Chinese startups see March. insurance registrations leap 86% MoM

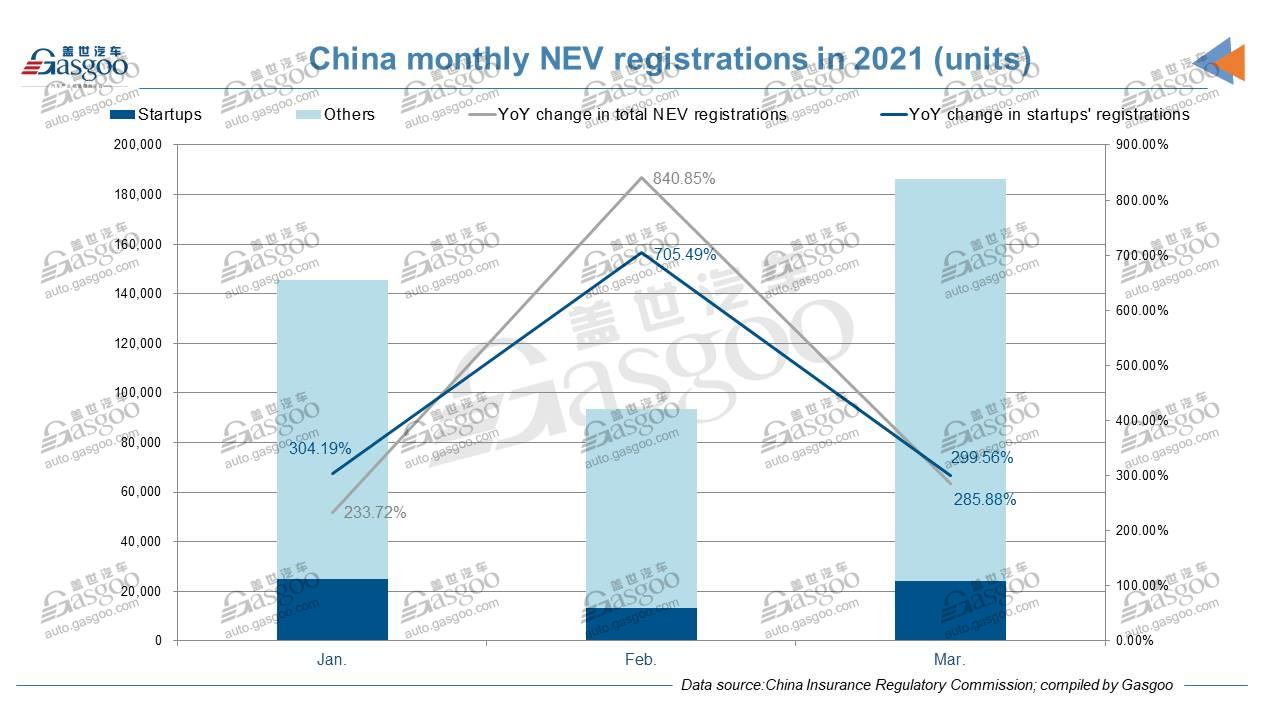

Shanghai (Gasgoo)- In March 2021, consumers in China bought the MLI (Mandatory Liability Insurance for Traffic Accidents of Motor Vehicles) for 186,261 China-built new energy vehicles (NEVs) , representing a hike of 286% over the previous year, according to the China Insurance Regulatory Commission (CIRC).

The remarkable growth was mainly due to the low base for the year-ago period when the world's largest auto market were still suffering the negative impact of the coronavirus pandemic.

Thanks to the same reason, Chinese startups also boasted impressive increase. In March, the insurance registrations of the vehicles from Chinese EV startups exceeded 24,000 units, rocketing 300% from the previous year, while also leaping 86% from the previous month.

For the first quarter of 2021, China's NEV insurance volume totaled 425,397 units (+695% YoY), around 14.7% of which were contributed by Chinese startups.

