China's passenger vehicle market logs YoY growth in both Q1 2025 retail sales, wholesales

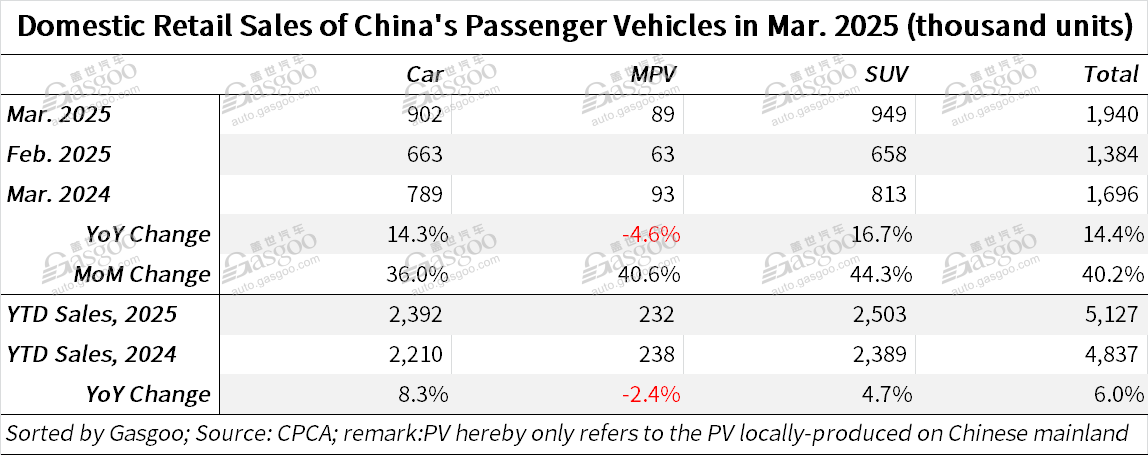

Shanghai (Gasgoo)- Retail sales of passenger vehicles (PVs) in China reached 1.94 million units in March 2025, marking a 14.4% year-on-year increase and a 40.2% surge from February, according to data from the China Passenger Car Association ("CPCA").

Total retail volume for the first quarter climbed to 5.127 million units, up 6% year-on-year.

For clarity, the passenger vehicles mentioned here are all locally produced on the Chinese mainland.

The performance in March this year ranks among the strongest in recent years, falling just shy of the record 1.98 million units sold in March 2018. The improvement was driven by steady consumer recovery, policy incentives for new energy vehicle (NEV) adoption, and a relatively moderate pricing environment, easing the industry's prolonged internal competition. Notably, March recorded the highest year-on-year retail sales growth rate for the month in a decade, reversing the trend of typically subdued March performance.

The month of March had 21 working days—on par with the same period last year. Following the Chinese New Year holiday, industries resumed operations quickly, pushing February's production and sales to surge, with March showing normalized yet robust demand. The combined retail momentum over February and March was particularly strong.

China's wholly-owned brands remained dominant in March, with retail sales hitting 1.22 million units—up 31% year-on-year and 33% month-on-month. They accounted for 62.7% of the PV market, a 7.7-percentage-point increase over the same month last year. From January to March, their cumulative share stood at 63%, up 7.9 points year-on-year, thanks to strong performance in both NEV and export markets.

Mainstream joint ventures saw mixed results, with their combined March retail sales at 480,000 units, down 4% year-on-year but up 45% month-on-month. German brands held a 17% market share (down 3.6 percentage points year on year), Japanese brands 12.2% (down 1.5 percentage points year on year), and American brands 6.8% (down 1.4 percentage points year on year).

Premium PV sales reached 250,000 units in March, down 7% from a year ago but up 68% compared to February. Premium vehicle brands held a 12.9% share of overall retail sales, declining three percentage points year-on-year, though traditional premium marques maintained relatively stable performance.

