June 2022 sales update of main Chinese auto groups and NEV startups

China's auto sales regained a vigorous rising impetus in June after shrinking year on year for three consecutive months, driven by waning coronavirus outbreaks and strong policies stimulus.

Last month, there were around 2.502 million vehicles sold across China, up 23.8% and 34.4% from the previous year and the previous month respectively, according to data from the China Association of Automobile Manufacturers (CAAM).

In the first half of 2022 (“H1”), overall auto sales in the world's largest car market amounted to 12.057 million units, with new energy vehicle (“NEV”) sales rocketing 115% over a year earlier, the industrial data showed.

The general upward movement indicates that most mainstream automakers in China scored a year-on-year growth in June sales.

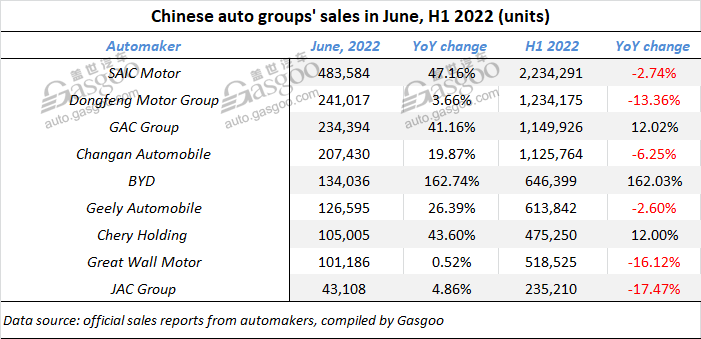

Gasgoo hereby displayed the sales data released by ten main Chinese automobile groups, and found out that none of them faced a year-on-year drop in June.

SAIC Motor, the largest auto group in China, witnessed its June sales surge 47.16% from a year ago. The robust growth took place after the group faced a two-digit year-on-year dip for three straight months.

Apart from SAIC Motor, five auto groups (GAC Group, Changan Automobile, BYD, Geely Automobile, and Chery Holding) also saw their June sales rise at a two-digit growth rate or higher.

As for the year-to-date performance, the sales decrease emerging between March and May has been significantly narrowed, or even turned into a positive growth. Among the ten auto groups listed in the table, GAC Group, BYD, and Chery Holding all achieved a remarkable rising movement in Jan.-Jun. sales.

Notably, BYD was the only one that boasted a three-digit spike in both June sales and year-to-date sales.

Another noteworthy point is that most self-owned brands of these auto groups vigorously perked up last month. For instance, June sales of SAIC Motor Passenger Vehicle Company, GAC Motor, and GAC AION went up 75.75%, 30.94%, and 182.44% over a year earlier, respectively.

The blooming NEV sales growth significantly contributed to the year-on-year increase in each group's overall sales.

Of the ten auto groups, BYD outsold others in terms of both June and H1 NEV sales. Since it discontinued production of oil-fueled vehicles in March this year, NEVs have made up 100% of the automaker's monthly auto sales.

In addition, Dongfeng Motor Group, Geely Automobile, GAC Group, and Chery Holding all announced a three-digit year-on-year growth in June NEV sales.

With the ambition to see products go upscale, a slew of automakers in China have launched their self-owned premium NEV brands, some of which have started vehicle deliveries with sales data shown in their monthly sales results. For example, Dongfeng Motor Group’s VOYAH sold 906 vehicles in June, resulting in a year-to-date sales volume of 5,676 units, while Geely's ZEEKR recorded a sales volume of 4,302 units in June and 19,010 units for the first half of this year.

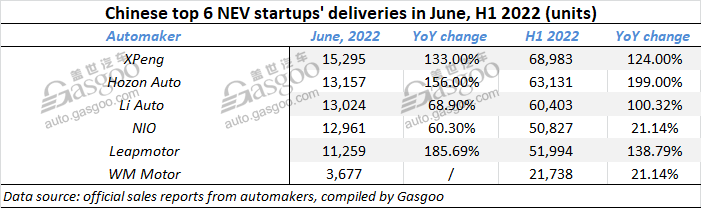

Startups also served as important contributors to China's NEV sales boom. In June, the top 5 Chinese NEV startups all saw their deliveries leap over 60% year on year to exceed 11,000 units. XPeng still ranked highest, while Hozon Auto won the biggest growth rate.

Aside from NIO and WM Motor, the other four among the top 6 startups all attained a three-digit year-over-year hike in Jan.-Jun. deliveries.

Some startups expect their sales to further increase with new products put onto the market in the second half of 2022. NIO will begin deliveries of the ES7 and the ET5 in August and September, while Li Auto's L9 and XPeng's G9 are expected for delivery in August and the fourth quarter, respectively.

Gasgoo not only offers timely news and profound insight about China auto industry, but also help with business connection and expansion for suppliers and purchasers via multiple channels and methods. Buyer service:buyer-support@gasgoo.comSeller Service:seller-support@gasgoo.com