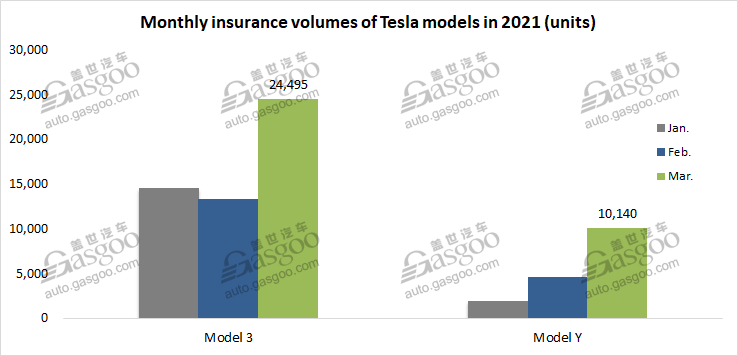

In terms of March registrations, Chinese startups were still greatly eclipsed by Tesla. Last month, the U.S.-based EV manufacturer saw the insurance registrations of its China-made models reached 34,635 units, more than the totals of all indigenous startups. Of the vehicles registered, there were 24,495 Model 3s and 10,140 Model Ys. It is worth noting that the Model Y had a surge of 118.3% month over month.

ES8; photo credit: NIO

With regard to the landscape of Chinese EV startups in March, the majority of market share was still occupied by the six companies—NIO, Li Auto, XPeng, HOZON Auto, Leapmotor, and WM Motor. With aggregated registrations of 20,894 units, they contributed to roughly 86% of the Chinese startups' totals.

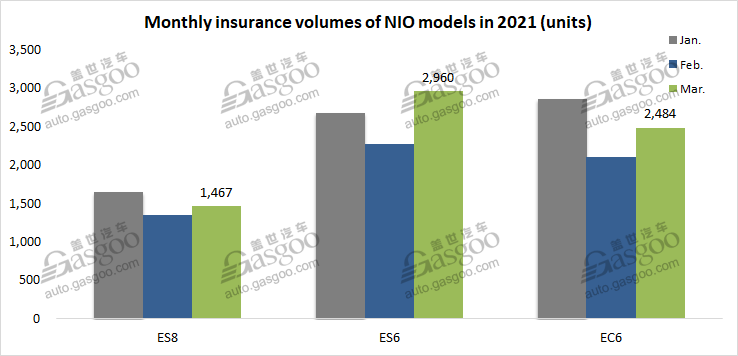

NIO, Li Auto and XPeng were still the top 3 startups with their respective insurance volumes all topping 40,000 units in March. NIO once again gained the championship with its registrations reaching nearly 7,000 units. Li Auto's products outsold that of XPeng by 324 units last month.

NIO posted a month-on-month growth of 20.4% in Mar. registrations with all three models achieving increase. With 2,960 vehicles registered, the ES6 was the best-selling one.

According to the China Automotive Technology & Research Center (CATARC), the ES6 and the EC6 were honored runner-up and second runner-up among all-electric SUV models in China by Mar. registrations, while the ES8 ranked seventh.

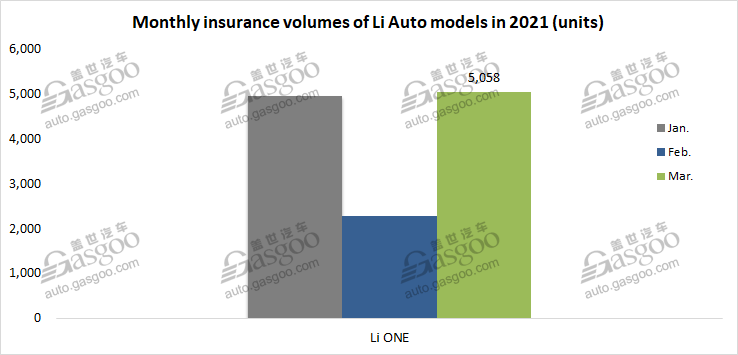

With only one production model for sale, Li Auto outstripped XPeng last month and also scored a robust growth of 120.8% over the previous month.

For the first quarter of 2021, Li ONE's insurance registrations totaled 12,321 units, zooming up 312.2% from the year-ago period.

To shore up the rising momentum for deliveries, Li Auto continued to expand its sales and service networks. As of March 31, 2021, the company had 65 retail stores covering 49 cities, and 135 service centers and Li Auto-authorized body & paint shops across 98 cities in China.