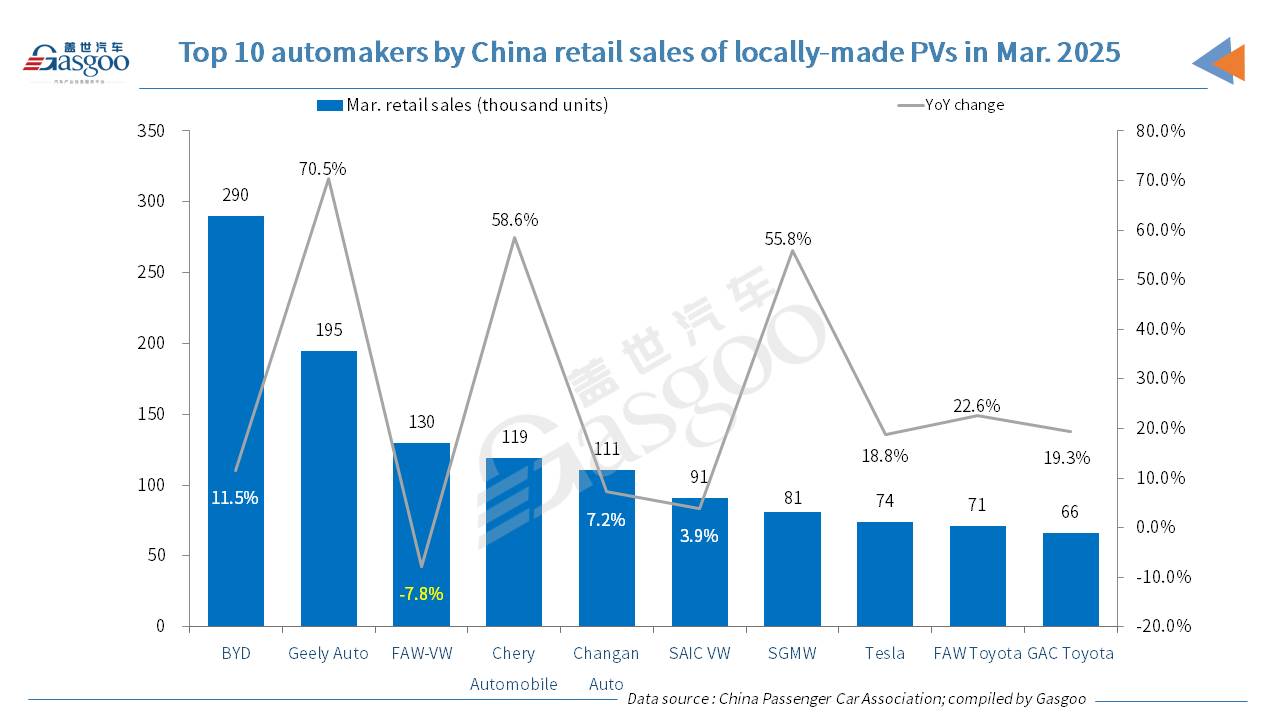

Among the top 10 automakers by China PV retail sales in March, BYD still took the lead with a volume of around 290,000 units, while Geely Auto, Chery Automobile, and SAIC-GM-Wuling all boasted a year-on-year surge of over 50%.

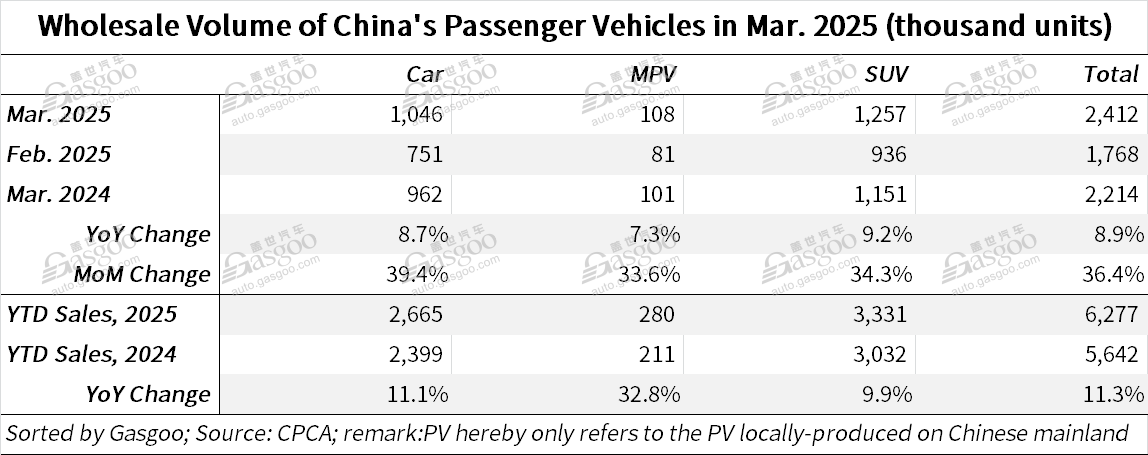

Wholesale figures also showed strong momentum, with manufacturers selling 2.412 million PVs in March—a record high for the month—representing an 8.9% year-on-year and 36.4% month-on-month increase. Cumulative wholesale volume for the first quarter stood at 6.277 million units, up 11.3% year-on-year.

While retail growth outpaced wholesale, March wholesales still showed robust gains. In the month, China's indigenous brands led the way with 1.58 million units sold, up 22% year-on-year and 27% from February. Joint-venture brands recorded 550,000 units, down 6% year-on-year but up 55% month-on-month. Premium brands' wholesales hit 280,000 units, down 16% year-on-year but up 71% from the previous month.

