash and short-term investment were RMB2,397.4 million (US$338.6 million) as of March 31, 2020.

Key Financial Results

(in RMB million, except for per

ordinary share data and percentage)

Recent Developments

Deliveries in April 2020

Deliveries of the ES8 and ES6 were 3,155 vehicles in April 2020, representing a strong growth of 105.8% month over month and a 180.7% growth year over year. The deliveries consisted of 2,907 ES6s, the Company’s 5-seater high-performance premium smart electric SUV, and 248 ES8s, the Company’s 7-seater high-performance premium smart electric SUV and its 6-seater variant. The Company commenced deliveries of the all-new ES8 with more than 180 improvements on April 19, 2020. As of April 30, cumulative deliveries of the ES8 and the ES6 reached 38,906 vehicles, of which 6,993 were delivered in 2020.

Entry into Definitive Agreements for Investments in NIO China

On April 29, 2020, the Company announced that it entered into definitive agreements for investments in NIO China with a group of investors (collectively, the “Strategic Investors”) led by Hefei City Construction and Investment Holding (Group) Co., Ltd., CMG-SDIC Capital Co., Ltd., and Anhui Provincial Emerging Industry Investment Co., Ltd..

Under the definitive agreements, the Strategic Investors will invest an aggregate of RMB7 billion in cash into NIO (Anhui) Holding Ltd., the legal entity of NIO China. NIO will inject its core businesses and assets in China, including vehicle research and development, supply chain, sales and services and NIO Power (the “Asset Consideration”), into NIO China. The Asset Consideration is valued at RMB17.77 billion, as calculated based on 85% of the average market value of NIO Inc. over the thirty public trading days preceding April 21, 2020. Further, NIO will invest RMB4.26 billion in cash into NIO China. Upon the completion of the investments, NIO will hold 75.9% of controlling equity interests in NIO China, and the Strategic Investors will collectively hold the remaining 24.1%.

The Company expects the closing of the investments to take place in the second quarter of 2020, subject to the satisfaction of customary closing conditions. The Strategic Investors and NIO will each inject cash into NIO China in five installments, namely (i) RMB3.5 billion and RMB1.278 billion respectively within five business days of the satisfaction of closing conditions, (ii) RMB1.5 billion and RMB1.278 billion respectively on or prior to June 30, 2020, (iii) RMB1 billion and RMB0.852 billion respectively on or prior to September 30, 2020, (iv) RMB0.5 billion and RMB0.426 billion respectively on or prior to December 31, 2020, and (v) RMB0.5 billion and RMB0.426 billion respectively on or prior to March 31, 2021. Moreover, the Asset Consideration shall be injected into NIO China within one year of closing.

NIO China will establish its headquarters in the Hefei Economic and Technological Development Area (HETA), where the Company’s main manufacturing hub is located, for its business operation, research and development, sales and services, supply chain and manufacturing functions. NIO will collaborate with the Strategic Investors and HETA to develop NIO China’s business and to support the accelerated development of the smart electric vehicle sectors in Hefei in the future.

CEO and CFO Comments

“We delivered a total of 3,838 ES8 and ES6 vehicles in the first quarter of 2020, representing a 3.8% year on year decrease, due to the impact of the COVID-19 outbreak in China in the first quarter,” said William Bin Li, founder, chairman and chief executive officer of NIO. “In April 2020, we delivered 3,155 vehicles, a robust increase of 105.8% month over month. Meanwhile, we have witnessed the order growth to have rebounded to the level prior to the COVID-19 outbreak since late April. Our strong recovery and growth were attributable to the competitiveness of our products and services, the continuous support from our user community, and the effective expansion of our sales network. We expect to deliver 9,500 to 10,000 vehicles in the second quarter, a record of quarterly deliveries since our first deliveries.”

“On April 29, 2020, NIO entered into the definitive agreements with the strategic investors for the investment in NIO China. The strategic investment will provide sufficient funds to support NIO’s business development, enhance our leadership in the products and technologies of smart electric vehicles, and offer services exceeding users’ expectations. The establishment of NIO China’s headquarters in Hefei will further improve our operating efficiency in the long run,” concluded Mr. Li.

“We are pleased to achieve the overall operational efficiency and cash management improvement in the first quarter of 2020,” added Wei Feng, NIO’s chief financial officer. “Our operating loss significantly decreased by approximately 44.4% quarter over quarter. While these results are partially attributable to our enhanced cost control measures taken during the COVID-19 outbreak, the improved operational efficiency reflects the initial returns of our continuous efforts in the operation optimization and expense control during the past quarters. We believe these efforts will drive positive trend of our performance in the rest of 2020 and beyond.”

Financial Results for the First Quarter of 2020

Revenues

Total revenues were RMB1,372.0 million (US$193.8 million) in the first quarter of 2020, representing a decrease of 51.8% from the fourth quarter of 2019 and a decrease of 15.9% from the same quarter of 2019.

Vehicle sales were RMB1,255.6 million (US$177.3 million) in the first quarter of 2020, representing a decrease of 53.2% from the fourth quarter of 2019 and a decrease of 18.2% from the same quarter of 2019. The decrease in vehicle sales of the first quarter of 2020, compared to the fourth quarter of 2019, was due to the decrease of vehicle deliveries during the COVID-19 outbreak in China. The decrease in vehicle sales of the first quarter of 2020, compared to the same quarter of 2019, was due to a higher proportion of ES6 sold in the first quarter of 2020, of which the selling price is lower than that of the ES8, which was the sole model sold in the first quarter of 2019.