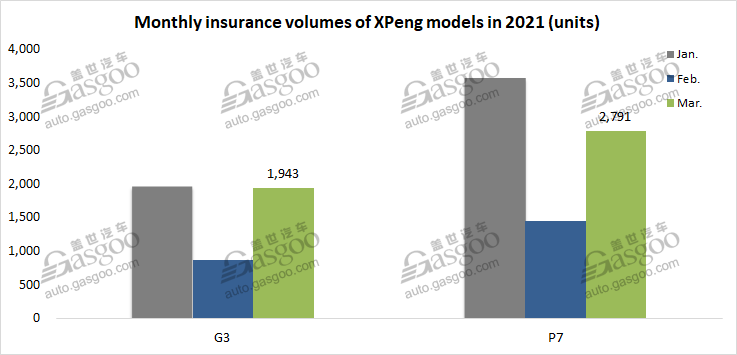

XPeng boasted a substantial month-on-month growth in March as well. The G3 ranked fourth on the list of all-electric SUV models by Mar. registrations, according to the CATARC.

The Guangzhou-based startup is forging ahead with its intelligence strategy. It kicked off on March 19 an autonomous driving expedition with a fleet of XPeng P7s to showcase the capability of Navigation Guided Pilot (NGP), the full-stack autonomous driving solution developed in-house by XPeng, on China's highways. During the 8-day period, the XPeng P7 fleet, which drove from Guangzhou to Beijing with 2,930 km highway driving under the control of the NGP, achieved an average of 0.71 human driver interventions per 100 km.

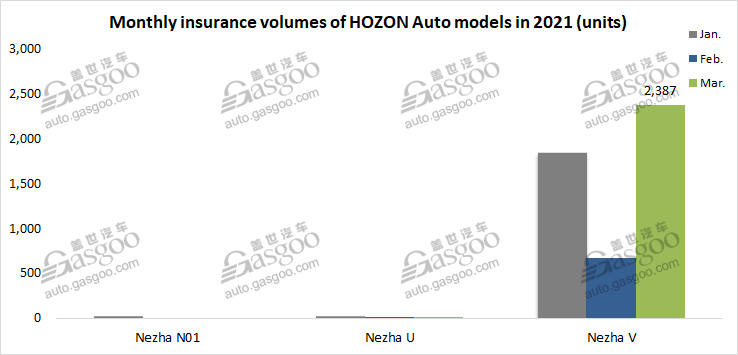

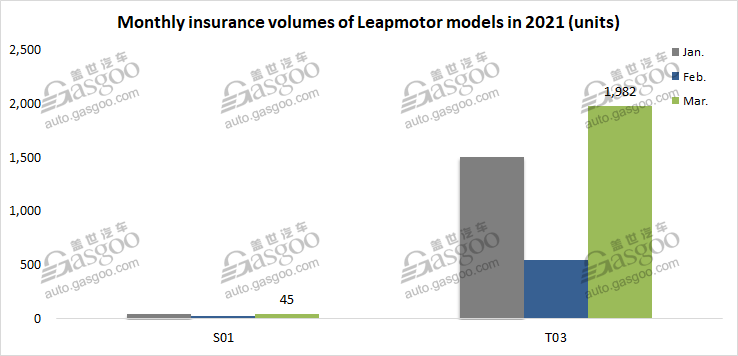

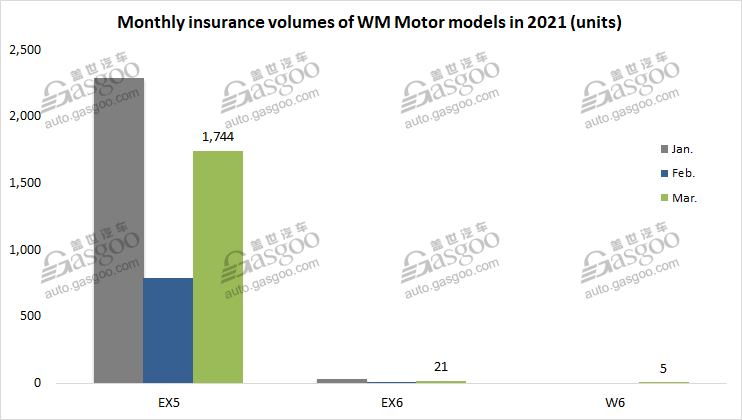

Compared to February, the three startups of the so-called second-tier group—HOZON Auto, Leapmotor and WM Motor—all gained vigorous leap. Nevertheless, their sales performances heavily relied on a single model.

The biggest sales contributor of HOZON Auto was the Nezha V, which accounted for up to 98.6% of the company's total March registrations. For Leapmotor, the T03 had an insurance volume of 1,982 units, versus 45 units for the S01. With regard to WM Motor, 98.5% of its March registrations were contributed by the EX5.

Notably, the W6, WM Motor's third production model, recorded a registration volume of 5 units last month.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com