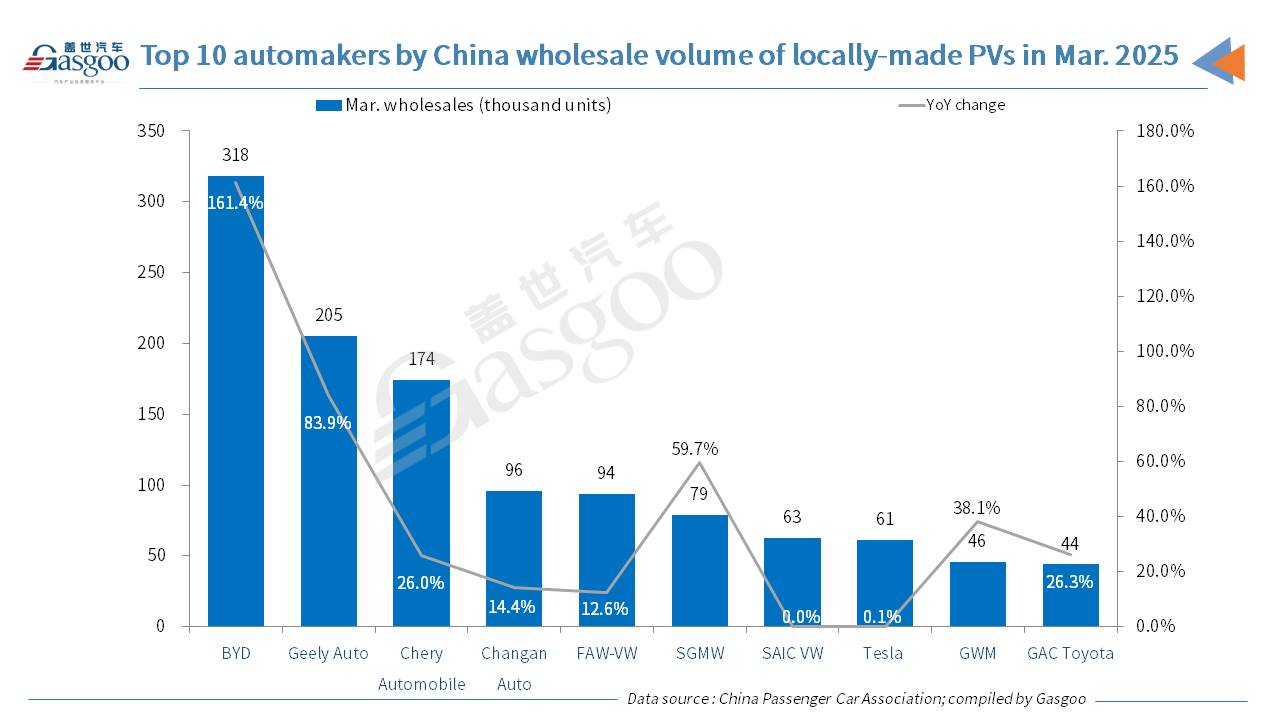

Performance varied across leading automakers. Geely Automobile, Chery Automobile, and Changan Auto all posted strong year-on-year and month-on-month wholesale gains. In total, five automakers surpassed 150,000 units in March, up from three in February, jointly accounting for 47% of the market (up from 39% the prior month and 42% a year ago). Among the 13 automakers with wholesale volumes above 50,000 units, eight achieved year-on-year growth, including joint ventures like SAIC Volkswagen, GAC Toyota, and FAW Toyota.

PV production in China reached 2.481 million units in March, representing an 11.5% year-on-year increase and a 42.9% spike from February. This figure is 320,000 units higher than the previous March peak of 2.16 million units recorded in 2018. For the first quarter, cumulative PV production rose 14.5% year-on-year to 6.311 million units.

Production performance varied across segments. Premium PV output declined 15% year-on-year but soared 56% from the previous month. Joint-venture brands saw a modest 1% year-on-year dip but posted a 63% month-on-month spike. China's self-owned brands led the surge with a 22% year-on-year rise and a 34% gain compared to February.

PV exports, including complete units and CKD kits, totaled 391,000 units in March, down 8% from a year earlier but up 10% month-on-month. In the first quarter, China's PV exports reached 1.12 million units, edging up 1% year-on-year.

China's wholly-owned brands contributed 340,000 units to March's exports, up 1% year-on-year and 10% month-on-month. In contrast, exports from joint ventures and premium marques slumped 45% from a year earlier to 47,000 units.

New energy passenger vehicle (NEPV) production continued its strong momentum, reaching 1.165 million units in March—an increase of 43% year-on-year and 42.1% month-on-month. In the January–March period, NEPV production totaled 2.924 million units, up 46% from a year ago.

Wholesale volume of NEPVs hit 1.128 million units in March, growing 35.5% year-on-year and 35.9% from February. Cumulative wholesale volume in the first quarter zoomed up 42.8% year over year to 2.847 million units.

Retail sales of NEPVs reached 991,000 units in March, up 38% year-on-year and 45% month-on-month. First-quarter retail totaled 2.42 million units, marking a 36.4% increase from the same period last year.

China's NEPV exports in March stood at 143,000 units, climbing 6.4% year-on-year and 21.2% month-on-month. These accounted for 36.6% of all PV exports—up five percentage points year-on-year. For the first quarter, NEPV exports totaled 401,000 units, a 19.8% increase over the previous year.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com