Other sales in the first quarter of 2020 were RMB116.4 million (US$16.4 million), representing a decrease of 29.2% from the fourth quarter of 2019 and an increase of 21.2% from the same quarter of 2019. The decrease in other sales of the first quarter of 2020, compared to the fourth quarter of 2019, was mainly attributed to decreased revenues derived from the home chargers installed and accessories sold, which were in line with the decreased vehicle sales in the first quarter of 2020.

Cost of Sales and Gross Margin

Cost of sales in the first quarter of 2020 was RMB1,539.4 million (US$217.4 million), representing a decrease of 50.4% from the fourth quarter of 2019 and a decrease of 16.8% from the same quarter of 2019. The decrease in cost of sales compared to the fourth quarter of 2019 was mainly driven by the decrease of delivery volume of the ES6 and ES8 in the first quarter of 2020.

Gross margin in the first quarter of 2020 was negative 12.2%, compared with negative 8.9% in the fourth quarter of 2019 and negative 13.4% in the same quarter of 2019. The decrease of gross margin compared to the fourth quarter of 2019 was mainly driven by the decrease of vehicle margin in the first quarter of 2020.

Vehicle margin in the first quarter of 2020 was negative 7.4%, compared with negative 6.0% in the fourth quarter of 2019 and negative 7.2% in the same quarter of 2019. The decrease of vehicle margin compared to the fourth quarter of 2019 was mainly driven by the decrease of production and delivery volume of ES6 and ES8 in the first quarter of 2020.

Operating Expenses

Research and development expenses in the first quarter of 2020 were RMB522.4 million (US$73.8 million), representing a decrease of 49.1% from the fourth quarter of 2019 and a decrease of 51.6% from the same quarter of 2019. Excluding share-based compensation expenses (non-GAAP), research and development expenses were RMB514.4 million (US$72.6 million), representing a decrease of 49.3% from the fourth quarter of 2019 and a decrease of 50.8% from the same quarter of 2019. The substantial decrease in research and development expenses was primarily attributed to the COVID-19 outbreak that caused the significant reduction in design and development activities.

Selling, general and administrative expenses in the first quarter of 2020 were RMB848.3 million (US$119.8 million), representing a decrease of 45.1% from the fourth quarter of 2019 and a decrease of 35.7% from the same quarter of 2019. Excluding share-based compensation expenses (non-GAAP), selling, general and administrative expenses were RMB824.8 million (US$116.5 million), representing a decrease of 45.3% from the fourth quarter of 2019 and a decrease of 33.2% from the same quarter of 2019. The decrease in selling, general and administrative expenses over the fourth quarter of 2019 was primarily attributed to some one-off expenses incurred for the optimization of our sales network structure in late 2019 and the COVID-19 outbreak that caused significant decrease in marketing and promotional activities, as well as decrease of activities in business support functions in the first quarter of 2020. The decrease in selling, general and administrative expenses over the first quarter of 2019 was mainly attributed to less employee compensation due to the reduced number of employees and more efficient promotional activities during the outbreak of the COVID-19.

Loss from Operations

Loss from operations was RMB1,570.3 million (US$221.8 million) in the first quarter of 2020, representing a decrease of 44.4% from the fourth quarter of 2019 and a decrease of 40.0% from the same quarter of 2019. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB1,537.9 million (US$217.2 million) in the first quarter of 2020, representing a decrease of 44.6% from the fourth quarter of 2019 and a decrease of 38.4% from the same quarter of 2019.

Share-based Compensation Expenses

Share-based compensation expenses in the first quarter of 2020 were RMB32.4 million (US$4.6 million), representing a decrease of 36.8% from the fourth quarter of 2019 and a decrease of 72.9% from the same quarter of 2019. The decrease in share-based compensation expenses over the fourth quarter of 2019 was primarily attributed to the continuous decline in the number of employees, and the impact of part of the share-based compensation expenses being recognized by using the accelerated method previously.

Net Loss and Earnings Per Share

Net loss was RMB1,691.8 million (US$238.9 million) in the first quarter of 2020, representing a decrease of 40.9% from the fourth quarter of 2019 and a decrease of 35.5% from the same quarter of 2019. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,659.4 million (US$234.4 million) in the first quarter of 2020, representing a decrease of 41.0% from the fourth quarter of 2019 and a decrease of 33.7% from the same quarter of 2019.

Net loss attributable to NIO’s ordinary shareholders was RMB1,722.8 million (US$243.3 million) in the first quarter of 2020, representing a decrease of 40.5% from the fourth quarter of 2019 and a decrease of 35.0% from the same quarter of 2019. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB1,658.9 million (US$234.3 million).

Basic and diluted net loss per ADS were both RMB1.66 (US$0.23) in the first quarter of 2020. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.60 (US$0.22).

Balance Sheets

Balance of cash and cash equivalents, restricted cash and short-term investment was RMB2,397.4 million (US$338.6 million) as of March 31, 2020. The Company operates with continuous loss and negative equity. The Company's cash balance is not adequate to provide the required working capital and liquidity for continuous operation in the foreseeable future. The Company’s continuous operation depends on the successful implementation of the management's plans which considers the improvements in its operating cash flows and the consummation of the Investments in NIO China. Based on its evaluation, the Company believes that its existing working capital, the funds from the Investments in NIO China and available loan facilities will be sufficient to support the Company's continuous operations and developments in the next twelve months.

Business Outlook

For the second quarter of 2020, the Company expects:

Deliveries of the vehicles to be between 9,500 and 10,000 vehicles, representing an increase of approximately 147.5% to 160.6% from the first quarter of 2020, and an increase of approximately 167.4% to 181.5% from the second quarter of 2019.

Total revenues to be between RMB3,368.4 million (US$475.7 million) and RMB3,534.2 million (US$499.1 million), representing an increase of approximately 145.5% to 157.6% from the first quarter of 2020, and an increase of approximately 123.3% to 134.3% from the second quarter of 2019.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com